Bike And Scooter Rental Market Size, Share & Trends Analysis Report By Propulsion (Pedal, Electric), By Vehicle (Bike, Scooter), By Service (Pay-as-you Go, Subscription Based), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-333-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Bike And Scooter Rental Market Trends

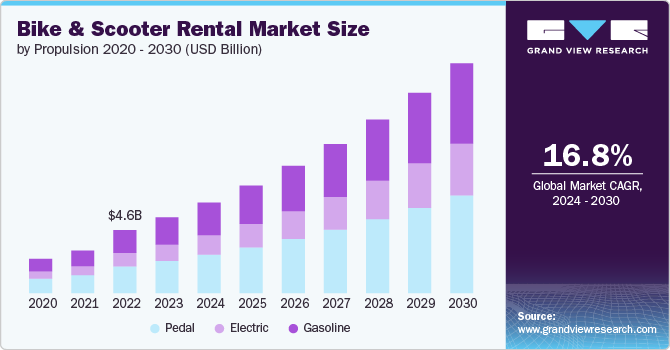

The global bike and scooter rental market size was estimated at USD 5.54 billion in 2023 and is anticipated to grow at a CAGR of 16.8% from 2024 to 2030. The increasing awareness of environmental sustainability and the urgent need to reduce carbon emissions are major drivers for the growth of the market. With rising pollution and traffic congestion, e-bikes and scooters offer a green alternative to traditional vehicles, helping cities lower their carbon footprint. This shift towards eco-friendly transportation is being supported by both governmental policies and consumer preferences, creating a robust market for e-bike and scooter rentals.

Technological advancements are another significant factor propelling the market growth. Innovations in battery technology, such as longer battery life and faster charging times, have made e-bikes and scooters more reliable and convenient for users. Additionally, the integration of GPS and IoT (Internet of Things) technologies has enhanced the user experience by providing real-time tracking, seamless payments, and improved safety features. These technological improvements have made it easier for rental companies to manage their fleets and for customers to access and use these services efficiently.

Growing investment and interest from key automakers and startups in the mobility sector are propelling the growth of the market. Bike and scooter rental companies are investing heavily in expanding their fleets, improving infrastructure, and enhancing user experience. This influx of capital is accelerating the growth and adoption of these services, with many companies partnering with cities to create dedicated lanes and parking zones, further integrating e-bikes and scooters into urban transportation networks.

Health and fitness consciousness among consumers is also playing a role in the growth of the bike and scooter rental market. Many people are seeking ways to incorporate physical activity into their daily routines, and e-bikes provide a perfect balance of exercise and convenience. Even though scooters offer less physical exertion, they still promote an active lifestyle by encouraging outdoor mobility. This health-conscious trend is particularly strong in urban areas where sedentary lifestyles are prevalent, making e-bikes and scooters a popular choice for short commutes and recreational use, which is driving the growth of bikes & scooter rentals.

Consumer preferences are shifting towards shared and on-demand services, influenced by the broader trend of the sharing economy. Many urban residents, particularly younger generations, prefer the flexibility and cost savings of renting over owning vehicles. This preference is bolstered by the convenience of app-based rental platforms that allow users to locate, unlock, and pay for bikes and scooters with just a few taps on their smartphones. The convenience and affordability of these rental services make them appealing alternatives to car ownership or public transportation.

Propulsion Insights

The pedal segment accounted for the largest market share of 42.46% in 2023. Pedal bikes offer a traditional biking, making them attractive to a broad range of users, including daily commuters, recreational riders, and fitness enthusiasts. Improvements in designs and affordability have also contributed to their rising popularity. Additionally, the infrastructure improvements in many cities, such as bike lanes and parking facilities, have made pedal-assist bikes a more practical and appealing choice for urban travel.

The electric segment is experiencing robust growth due to consumers’ shift towards electric mobility solutions, growing concerns about climate change, rising fuel costs, and the increasing demand for convenient and efficient urban transportation. E-bikes and e-scooters offer an eco-friendly alternative to traditional gas-powered vehicles, reducing carbon footprints and traffic congestion. The technological advancements in battery life, charging infrastructure, and vehicle design have made these electric vehicles more accessible and practical for daily use. Additionally, government incentives and investments in electric mobility infrastructure have further fueled their adoption. As cities worldwide aim to become more sustainable, the high growth of electric bikes and scooters is expected to continue, transforming urban transportation landscapes.

