- Home

- »

- Homecare & Decor

- »

-

Beer Tourism Market Size, Share & Growth Report, 2030GVR Report cover

![Beer Tourism Market Size, Share & Trends Report]()

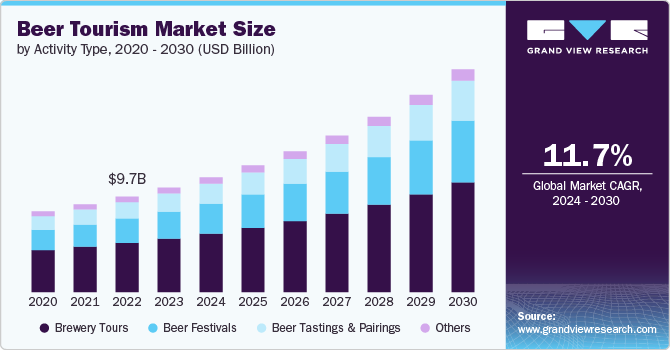

Beer Tourism Market Size, Share & Trends Analysis Report By Activity Type (Brewery Tours, Beer Festivals, Beer Tastings & Pairings), By Tourist Type (Domestic, International), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-434-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Beer Tourism Market Size & Trends

The global beer tourism market size was valued at USD 10.58 billion in 2023 and is expected to grow at a CAGR of 11.7% from 2024 to 2030, primarily due to the increasing global popularity of craft breweries, the rise in experiential travel and the growing demand for immersive cultural experiences. Enhanced marketing efforts by breweries, combined with the expansion of beer festivals and brewery tours, are further driving this growth, making beer tourism a significant and expanding sector in the travel industry.

As more consumers seek out beer-centric vacations, hospitality companies and travel agencies have responded by offering specialized tours and experiences that cater to this demand. Many travelers are embracing beer-centric journeys right from the airport. BrewDog Airlines, for instance, launched flights between London and Columbus, Ohio, offering in-flight beer tastings with specially crafted brews suited for high altitudes.

Additionally, beer tourism is impacting local economies, especially in regions where breweries are located in non-traditional tourist areas. Cities like Portland, Oregon, and Denver, Colorado, witness surges of visitors during major beer festivals.

Beer tourism is expanding beyond traditional beer-centric destinations, attracting a broader demographic that includes both younger craft beer enthusiasts and older tourists with the resources to travel. Unique experiences, such as Florence's artisan Italian craft beer tastings and Germany's iconic Oktoberfest, highlight the global appeal of beer-focused travel.

Key countries in the beer tourism market include Germany, the U.S., Belgium, the U.K., and the Czech Republic. Germany is renowned for Oktoberfest in Munich, a global beer festival drawing millions annually, while Belgium is celebrated for its historic breweries and diverse beer styles, attracting enthusiasts to cities like Brussels and Bruges. The U.S. boasts a dynamic craft beer scene with major festivals in Portland and Denver, contributing significantly to its market share.

Activity Type Insights

The brewery tours segment accounted for over 51% of the global revenue share in 2023, largely due to the growing interest in immersive and educational experiences among beer enthusiasts. Visitors are increasingly drawn to the opportunity to explore the brewing process firsthand, learn about different beer styles, and engage directly with brewers. The rise of craft breweries offering personalized tours, tastings, and behind-the-scenes access has further fueled this trend, making brewery tours a central component of the beer tourism experience and a significant revenue driver in the market.

The revenue from beer festivals is expected to grow at a CAGR of 12.8% from 2024 to 2030. The growth in beer tourism is evident through notable festivals such as the Great American Beer Festival (GABF) and the Festival of Wood & Barrel-Aged Beer (FoBAB). The GABF, held annually in Denver, is a major event attracting brewers and beer enthusiasts nationwide to celebrate American brewing diversity. Similarly, FoBAB in Chicago, recognized as the world’s largest barrel-aged beer festival, showcases rare and innovative brews from around the globe. These festivals reflect a broader trend in beer tourism, where enthusiasts seek unique and immersive experiences, driving the expansion and popularity of beer-focused events across the country.

