- Home

- »

- Automotive & Transportation

- »

-

Bicycle Saddles Market Size & Share, Industry Report, 2030GVR Report cover

![Bicycle Saddles Market Size, Share & Trends Report]()

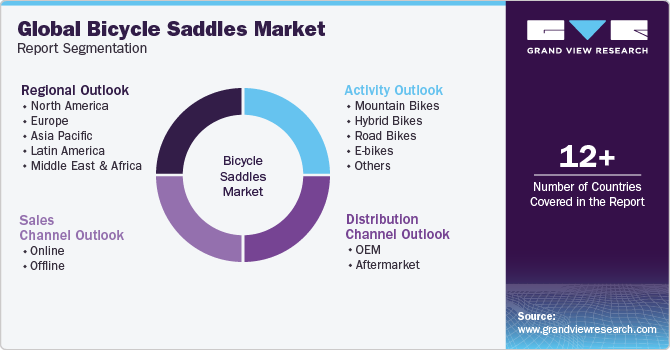

Bicycle Saddles Market (2025 - 2030) Size, Share & Trends Analysis Report By Activity (Mountain Bikes, Hybrid Bikes, Road Bikes, E-bikes), By Distribution Channel (OEM, Aftermarket), By Sales Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-140-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bicycle Saddles Market Size & Trends

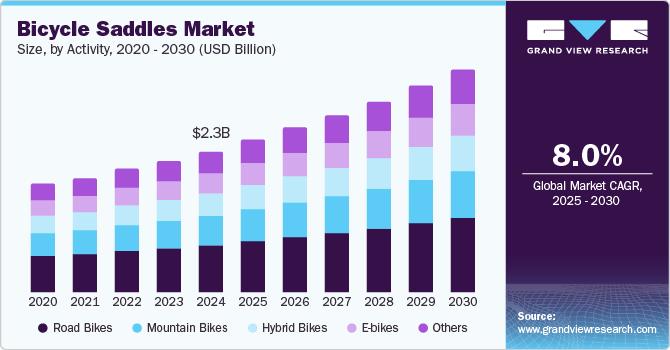

The global bicycle saddles market size was valued at USD 2.27 billion in 2024 and is projected to grow at a CAGR of 8.0% from 2025 to 2030. In recent years, the industry has grown significantly, propelled by a few significant trend aspects. Customers are increasingly looking for saddles that are more comfortable and supportive as they are becoming more aware of the value of ergonomic design in bicycle saddles. Cycling enthusiasts look for saddles that improve riding comfort and reduce pressure spots, especially for lengthy rides. As a result of a desire for eco-friendly transportation and a healthy way of life, the bicycle industry, including saddles, has expanded. As more individuals choose bicycles as an eco-friendly mode of transportation, bicycle sales have surged, increasing the demand for high-quality saddles.

Manufacturers of saddles are now able to produce designs that are lighter, more robust, and more performance-enhancing as a result of advancements in materials and technology. Innovative forms, carbon fiber, gel padding, and gel padding have all drawn customers looking for cutting-edge saddle solutions. The popularity of e-bikes has also carved out a special place for itself in the bicycle saddles industry. Due to the faster speeds and longer rides associated with electric bikes, e-bike users frequently have distinct needs when it comes to saddle comfort and support. Specialized e-bike saddles have resulted from this, helping the market to expand. The industry is growing because of trends highlighting comfort, sustainability, the adoption of e-bikes, and technological improvements. The industry is projected to maintain its growth trajectory in the upcoming years as more bikers place a higher priority on their riding experience and health.

Rising disposable income is driving the global bicycle saddles industry by enabling consumers to invest in premium, high-quality products that prioritize comfort and durability, especially for recreational and competitive cycling. This trend supports the expansion of e-bikes and personalized saddle options, catering to fitness-conscious and urban commuters. Higher spending power is also boosting demand for ergonomic and innovative designs, enhancing the overall cycling experience.