Vehicle

The bikes segment held the largest market share in 2023. The high segmental share of bikes can be attributed to technological advancements that have made bike-sharing more accessible and efficient. The integration of GPS tracking, mobile applications, and digital payment systems has streamlined the rental process, making it convenient for users to locate, unlock, and pay for bikes with ease. This seamless user experience has attracted a broader audience, including those who might not have yet to consider biking as a viable mode of transportation before. Additionally, the ability to collect and analyse data through these technologies allows companies to optimize bike distribution and maintenance, ensuring a reliable service that meets the demand of urban commuters.

Moreover, environmental concerns and the global push towards sustainable living have also played a significant role in the proliferation of rental bikes. As cities worldwide grapple with issues like traffic congestion and air pollution, bike-sharing presents an eco-friendly alternative that reduces carbon emissions and alleviates road congestion. Governments and municipalities have recognized the benefits of promoting cycling and have supported the development of bike-sharing programs through subsidies, infrastructure improvements, and integration with public transit systems. This institutional support has bolstered the expansion of bike-sharing networks, making them a staple in urban transportation strategies aimed at creating greener cities.

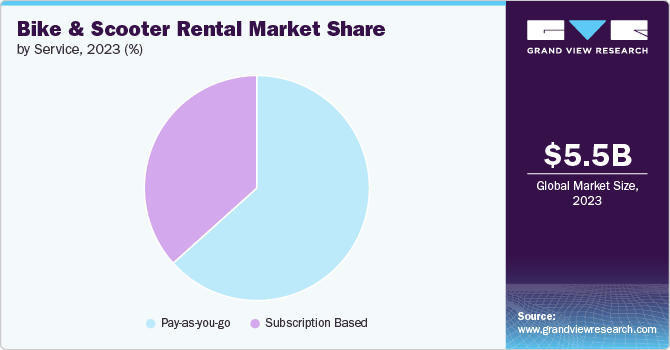

Service Insights

The Pay-as-you-go segment dominated the market in 2023. The high share of the segment is attributed to several factors it offers flexibility and affordability to users who may not require frequent access to vehicles but still need them occasionally. This model appeals to a wide range of customers, including tourists, occasional commuters, and individuals who prefer spontaneous usage without the commitment of ownership or fixed costs. Additionally, advancements in digital payment systems and mobile apps have made it convenient for users to access and pay for rentals on-the-go, further boosting the adoption of pay-as-you-use services. Moreover, the growing awareness and concern for environmental sustainability have prompted more people to opt for shared mobility options like pay-as-you-use bikes and scooters, contributing to their increasing market share.

Subscription-based bike and scooter rental services are experiencing rapid growth due to several key factors. These services offer a hassle-free experience to users who require regular access to vehicles for commuting or leisure purposes. Subscribers benefit from fixed monthly or annual fees that provide predictable costs and unlimited access within specified terms, appealing to frequent users looking for convenience and cost-effectiveness. Moreover, subscription models often include additional perks such as priority access to vehicles, maintenance services, and insurance coverage, enhancing their value proposition compared to traditional ownership or sporadic pay-as-you-use options.

Regional Insights

The North American market is expected to register a considerable growth rate from 2024 to 2030. The market in North America has experienced robust growth in recent years, driven by increasing urbanization and a growing preference for eco-friendly transportation options. Major cities across the United States and Canada have seen a proliferation of bike-sharing and scooter-sharing services, catering to both commuters and tourists. The adoption of smartphone apps for convenient rental access has further fuelled market expansion. Government initiatives promoting sustainable mobility and reducing traffic congestion have also contributed to the market's growth trajectory.

U.S. Bike And Scooter Rental Market Trends

Bikes and scooters have emerged as popular alternatives to traditional transportation modes. Cities like San Francisco, Los Angeles, and New York have witnessed significant investment in bike and scooter-sharing infrastructure. Companies offering dockless bikes and electric scooters have capitalized on the demand for convenient and affordable last-mile transportation solutions. Regulatory challenges regarding safety and operational guidelines have shaped the market dynamics, prompting companies to innovate in fleet management and user safety features.

