- Home

- »

- Electronic & Electrical

- »

-

Beauty Fridge Market Size, Share & Growth Report, 2030GVR Report cover

![Beauty Fridge Market Size, Share & Trends Report]()

Beauty Fridge Market (2023 - 2030) Size, Share & Trends Analysis Report By Capacity (Up To 4 Liters, 4 Liters To 7 Liters, 7 Liters To 10 Liters, More Than 10 Liters), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-016-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global beauty fridge market size was valued at USD 146.67 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. Beauty fridges, also known as beauty fridges, and cosmetic fridges, are experiencing rapid growth due to increased demand for premium cosmetics and skin care products across the world as these products require cool and dark storage. In recent years, with the increase in skin care awareness among people, the demand for beauty products has witnessed a dramatic increase, which has further augmented the demand for the market across the world.

According to a survey conducted by a UK-based online skin clinic, Face the Future, 61% of the respondents are not storing their skincare products correctly, nor do they know when these skincare products expire. In addition, according to Face the Future, skincare products need to be stored in cool and dark places, and thus, the company recommends the use of beauty fridges for the same. In addition, according to Clinicbe founder and aesthetic doctor, Dr. Barbara Kubicka, many skincare products (specifically natural products and those which contain few preservatives) benefit from being kept in the fridge as they stay potent for longer and as well as extending their shelf life.

Furthermore,according to Vogue, beauty fridges can help extend the shelf life of certain products. The increasing awareness regarding the correct storing of cosmetics & skin care products is expected to drive the growth of the beauty fridge market during the forecast period. One of the key factors directly contributing to the growth of the market for beauty fridges is digitalization. The increasing use of social media and the internet serves as a significant medium for increasing brand and product awareness.

Consumer demand for beauty fridges is a growing trend, primarily in both developed and developing countries, and is being fueled by the plethora of information available and product visibility online. The rising manufacturer presence on online marketplaces is also anticipated to help boost the market for beauty fridges across the world during the forecast period. Beauty fridges too find wide applications in the commercial sector. These fridges widely find their place in beauty parlors, and salons. The beauty salon industry has been witnessing tremendous growth in the past few years globally.

According to the U.S. Bureau of Labor Statistics, the personal care services industry (which includes beauty salons) is projected to grow 8.1% from 2020 to 2030. In addition, the opening of new beauty parlors across the world is further expected to contribute significantly to the demand for beauty fridges during the forecast period. For instance, in October 2022, a new hair and beauty salon opened in downtown Franklin, U.S. In July 2022, a new beauty salon opened in Newport, U.K. The growing expansion of hospitality establishments offering premium services coupled with an increasing consumer going to beauty salons will drive the demand for beauty fridges in near future from commercial establishments.

The COVID-19 pandemic had significantly affected the market for beauty fridges. Initially, the lockdown and supply chain disruption negatively affected the market. Short-term negative growth was observed in the market due to the almost entire closure of offline distribution channels, limited operations of manufacturing, and disruption in the supply chain. Moreover,restrictions on traveling, a ban on gatherings, meetings, and parties have negatively impacted the beauty products market and restricted spending habits in 2020 were other reasons that contributed to the decrease in demand for beauty fridges.

However, the market for beauty fridges has seen a sharp recovery after the lockdown. In 2021, the market witnessed high demand due to the backlog of 2020 and increased interest from people for cosmetics and beauty products. Companies are focusing on investments in research and development and product development to expand their product portfolio and provide consumers with beauty fridges equipped with various features. For instance, in February 2021, FaceTory,a manufacturer of beauty fridges, launched an enhanced skin care fridge with new features.

The fridge comes with a 5-liter storage capacity intended to store skin care products and features include a built-in LED light, temperature display, and silent mode option. In addition, manufacturers are getting into long-term contracts and partnerships with local distributors of different countries in order to augment their presence and reinforce their positions in the market. In the near term, global market players are likely to acquire small- and medium-sized companies operating in the market in a bid to facilitate regional and global expansion.

