BFSI Contact Center Analytics Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment, By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-621-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

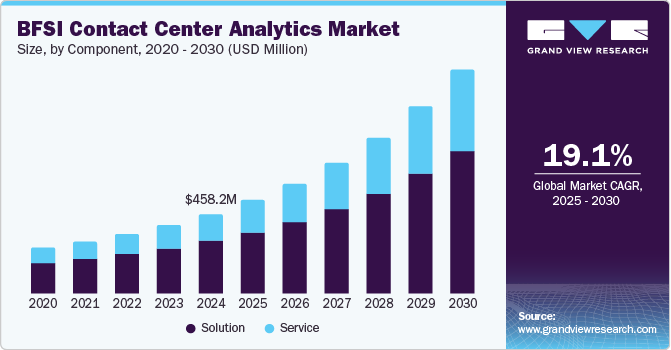

The global BFSI contact center analytics market size was valued at USD 458.2 million in 2024 and is projected to grow at a CAGR of 19.1% from 2025 to 2030. BFSI enterprises focus on delivering enhanced customer experience, performance monitoring, optimizing resource allocation, understanding customer behavior, ensuring compliance, and developing competitive advantage over other market participants. Enhanced operational benefits offered by technology, ease of use, and improved understanding of customer behavior are expected to fuel demand for this market.

The changing nature of the BFSI industry is driven by technology transformations, increasing inclusion of innovative solutions, immense competition, and global scale operations of multiple organizations, which have increased the significance of customer assistance and support. To address growing competition, demand for convenient services equipped with high-performance technology, and the diverse preferences of global customers, BFSI sector companies are embracing various strategies, including adopting BFSI contact center analytics.

Contact center analytics enable BFSI organizations to understand consumer behavior, process preferences, and problems that need to be addressed better. The insights derived from contact center analytics, with the help of technology, enable gear to assist BFSI enterprises in attaining operational excellence, developing and implementing improved customer engagement strategies, and enhancing risk management abilities. By analyzing interactions and previous communication patterns, companies can identify potential fraud threats, attempts to gain unauthorized access and malicious activities. These factors are expected to drive the growth of this market.

Growing demand by BFSI customers for self-experience services and solutions, rising significance of convenience and ease of use, and increasing emphasis in the industry on delivering improved customer experience encourage multiple banks, insurance service providers, and other finance industry participants to adopt advanced contact center analytics solutions. Companies' multi-channel customer experience management approach has shown noteworthy changes in operations and enhancements in customer-business interaction, which further fuels the demand.

Component Insights

Based on components, the solution segment dominated the global industry with a revenue share of 66.6% in 2024. This is attributed to the increasing adoption of advanced AI-equipped software offerings by multiple companies in the BFSI industry, the growing focus of businesses on developing an enhanced understanding of customer preferences, customer behavior, and pain points in customer experience, and the benefits derived from the implementation of contact center analytics, such as improved operations and enhanced customer experiences. The solutions that companies increasingly embrace include cross-channel analytics, performance analytics, predictive analytics, speech analytics, text analytics, and others.

Service is expected to experience the fastest CAGR from 2025 to 2030. Integration, deployment, post-integration support, maintenance activities, and other managed services experience continuous growth at a rapid pace owing to increased adoption and advancements in technologies. In addition, the lack of trained personnel fuels the demand for training and consulting services in the BFSI industry.

Deployment Insights

The on premise deployment segment held the largest revenue share of this market in 2024. BFSI organizations have large amounts of data, consumer information, and communications details. Multiple BFSI companies still prefer complete control of these valuable aspects and limit themselves from involving other parties and using networks outside organizations. The growing focus on developing an improved understanding of customer experience and the increasing availability of software technologies that analyze multiple elements of contact center data and customer communications are expected to drive growth in this market.

The hosted deployment segment is expected to grow at the fastest CAGR from 2025 to 2030. This is attributed to multiple factors, such as the growing availability of cloud computing technology and preference given by companies owing to benefits such as scalability, flexibility of scaling up and down according to workloads, enhanced control, remote monitoring, remote access, and more. The hosted deployment also allows businesses to enhance operational capabilities while ensuring improved data security and protection.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment dominated the global BFSI contact center analytics market in 2024. Extra-ordinary financial capabilities, large-scale operations that require automation or software assistance, increasing focus on improving customer engagement strategies, presence of in-house experts, and fewer restraints in adoption and implementation are key growth driving factors for this segment.