Asia Pacific Bike And Scooter Rental Market Trends

Asia Pacific regiondominated the market in 2023. The market in Asia Pacific has seen explosive growth, driven by densely populated urban areas and increasing awareness of sustainable transportation solutions. Countries like China and India have become hotbeds for bike-sharing and electric scooter rental services. Rapid urbanization, coupled with government support for green mobility initiatives, has accelerated market expansion. Tech-savvy consumers in cities like Beijing, Shanghai, and Bangalore have embraced smartphone-enabled rental platforms, contributing to the market's rapid evolution and competitive landscape.

Europe Bike And Scooter Rental Market Trends

The market in Europe has evolved amidst a push towards reducing carbon emissions and enhancing urban mobility. Cities such as Paris, London, and Berlin have integrated bike-sharing programs into their public transportation networks, promoting seamless multimodal transit options. The popularity of electric scooters has also surged, with companies offering shared fleets across major urban centers. Regulatory frameworks addressing safety, parking, and sustainability have shaped market growth, fostering innovation in mobility solutions tailored to European cities' unique needs.

Key Bike And Scooter Rental Company Insights

Some of the participants operating in the market include Lime, Nextbike, Cityscoot, Mobike, Spin, Scoot, Lyft, Skip, Tier Mobility, Bolt. The companies are focusing on various strategic initiatives, including investments, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024, Lime a rental electric scooter and bike operator backed by Uber Technologies Inc., announced a plan to invest $55 million to increase its existing fleet size.

-

In January 2024, e-scooter rental companies Tier Mobility and Dott announced their merger, which will create the largest operator in Europe. Their investors are contributing an extra 60 million euros ($66 million) to support the newly combined entity.

-

In March 2022, TIER Mobility (TIER) acquired Spin, a micromobility operator previously owned by Ford, expanding its reach to an additional 106 communities across North America.

Key Bike And Scooter Rental Companies:

The following are the leading companies in the bike and scooter rental market. These companies collectively hold the largest market share and dictate industry trends.

- Lime

- Nextbike

- Cityscoot

- Mobike

- Spin

- Scoot

- Lyft

- Skip

- Tier Mobility

- Bolt

Bike and Scooter Rental Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.61 billion |

|

Revenue forecast in 2030 |

USD 16.78 billion |

|

Growth rate |

CAGR of 16.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Propulsion, vehicle, service, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S., Canada, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, Mexico, U.A.E., Saudi Arabia, South Africa |

|

Key companies profiled |

Lime, Nextbike, Cityscoot, Mobike, Spin, Scoot, Lyft, Skip, Tier Mobility, Bolt |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bike and Scooter Rental Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bike and scooter rental market report based on propulsion, vehicle, service, and region.

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Bike

-

Scooter

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Pedal

-

Electric

-

Gasoline

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Pay-as-you go

-

Subscription Based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bike & scooter rental market size was estimated at USD 5.54 billion in 2023 and is expected to reach USD 6.61 billion in 2024.

b. The global bike & scooter rental market is expected to grow at a compound annual growth rate of 17.1% from 2024 to 2030 to reach USD 16.78 billion by 2030.

b. The bikes segment held the largest market share of over 63.6% in 2023. The high segmental share of bikes can be attributed to technological advancements that have made bike-sharing more accessible and efficient. The integration of GPS tracking, mobile applications, and digital payment systems has streamlined the rental process, making it convenient for users to locate, unlock, and pay for bikes with ease.

b. Some key players operating in the bike & scooter rental market include Lime, Nextbike, Cityscoot, Mobike, Spin, Scoot, Lyft, Skip, among others.

b. Key factors that are driving the market growth include innovations in battery technology, such as longer battery life and faster charging times, have made e-bikes and scooters more reliable and convenient for users. Additionally, the integration of GPS and IoT (Internet of Things) technologies has enhanced the user experience by providing real-time tracking, seamless payments, and improved safety features.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."