- Home

- »

- Beauty & Personal Care

- »

-

Beauty Subscription Box Market Size & Share Report, 2030GVR Report cover

![Beauty Subscription Box Market Size, Share & Trend Report]()

Beauty Subscription Box Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Skincare, Haircare, Makeup, Fragrance, Nail Care), By Price Range (Budget, Moderate, Premium), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-377-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beauty Subscription Box Market Summary

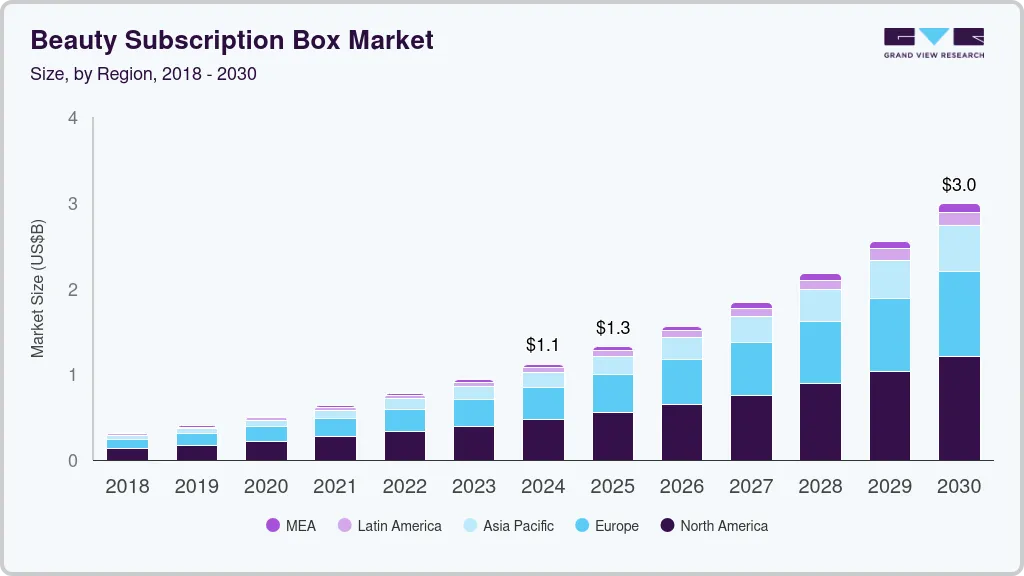

The global beauty subscription box market size was estimated at USD 1.11 billion in 2024 and is projected to reach USD 2.99 billion by 2030, growing at a CAGR of 17.7% from 2025 to 2030. The beauty box subscription market has experienced substantial growth in recent years, driven by the increasing consumer demand for personalized beauty experiences and the convenience of receiving curated products delivered to their doorsteps.

Key Market Trends & Insights

- The beauty subscription box market in North America accounted for a revenue share of 42.3% of the global market in 2023.

- Beauty subscription box market in the U.S. is expected to grow at a CAGR of 21.7% from 2024 to 2030.

- The Asia Pacific beauty subscription box market is expected to grow at a CAGR of 26.8% from 2024 to 2030.

- Based on product, skincare subscription sales accounted for a revenue share of 42.70% in 2023.

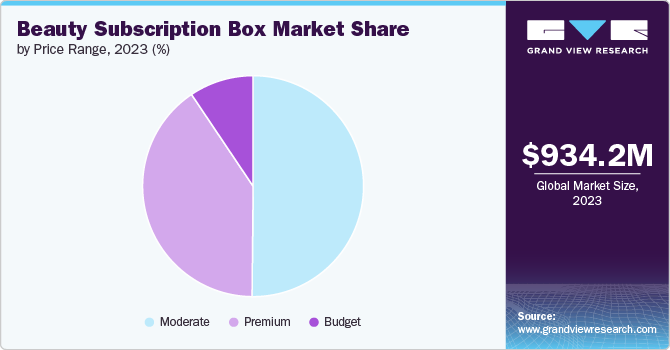

- In terms of price range, moderately priced beauty box subscriptions accounted for over 50% of the global market revenue in 2023.

Market Size & Forecast

- 2024 Market Size: USD 1.11 Billion

- 2030 Projected Market Size: USD 2.99 Billion

- CAGR (2025-2030): 17.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This growth is mainly driven by the rising interest in beauty and skincare routines, particularly among millennials and Gen Z, who value the discovery of new products and brands through these subscription services. The beauty box market offers a wide range of subscription types such as monthly subscriptions, quarterly subscriptions, and biannual subscriptions to cater to diverse consumer preferences. Beauty subscription boxes often utilize surveys to personalize the product selection for each subscriber, ensuring that the items received align with individual preferences and needs.For example, Ipsy employs a detailed beauty quiz during the sign-up process, where subscribers provide information about their skin type, hair type, makeup preferences, and specific beauty concerns. This data is then used by Ipsy’s algorithm to tailor the monthly Glam Bag, a beauty box to include products that best match the subscriber's profile. The company continuously refines its personalization by encouraging users to rate the products they receive, allowing the algorithm to learn and adapt to changing preferences.

