- Home

- »

- Electronic & Electrical

- »

-

Beverage Fridge Market Size, Share & Growth Report, 2030GVR Report cover

![Beverage Fridge Market Size, Share & Trends Report]()

Beverage Fridge Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Free-standing, Built-in), By Application (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-405-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beverage Fridge Market Size & Trends

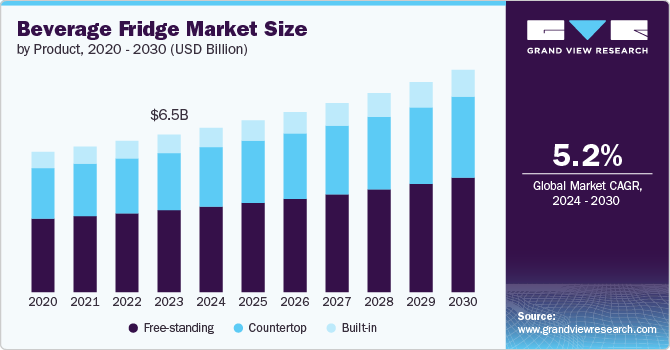

The global beverage fridge market size was estimated at USD 6.54 billion in 2023 and is expected to grow at a CAGR of 5.2% from 2024 to 2030.The demand for household appliances, including beverage fridges, increases as the global population rises. Larger populations mean more households and, consequently, more potential customers. Urban areas typically have higher disposable incomes and a greater tendency to adopt modern appliances, including beverage fridges. The convenience and lifestyle benefits of urban living drive the need for compact and efficient cooling solutions for beverages. With rising disposable incomes, consumers are more willing to invest in appliances that enhance their lifestyle and convenience. Beverage fridges, often considered a luxury item, become more accessible to a broader demographic.

The growing popularity of alcoholic drinks, particularly among young consumers in countries such as the U.S., the UK, India, and Germany, significantly contributes to the demand for beverage fridges. Young adults often seek convenient and stylish ways to store their beverages at home. The trend of microbreweries and craft beer pubs has also increased demand for specialized beverage fridges that accommodate various drinks at optimal temperatures.

The rise of beer-focused events and festivals, such as beer tastings and brewery tours, has become a trendy and fashionable choice for many. This is especially true in big cities like Paris, where beer bars and pubs have become popular hangout spots for young adults, driving the adoption of beer-cooling equipment like beverage coolers. Such attributes shape the demand for draught beers. According to the European Beer Trends Statistics Report 2023 Edition, the popularity of beer has been growing; beer consumption in France increased by 2.7% from 2021 to 2022, reaching a total of 228,00,000 hectoliters (hl).

Furthermore, the trend of home bars and entertaining guests at home has also spurred the demand for beverage fridges. Consumers prefer having chilled drinks readily available, which drives the need for dedicated cooling appliances. The commercial sector, including bars, restaurants, hotels, and cafes, significantly drives the demand for beverage fridges. These establishments require reliable and efficient cooling solutions to store large quantities of beverages.

Manufacturers increasingly offer customizable options for beverage fridges to cater to consumers' aesthetic preferences. These include various sizes, designs, and finishes to match different home decor. In May 2023, Budweiser, in collaboration with BETC Paris and Frog, introduced the “Bud Ground Cooler”-the first sustainable, electricity-free fridge capable of cooling below 6°C. Designed to address extreme heat, the Bud Ground Cooler features an umbrella-like top that provides shade from the intense sun. Beyond its cooling capabilities, it is a perfect gathering spot to beat the heat and stay refreshed.

The market is set for sustained growth, driven by product design innovations, campaigns, collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

In September 2023, Cooler Screens, a leader in retail media technology, has recently announced a collaboration with the beverage brand Sparkling Ice. This campaign uses Cooler Screens' advanced AI-driven targeting capabilities to promote Sparkling Ice’s lineup of zero-sugar, bold-flavored beverages. The key deliverable of this partnership is stunning high-definition 4K visuals that are contextually presented and powered by artificial intelligence. These visuals effectively showcase Sparkling Ice's various flavors, including its original and caffeinated options.

Product Insights

The free-standing segment accounted for a share of 52.06% of the global revenue in 2023. Free-standing beverage coolers offer greater flexibility in terms of placement. They can be easily moved and repositioned according to the user's needs without needing installation. This is particularly appealing for consumers who frequently entertain guests or those who prefer to have the option to rearrange their living spaces. Manufacturers offer a variety of designs and finishes in free-standing models, allowing consumers to choose coolers that complement their home decor. This aesthetic versatility makes them popular for those looking to integrate appliances seamlessly into their home environment.

