- Home

- »

- Next Generation Technologies

- »

-

BFSI Security Market Size And Share, Industry Report, 2030GVR Report cover

![BFSI Security Market Size, Share & Trends Report]()

BFSI Security Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Physical, Information), By Enterprise Size (Large Enterprises, SMEs), By End Use (Banking, Insurance), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-790-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

BFSI Security Market Summary

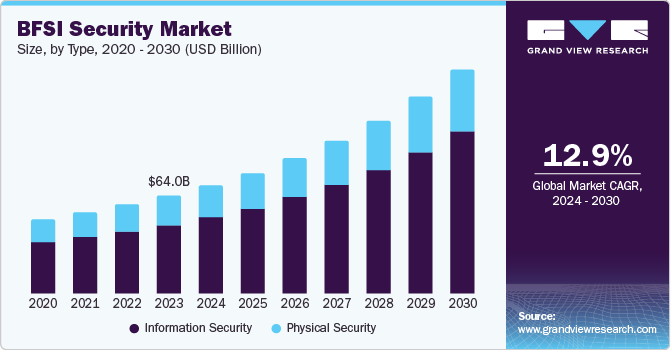

The global BFSI security market size was estimated at USD 64.0 billion in 2023 and is projected to reach USD 146.2 billion by 2030, growing at a CAGR of 12.9% from 2024 to 2030. The increasing frequency of cyberattacks such as ransomware, malware, data breaches, and phishing have heightened the requirement for robust security solutions in the BFSI sector.

Key Market Trends & Insights

- North America BFSI security market held the largest market share of 38.7% in 2023.

- The U.S. held a majority share in the regional market in 2023.

- By type, the information security segment accounted for the highest revenue share of 70.2% in 2023.

- By enterprise size, large enterprises segment accounted for the leading revenue share of 60.6% in the market in 2023.

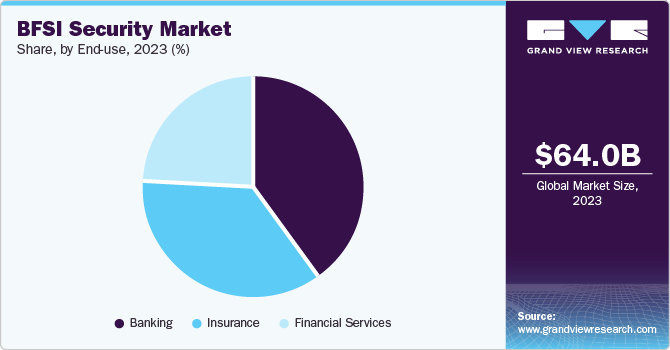

- By end use, the banking sector accounted for the highest market revenue share of 40.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 64.0 Billion

- 2030 Projected Market Size: USD 146.2 Billion

- CAGR (2024-2030): 12.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The sector's rapid adoption of digital technologies such as cloud computing, mobile banking, and internet banking has further expanded the avenues for such attacks and increased system vulnerability, commanding adequate digital security enhancements. Additionally, governments and regulatory bodies are coming up with stringent policies for data protection such as GDPR, PCI DSS, and BSA, compelling financial institutions to adhere to them by implementing strong security measures.

The growing demand for seamless digital experiences has amplified the need for secure and reliable online platforms, boosting investments in security measures to safeguard customer data and trust. For instance, growing digital financial literacy among consumers has compelled banks to implement digital financial services for faster and efficient transactions. Additionally, the BFSI sector is implementing zero-trust architecture on its IT platform to make it difficult for cyber attackers to invade their systems and thus ensure complete data security. These security measures require continuous monitoring and periodic updates, ensuring steady market demand for such solutions.

Increasing geopolitical uncertainties and nation-state cyberattacks have underscored the criticality of resilient security measures for the BFSI sector. The Global Financial Stability Report published by the International Monetary Fund in April 2024 revealed that cyber-attack incidences in the BFSI sector have doubled since the COVID-19 pandemic, and continue to pose a serious threat to global economic stability. Additionally, the existing absence of adequate policy regulations in developing countries as revealed by the IMF survey is expected to present a lucrative opportunity for cybersecurity services firms to incorporate their solutions in such use cases.

Type Insights

The information security segment accounted for the highest revenue share of 70.2% in 2023. The use of cloud storage infrastructure, adoption of digital banking, online transactions, and the increasing reliance on data-driven decision-making have made the BFSI sector highly susceptible to cyber-attacks. The substantial financial repercussions associated with such data breaches, including reputational damage, legal liabilities, and operational disruptions, have compelled BFSI organizations to prioritize investments in advanced information security technologies and solutions. This vulnerability leads to high market demand for these services.

