- Home

- »

- Electronic & Electrical

- »

-

Beer Dispenser Market Size, Share & Growth Report, 2030GVR Report cover

![Beer Dispenser Market Size, Share & Trends Report]()

Beer Dispenser Market Size, Share & Trends Analysis Report By Product (Single Faucet, Double Faucet), By Application (Bars & Clubs, Hotels & Restaurants), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-179-7

- Number of Report Pages: 86

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Beer Dispenser Market Size & Trends

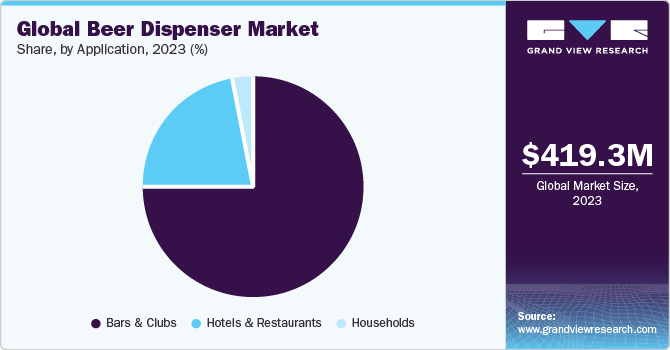

The global beer dispenser market size was estimated at USD 419.27 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2030. The growing popularity of craft beer, especially among millennials and younger consumers, is driving the demand for beer dispensers as bars, restaurants, and breweries seek to offer a wider variety of draft beer options. Technological advancements play a pivotal role in shaping the landscape of the beer dispenser industry, driving innovation, and enhancing the overall user experience. One key aspect is the integration of smart dispensing systems, which leverage cutting-edge technologies such as Internet of Things (IoT) connectivity and data analytics.

The beer dispenser industry is experiencing notable improvement, driven by the increasing popularity of craft beers. Technological advancements, such as smart dispensing systems and innovative design features, contribute to the market's growth, enhancing the overall consumer experience.The rise of beer culture and the experiential aspect of enjoying different brews contribute to the demand for advanced dispensing technologies, such as smart taps, temperature-controlled systems, and aesthetically appealing designs. As a result, manufacturers and stakeholders in the market are compelled to innovate and cater to the evolving needs of consumers, creating a symbiotic relationship between beer consumption trends and the growth of the market.

The dynamics of beer consumption significantly influence the market. As consumer preferences evolve and beer enthusiasts seek diverse and premium options, the demand for innovative dispensing solutions rises. Craft beer's growing popularity has led to an increased emphasis on preserving and serving these unique brews optimally, driving the adoption of specialized dispensing systems. According to Kirin Brewery Company, Limited, global beer consumption witnessed a notable upswing, reaching an impressive 185.60 million kiloliters in 2021, marking a substantial year-on-year growth of 4.0%. This surge underscores the robust and dynamic nature of the beer market, reflecting evolving consumer preferences and a sustained global appetite for this popular beverage.

Market Concentration & Characteristics

The global beer dispenser market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced at regular intervals. In February 2023, The Middleby Corporation, a prominent global food service industry player, partnered with Sustainable Beverage Technologies (SBT), a company dedicated to transforming the beer market through cutting-edge technological innovations while maintaining environmental sustainability. SBT collaborated with Middleby to produce the NexDraft dispensing system, incorporating Newton CFV technology with superior quality, high profitability, efficiency, and ecological sustainability.

Several market players such as Beerjet GmbH, Bottoms Up Draft Beer Systems (GrinOn Industries), PourMyBeer (Innovative Tap Solutions), and BeerMatic (HOSHIZAKI - GLOBAL AB MON. EΠΕ.) are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. Perlick announced a new collaboration with Draught Guard, combining its top-tier beer systems with Draught Guard's innovative beer line cleaning technology. This partnership aims to enhance efficiency and profitability for bar and brewery operators.

As the industry evolves and new technologies are introduced, navigating the intricate web of regulations governing the manufacturing, distribution, and operation of beer dispensers becomes increasingly challenging. Manufacturers and businesses must stay abreast of changing regulatory requirements, both at the global and local levels, to ensure compliance and avoid potential legal and operational setbacks.

There are compact and portable draft systems available that work with beer cans or bottles. These systems aim to recreate the draft beer experience by adding aeration and controlling the flow of the beer.

Application Insights

The bars & clubs segment dominated the market in 2023. The expansion of the pub and bar industry has played a pivotal role in driving the demand for beer dispensers. As more pubs and bars have opened or expanded their operations, the need for efficient and cost-effective dispensing systems has increased. According to research conducted by Co-Operatives UK in October 2023, there has been a remarkable 62.6% increase in community-owned pubs over the past five years in the UK The results represent a noteworthy growth of pubs in the UK despite the record closures within the broader pub industry.

