- Home

- »

- Clothing, Footwear & Accessories

- »

-

Bicycle Lights Market Size & Share, Industry Report, 2030GVR Report cover

![Bicycle Lights Market Size, Share & Trends Report]()

Bicycle Lights Market Size, Share & Trends Analysis Report By Bicycle Type (Conventional, E-Bicycle), By Voltage (Up to 12V, 36V, 48V), By Mounting Type (Headlight, Taillight), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-491-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Bicycle Lights Market Size & Trends

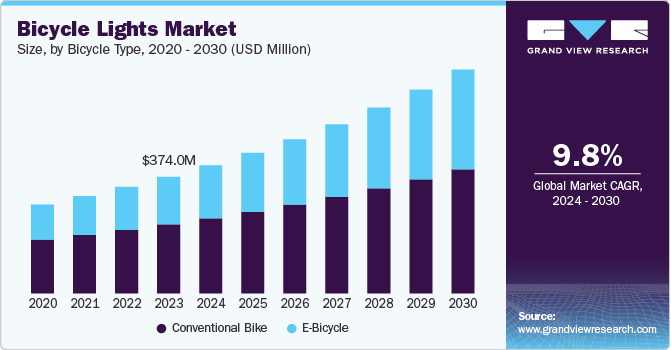

The global bicycle lights market size was estimated at USD 374 million in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030. One significant factor propelling the market is the rising awareness regarding road safety among cyclists. With a notable increase in urban cycling and recreational biking, there is a heightened demand for bike lights to ensure visibility and safety during low-light conditions. In many regions, including Europe and North America, regulations mandate the use of front and rear lights on bicycles, further driving sales in this segment. In fact, headlights account for the largest share of the market due to their critical role in illuminating paths and enhancing visibility to other road users.

The growing popularity of cycling as a sport also contributes significantly to the market's expansion. As more individuals engage in cycling for fitness and leisure, particularly mountain biking and road cycling, the demand for specialized lighting solutions increases. For instance, mountain bicycles often require high-powered lights capable of illuminating trails under challenging conditions.

Cycling events play a significant role in driving the growth of the market by fostering increased participation in cycling and raising awareness about safety and visibility. These events, ranging from local races to international competitions, not only encourage cycling as a sport but also highlight the importance of equipping bicycles with proper lighting systems. As more cyclists participate in these events, the demand for high-quality bicycle lights rises, contributing to market expansion.

One of the primary impacts of cycling events is the promotion of safety standards among participants. Many organized cycling events require riders to use appropriate lighting, especially during early morning or evening rides when visibility is low. This requirement has led to an increased adoption of bicycle lights as participants seek to comply with safety regulations and enhance their visibility on the road. For instance, events like the Tour de France and various charity rides often emphasize the necessity of using lights, thereby influencing consumer behavior and driving sales in the market.

Moreover, cycling events often serve as platforms for manufacturers to showcase their latest products, including advanced lighting technologies. Companies frequently use these events to launch new models or innovative features, such as integrated smart technology that enhances visibility and safety. The exposure gained during these events can significantly boost brand recognition and consumer interest in specific lighting products. For example, brands like Garmin have introduced products like rearview radar-activated taillights during major cycling events, capitalizing on the attention these gatherings bring.

The rise of cycling tourism is another aspect where cycling events contribute to the growth of the bicycle lights industry. Events that attract tourists, such as scenic bike tours or multi-day cycling festivals, create a demand for high-quality lighting solutions among participants who may not be familiar with local riding conditions. According to statistics from the European Parliament, approximately 2.3 billion cycle tourism trips are planned annually in Europe, which underscores the potential market for bicycle lights tailored for tourists seeking enhanced safety during their rides.

Another key driver is the increasing adoption of electric bicycles (e-bikes), which are often equipped with integrated lighting systems. The surge in e-bike sales is linked to their convenience as an alternative mode of transportation amid growing urban congestion. In countries like China and Germany, where traffic congestion is a significant concern, more people are opting for bicycles as a practical solution for commuting. This trend not only boosts sales of e-bikes but also drives demand for compatible lighting systems.