The rising trend of K-Beauty is driving demand for Korean skincare products in beauty boxes as consumers increasingly seek innovative, high-quality formulations. Subscription services such as Bomibox offer curated selections of popular K-Beauty items, making it easy for enthusiasts to discover and access authentic Korean skincare products. This growing interest in personalized skincare experiences and the influence of social media further amplify the appeal of K-Beauty products in the beauty subscription market.

Product Insights

Skincare subscription sales accounted for a revenue share of 42.70% in 2023, attributed to the growing consumer preference for personalized skincare routines and the convenience of regular product delivery. In addition, innovative brands are increasingly offering targeted solutions for specific skin concerns, creating a diverse range of options that appeal to a broad audience. Beauty subscriptions include a majority of skincare products owing to the high demand for personalized skincare solutions. Skincare's prominence in beauty routines also drives brands to prioritize it in their offerings. For instance, Birchbox offers skincare products based on a Beauty Quiz analyzing consumer’s complexion, skin tone, and beauty style, etc.

Haircare subscription sales are projected to grow at a CAGR of 25.6% from 2024 to 2030. There is a rising demand for personalized beauty solutions, with consumers seeking products that cater to their unique hair needs. The emergence of niche and indie brands that focus on specific hair types, such as textured or curly hair, is increasing product variety to cater to different hair needs. Brands such as Curlbox, the pioneering textured haircare subscription service founded in 2012, elevated the visibility of textured hair brands through its subscription boxes.

Some of the haircare products that are increasingly gaining demand among consumers include hair masks and hair care creams. BoxyCharm by Ipsy offers hair masks and hair creams in its July 2024 beauty boxes.

Price Range Insights

Moderately priced beauty box subscriptions accounted for over 50% of the global market revenue in 2023, as they offer a balance of affordability and quality, making them accessible to a broader audience. Consumers are increasingly drawn to options that provide value. This has led to the popularity of boxes such as Birchbox, Allure Beauty Box, BoxyCharm, and Ipsy. These subscriptions typically cost between USD 16 to USD 30 per beauty box, featuring a minimum of 5 product varieties in the box, allowing users to explore new brands and products.

The expenditure on budget beauty box subscriptions is expected to grow at a CAGR of 27.8% from 2024 to 2030. This is mainly due to increasing consumer demand for affordable beauty solutions that allow experimenting with various products. The rising popularity of subscription models, combined with the expansion of value-driven brands offering high-quality items, makes these options appealing to a wider audience.

In addition, the convenience of regular delivery and curated selections enhances consumer loyalty and repeat subscriptions of budget beauty boxes. FabFitFun, Ipsy Glam Bags and perfume subscription boxes by ScentBox, Inc. are some of the budget beauty subscription options in the market.

Regional Insights

The beauty subscription box market in North America accounted for a revenue share of 42.3% of the global market in 2023. In 2021, beauty boxes captured 23% of subscription users in the U.S., outpacing food and drink at 19% and fashion at 15%, according to Emarsys. With 32% of U.S. consumers engaging in subscription services and an average monthly spend of USD 57, the North America beauty subscription market is expected to witness substantial growth.

U.S. Beauty Subscription Box Market

Beauty subscription box market in the U.S. is expected to grow at a CAGR of 21.7% from 2024 to 2030. While subscription services have expanded across various categories, beauty boxes continue to be the most popular choice among consumers. Data from Emarsys indicates that beauty boxes are the most subscribed services in the U.S. as of 2021. According to the same source, beauty box subscriptions surpassed the popularity of food and fashion subscription boxes in the U.S.

Europe Beauty Subscription Box Market

Beauty subscription box market in Europe accounted for a share of over 33% of the global market revenue in 2023, reflecting a strong consumer interest in personalized beauty experiences and a diverse range of high-quality skincare products. The presence of innovative local brands and collaborations with influencers have significantly boosted market visibility and subscriber engagement. In addition, European consumers value sustainability and cruelty-free options, driving brands to prioritize eco-friendly practices.