The built-in segment is expected to grow at a CAGR of 5.6% from 2024 to 2030. Built-in models help optimize available space by being incorporated into the kitchen or living area rather than occupying standalone space. This allows for a more streamlined and efficient use of space. Built-in beverage fridges are often associated with luxury and convenience, offering precise temperature control, advanced cooling technologies, and high-end finishes. This appeals to consumers who prioritize both functionality and aesthetics. Home improvement and kitchen renovation projects are driving the demand for built-in appliances. Consumers undertaking kitchen upgrades are more likely to choose built-in beverage fridges to enhance the functionality and appearance of their space.

Application Insights

Commercial accounted for a share of 70.42% of the global revenue in 2023. Restaurants, bars, cafes, and hotels require reliable beverage cooling solutions to meet the high demand for cold drinks. Beverage coolers are essential for maintaining the quality and safety of beverages served to customers, making them indispensable in the food service industry. Commercial establishments often require coolers with larger capacities to store significant quantities of beverages. Commercial beverage coolers are designed to handle higher volumes than residential units, meeting the needs of businesses with high drink turnover rates.

Residential is expected to grow at a CAGR of 6.1% from 2024 to 2030. Modern consumers prefer convenient and accessible solutions for their everyday needs. Beverage coolers offer an easy way to keep drinks cold without constantly using the main refrigerator, enhancing convenience in daily life. The popularity of craft beers, fine wines, and artisanal sodas has led consumers to seek dedicated storage solutions. Beverage coolers cater to this need by offering optimal storage conditions for these specialty drinks. The rise of DIY home improvement projects has led many homeowners to upgrade their living spaces with new appliances, including beverage coolers. These projects often focus on enhancing functionality and adding value to the home.

Distribution Channel Insights

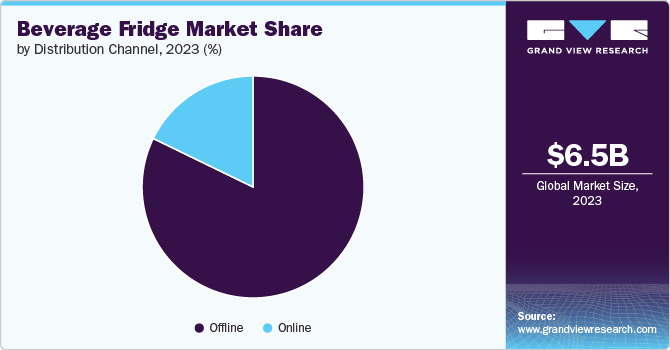

The sales of beverage fridges through offline channels accounted for a revenue share of 82.20% in 2023. Retail stores often run exclusive in-store promotions, discounts, and bundle deals that can be more appealing than online offers. Seasonal sales and holiday promotions can drive significant foot traffic and sales. Retail stores often host product demonstrations where brand representatives showcase beverage fridges' and other electronics' features and benefits. These demonstrations allow customers to see the products in action, ask questions, and get hands-on experience, which can significantly influence purchasing decisions. Moreover, luxury appliance brands are reshaping offline retail by collaborating with supermarkets and hypermarkets. These partnerships aim to showcase innovative appliances, boosting product visibility and drawing customers to physical stores. In January 2024, ZLINE, the luxury brand known for transforming the drop shipping of kitchen and bath appliances, unveiled its latest refrigeration line: Touchstone Undercounter Refrigeration. These Touchstone wine coolers and beverage refrigerators combine luxurious design with exceptional craftsmanship, setting a new benchmark for home entertainment. ZLINE’s Touchstone Undercounter Refrigeration models are available at Home Depot, Lowe's, Wayfair, and The Range Hood Store in the U.S.

The sales of beverage fridges through online channels are expected to grow at a CAGR of 5.9% from 2024 to 2030. Online platforms offer round-the-clock accessibility, allowing consumers to purchase beverage fridges anytime from the comfort of their homes or on the go. E-commerce has significantly altered consumer shopping behavior, offering several advantages, such as doorstep delivery, attractive discounts, and the convenience of finding various items on a single platform. Brands utilize social media platforms like Instagram, Facebook, and Twitter to showcase their products, engage with customers, and run targeted advertising campaigns. Social media allows brands to reach potential customers, build brand awareness, and drive traffic to online stores.

Regional Insights

The beverage fridge market in North America captured a revenue share of over 30.21%. With more consumers focusing on home entertainment, the demand for beverage fridges has increased. These appliances are popular for home bars, living rooms, and outdoor kitchens, making it convenient to access chilled beverages during social gatherings or family time. The growing emphasis on health and wellness has led consumers to stock a variety of beverages, including bottled water, sports drinks, and juices, which require proper storage. Beverage fridges provide an organized and accessible solution for these drinks.

