- Home

- »

- Medical Devices

- »

-

Biliary Stents Market Size, Share & Trends Report 2030GVR Report cover

![Biliary Stents Market Size, Share & Trends Report]()

Biliary Stents Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Metal, Plastic), By Application (Bilio-pancreatic Leakages, Pancreatic Cancer), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-174-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biliary Stents Market Size & Trends

The global biliary stents market size was estimated at USD 140.96 million in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.0% from 2024 - 2030. The market is witnessing significant growth, largely attributed to the increasing prevalence of biliary disorders and chronic liver diseases. According to the CDC, annual statistics in the U.S. reveal approximately 25,000 men and 11,000 women being affected by liver cancer, resulting in the loss of around 19,000 men and 9,000 women to these chronic conditions.

The widespread success and adoption of endoscopic luminal stenting (ELS) in managing malignant obstructions along the gastrointestinal tract, including biliary obstructions, emerged as a key growth driver for the market. According to the NCBI article published in April 2023, ELS is a minimally invasive and effective solution for various neoplastic strictures; its superiority over traditional modalities like radiotherapy and surgery positions it as a first-line application in palliative and neoadjuvant settings. The expanding indications of ELS and its success in relieving non-neoplastic obstructions, sealing perforations, closing fistulae, and addressing post-sphincterotomy bleeding emphasize its pivotal role in clinical practice. The continued evolution of stent types, driven by the demand for enhanced efficacy, safety, and adaptability to new technologies, further propels the growth and relevance of the market.

The market is experiencing growth driven by the increasing adoption of minimally invasive procedures. According to an NCBI article published in January 2021, procedures like endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic approaches are widely employed, utilizing devices such as biliary drains and stents. The shift towards minimally invasive options is evident in managing complications like occlusion and migration. The preference for ERCP or percutaneous approaches over open surgery highlights the trend towards less invasive interventions. The percutaneous transhepatic approach, especially in rare cases of catheter fractures, proves effective, contributing to reduced morbidity and mortality. This emphasis on minimally invasive techniques, supported by successful outcomes, positions them as significant drivers in the market's growth. The ongoing exploration of various techniques emphasizes the dynamic nature of this field and the continuous quest for innovative solutions.

Market Characteristics

The global market for biliary stents is witnessing expansion through continuous innovation, with a steady influx of novel ideas and advanced approaches. These stents have gained popularity due to their minimal invasiveness and the relief they provide with reduced pain. Companies are actively investing in innovative technologies and procedures to meet the growing demand, ensuring they remain at the forefront of progress in this field.

Key market players, including Boston Scientific, Cook Group, Olympus Corporation, Taewoong Medical Co., Ltd., Becton, Dickinson and Company among others are engaging in mergers and acquisitions to expand their geographic reach and enter new territories. Moreover, companies are investing substantial resources in clinical trials and regulatory submissions to obtain approval for their pipeline products, potentially leading to increased costs in developing novel biliary stent technologies.

Furthermore, biliary stents, crucial for treating obstructions in the bile ducts, face limited substitutes. While alternative procedures like surgery or radiotherapy may address similar issues, they often lack the minimally invasive nature and versatility of biliary stents. The unique features of biliary stents, including adaptability to various conditions and effectiveness in palliative care, establish them as indispensable tools in managing biliary obstructions.

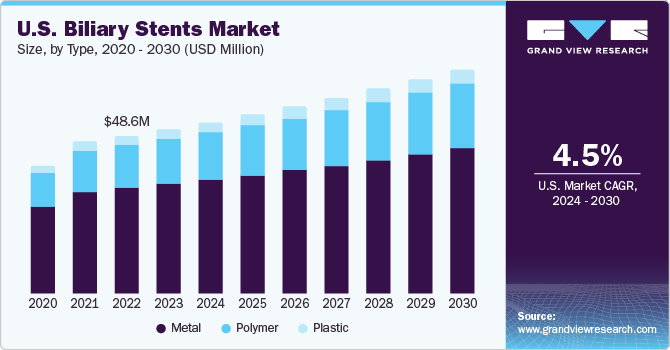

Type Insights

The metal biliary stents segment held the largest revenue share of 66.99% in 2023. The introduction of fully covered self-expandable metal stents (FCSEMS) marks a significant advancement in endoscopic treatment for obstructive biliary issues, as highlighted in an October 2021 NCBI article. The prevalence of FCSEMS can be attributed to various factors. Their substantial diameter and the synthetic covering enveloping the tubular mesh contribute to prolonged stent patency, enhancing their effectiveness and reducing the risk of tissue hyperplasia and tumor ingrowth. A notable feature of FCSEMS is their easy removal, addressing a critical limitation faced by plastic and uncovered metal stents. This removal ease adds a layer of versatility to their application.