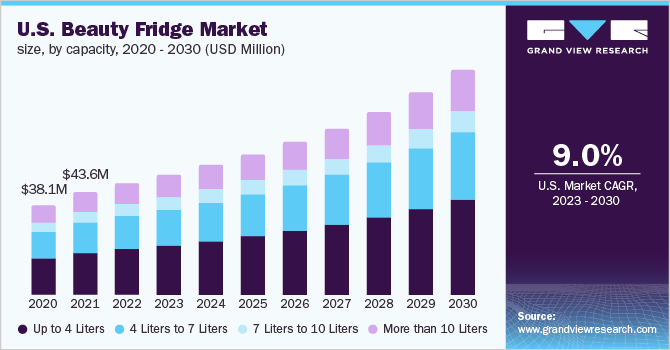

Capacity Insights

The up-to-4-liter capacity beauty fridge segment led the market share in 2022 with a share of 43.6%. Furthermore, the 4-liter capacity beauty fridge segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is driven by the rising consumer preference for small-sized skincare refrigerators compared to that of more than the 4-liter capacity fridge. The small-size capacity fridge is easy to carry and move from one place to another, which is augmenting its demand among consumers. Additionally, manufacturers are manufacturing fridges with smaller capacities.

For instance, STYLPRO introduced a 4-liter beauty fridge in August 2022. The Organic Harvest Company introduced 4-liter capacity beauty fridges in June 2019. These products were quickly sold out. Moreover, most of the manufacturers have a high number of products in the up-to-4-liter capacity beauty fridge portfolio. Furthermore, the up to 4-liter capacity beauty fridges are less expensive compared to the higher capacity fridges, offer convenience of usage, are easy to maintain, and are energy efficient. All the above-mentioned factors strongly support the growth of up-to-4-liter capacity beauty fridges during the forecast period.

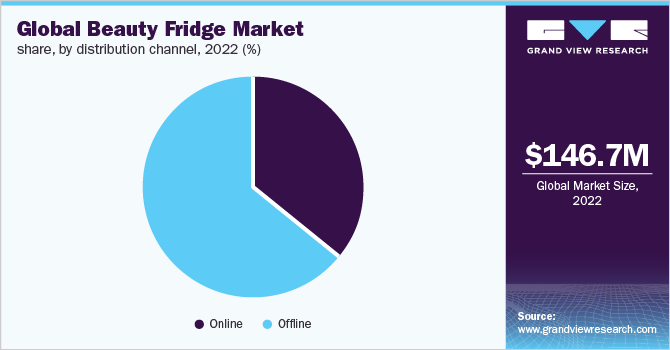

Distribution Channel Insights

The sales of beauty fridges through offline channels captured 64.2% of the market share in 2022. The growth of the segment is driven by the increasing people’s preference for shopping in person. According to 2022 Raydiant's second annual State of Consumer Behavior Report, 44.4% of respondents prefer shopping at physical stores because they like to view, touch, and interact with actual products. In addition, 27.6% of respondents enjoy the overall shopping experience that a physical location offers, and more than 13% appreciate the immediate satisfaction that in-store shopping offers - as opposed to waiting for delivery. In the near future, this is anticipated to drive the segment growth and will maintain its dominant share in the market.

However, sales of beauty fridge through online channels is expected to grow at the fastest CAGR during the forecast period. The popularity of e-commerce channels is expected to increase over the projected timeframe, compared to offline distribution channels, given the increasing number of market players marking their presence online. The market players have been offering customers the ability to place and track orders online on their platforms, e-commerce sites, or third-party platforms like Shopify. In this regard, the emergence of high-end online shopping platforms is expected to act as a driver for the market in the foreseeable future.