Tourist Type Insights

Domestic tourists made up over 70% of the revenue share in 2023. This dominance is attributed to their proximity to local breweries and a rising interest in exploring nearby beer destinations. Economic benefits such as affordability, convenience, and a stronger cultural affinity with local beer traditions have significantly contributed to this trend. Additionally, the increasing appeal of local craft beer and regional brewery tours has further driven domestic beer tourism.

Beer tourism among international/foreign tourists is expected to grow at a CAGR of 12.3% from 2024 to 2030, driven by increasing global interest in unique cultural experiences, the rising popularity of beer-producing regions as vacation destinations, and enhanced marketing efforts by breweries targeting foreign visitors. Additionally, the expansion of direct flights and improved infrastructure in emerging beer-producing regions are making these destinations more accessible to international travelers, further boosting growth.

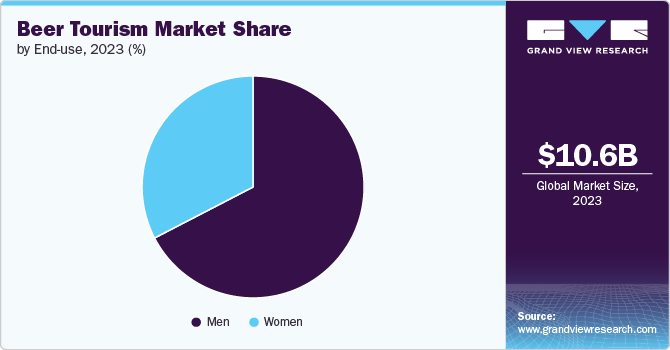

End Use Insights

Beer tourism among men accounted for over 67% of revenue share in 2023, driven by their strong affinity for craft beer culture and a higher participation rate in beer-related events and activities. Studies indicate that men are more likely to seek out brewery tours, attend beer festivals, and engage in beer-tasting experiences.

According to a 2023 Gallup poll, 53% of men reported beer as their most frequently consumed drink, compared to just 22% of women. This preference for beer among men drives their higher participation in brewery tours, beer festivals, and other beer-centric activities, making them a dominant demographic in the beer tourism market.

Revenue from beer tourism among women is projected to witness a CAGR of 12.4% from 2024 to 2030, driven by a growing interest in craft beer and the increasing inclusion of women in the craft beer community. According to the 2022 Great American Beer Festival study, 37% of women in the U.S. drink craft beer, and a 2020 study by Watson found that 31.5% of women enjoy craft beer several times a year. This rising trend is further supported by breweries and festivals tailoring experiences to appeal to female consumers, such as offering beer and food pairings, educational workshops, and women-focused beer events like the Pink Boots Society's gatherings, which encourage women to explore and enjoy craft beer tourism.

Regional Insights

North America beer tourism market accounted for a share of over 45% in 2023. Key destinations in the U.S., such as Portland, Oregon, and Denver, Colorado, significantly contributed to this share, drawing large crowds for major beer festivals and events. Portland's annual Oregon Brewers Festival and Denver's Great American Beer Festival are prime examples, each attracting tens of thousands of visitors and generating substantial economic impacts. Additionally, cities like Asheville, North Carolina, and Grand Rapids, Michigan, have also emerged as important beer tourism hubs, with Asheville boasting over 100 breweries and Grand Rapids known for its beer-centric events that contribute millions to local economies.

U.S. Beer Tourism Market Trends

The beer tourism market in the U.S. is expected to grow at a CAGR of 11.8% from 2024 to 2030. Beer tourism in the U.S. is on the rise, drawing substantial economic benefits to various communities. Studies highlight its impact, such as the USD 38.5 million generated by nearly 94,000 beer tourists in Kent County, MI, and the USD 23.9 million from the 2017 Oregon Brewer Festival in Portland. This growth reflects the increasing interest in craft beer, with research indicating that beer tourists are typically male, young, well-educated, and economically well-off.

Europe Beer Tourism Market Trends

The beer tourism market in Europe is expected to grow at a CAGR of 12.4% from 2024 to 2030, driven by increased consumer interest in craft beers and unique brewing experiences. Iconic beer festivals such as Oktoberfest in Munich and the Brussels Beer Festival attract large crowds and boost regional tourism. Additionally, the rise of local breweries across Europe, combined with innovative beer tourism experiences and culinary pairings, is attracting both international and domestic tourists.