Advancements in technology have led to the development of more efficient and durable lighting options, such as LED lights. These lights offer better visibility while being energy-efficient and rechargeable, appealing to environmentally conscious consumers. The shift towards lightweight and compact designs aligns with consumer preferences for modern bicycles, further enhancing the appeal of advanced bicycle lighting solutions. As urban mobility continues to evolve towards sustainable practices, the market is well-positioned for ongoing growth driven by these multifaceted applications and trends.

One of the primary challenges is the lack of infrastructure in many regions, particularly in developing countries. Poorly maintained roads, inadequate bike lanes, and insufficient lighting in urban areas can deter cyclists from riding at night or in low-light conditions, which directly impacts the demand for bicycle lights. Without a supportive infrastructure that encourages safe cycling practices, the adoption of bicycle lights may remain limited, restricting market growth.

Another challenge is the varying regulations regarding bicycle lighting across different regions. While some countries have stringent laws mandating the use of lights on bicycles, others lack clear regulations, leading to inconsistencies in market demand. For instance, in the U.S. and UK, regulations require specific types of lights for nighttime riding, while other regions may not have such requirements. This inconsistency can create confusion among consumers and manufacturers alike, potentially stifling innovation and investment in bicycle lighting solutions. Manufacturers may hesitate to introduce advanced products if they are unsure about the regulatory landscape in various markets.

Finally, competition from alternative lighting solutions poses a challenge for the bike lights industry. As technology evolves, cyclists may opt for multifunctional devices that combine lighting with other features such as GPS navigation or fitness tracking. This trend could divert attention from traditional bicycle lights, especially among tech-savvy consumers who prioritize multifunctionality over specific lighting needs. In addition, the rise of smart technology and IoT devices could lead to a preference for integrated systems rather than standalone bicycle lights, further complicating market dynamics.

Bicycle Type Insights

The conventional bicycle segment was the largest user of lights, with a market revenue of USD 221 million in 2023. The growth of conventional bikes is significantly driven by increasing safety awareness among cyclists and stringent regulations regarding visibility. As cycling becomes a more popular mode of transportation and recreation, especially in urban areas, the demand for bicycle lights has surged. Many regions, particularly in Europe, have implemented laws requiring bicycles to be equipped with lights, which has led to a rise in sales. For instance, countries like Germany mandate that every bicycle sold must include lighting systems, thereby enhancing rider safety during nighttime rides. This regulatory push not only ensures compliance but also fosters a culture of safety among cyclists, leading to increased adoption of bicycle lights.

In addition, the growing popularity of cycling as a sport and recreational activity contributes to the demand for bicycle lights. Events such as mountain biking and road races have heightened the focus on rider visibility and safety, encouraging cyclists to invest in high-quality lighting solutions. The increasing interest in mountain biking, particularly in regions like North America, has led to a surge in demand for specialized lighting that can illuminate trails effectively. As health-conscious individuals turn to cycling for fitness and leisure, the need for reliable and durable bicycle lights becomes paramount.

The use of bike lights in e-bicycles is expected to show rapid growth, resulting in a projected CAGR of 11.1% from 2024 to 2030. The growth of e-bikes is significantly driven by the increasing adoption of electric bicycles as a preferred mode of transportation. As urban areas become more congested and concerns about environmental sustainability rise, many consumers are turning to e-bikes for their convenience and efficiency. E-bikes offer a practical solution for commuting, allowing riders to navigate through traffic with ease while reducing their carbon footprint. As e-bikes gain popularity, the demand for compatible lighting systems that enhance safety and visibility is also on the rise.