The physical security segment is expected to contribute significantly in terms of revenue during the forecast period. The increasing complexity of financial operations and the expansion of branch networks by banks in remote areas have amplified the need for comprehensive physical security solutions. These factors, coupled with the rising incidence of physical security breaches and unauthorized intrusion into bank premises, have contributed to a notable share of the physical security segment within the global BFSI security market.

Enterprise Size Insights

Large enterprises accounted for the leading revenue share of 60.6% in the market in 2023. These organizations possess significantly larger volumes of sensitive financial data, customer information, and intellectual property compared to smaller financial institutions. Consequently, protection of such critical assets necessitates the presence of a robust security infrastructure and advanced solutions, driving higher security expenditure. Additionally, stringent regulatory frameworks developed by central banks of several countries for governing data privacy, security, and fraud prevention impose substantial compliance obligations on large BFSI institutions, leading to their larger share.

Small- and medium-sized enterprises (SMEs), meanwhile, are expected to register the fastest CAGR of 14.0% during the forecast period. Small enterprises are becoming highly susceptible to being targeted by cybercriminals due to their perceived weaker security infrastructures. As a result, growing awareness of the financial and reputational consequences of cyberattacks has driven smaller enterprises to prioritize cybersecurity investments and risk mitigation strategies. These factors are expected to drive substantial market expansion.

End Use Insights

The banking sector accounted for the highest market revenue share of 40.3% in 2023. This sector handles substantial financial assets and sensitive customer data, rendering it a prime target for cybercriminals and fraudsters. According to the ‘Cost of a Data Breach’ 2023 report published by IBM, institutions globally incur, on an average, USD 4.45 million for a data breach. Worldwide, the banking sector has become vulnerable to both IT infrastructure attacks and physical security breaches. The implementation of certain measures such as investment in surveillance systems, incidence response planning and testing, threat detection and response, and employee training leads to a significant expenditure, justifying a larger share of this sector in the market.

On the other hand, the financial services sector is expected to register the fastest growth rate of 14.4% from 2024 to 2030. The increasing adoption of digital channels and IT-based services in the financial service industry has increased the opportunities available for cyber attackers to breach these systems. Cybercriminals target customers by phishing, fraudulent emails, and phone calls to extract money from their accounts. For instance, according to Truecaller, about 70 million U.S. citizens lost nearly USD 40 billion to fraudulent phone calls in 2022. To safeguard customer information and maintain operational resilience, financial institutions are prioritizing security investments, leading to market growth.

Regional Insights

North America BFSI security market held the largest market share of 38.7% in 2023. The presence of major global financial institutions that handle substantial amounts of financial data in the region has created a considerable demand for sophisticated security solutions to protect critical assets and customer data. Additionally, owing to the concentration of wealth and financial resources, North American BFSI institutions have historically been prime targets for cybercriminals, accelerating the adoption of advanced security measures.

U.S. BFSI Security Market Trends

The U.S. held a majority share in the regional market in 2023. Credit card fraud, account hacking, data breaches, and online banking scams are among the most frequently encountered financial attacks by U.S. citizens. According to experts, the U.S. financial system is susceptible to state-sponsored cyber-attacks, which are more sophisticated and at a larger scale, compelling the financial sector to invest heavily on security measures. Additionally, the U.S. Congress and other regulatory bodies in the country implement various regulations such as The Sarbanes-Oxley (SOX) Act of 2002, The Bank Secrecy Act (BSA), and The Gramm-Leach-Bliley Act (GLBA) to ensure a more secured financial services landscape.

Europe BFSI Security Market Trends

Europe accounted for a notable market share in 2023. The increasing dependency of the financial sector on technology has compelled the European Union to come up with various regulations such as the Digital Operational Resilience Act (DORA), which came into effect in January 2023. This is a new European law designed to protect financial systems from cyberattacks and other technology failures. It sets common cybersecurity rules for banks, insurers, and other 20 such financial companies, as well as for tech firms that support them. By creating a single set of standards across the EU, DORA aims to strengthen the overall resilience of the financial sector and build on existing data protection and cybersecurity laws.

The UK held a substantial share of the regional BFSI security market. This is owing to the historic economic affluence of this country and a well-established infrastructure of the BFSI sector. Brexit has cut down the affiliation of the UK from European regulations; however, local regulations such as UK GDPR still apply for the protection of personal data in the country. Global events have a spillover effect on the country’s financial system. For instance, according to a study by Bridewell, since the start of the Russia-Ukraine conflict, financial service firms in the UK have observed an 81% surge in cyber-attacks. This vulnerability leads to increased spending for robust security infrastructure, propelling market growth.