Asia Pacific Beer Tourism Market Trends

The beer tourism market in Asia Pacific is expected to grow at a CAGR of 12.1% from 2024 to 2030, driven by rising consumer interest in craft and premium beers, and a burgeoning beer culture in the region. The beer tourism market growth in Asia Pacific is fueled by the expansion of local breweries and beer festivals in countries like Japan, South Korea, and China, where beer tourism is becoming increasingly popular. Additionally, the rise in disposable incomes and an increasing number of international visitors seeking unique and culturally immersive experiences contribute to this growth.

Key Beer Tourism Company Insights

Some of the prominent beer manufacturers, including BrewDog, Anheuser-Busch InBev, and Heineken, leverage their established global brands and extensive brewery networks to attract beer tourists. These companies, along with leading regional brewers like Guinness and Craft Brew Alliance, hold significant market shares due to their extensive range of beer offerings and high-profile events.

Key strategies employed by companies in the market include enhancing consumer engagement through immersive brewery tours and exclusive beer tastings, and investing in unique beer-related travel experiences like dedicated beer airlines and brewery-themed accommodations. Taste Vacations, a travel company that specializes in organizing food and drink-focused vacations, offers multi-day brewery tours in renowned beer regions like Belgium, Colorado, and North Carolina. These curated experiences attract beer enthusiasts from all over the world, contributing to the expansion of the market.

Key Beer Tourism Companies:

The following are the leading companies in the beer tourism market. These companies collectively hold the largest market share and dictate industry trends.

- G Adventures

- BeerTrips.com

- Bon Beer Voyage

- City Brew Tours

- Intrepid Travel

- World of Beer

- Brewery Hops

- Beercycling LLC

- Inner Circle Beer Tours

- Brews Cruise

Recent Developments

-

Sugar Land, TX, recently joined the Brew City, Texas program, initiated by the Texas Craft Brewers Guild in March 2024. As an 'Emerging Brewscape,' the city aims to attract new businesses and expand its craft beer scene. Local developments include Talyard Brewing Co.'s upcoming 3.5-acre site and ongoing support from Saint Arnold Brewery for community events. Sugar Land anticipates transitioning to a 'Craft Beer Destination' within the year. Sugar Land’s inclusion in the Brew City, Texas program highlights its growing role as a key player in the Texas beer tourism market, with initiatives designed to boost local craft beer experiences and economic growth.

-

In November 2023, the Festival of Wood & Barrel-Aged Beer (FoBAB), the world’s largest and most prestigious barrel-aged beer festival, was held from November 3rd to 4th in Chicago. Hosted annually by the Illinois Craft Brewers Guild, the event drew breweries from around the globe to showcase their rare and innovative wood and barrel-aged beers.

Beer Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.63 billion

Revenue forecast in 2030

USD 22.56 billion

Growth Rate (Revenue)

CAGR of 11.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Activity type, tourist type, end use, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., France, Italy, Belgium, Netherlands, China, Japan, India, Australia, Brazil, South Africa

Key companies profiled

G Adventures, BeerTrips.com, Bon Beer Voyage, City Brew Tours, Intrepid Travel, World of Beer, Brewery Hops, Beercycling LLC, Inner Circle Beer Tours, Brews Cruise

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beer Tourism Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global beer tourism market report on the basis of activity type, tourist type, end use, and region.

-

Activity Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Brewery Tours

-

Beer Festivals

-

Beer Tastings & Pairings

-

Others

-

-

Tourist Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Belgium

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beer tourism market size was estimated at USD 10.58 billion in 2023 and is expected to reach USD 11.63 billion in 2024.

b. The global beer tourism market is expected to grow at a compound annual growth rate of 11.7% from 2024 to 2030 to reach USD 22.56 billion by 2030.

b. The beer tourism market in North America accounted for a share of over 45% of the global market revenue in 2023 owing to the region's region's deep-rooted beer culture and the appeal of visitor-friendly breweries in Oregon, Colorado, North Carolina, and Michigan.

b. Some of the key market players include G Adventures, BeerTrips.com, Bon Beer Voyage, City Brew Tours, Brews Cruise, and Beercycling LLC.

b. Key factors that are driving the beer tourism market growth include increasing global popularity of craft breweries, the rise in experiential travel, and the growing demand for immersive beer-tasting experiences.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."