Another key driver for the growth of the e-bike lights industry is the increasing emphasis on safety regulations and government initiatives that promote cycling. Many countries are implementing laws that require e-bikes to be equipped with lights, like conventional bicycles. This regulatory environment not only ensures compliance but also encourages consumers to invest in high-quality lighting solutions for their e-bikes. For instance, countries like Denmark have established specific requirements for bicycle lighting, mandating that e-bikes include visible headlights and taillights. Such regulations create a consistent demand for bicycle lights as manufacturers adapt their products to meet these standards.

Technological advancements in lighting solutions are contributing to the growth of the e-bike lights market. The shift towards LED technology has revolutionized bicycle lighting by providing brighter illumination, longer battery life, and energy efficiency compared to traditional lighting options. Overall, the combination of increased e-bike adoption, supportive regulations, and technological advancements positions the bicycle lights industry for significant expansion in the coming years.

Mounting Type Insights

Bicycle headlights were the largest segment in terms of revenue, and it is expected to reach USD 480 million by 2030. Headlights are crucial for illuminating the path ahead, especially during night rides or in low-light conditions. As cycling becomes increasingly popular as a mode of transportation and recreation, the demand for effective lighting solutions has surged. Headlights provide essential visibility not only for cyclists but also for other road users, thereby reducing the risk of accidents. This heightened focus on safety has led to a significant increase in the adoption of high-quality headlights, which are often equipped with advanced features such as adjustable brightness levels and longer battery life.

The bicycle taillights segment is expected to grow at a CAGR of 8.5% from 2024 to 2030. Taillights are gaining traction as well, particularly due to their role in enhancing visibility from behind. Recent innovations, such as brake signal technology that alerts drivers when a cyclist is slowing down, have also contributed to the growing popularity of taillights. As a result, the taillight segment is anticipated to exhibit one of the highest growth rates in the bicycle lights industry, reflecting changing consumer preferences toward comprehensive safety solutions.

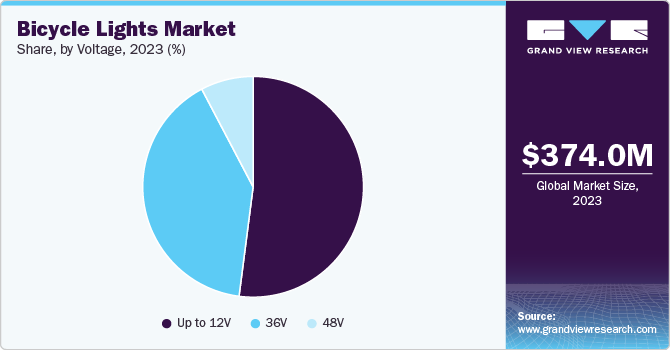

Voltage Insights

The up to 12V bicycle light segment was the largest, with a market share exceeding 50% in 2023. The 12V segment is particularly attractive due to its balance between power and energy efficiency, making it suitable for a wide range of bicycles, including mountain and road bikes. This voltage level provides sufficient brightness to illuminate paths while being manageable in terms of battery consumption, appealing to both casual riders and enthusiasts alike.

Another contributing factor to the growth of 12V bicycle lights is the technological advancements in LED lighting. With the increasing availability of high-quality 12V LED lights that are easy to install and cost-effective, more cyclists are equipping their bikes with these lighting solutions. As a result, the 12V bicycle lights market is expected to witness substantial growth, driven by both safety considerations and advancements in lighting technology.

The 36V bicycle lights segment is expected to be the fastest-growing category and is anticipated to witness a CAGR of 10.3% from 2024 to 2030. A key driver for the growth of 36V bicycle lights is the regulatory environment surrounding cycling safety. Many countries have implemented strict regulations requiring bicycles, particularly e-bikes, to be equipped with adequate lighting systems. This has led to a significant increase in the sales of 36V lights, as they meet the requirements for brightness and visibility mandated by these regulations. For instance, regions like the U.S. and Europe have seen a rise in compliance with lighting regulations, further boosting the demand for 36V systems. In addition, advancements in LED technology have made these lights more efficient and cost-effective, appealing to consumers looking for reliable lighting solutions that enhance their riding experience while adhering to safety standards.