SMEs segment is anticipated to experience the fastest CAGR during the forecast period owing to increasing inclination of small and medium scale BFSI enterprises towards adopting advanced analytics software to ensure improved customer communication and engagement. SMEs often prefer adopting managed services as maintaining in-house teams adds extra costs. In contrast, managed services for contact center analysis allow SMEs to access IT expertise to improve operations, enhance security, and embrace scalability and flexibility.

Application Insights

Customer experience management segment held the largest revenue share in 2024. The rapid pace of digitization, growing ubiquity of smartphones, increasing demand for self-service banking experiences, and rising availability of high-speed internet have changed the dynamics of the BFSI industry in recent years. This has resulted in the continuous investment of resources by the BFSI organization to improve the customer experience. Contact center analytics offers significant insights regarding customer communication, pain points in customer experiences, and more by analyzing previous customer interactions.

The workforce optimization segment is projected to experience the fastest CAGR from 2025 to 2030. Contact center analytics provides multiple benefits to companies, which help them optimize their workforce. This includes identifying staffing needs, assessing and reallocating resources according to skillsets and expertise, real-time monitoring, performance management, and more. Companies also prefer contact center analytics to ensure the availability of detailed reviews of previous customer communication activities to address problems and identify necessary solutions.

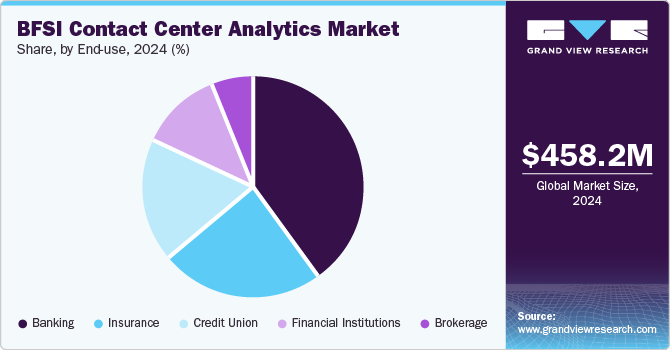

End-use Insights

Banking segment dominated the global BFSI contact center analytics market in 2024. Banking services have experienced substantial changes in customer requirements, communication methods, the number of customer interactions, and customer engagement strategies. The growing scale of operations for multiple banks and the emergence of neobanks have encouraged numerous banks to address competition and increasing demand for personalized services worldwide. Contact center analytics enables banks to embrace analytical abilities, which provide valuable insights regarding customer behavior and preferences.

The credit union segment is projected to experience fastest CAGR from 2025 to 2030. This is attributed to the increasing focus of credit unions on offering improved customer experience by understanding significant patterns of customer behavior, changes in expectations, preferences, priorities, requirements, and more. Contact center analytics technology assists these companies in attaining operational excellence, optimizing resource allocation, reaching improved strategies, and working efficiently on growth.

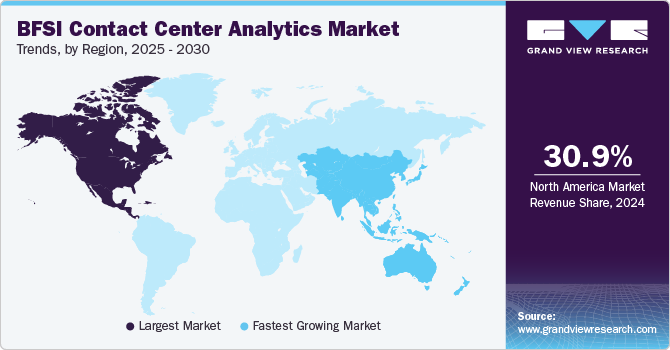

Regional Insights

North America BFSI contact center analytics market dominated the global market with revenue share of 30.9% in 2024. This is attributed presence of large BFSI industry enterprises in the region, growing adoption of modern technologies, increasing technology transformations, changing customer requirements, role of advanced technologies in modern baking operations, increasing focus of companies on delivery of enhanced customer experience and availability of sophisticated solutions diligently designed for the BFSI sector.

U.S. BFSI Contact Center Analytics Trends

The U.S. BFSI contact center analytics market held the largest revenue share of the regional market in 2024. The country's robust IT and telecom industry, BFSI organizations' rising focus on adopting advanced AI analytics technology, and significant growth in client communication for support, service maintenance, and more are key growth drivers for this market. Furthermore, the growing availability of customized solutions developed for specific requirements of different types of BFSI enterprises adds to the growth opportunities of this market.