Continuous innovation in bicycle saddles is a key driver of bicycle saddles industry growth by enhancing user comfort, performance, and customization options. Additive manufacturing is revolutionizing bicycle saddle design by enabling precise customization and optimized comfort through technologies like Carbon, Inc.’s Digital Light Synthesis (DLS) 3D printing. The use of lightweight, durable materials such as carbon fiber and titanium alloys is becoming more common in high-performance saddles. For example, Selle Italia offers models with carbon fiber rails and shells, which reduce weight without sacrificing comfort

Activity Insights

Based on the activity, the road bikes segment dominated the overall market, gaining a revenue share of 34.6% in 2024. Road cyclists look for saddles that offer a seamless fusion of comfort and performance, whether they are professional athletes or enthusiasts. To ensure riders can maintain comfort over extended rides while improving pedaling efficiency for increased speed and endurance, manufacturers have actively invested in saddle design. These features include ergonomic elements, lightweight materials, and improved padding technologies. The rise of the road bike saddle market is being fueled by customization options that suit individual preferences and body types, as well as the ease of online shopping, which allows riders to access a wide range of alternatives and read user reviews to make informed choices. As the popularity of road riding grows, so will the demand for specialty saddles designed to meet the specific needs of road bike enthusiasts.

The e-bikes segment is anticipated to register the highest growth rate from 2025 to 2030. The surge in e-bike adoption, driven by their electric-assist capabilities and suitability for commuting and recreational cycling, has created a distinct niche in the industry. E-bike riders often face different comfort and support requirements due to the increased speeds and longer rides facilitated by electric assistance. As a result, there is a growing demand for specialized e-bike saddles that can meet these requirements. Manufacturers have responded by developing saddles with greater padding, fewer pressure spots, and increased stability, making riding an e-bike more pleasurable and comfortable. The demand for specially designed saddles is anticipated to increase as e-bikes continue to gain popularity as an eco-friendly and effective mode of transportation, thereby fostering innovation and development in this market niche.

Distribution Channel Insights

Based on the distribution channel, the OEM segment dominated the market in 2024, gaining a share of 57.2%. OEMs play a pivotal role in the production of bicycles, and consequently, their choice of saddles significantly influences the market. When buying seats for their bikes, OEMs frequently look for a balance between cost-effectiveness, personalization, and quality. OEMs are increasingly searching for saddle makers who can offer a varied selection of solutions to fit different sorts of bicycles, from mountain bikes to urban commuters, as the bicycle business continues to change in response to shifting consumer tastes. By providing OEMs with a variety of materials, designs, and technologies that follow the most recent cycling trends, saddle manufacturers are encouraged to continuously innovate. As a result, bicycles are outfitted with comfortable and performance-improving saddles that satisfy riders' changing needs.

The aftermarket segment is anticipated to observe significant growth from 2025 to 2030. Aftermarket consumers, including individual riders and cycling enthusiasts, often seek to upgrade or replace their existing saddles to enhance comfort, performance, and aesthetics. This demand is driven by a desire for personalized riding experiences, whether for road cycling, mountain biking, or other specialized disciplines. The aftermarket saddle segment has responded by providing a wide range of options, including high-performance saddles with enhanced cushioning, ergonomic forms, and lightweight construction. This is because cyclists are becoming pickier about saddle ergonomics, materials, and design. Additionally, it is now simpler for cyclists to find and buy aftermarket saddles that best suit their unique riding styles and preferences because of the rising popularity of online retail and the availability of user ratings and recommendations. This pattern is anticipated to continue as the cycling community prioritizes comfort and performance, fostering more innovation and competition in the aftermarket for bicycle saddles.

Sales Channel Insights

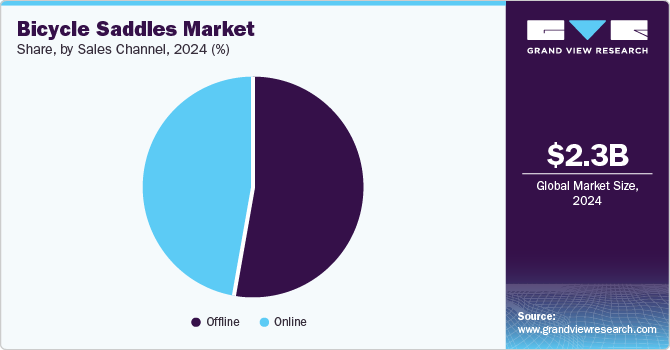

Based on sales channels, the offline segment dominated the market in 2024, gaining a share of 53.3%. The demand for bicycle saddles through offline sales channels remains robust despite the growing prevalence of online shopping in the bicycle industry. Brick-and-mortar bicycle shops, sporting goods stores, and cycling specialty retailers continue to serve as essential outlets for cyclists seeking high-quality saddles. These offline sales channels offer customers the advantage of in-person consultations and hands-on experiences, allowing them to physically assess the comfort and fit of saddles before making a purchase. Moreover, these local retailers often provide valuable expertise, helping cyclists choose the right saddle based on their individual riding needs and body geometry. This personalized service is particularly beneficial for beginners and riders looking for precise guidance. As the bicycle industry evolves with technological advancements, offline sales channels continue to play a vital role in catering to the diverse needs and preferences of cyclists, ensuring that they can access the most suitable saddles for their biking journeys.