Furthermore, the growing popularity of cycling events and adventure activities has also contributed to the demand for 36V bicycle lights. Overall, these factors position 36V bike lights as a critical segment within the broader bicycle lights industry, reflecting changing consumer preferences and regulatory demands.

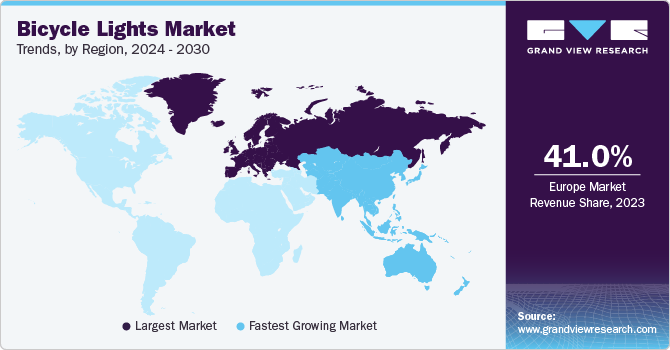

Regional Insights

North America bicycle lights market sales exceeded USD 70 million in 2023. The growth of the bicycle lights industry in North America, particularly in the United States, is largely driven by the increasing popularity of cycling as both a recreational activity and a viable mode of transportation. As more individuals embrace cycling for fitness and commuting, the demand for effective lighting solutions has surged.

U.S. Bicycle Lights Market Trends

The U.S. bicycle lights market growth is fueled by rising participation in cycling events and recreational biking, with around 51.4 million participants engaged in various cycling activities in the U.S. alone. The emphasis on safety during these activities has led to an increased focus on equipping bicycles with high-quality lights to enhance visibility and reduce accidents.

Europe Bicycle Lights Market Trends

The bicycle lights market in Europe was the largest globally and accounted for a revenue share of 41.0% in 2023. The growth of the bicycle lights industry in Europe is significantly driven by the increasing adoption of cycling as a primary mode of transportation and the accompanying regulatory frameworks that promote safety. Countries like Germany, the Netherlands, and Denmark have established comprehensive cycling infrastructures, including dedicated bike lanes and extensive cycling paths, which encourage more people to cycle regularly.

The rising popularity of electric bicycles (e-bikes) in Europe is a significant factor contributing to the growth of the bicycle lights industry. E-bikes are increasingly favored for their convenience and efficiency, particularly in urban settings where traffic congestion is prevalent. Countries such as Norway and the Netherlands are witnessing a surge in e-bike adoption, which often comes with built-in lighting systems designed to enhance visibility and safety during rides. As e-bikes typically require more robust lighting solutions, the demand for higher voltage lights, such as 36V systems, is also increasing.

Asia Pacific Bicycle Lights Market Trends

Asia Pacific bicycle lights market is expected to grow at a CAGR of 11.7% from 2024 to 2030. The growth of the bicycle lights industry in Asia is significantly driven by the increasing popularity of cycling as a mode of transportation and recreation, particularly in countries like China and India.

The China bicycle lights market growth is driven by rapid urbanization and rising traffic congestion, which have led to a surge in bicycle usage as a practical solution for commuting. As a result, there is a growing demand for effective lighting solutions to enhance visibility and safety during nighttime rides. The country is not only the largest producer of bicycles but also the leading exporter of bicycle lights. This growth is supported by the government's initiatives to promote cycling as an eco-friendly alternative to motor vehicles, further driving the need for reliable bicycle lighting systems.