Europe BFSI Contact Center Analytics Market Trends

Europe BFSI contact center analytics market held a significant revenue share of the global industry in 2024. The rapid pace of digitization, BFSI enterprises' increasing focus on enhanced customer engagements, rising availability and accessibility of cloud-deployed solutions, and the presence of highly regulated BFSI industry participants are some of the key growth driving factors.

Germany BFSI contact center analytics market held largest revenue share of the regional industry in 2024. This is attributed to the growing adoption of omnichannel analytics technologies to understand customers better while focusing on improving customer interactions. The presence of private commercial banks, public banks, cooperative banks, and other financial organizations is generating greater demand for contact center analytics services and solutions in this market.

Asia Pacific BFSI Contact Center Analytics Market Trends

Asia Pacific BFSI contact center analytics market is projected to experience the fastest CAGR during the forecast period. Lasting changes in the BFSI industry, technology transformation in countries such as India, growing entry of global BFSI enterprises in the region, and increasing focus of domestic and multi-national organizations on developing an improved customer experience, better customer interaction, and enhanced engagement are some of the key growth driving factors.

Japan BFSI contact center analytics market held a significant market share of regional industry in 2024 owing to various aspects such as rapid technology advancements in the country, availability of multiple alternatives for BFSI industry participants that offer BFSI contact center analytics, rising inclusion of modern technologies, ease of accessibility, and availability.

Key BFSI Contact Center Analytics Company Insights

Some of the key companies operating in the BFSI contact center analytics market are Cisco Systems, Inc., Genesys, Oracle, and others. To address increasing demand and rapid growth in competition, major companies are adopting strategies such as increased focus on support services and quick response to maintenance requests, innovation, inclusion of advanced technology tools in product design, and more.

-

Cisco Systems, Inc., a major market participant in the communication technologies and innovation industry, provides various services and solutions, including contact center solutions such as cloud contact centers, on-premises contact centers, cloud applications, and more.

-

Genesys, one of the key companies in this market, offers CX Contact Analytics through cloud resources and provides customer experience analytics characterized by actionable intelligence regarding contact center operations.

Key BFSI Contact Center Analytics Companies:

The following are the leading companies in the BFSI contact center analytics market. These companies collectively hold the largest market share and dictate industry trends.

- 8X8 Inc.

- Cisco Systems, Inc.

- Enghouse Interactive

- Five9, Inc.

- Genesys

- Genpact

- Mitel Networks Corp.

- Oracle

- SAP SE

- Verint Systems Inc.

Recent Developments

-

In September 2024, Verint Systems Inc. announced an expansion of its contact center business analytics suite by introducing the Verint Genie Bot, which enhances the capabilities of its speech analytics solution. This new bot allows business analysts to generate insights more quickly, significantly reducing the time needed to analyze data from days or weeks to seconds, saving organizations millions of dollars. The Verint suite empowers business leaders and IT developers by providing immediate access to critical data and insights across customer interactions.

-

In May 2024, 8x8 announced updates to its contact center and unified communications (UC) platform to enhance customer experience and operational efficiency. The new features include improved analytics, AI-driven capabilities, and integration options supporting a more seamless business communication flow. These enhancements help organizations better manage customer interactions and streamline their communication processes.

BFSI Contact Center Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 535.3 million |

|

Revenue forecast in 2030 |

USD 1.280.9 million |

|

Growth rate |

CAGR of 19.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

8X8 Inc.; Cisco Systems, Inc.; Enghouse Interactive; Five9, Inc.; Genesys; Genpact; Mitel Networks Corp.; Oracle; SAP SE, Verint Systems Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global BFSI Contact Center Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the BFSI contact center analytics market report based on component, deployment, enterprise size, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Cross-Channel Analytics

-

Performance Analytics

-

Predictive Analytics

-

Speech Analytics

-

Text Analytics

-

-

Service

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Organization

-

SMEs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic Call Distributor

-

Customer Experience Management

-

Log Management

-

Real-Time Monitoring & Reporting

-

Risk & Compliance Management

-

Workforce Optimization

-

Others (Customer Relationship Management, Chat Management, Performance Management)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Banking

-

Brokerage

-

Credit Union

-

Financial Institutions

-

Insurance

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."