- Home

- »

- Next Generation Technologies

- »

-

Battlefield Management Systems Market Size Report, 2030GVR Report cover

![Battlefield Management Systems Market Size, Share & Trends Report]()

Battlefield Management Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By System, By Component (Hardware, Software), By End Use (Army, Navy, Air Force), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-370-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battlefield Management Systems Market Summary

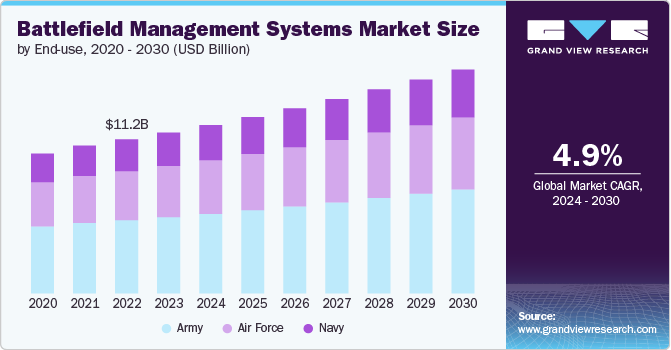

The global battlefield management systems market size was estimated at USD 11.68 billion in 2023 and is projected to reach USD 16.25 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The rising demand for battlefield management systems among the increasing military budgets across several countries during the heightened geopolitical tensions is contributing to the market growth.

Key Market Trends & Insights

- North America dominated the battlefield management systems market for largest revenue share of 39.06% in 2023.

- The battlefield management systems market in Asia Pacific is expected to grow at the fastest CAGR of 7.0% from 2024 to 2030.

- Based on end use, the army segment led the market with the largest revenue share of 47.41% in 2023.

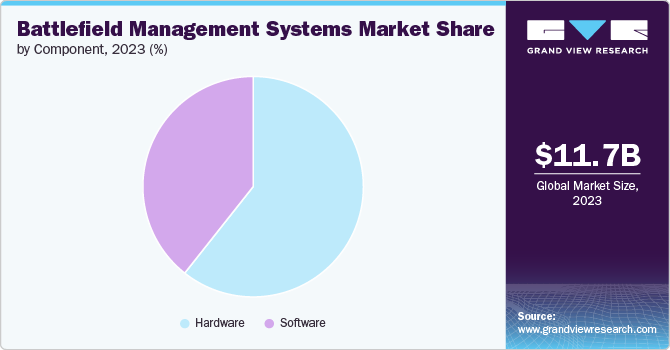

- Based on component, the hardware segment led the market with the largest revenue share of 60.66% in 2023.

- Based on system, the command and control segment led the market with the largest revenue share of 33.94% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.68 Billion

- 2030 Projected Market Size: USD 16.25 Billion

- CAGR (2024-2030): 4.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

For instance, the Fiscal Year 2024 Defense Budget released by the U.S. Department of Defense in March 2023 encompassed USD 1.8 billion for AI and USD 1.4 billion for Joint All-Domain Command and Control (JADC2) initiatives. Such favorable government initiatives are expected to drive market expansion over the coming years.

The market growth is being further driven by technological advancement that enhances the overall functionality of warfare and optimizes military operations. The developments include secure communication, such as satellite networks and tactical radios that allow effective real-time data exchange, powerful processors for faster data processing, and advanced software functionalities like AI and machine learning. Moreover, the advancements pertaining to cybersecurity within battlefield management systems to protect sensitive data and ensure system integrity are driving their adoption, thereby enhancing the overall market outlook.

Increasing collaboration between defense organizations and various battle management systems providers is also expediting the market expansion. For instance, in April 2024, Lockheed Martin Corporation signed a USD 330.9 million deal with the Department of Defense to develop a Joint Air Battle Management System as part of the AIR6500 Phase 1 project for Australia. This system will offer advanced integrated air and missile defense capability to combat high-speed threats.