The bicycle lights market in India is driven by the increasing awareness of the health and environmental benefits associated with cycling. The country's burgeoning population and urban infrastructure development are encouraging more people to adopt bicycles for commuting and leisure activities. As cycling gains traction, there is a corresponding rise in the demand for bicycle lights to ensure safety on the roads. In addition, Indian cities are beginning to implement better cycling infrastructure, which includes dedicated bike lanes and improved traffic regulations that mandate lighting for bicycles at night. These developments are expected to significantly boost the bicycle lights industry in India, as consumers prioritize safety and visibility while riding in urban environments.

Key Bicycle Lights Company Insights

The bicycle lights industry is characterized by a competitive landscape featuring a mix of established brands and emerging players. Key companies in this sector include Trek Bicycle Corporation, Garmin, Cateye Co., Ltd., and Lezyne, which are known for their innovative lighting solutions tailored for both conventional and electric bicycles. These companies are leveraging advancements in LED technology to enhance the brightness, efficiency, and durability of their products. In addition to these major players, several niche brands are making their mark in the bicycle lights industry. Companies such as Knog and Cygolite focus on creating stylish yet functional lighting solutions that appeal to urban cyclists. The market is also seeing growth from companies like GACIRON, which offers a variety of affordable yet reliable lighting options, particularly in the Asian market, where demand is rapidly increasing. This competitive environment encourages continuous innovation, with companies striving to meet the evolving safety standards and preferences of cyclists worldwide.

Key Bicycle Lights Companies:

The following are the leading companies in the bicycle lights market. These companies collectively hold the largest market share and dictate industry trends.

- Trek Bicycle Corporation

- Knog

- Lupine Lighting Systems

- Princeton Tec

- Dinotte Lighting

- Garmin

- Lezyne

- Kryptonite

- Cygolite

- BBB Cycling

- Cateye Co., Ltd.

- Gaciron Technology

- Lord Benex International Co., Ltd.

- NiteRider Technical Lighting Systems

- Blackburn

Bicycle Lights Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 410.3 million

Revenue forecast in 2030

USD 717.2 million

Growth rate (Revenue)

CAGR of 9.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Bicycle type, voltage, mounting type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil, South Africa

Key companies profiled

Trek Bicycle Corporation; Knog; Lupine Lighting Systems; Princeton Tec; Dinotte Lighting; Garmin; Lezyne; Kryptonite; Cygolite; BBB Cycling; Cateye Co., Ltd.; Gaciron Technology; Lord Benex International Co., Ltd.; NiteRider Technical Lighting Systems; Blackburn

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bicycle Lights Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bicycle lights market report based on bicycle type, voltage, mounting type and region:

-

Bicycle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

E-Bicycle

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 12V

-

36V

-

48V

-

-

Mounting Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Headlight

-

Taillight

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bicycle lights market size was USD 374 million in 2023 and is expected to reach USD 410.3 million in 2024.

b. The global bicycle lights market is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030 to reach USD 717.2 million by 2030.

b. The up to 12V bicycle light segment was the largest with market share exceeding 50% in 2023. The 12V segment is particularly attractive due to its balance between power and energy efficiency, making it suitable for a wide range of bicycles, including mountain and road bikes. This voltage level provides sufficient brightness to illuminate paths while being manageable in terms of battery consumption, appealing to both casual riders and enthusiasts alike.

b. Some key players operating in the bicycle lights market include Trek Bicycle Corporation; Knog; Lupine Lighting Systems; Princeton Tec; Dinotte Lighting; Garmin; Lezyne; Kryptonite; Cygolite; BBB Cycling; Cateye Co., Ltd.; Gaciron Technology; Lord Benex International Co., Ltd.; NiteRider Technical Lighting Systems; Blackburn

b. One significant factor propelling the market is the rising awareness regarding road safety among cyclists. With a notable increase in urban cycling and recreational biking, there is a heightened demand for bike lights to ensure visibility and safety during low-light conditions. In many regions, including Europe and North America, regulations mandate the use of front and rear lights on bicycles, further driving sales in this segment. In fact, headlights account for the largest share of the market due to their critical role in illuminating paths and enhancing visibility to other road users.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."