U.S. Beverage Fridge Market Trends

The beverage fridge market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030.The trend of home entertainment and social gatherings at home has led to higher demand for beverage fridges. These appliances are essential for home bars, game rooms, and outdoor kitchens. Growing health consciousness is driving consumers to store a variety of healthy beverages, such as water, juices, and sports drinks, in dedicated fridges. Beverage fridges offer an organized and accessible way to keep these drinks chilled.In addition, the American Homebrewers Association (AHA) is a prominent organization dedicated to promoting and advancing the hobby of home brewing in the U.S. The AHA plays a significant role in supporting home brewers, advocating for their interests, and providing educational resources for beginners and experienced enthusiasts.

Europe Beverage Fridge Market Trends

The beverage fridge market in Europe is expected to grow at a CAGR of 5.3% from 2024 to 2030. The European market has seen a rise in the popularity of specialty beverages, such as craft beers, fine wines, and artisanal sodas. This trend has led to a growing demand for beverage fridges that offer precise temperature control to preserve the quality of these drinks. The demand for home appliances, including beverage fridges, has surged in Europe. This is attributed to the rise in home entertainment, remote working arrangements, and overall increased time spent at home. Consumers are investing in home improvement and convenience products, leading to higher sales of beverage fridges. European consumers are increasingly health-conscious and are stocking up on healthy beverages like bottled water, juices, and plant-based drinks. Beverage fridges provide an organized and accessible storage solution, keeping these beverages at optimal temperatures.

Asia Pacific Beverage Fridge Market Trends

The beverage fridge market in Asia Pacific is expected to witness a CAGR of 5.7% from 2024 to 2030. Rapid urbanization and increasing disposable incomes in countries like China, India, and Southeast Asia drive the demand for modern home appliances, including beverage fridges. Consumers are investing in home convenience and luxury items, boosting market growth. The trend towards home entertainment, including home bars and social gatherings, fuels the demand for beverage fridges. Consumers are looking for appliances that enhance their home experience by providing convenient storage for various beverages. The Asia Pacific region has a growing emphasis on health and wellness. Consumers are increasingly stocking up on bottled water, fresh juices, and health drinks. Beverage fridges offer an organized and accessible way to store these beverages, maintaining their freshness and taste.

Key Beverage Fridge Company Insights

The market is characterized by dynamic competitive dynamics shaped by product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, reinforcing their leadership in international markets that embrace dog treats.

Key Beverage Fridge Companies:

The following are the leading companies in the beverage fridge market. These companies collectively hold the largest market share and dictate industry trends.

- Haier Inc.

- LG Electronics Inc.

- Whirlpool Corporation

- Samsung Electronics Co., Ltd.

- The Middleby Corporation

- Panasonic Corporation

- Danby Products Ltd.

- Electrolux AB

- Perlick Corporation

- Liebherr-International Deutschland GmbH

Recent Developments

-

In June 2024, Zephyrunveiled the first-ever Presrv Outdoor Kegerator & Beverage Cooler, a groundbreaking addition to the appliance market. This versatile unit effortlessly transforms from a kegerator into a beverage cooler, making it ideal for when kegs aren’t in use. Its innovative design caters to large gatherings and everyday needs, providing easy access to chilled drinks.

-

In June 2023, MAGNOTHERM, in partnership with MyMuesli, unveiled their newest innovation, POLARIS-the magnetic beverage cooler-at an exclusive after-work event in Munich, Germany. POLARIS represents a breakthrough in efficient cooling technology, providing a unique and engaging experience.

Beverage Fridge Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.83 billion

Revenue forecast in 2030

USD 9.23 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Haier Inc.; LG Electronics Inc.; Whirlpool Corporation; Samsung Electronics Co., Ltd.; The Middleby Corporation; Panasonic Corporation; Danby Products Ltd.; Electrolux AB; Perlick Corporation; Liebherr-International Deutschland GmbH

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Beverage Fridge Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global beverage fridge market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Free-standing

-

Countertop

-

Built-in

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beverage fridge market size was estimated at USD 6.54 billion in 2023 and is expected to reach USD 6.83 billion in 2024.

b. The global beverage fridge market is expected to grow at a compounded growth rate of 5.2% from 2024 to 2030 to reach USD 9.23 billion by 2030.

b. The free-standing segment dominated the beverage fridge market with a share of 52.06% in 2023. They can be easily moved and repositioned according to the user's needs without needing installation. This is particularly appealing for consumers who frequently entertain guests or those who prefer to have the option to rearrange their living spaces.

b. Some key players operating in the beverage fridge market include Haier Inc.; LG Electronics Inc.; Whirlpool Corporation; Samsung Electronics Co., Ltd.; The Middleby Corporation; and Panasonic Corporation

b. Key factors driving the market growth include the trend of home bars and entertaining guests at home. Also, the commercial sector, including bars, restaurants, hotels, and cafes, significantly drives the demand for beverage fridges. These establishments require reliable and efficient cooling solutions to store large quantities of beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.