The hotels & restaurants segment is anticipated to grow at the fastest CAGR during the forecast period.Boutique hotels and resorts collaborate with brewing companies to unveil exclusive and limited-edition beers as a unique offering within their hospitality services. These hotels focus on serving these beers through dispensers to create a personalized drinking experience for customers. For example, in August 2023, Noble House Hotels & Resorts, a family-owned boutique hotel brand, joined forces with the acclaimed Melvin Brewing, based in Wyoming, to introduce the exclusive Noble Wolf pilsner. This signature beer is available on tap across all properties and experiences within the portfolio.

Regional Insights

Europe Dominated the beer dispenser market with the market share of 34.8% in 2023. The presence of a dominant drinking culture in Europe is playing a significant role is driving the demand for beer dispensers. According to the 2021 European health report from the World Health Organization (WHO), the average annual alcohol consumption per person aged 15 and over in Europe is 9.5 liters of pure alcohol. This amount is equivalent to approximately 190 liters of beer, 80 liters of wine, or 24 liters of spirits. Consequently, this is anticipated to drive the demand for beer dispensers, which allow pubs, bars, and restaurants to offer a wide variety of beers on taps and cater to the rising demand from European consumers for different styles and flavors of beer.

Germany accounted for the largest revenue share of the beer dispenser industry in Europe in 2023. Germany’s deep-rooted beer culture and the presence of numerous beer festivals are driving the country's demand for beer dispensers. Germany hosts a multitude of beer festivals, with the most famous being Oktoberfest in Munich. According to Oktoberfest.de, about 6 million people attend the Oktoberfest each year. During these festivals, large quantities of beer are consumed. Beer dispensers play an important role in efficiently serving the vast number of attendees and travelers, ensuring a continuous and smooth beer supply. To address the rise in beer festival enthusiasts, several companies are offering beer dispensers to several festivals in Germany. For instance, in October 2023, Vienna-based One Two Beer GmbH announced the launch of an automated beer tap to minimize queues in festivals. Its compact system makes it easy to transport and is resistant to harsh festival environments.

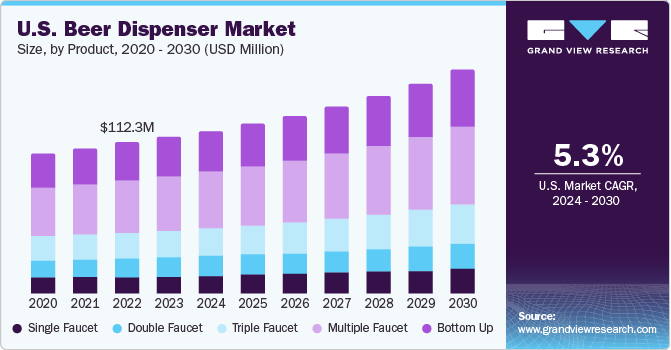

North America held a significant market share in 2023. The rising number of craft breweries catering to the beer-drinking culture has led to an increased demand for beer dispensers in the region. Consumers in the region are increasingly interested in trying new and unique brews. Beer dispensers allow several food service establishments and pubs to offer a rotating selection of craft beers on tap, enabling variety and innovation in the beer-drinking experience.

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. The rise in higher levels of disposable income has led to consumers exhibiting a greater willingness to allocate their spending towards premium and specialty beverages in the region. In response to this shift in consumer preferences, establishments are investing in advanced beer dispensing systems to cater to the evolving consumer demands in the region.

Several countries in the region are popular tourist destinations and host several expatriate communities. These communities increasingly seek diverse beer offerings. Beer dispensers in several bars and pubs help meet the growing demand for diverse beers, including local and international brews.

Japanese consumers are increasingly inclined towards unique and artisanal beers. This shift in preference is reshaping the beverage landscape, with craft beers gaining popularity for their distinct flavors. For instance, according to the local newspaper, The Mainichi Shimbun, in 2021, 559 craft breweries in Japan existed, and the number is poised to grow.

Product Insights

Multiple faucet beer dispenser segment accounted for the largest revenue share of 34.7% in 2023. Multiple faucet beer dispensers enhance operational efficiency in bars, restaurants, and breweries by enabling simultaneous dispensing of different beer types, reducing serving time, and enhancing customer satisfaction.Multiple faucets allow bartenders to serve different types of beer simultaneously, thereby expediting service and minimizing customer wait times. Establishments with beer dispensers featuring multiple taps can offer various beers, catering to different tastes and preferences.Many key players like Beerjet GmbH, KegWorks, Beverage-Air Corp., and others offer a variety of draft beer dispensing products, including multiple faucet beer towers. These towers typically feature two or more taps, allowing for the simultaneous dispensing of different types of beer or other beverages.

Bottom up segment is anticipated to witness the fastest CAGR over the forecast period. Bottom up dispensers are known for their ability to fill the glasses quickly. This is particularly advantageous in high-traffic venues such as sports stadiums, concert arenas, and busy bars where swift service is essential. Bottom up dispensers minimize beer wastage due to their precise measurement. The dispensing process stops automatically when the glass is full, avoiding over-pouring and spillage. Bottom-up dispensers stand out owing to their visual appeal and unique dispensing mechanism.