The online segment is anticipated to register a significant growth from 2025 to 2030. Online retailers, e-commerce websites, and marketplaces have become popular destinations for cyclists seeking a wide range of saddle options. This surge in online demand is attributed to the convenience of browsing and purchasing from the comfort of one's home, as well as access to a vast array of products, including specialized and niche saddle designs. Customer reviews and recommendations also play a significant role in influencing purchasing decisions, offering insights into the comfort and performance of saddles from fellow cyclists. Furthermore, online sales channels have made it easier for consumers to compare prices, features, and specifications, allowing them to make informed choices and find the best saddle to match their specific riding styles and preferences. As digital retail continues to evolve and grow, the online sales channel is expected to remain a prominent and convenient option for cyclists searching for the perfect bicycle saddle.

Regional Insights

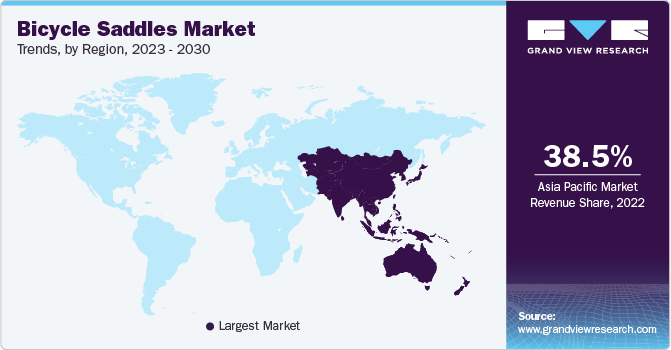

North Americabicycle saddles market is driven by increased cycling adoption, fueled by urban commuting and the growing focus on sustainability. Rising health consciousness and the growing popularity of e-bikes further stimulate demand for specialized, comfortable saddles. Additionally, government initiatives to expand cycling infrastructure and a rising preference for customizable products are contributing to market growth.

U.S. Bicycle Saddles Market Trends

The bicycle saddles industry in the U.S. is driven by the increasing popularity of outdoor recreational activities, particularly cycling. The U.S. outdoor recreation economy, which includes cycling, has seen substantial growth, reflecting a cultural shift towards active lifestyles. Additionally, the demand for customized and performance-oriented bicycle saddles is rising, particularly among road cyclists who seek specialized saddles to enhance comfort and performance. The convenience of online shopping further fuels this trend, as consumers have access to a wider variety of saddles with detailed user reviews, enabling informed purchasing decisions.

Asia Pacific Bicycle Saddles Market Trends

The bicycle saddles market in Asia Pacific led the overall market in 2024, with a share of 38.6%. In recent times, the Asia-Pacific region has experienced a notable upswing in the demand for bicycle saddles, influenced by several key factors. One prominent driver is a cultural shift toward embracing healthier and environment-friendly modes of transportation, exemplified by the increasing popularity of cycling across many Asian nations. This shift has created a heightened demand for saddles that prioritize comfort and ergonomic design, enhancing the overall riding experience. The introduction and increasing popularity of electric bicycles (e-bikes) have further contributed to this demand, as e-bike riders seek specialized saddles tailored to their unique needs. Additionally, the rising middle class in many Asian countries, coupled with higher disposable incomes, has driven the desire for premium and performance-oriented saddles, prompting manufacturers to diversify their offerings. Overall, the Asia-Pacific market for bicycle saddles is flourishing, driven by health-conscious lifestyles, the e-bike trend, and the growing middle class's demand for quality cycling equipment.

Europe Bicycle Saddles Market Trends

The bicycle saddles industry in Europe is anticipated to register significant growth from 2025 to 2030. In Europe, the demand for bicycle saddles remains consistently strong, driven by a combination of cultural, environmental, and competitive factors. The continent's deep-rooted cycling tradition, along with well-developed cycling infrastructure in many cities, fuels an ongoing need for comfortable and high-performance saddles catering to a diverse range of cyclists, from daily commuters to professional athletes. Furthermore, Europe's emphasis on sustainability and eco-friendly mobility encourages consumers to seek saddles that deliver comfort during their daily commuting and leisure cycling pursuits. With cyclists increasingly acknowledging the pivotal role of saddle ergonomics in realizing their objectives, there persists a demand for inventive saddle designs and advanced materials. Europe continues to have a strong bicycle saddle industry, which reflects the continued attractiveness of cycling as a sensible and ecologically responsible lifestyle choice.