The polymer stents segment is anticipated to witness the fastest market growth over the forecast period. One significant driver is the continuous innovation and advancements in polymer technology, leading to the development of stents with enhanced flexibility and biocompatibility. Polymer stents offer a viable alternative to traditional metal stents, as they are often more easily deployable and adaptable to various anatomical structures. In addition, the polymer's inherent non-metallic nature reduces the risk of interference with imaging modalities such as MRI. The growing preference for minimally invasive procedures further fuels the demand for polymer stents, given their ability to provide effective relief in treating biliary obstructions while minimizing patient discomfort.

Application Insights

The gallstones segment held the largest revenue share in 2023. The rising incidence of gallstone-related issues necessitates effective and minimally invasive treatment options. Biliary stents designed specifically for gallstone management offer a targeted approach, aiding in alleviating symptoms and promoting smoother bile flow. Advancements in stent technology, including improved materials and design, enhance efficacy in addressing gallstone-related complications. The growing awareness among healthcare professionals and patients regarding the advantages of using stents for gallstone management further boosts the demand for such specialized devices. As a result, the gallstone stents segment is poised for sustained growth within the broader market.

The benign biliary structures segment is estimated to register the fastest CAGR over the forecast period. The demand for effective and minimally invasive treatment options has led to the development and adoption of specialized biliary stents tailored to address benign strictures. Technological advancements in stent design and materials contribute to improved efficacy and durability, providing long-term relief for patients with benign biliary strictures. Moreover, the growing emphasis on enhancing patient outcomes and reducing the need for repeated interventions further fuels the demand for specialized stents in this segment.

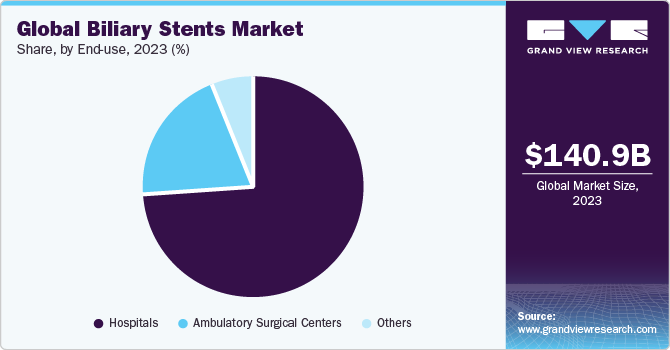

End-use Insights

The hospitals segment held the largest revenue share in 2023. Hospitals primarily contribute to the biliary stents industry growth, serving as prime centers for comprehensive medical care. Equipped with diverse medical services and specialized departments, hospitals play a central role in addressing a wide range of patient needs. In the context of biliary stents, hospitals provide the infrastructure and expertise necessary for intricate procedures and interventions.

The ambulatory surgical centers segment has also been anticipated to grow rapidly during the forecast period. Ambulatory surgical centers play a vital role in the biliary stents industry by offering a convenient and efficient setting for outpatient procedures, including those involving biliary stents. ASCs provide an alternative to traditional hospital settings, allowing for same-day surgical interventions. Patients benefit from the streamlined processes and specialized care within ASCs, contributing to the accessibility and utilization of biliary stent procedures. The ambulatory nature of these centers aligns with the growing trend towards outpatient care and minimally invasive interventions.

Regional Insights

North America held the largest revenue share of 43.69% in 2023, which is attributed to the growing demand for minimally invasive procedures in North America. According to the American Cancer Society, the incidence of bile duct cancer (cholangiocarcinoma), a rare condition with around 8,000 annual diagnoses in the U.S., signifies a distinctive healthcare concern. In this scenario, biliary stents emerge as pivotal therapeutic tools for managing conditions associated with bile duct cancer, addressing issues like tumor-induced obstructions or narrowing. The prevalence of bile duct cancer cases creates a specific and significant demand for biliary stents and highlights their integral role in North America's healthcare landscape.

The U.S. held the largest share of the market in North America in 2023. Growing incidence of cancer and growing awareness regarding early disease diagnosis are some of the major factors anticipated to foster the country’s growth. For instance, according to the Cleveland article, the substantial incidence of acute and chronic pancreatitis in the U.S., leads to 275,000 and 86,000 hospital stays per year, respectively, which positions biliary stents as crucial therapeutic tools. With about 20% of acute cases considered severe, the demand for effective interventions, including biliary stents, is evident. The high number of hospital stays underscore the critical role of biliary stents in addressing complications associated with pancreatitis, thereby contributing to the growth of the U.S. market.

The Asia Pacific region is anticipated to register the fastest growth during the forecast period, driven by a surge in patient numbers and the expanding presence of prominent healthcare providers in rapidly developing economies such as India and China. Opportunities for expansion are created by the increasing demand for healthcare services in the region, coupled with government support for advancements in healthcare utilization. For instance, the Indian government's financial aid to indigent cancer patients through the Tertiary Care Cancer Centers (TCCC) scheme, which aims to strengthen or establish 20 State Cancer Institutes (SCI) and 50 TCCCs, is expected to stimulate the demand for biliary stent devices, contributing to the region's overall growth.