Regional Insights

North America emerged as the largest market in 2022 and is also expected to maintain its dominance over the forecast period owing to increased consumer spending levels driven by a combination of greater demand for beauty products from consumers. Furthermore, an increase in the number of beauty salons and parlors, coupled with an increasing number of product launches by manufacturers in the region is anticipated to drive the regional market. For instance, Iris Smit, the founder, and CEO of BeautyFridge, a company that manufactures beauty fridges, said that her companyis looking to expand its business to the U.S. markets by launching the beauty fridge in the U.S. market as the country serves as the biggest consumer group for such products.

On the other hand, Europe is too expected to expand at a significant CAGR during the forecast period. Increasing product penetration in developed countries such as the U.K., Germany, and France is likely to bode well with regional growth. Many regional and international players are launching their products in these countries where the population has a significant per-capita income in order to generate greater revenue and increase the customer base for their products. For instance, STYLIDEAS Ltd., a U.K.-based beauty fridge manufacturer offer a wide range of beauty fridge in and around the U.K. and Europe.

Key Companies & Market Share Insights

Key players in this market face intense competition from each other as some of them are among the top manufacturers, distributors, and suppliers of beauty fridges in various capacities. These players are continuously investing in research and development and product launches in order to make a significant presence in the market. Moreover, these market players have strong and vast distribution networks, which help them reach a larger customer base.

-

In August 2022, Aldi, a German multinational family-owned discount supermarket chain operating over 10,000 stores in 20 countries, launched a new beauty fridge made by Stylproto keep skincare and makeup products cool, helping them maintain freshness & provide incredible skincare results

-

In January 2022, The Cosmetics Fridge, a manufacturer of beauty fridges announced the availability of its beauty fridge through the online platform at Saks Fifth Avenue, which was earlier only, used to sell through offline channels

-

In February 2021, FaceTory, a manufacturer of beauty fridges, launched an enhanced skin care fridge with new features. The fridge comes with a 5-liter storage capacity intended to store skin care products and features include a built-in LED light, temperature display, and silent mode option

Some of the key players operating in the global beauty fridge market include:

-

Beautyfridge (Quick Beauty Pty. Ltd.)

-

Cooluli

-

Teami LLC

-

HCK (USA) LLC

-

Chefman

-

FaceTory Inc.

-

Flawless (Church & Dwight Co., Inc.)

-

Crownful (Nekteck, Inc.)

-

Koolatron

-

COOSEON

Beauty Fridge Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 156.58 million

Revenue forecast in 2030

USD 280.51 million

Growth rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; Australia

Key companies profiled

Beautyfridge (Quick Beauty Pty. Ltd.); Cooluli; Teami LLC; HCK (USA) LLC; Chefman; FaceTory Inc.; Flawless (Church & Dwight Co., Inc.); Crownful (Nekteck, Inc.); Koolatron; COOSEON

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beauty Fridge Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global beauty fridge market report based on capacity, distribution channel, and region.

-

Capacity Outlook (Revenue, USD Million, 2017 - 2030)

-

Up to 4 Liters

-

4 Liters to 7 Liters

-

7 Liters to 10 Liters

-

More than 10 Liters

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global beauty fridge market size was estimated at USD 146.67 million in 2022 and is expected to reach USD 156.58 million in 2023

b. The global beauty fridge market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 280.51 million by 2030.

b. North America emerged as the largest market in 2022 and is also expected to maintain its dominance over the forecast period owing to increased consumer spending levels driven by a combination of greater demand for beauty products from consumers. Furthermore, an increase in the number of beauty salons and parlors, coupled with an increasing number of product launches by manufacturers in the region is anticipated to drive the regional market.

b. Some of the key players operating in this market include Beautyfridge (Quick Beauty Pty. Ltd.), Cooluli, Teami LLC, HCK (USA) LLC , Chefman, FaceTory Inc., Flawless (Church & Dwight Co., Inc.), Crownful (Nekteck, Inc.), Koolatron, and COOSEON

b. Key factors that are driving the beauty fridge market growth include the increased demand for premium cosmetics and skin care products across the world as these products require cool and dark storage. In recent years, with the increase in skin care awareness among people, the demand for beauty products has witnessed a dramatic increase, which has further augmented the demand for the skincare fridge market across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.