Many fast food brands are including beer in their menus as a part of their expansion strategy. For example, Taco Bell started selling beer in select UK locations. The fast food business used the Bottoms Up system, widely regarded as the 'world's most efficient beer serving' technology, to attract customers to its Hammersmith store in February 2019. This system features a bespoke branded magnet that firmly secures the liquid in the cup after dispensing it. Such developments are expected to generate new opportunities for the market and drive the sales of bottom-up beer dispensers across such establishments.

Key Companies & Market Share Insights

-

Beerjet GmbH, Bottoms Up Draft Beer Systems (GrinOn Industries), PourMyBeer (Innovative Tap Solutions), and BeerMatic (HOSHIZAKI - GLOBAL AB MON. EΠΕ.) are some of the dominant players operating in the market.

-

Beerjet GmbH has a strong global presence, and its dispensing systems are utilized in hospitality venues across Europe, North America, Asia, and beyond.

-

Bottoms Up provides portable draft systems, ideal for serving large crowds and at festivals in addition to beer dispensing systems

-

PourMyBeer's product portfolio includes systems that offer real-time insights and analytics, helping business owners make data-driven decisions to optimize their beverage programs.

-

Frothstop and RevolMatic are some of the emerging market players functioning in the beer dispenser industry.

-

Frothstop’s flagship product is a fully automatic, touchless beverage dispensing system designed for beer and other alcoholic beverages.

-

RevolMatic has established a robust global presence, serving customers worldwide through an extensive network of distributors and partners.

Key Beer Dispenser Companies:

- Beerjet GmbH

- Bottoms Up Draft Beer Systems (GrinOn Industries)

- PourMyBeer (Innovative Tap Solutions)

- Table Tap

- BeerMatic (HOSHIZAKI - GLOBAL AB MON. EΠΕ.)

- iPourIt

- RevolMatic

- PUBINNO

- Frothstop

Recent Developments

-

In September 2023, Perlick announced a new collaboration with Draught Guard, combining its top-tier beer systems with Draught Guard's innovative beer line cleaning technology. This partnership aims to enhance efficiency and profitability for bar and brewery operators. Draught Guard's unique technology extends the beer line cleaning intervals from every two weeks to 12 weeks.

-

In February 2021, Revolmatic introduced an automated beer dispensing robot that can function either as a bartender's assistant or a standalone vending machine. This device, which connects to a keg to pour beers automatically, can dispense up to 450 beers per hour. The standalone version integrates with Nayax's payment system, allowing contactless payments via various methods, including credit cards and mobile apps like Monyx Wallet. This innovation is part of a growing trend in robotic bartenders, driven by their novelty, the efficiency of handling repetitive tasks, and the reduction of human contact in post-pandemic scenarios.

-

In October 2020, Hoshizaki broadened its range of cooling solutions by introducing the BeerMatic Dual Tap DBF-AS65WE. This new, automated beer dispensing system is designed to streamline and accelerate bar service, particularly in venues such as beer gardens, stadiums, concessions, and mobile bars.

Beer Dispenser Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 435.90 million

Revenue forecast in 2030

USD 595.64 million

Growth rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; UK; Germany; France; Spain; China; India; Japan; Brazil; South Africa

Key companies profiled

Beerjet GmbH; Bottoms Up Draft Beer Systems (GrinOn Industries); PourMyBeer (Innovative Tap Solutions); Table Tap; BeerMatic (HOSHIZAKI - GLOBAL AB MON. EΠΕ.); iPourIt; RevolMatic; PUBINNO; Frothstop

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beer Dispenser Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global beer dispenser market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018- 2030)

-

Single Faucet

-

Double Faucet

-

Triple Faucet

-

Multiple Faucet

-

Bottom Up

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bars & Clubs

-

Hotels & Restaurants

-

Households

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beer dispenser market size was estimated at USD 419.27 million in 2023 and is expected to reach USD 435.90 million in 2024

b. The global beer dispenser market is expected to grow at a compounded growth rate of 5.1% from 2024 to 2030 to reach USD 595.64 billion by 2030.

b. Multiple faucet beer dispenser segment accounted for the largest revenue share of 34.7% in 2023. Multiple faucet beer dispensers enhance operational efficiency in bars, restaurants, and breweries by enabling simultaneous dispensing of different beer types, reducing serving time, and enhancing customer satisfaction. Multiple faucets allow bartenders to serve different types of beer simultaneously, thereby expediting service and minimizing customer wait times.

b. Some key players operating in the beer dispenser market include Beerjet GmbH; Bottoms Up Draft Beer Systems (GrinOn Industries); PourMyBeer (Innovative Tap Solutions); Table Tap; BeerMatic (HOSHIZAKI - GLOBAL AB MON. EΠΕ.); iPourIt; RevolMatic; PUBINNO; Frothstop

b. The growing popularity of craft beer, especially among millennials and younger consumers, is driving the demand for beer dispensers as bars, restaurants, and breweries seek to offer a wider variety of draft beer options. Technological advancements play a pivotal role in shaping the landscape of the beer dispenser market, driving innovation, and enhancing the overall user experience.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."