Beauty Salon Market Size & Trends

The global beauty salon market size was valued at USD 155.60 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. The beauty salon industry encountered significant challenges during the COVID-19 pandemic. However, it is currently undergoing transformation driven by key trends, including an upsurge in salons offering both products and services, customer preferences have shifted towards favoring specialized offerings over generic ones. Additionally, the growth in advanced beauty procedures, and a heightened emphasis on enhancing the overall customer experience within the industry are driving the growth of the beauty salon industry.

According to the 2021 Mindbody Wellness Index, hair salons were the most comfortable choice, with 64% of respondents expressing their willingness to return. Moreover, the survey underscores the growing popularity of the most in-demand services, namely haircuts (39%) and hair coloring (21%), which experienced significant demand during the pandemic. Furthermore, beauty salons providing massages and nail services have seen increased popularity, with 19% of Americans having received massages and 19% opting for manicures or pedicures.

Consumers in the beauty salon industry increasingly prefer the convenience of online appointment booking and check-in systems. This technology not only streamlines the process but also frees up stylists' time for more critical tasks. It is anticipated that the adoption of such modern technology will play a pivotal role in driving revenue growth during the forecast period. According to a blog published by gitnux in October 2023, around 40% of salon clients prefer online appointment booking. This highlights the importance for salons to prioritize and provide this convenient service to meet customer expectations and enhance their overall experience.

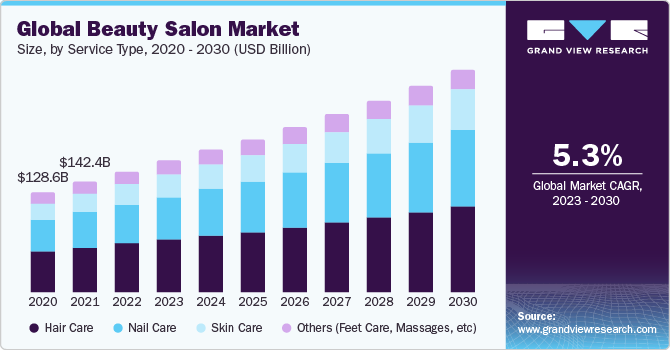

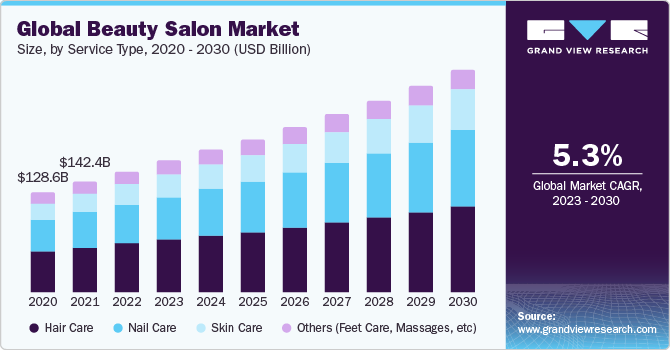

Service Type Insights

The global beauty salon industry specifically for hair care offers lucrative opportunity for the service providers due to the increased preference of various hair treatments such as hair coloring, hair styling, silk press, perms, hair straightening, and many more. According to Trafft in June 2023, in the U.S. hair salon industry, around 92% of revenue, is generated from the provision of various hair related services. Among these services, haircutting and styling account for the largest share, contributing to 62% of the industry's revenue. Additionally, hair coloring services make up 23% of the total revenue. This highlights the contribution of hair related services to the overall growth in the beauty salon industry.

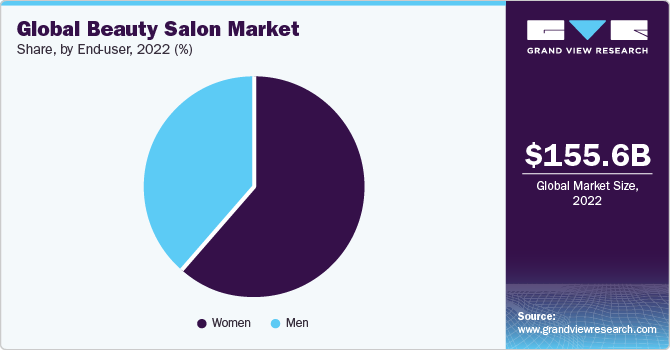

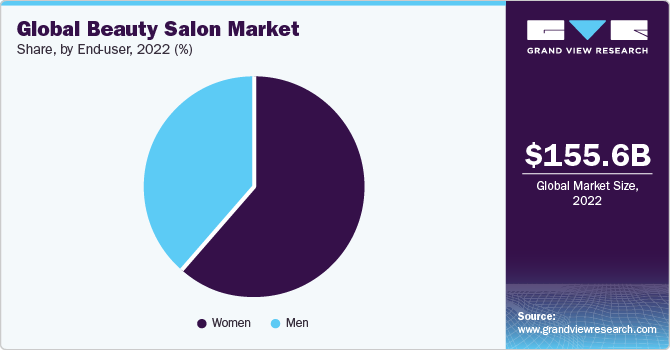

End-user Insights

In 2022, there has been a noticeable change in consumer behavior, particularly in the beauty industry, where an increasing number of men are opting to visit beauty salons. This shift indicates that men are showing a greater interest in grooming and self-care services traditionally associated with beauty salons. With the growing popularity of skincare among celebrities and social media influencers, it has become a regular part of daily grooming for many individuals. This trend indicates a positive outlook for future demand in the beauty salon market. In addition, numerous male influencers on platforms like YouTube, Instagram, and Facebook contribute to the widespread acceptance and normalization of facials, hair treatments, manicures, pedicures, and many other services for men.

Regional Insights

The Asia Pacific beauty salon market accounted for a significant share in 2022, driven by the rising disposable income, consumers are willing to spend more on premium and higher-quality services, including beauty salons that use organic beauty and personal care product.

Additionally, in India, the beauty salon market is one of the fastest-growing service sectors owing to the changing consumer trend such as increase in male footfall in beauty salons as compared to pre-covid times. According to an article in Times of India newspaper in September 2020, men displayed a greater eagerness to change their lockdown appearance compared to women. A higher percentage of male customers started visiting salons, and they are not limiting themselves to just haircuts since the pandemic. Following the reopening of beauty salons, there has been a 3% to 4% increase in male clientele compared to women.

Competitive Insights

Key players in the market include Great Clips, Inc., Regis Corporation, Dessange International, Ulta Beauty, Inc., The Lounge Hair Salon, among others. Salon service providers are adopting a dual strategy, serving as both service and product providers by launching their own line of grooming products. For instance, Sorbet, a leading service salon chain in South Africa, has capitalized on this trend by expanding its offerings through the introduction of Sorbet Man in more than 20 franchise stores across the country. Sorbet Man's product range encompasses various grooming categories, including hair care, beard care, skin care, ingestible, nail care, and body care.

Prominent industry leaders are acknowledging the growing trend within the nail salon sector and are increasing their efforts to seize this market opportunity.

In December 2021, MiniLuxe, a nail salon chain based in Boston, achieved a significant milestone by successfully completing the largest-ever Capital Pool Company (CPC) offering on the TSX (Toronto Stock Exchange). This accomplishment underscores the market's confidence in MiniLuxe's commitment to fostering a healthy work environment and delivering premium-quality services.