Japan's healthcare system is shifting from nursing care to preventive care in disease management due to rising healthcare expenditures. In February 2023, Olympus strategically acquired South Korean stent maker Taewoong Medical for approximately USD 370 million, emerging as a pivotal driver for the growth of the Japan market. This strategic move by the Japanese medical device’s giant reflects a deliberate effort to enhance its medical device offerings and diversify revenue streams. Olympus' strategic investment is anticipated to introduce advanced technologies and innovative solutions to the Japan market, fostering increased demand and shaping the competitive landscape.

Key Companies & Market Share Insights

Boston Scientific, Cook Group, ENDO-FLEX GmbH, and Olympus Corporation are some of the dominant players in the global arket.

-

Boston Scientific’s unit to tackle healthcare challenges impacts over 100 countries. Their mission: reduce costs, boost efficiency, and broaden healthcare access

-

Cook Group has been working since 1963 to develop ways to avoid open surgery. They use devices, materials, and therapies to help healthcare systems deliver better results more efficiently

-

ENDO-FLEX GmbH for more than 30 years has provided a wide range of flexible endoscopic products, including devices, instruments, and implants

Merit Medical System, CONMED Corporation, and M.I Tech some of the emerging market players in the market.

-

Merit Medical Systems, Inc. for over [30] years is specializing in crafting, producing, and distributing unique disposable medical devices

-

M.I Tech Established in 1991, South Korea, specializes in developing, manufacturing, and supplying unique medical devices for digestive endoscopy

Key Biliary Stents Companies:

- Boston Scientific

- Cook Group

- ENDO-FLEX GmbH

- Olympus Corporation

- B Braun Melsungen

- CONMED Corporation

- M.I Tech

- Becton, Dickinson & Company

- Medtronic plc

- Cardinal Health

- Merit Medical System

Recent Developments

-

In February 2023, Olympus[sb2] acquired the Taewoong Medical Co., Ltd., a Korean gastrointestinal stent company. This move aims at enhancing Olympus's Gastrointestinal EndoTherapy offerings by leveraging the expertise and technology brought together through the acquisition

-

In November 2021, B. Braun and REVA Medical have entered into a strategic partnership for the distribution of Fantom Encore, a bioresorbable scaffold for coronary interventions

-

In October 2020, Olympus introduced the StoneMasterV and VorticCatchV EndoTherapy devices. These innovations aim to enhance efficiency in managing and retrieving bile duct stones during endoscopic retrograde cholangiopancreatography (ERCP)

Biliary Stents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 147.54 million

Revenue forecast in 2030

USD 197.96 million

Growth Rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Boston Scientific; Cook Group; ENDO-FLEX GmbH;

Olympus Corporation; B Braun Melsungen; CONMED Corporation; M.I Tech; Becton; Dickinson & Company; Medtronic plc; Cardinal Health; Merit Medical System.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

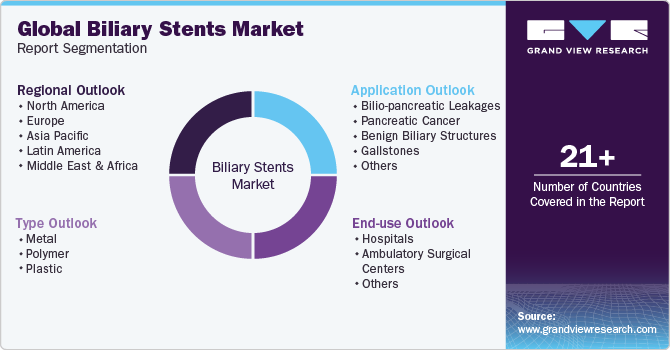

Global Biliary Stents Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biliary stents market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Polymer

-

Plastic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bilio-pancreatic Leakages

-

Pancreatic Cancer

-

Benign Biliary Structures

-

Gallstones

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biliary stents market size was estimated at USD 140.96 million in 2023 and is expected to reach USD 147.54 million in 2024.

b. The global biliary stents market is expected to grow at a compound annual growth rate of 5.0 % from 2024 to 2030 to reach USD 197.96 million by 2030.

b. In 2023, North America held the market's largest revenue share of 43.69%. The region's advanced healthcare infrastructure, increasing awareness about overall health, and a growing aging population contribute to the market's dominance.

b. Some key market players are Boston Scientific, Cook Group, Olympus Corporation, Taewoong Medical Co., Ltd., Becton, Dickinson and Company, and Others.

b. The biliary stents market is experiencing robust growth, driven by the growing incidence of biliary disorders and chronic liver diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.