Asia Pacific BFSI Security Market Trends

Asia Pacific is expected to register the fastest CAGR of 14.7% over the forecast period. The rapidly changing economic landscape and adoption of IT-based solutions for fast and efficient transactions have made the region prone to increased instances of cyber-attacks. According to a report on cybersecurity by Check Point Software Technologies Ltd. published in July 2024, the second quarter of 2024 experienced a significant surge in cyber-attacks globally and the Asia Pacific region accounted for 16% of these attacks, where the financial services sector had a notable share. With a steady rise in economic activities, the need for a reliable security infrastructure is expected to propel market expansion in this region from 2024 to 2030.

Increasing digital transformation and economic affluence in India has heightened the vulnerability to cyber-attacks for the country’s institutions. According to the Financial Stability Report published by the Reserve Bank of India (RBI) in December 2023, banks and financial institutions experienced over 1.3 million cyberattacks between January and October 2023. Dependency on third-party software services and adoption of cloud technologies have led to increased incidences of such attacks, as observed by RBI in its report. Additionally, Indians are experiencing increasing incidences of smishing, i.e. phishing via SMS. These incidences compel stakeholders to implement necessary security-related steps to avoid financial losses, leading to market demand for BFSI security services.

Key BFSI Security Company Insights

Some key companies involved in the BFSI security market include IBM Corporation, Cisco Systems, Inc., and Check Point Software Technologies Ltd., among others.

-

IBM Corporation is a U.S.-based multinational company operating in the field of IT consultancy, cloud computing, computer hardware, software, robotics, quantum computing, and artificial intelligence. IBM provides data security services under IBM Guardium Insights, Identity and Access Management (IAM), mobile security such as IBM MaaS360, extended detection and response under IBM QRadar SIEM, and attack surface management under IBM Randori Recon. The company offers IBM Trusteer solutions for the BFSI sector and is well-regarded in the market for its full lifecycle approach, right from consultation to actual implementation in cyber security services.

-

Cisco Systems, Inc. is an American multinational company offering services in computer networking hardware, telecom equipment, and cybersecurity. The company offers Cisco Umbrella, which is a cloud-delivered cybersecurity solution. Cisco Umbrella offers Data Loss Prevention (DLP) for securing important data; its DNS-layer security protects the network from ransomware, malware, and trojans. Cisco Umbrella facilitates closing security gaps, access to threat intelligence, and data recovery for financial institutions.

Key BFSI Security Companies:

The following are the leading companies in the BFSI security market These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Cisco Systems, Inc.

- Palo Alto Networks

- Check Point Software Technologies Ltd.

- McAfee, LLC

- Trend Micro Incorporated

- Fortinet, Inc.

- RSA Security LLC

- FireEye, Inc.

- Sophos Ltd.

Recent Developments

-

In July 2024, Check Point Software Technologies Ltd. and Logix InfoSecurity Pvt Ltd announced their Managed Security Service provider agreement for enhanced email security technology solutions. The partnership is expected to address the advanced threats of email phishing, account hacking, and malware scams in various critical sectors such as BFSI.

-

In May 2024, IBM Corporation and Palo Alto Networks announced their collaboration for offering AI-powered cybersecurity solutions to their customers. The strategic partnership is expected to tackle growing incidences of cyber threats among different industries, including the BFSI sector.

BFSI Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 70.7 billion

Revenue Forecast in 2030

USD 146.2 billion

Growth Rate

CAGR of 12.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

IBM Corporation; Cisco Systems, Inc.; Palo Alto Networks; Check Point Software Technologies Ltd.; McAfee, LLC; Trend Micro Incorporated; Fortinet, Inc.; RSA Security LLC; FireEye, Inc.; Sophos Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

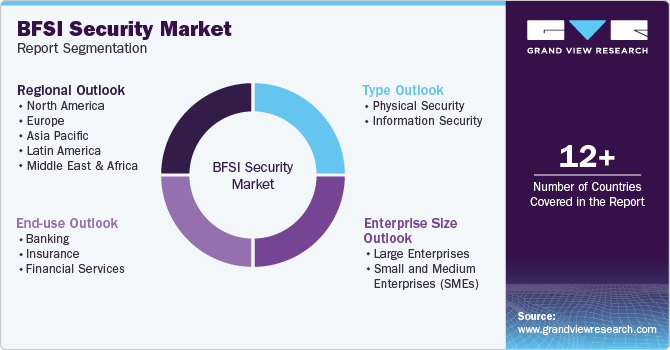

Global BFSI Security Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global BFSI security market report based on type, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physical Security

-

Access Control Systems

-

Video Surveillance Systems

-

Intrusion Detection & Prevention Systems

-

Security Guard Services

-

-

Information Security

-

Network Security

-

Endpoint Security

-

Data Security

-

Identity & Access Management (IAM)

-

Security Information & Event Management (SIEM)

-

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banking

-

Insurance

-

Financial Services

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.