Key Bicycle Saddles Company Insights

Some of the key players operating in the market include Giant Bicycles, MERIDA BIKES, and fizik, among others.

-

Giant Bicycles, founded in 1972, is a globally known company in the cycling industry, known for its innovative bike designs and cutting-edge technology. The company revolutionized cycling with the introduction of lightweight aluminum frames and carbon fiber bikes and continues to push boundaries with advancements like the Maestro Suspension system and industry-leading e-bikes. Giant Bicycles serves cyclists of all levels, offering a comprehensive ecosystem that includes bicycles, gear, and services.

Prologo and Fabric are some of the emerging market participants in the target market.

-

Prologo is an Italian brand renowned for producing high-performance saddles and accessories tailored to road cycling, mountain biking (MTB), e-bikes, and gravel bikes. Prologo's product line features a variety of saddle models, including those with cutting-edge designs and materials like Nack, Tirox, and Perineal Area System (PAS), focusing on enhancing performance, comfort, and durability for cyclists of all levels.

Key Bicycle Saddles Companies:

The following are the leading companies in the bicycle saddles market. These companies collectively hold the largest market share and dictate industry trends.

- Bontrager

- Cionlli

- DDK

- Fabric

- fizik

- Giant Bicycles

- MERIDA BIKES

- Prologo

- Schwinn

- SDG Components, Inc.

- Selle Italia s.r.l.

- SHIMANO INC.

- Specialized Bicycle Components, Inc.

- VELO

- WTB

Recent Development

-

In June 2024, Italian brand fizik, in collaboration with Carbon, Inc. and GEBIOMIZED, launched the One-to-One saddle, leveraging pressure mapping and advanced lattice designs to create tailored solutions for individual riders, enhancing performance and addressing unique ergonomic needs.

-

In May 2023, fizik launched its Antares saddle range which offers riders more comfort and adaptability. A center cut-out, a sleek low-profile design, and a wider snout are all features of the revised Antares line. These design changes were made to get rid of irritating pressure points, improve rider comfort, and allow for more mobility when seated.

-

In April 2023, Prologo launched the Scratch NDR, a new off-road saddle designed for XC and XCM disciplines, developed in collaboration with professional riders from eight teams. It features Prologo’s Multi Sector System technology, with three distinct zones that provide tailored support for various phases of pedaling, enhanced comfort, and a better fit during climbs and technical uphills.

Bicycle Saddles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.44 billion

Revenue forecast in 2030

USD 3.59 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Actual Data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Activity, distribution channel, sales channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, China, India, Japan, Australia, South Korea, Brazil, UAE, Kingdom of Saudi Arabia (KSA), South Africa

Key companies profiled

Bontrager, Cionlli, DDK, Fabric, fizik, Giant Bicycles, MERIDA BIKES, Prologo, Schwinn, SDG Components, Inc., Selle Italia s.r.l., SHIMANO INC., Specialized Bicycle Components, Inc., VELO, and WTB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bicycle Saddles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bicycle saddles market report based on activity, distribution channel, sales channel, and region:

-

Activity Outlook (Revenue, USD Million, 2017 - 2030)

-

Mountain Bikes

-

Hybrid Bikes

-

Road Bikes

-

E-bikes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

OEM

-

Aftermarket

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

Bike Store

-

Mass Market Retail Store

-

Sporting Goods Store

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The global bicycle saddles market size was estimated at USD 2.27 billion in 2024 and is expected to reach USD 2.44 billion in 2025.

b. The global bicycle saddles market is expected to witness a compound annual growth rate of 8.0% from 2025 to 2030 to reach USD 3.59 billion by 2030.

b. The road bikes bicycle saddle segment accounted for more than 34% share of the global revenue in 2024. The large share of this segment is attributed to the demand for saddles that offer a seamless fusion of comfort and performance.

b. Some key players operating in the bicycle saddle market include Bontrager, Cionlli, DDK, Fabric, Fizik, Giant Bicycles, MERIDA BIKES, Prologo, Schwinn, SDG Components, Selle Italia, SHIMANO INC., Specialized Bicycle Components, Inc., Velo, and WTB.

b. Key factors that are driving the bicycle saddles market growth include the increasing popularity of cycling as a means of transportation, growing emphasis on leading healthier lifestyles, surge in electric bicycle (e-bike) adoption, and advancements in the manufacture of bicycle saddles using innovative materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.