The UK beauty subscription box market is expected to grow at a CAGR of 25.0% from 2024 to 2030. According to Whistl, in 2022, 11% of the UK shoppers opted for a health & beauty subscription box service. This highlights a strong demand for curated product selections that cater to individual preferences. According to PaySafe, 53% percent of UK consumers believe that subscriptions offer a more convenient way to pay for goods or services they use regularly, highlighting the appeal of automated, hassle-free purchasing. This trend supports the growth of subscription models across various industries, including beauty, as consumers value the ease and consistency that subscription services provide.

Asia Pacific Beauty Subscription Box Market

The Asia Pacific beauty subscription box market is expected to grow at a CAGR of 26.8% from 2024 to 2030, indicating a rapidly expanding consumer base interested in trying new beauty trends and innovative products. The increasing popularity of K-beauty and J-beauty has led to a surge in demand for subscription services that offer curated selections. Furthermore, the region's young demographic is highly engaged with online shopping and beauty trends, supporting the growth of subscription models in beauty sector.

Key Beauty Subscription Box Company Insights

The beauty subscription box market is relatively fragmented due to the presence of numerous companies offering diverse products and personalized experiences to cater to various consumer preferences. Brands such as Ipsy, Birchbox, and Allure Beauty Box, each with their unique value propositions, are some of the key market participants.

Key Beauty Subscription Box Companies:

The following are the leading companies in the beauty subscription box market. These companies collectively hold the largest market share and dictate industry trends.

- Birchbox

- Ipsy

- GLOSSYBOX

- Allure Beauty Box

- Petit Vour

- OK! Beauty Box

- FabFitFun

- LOOKFANTASTIC

- Beauty Box Korea

- Bomibox Korean Beauty Box

Recent Developments

-

In July 2024, Allure Beauty Box launched a July Beauty Box Subscription that was packed with refreshing summer beauty treats, including a skin-cooling balm from Tula, a rum-inspired perfume oil from Malin + Goetz, and a gold-flecked primer from Yves Saint Laurent.

-

In May 2024, Lidl launched a new beauty box for just £2, containing over £70 worth of products. This trial offering included more than 20 full-size skincare, haircare, and fragrance items, such as Cien Myramaze Premium Face Day Cream and Suddenly Femelle Perfume. The beautifully packaged box is available since May 9 via lidlbeautybox.co.uk and is part of a limited trial.

-

Ipsy, the original beauty subscription service founded by Michelle Phan in 2012, strengthened its strategy by acquiring rival BoxyCharm in November 2020 for $500 million. Initially, both brands operated independently under Beauty for All Industries. This move was aimed to enhance personalization and offer a comprehensive beauty membership experience by combining Ipsy's AI-driven customization with BoxyCharm's brand curation.

Beauty Subscription Box Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.32 billion

Revenue forecast in 2030

USD 2.99 billion

Growth rate (Revenue)

CAGR of 17.7% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; South Korea; Australia; Brazil; South Africa; UAE

Key companies profiled

Birchbox; Ipsy; GLOSSYBOX; Allure Beauty Box; Petit Vour; OK! Beauty Box; FabFitFun; LOOKFANTASTIC; Beauty Box Korea; Bomibox Korean Beauty Box

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Beauty Subscription Box Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global beauty subscription box market on the basis of product, price range, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skincare

-

Facial Skincare

-

Lotions, Face Creams, & Moisturizers

-

Cleansers & Face Wash

-

Facial Serums

-

Face Masks

-

Sunscreen/Sun Care

-

Others

-

-

Body Skincare

-

Hair Removal Products

-

Lotions, Creams, & Moisturizers

-

Body Sunscreen/Sun Care

-

Body Scrub

-

Others

-

-

-

Haircare

-

Shampoo

-

Conditioner

-

Oils

-

Serums

-

Others

-

-

Makeup

-

Fragrance

-

Nail Care

-

Others

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Budget

-

Moderate

-

Premium

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global beauty subscription box market size was estimated at USD 2,261.7 million in 2023 and is expected to reach USD 2,846.3 million in 2024.

b. The global beauty subscription box market is expected to grow at a compound annual growth rate of 24.7% from 2024 to 2030 to reach USD 10,719.1 million by 2030.

b. The beauty subscription box market in North America accounted for a revenue share of 42.3% of the global market in 2023 owing to growing number of beauty subscription users surpassing food, drinks, and fashion categories.

b. Some of the key players operating in the beauty subscription box market include Birchbox, Ipsy, GLOSSYBOX, Allure Beauty Box, and Petit Vour.

b. The beauty box subscription market has experienced substantial growth in recent years, driven by the increasing consumer demand for personalized beauty experiences and the convenience of receiving curated products delivered to their doorsteps.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.