The modern battlefield management systems provide significant strategic and tactical advantages on the field. They enable military commanders to make informed decisions based on real-time data, enhance coordination among different units, and improve the overall effectiveness of military operations. These advantages are crucial in modern warfare, where rapid and accurate decision-making can determine the outcome of military engagements. The need for advanced battlefield management systems is expected to offer positive market growth.

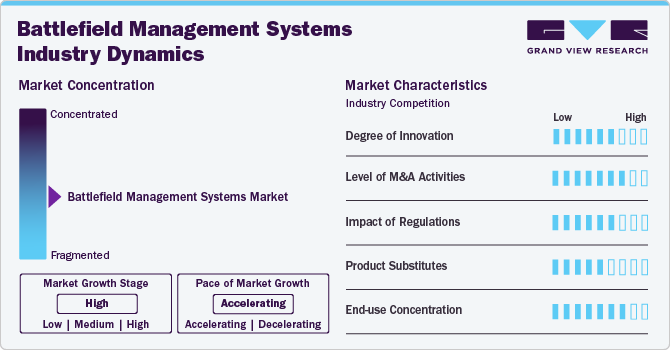

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. It characterized by a high degree of innovation on account of rapid technological advancements, including integration of artificial intelligence and machine learning, advent of cloud-based solutions, Internet of Things (IoT) integration, inclusion of immersive technologies, etc.

The market is characterized by a high level of merger and acquisition (M&A) activities by the leading market players. Through these initiatives, companies seek to leverage complementary strengths, expand their global footprint, and enhance technological capabilities, to gain a competitive edge in the industry.

Regulations have a significant impact on the global market due to the growing importance of security and compliance of these advanced systems among governments and defense agencies. The regulations are aimed at addressing concerns related to data privacy, cybersecurity, and ethical use of emerging technologies involved in command and control.

The threat of substitutes in the market is low, as battle management systems are critical for real-time decision making and operational coordination in military, government, and corporate settings, and there are very few direct substitutes that can offer the same level of integration, reliability, and capabilities.

End-user concentration is moderate in the market, as the major industries requiring battle management systems are limited to government, defense, and commercial companies operating in aerospace, land, space, and maritime sectors.

System Insights

Based on system, the command and control segment led the market with the largest revenue share of 33.94% in 2023. Modern warfare involves complex scenarios with faster-paced operations, multi-domain battlefields (land, air, sea, cyberspace), and the integration of various weapon systems. Effective command and control systems are crucial for situational awareness, making informed decisions, and facilitate coordinated responses across different domains. Besides, militaries are increasingly relying on the network of interconnected systems for communication, intelligence gathering, and weapon control. In this regard, advanced command and control systems are witnessing increased demand for ensuring interoperability between these disparate systems, thereby accelerating segmental growth.

The computing segment is anticipated to grow at the fastest CAGR of 6.0% from 2024 to 2030. The growth is ascribed tothe increasing demand for robust and reliable computing solutions for supporting advanced software functionalities, complex data processing, and ever-evolving needs of modern warfare. The modern battlefield management systems rely on the constant flow of data from various sources, such as drones, sensors, communication systems, and intelligence feeds. This large data volume requires powerful computing solutions to process, analyze, and interpret the information in real-time, which is creating ample growth opportunities for the segment.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 60.66% in 2023, owing to increasing demand for robust hardware components such as secure and reliable communication devices, including satellite terminals, radios, and tactical computers essential for real-time information sharing. Moreover, the growing significance of powerful computing hardware, such as sensors, drones, etc., to collect and process vast amounts of data from various sources within the battlefield environment is favoring segmental growth further. Moreover, the development of high-quality display systems for improved situational awareness is also positively influencing the market outlook.

The software segment is expected to grow at the fastest CAGR from 2024 to 2030. The growth is attributed to the growing significance of the software solutions with advanced functionalities such as real-time situational awareness, data fusion from various sensors, command and control capabilities, and integration with other battlefield systems. The improved functionality enables enhanced operational efficiency and more informed decision-making. Moreover, advancements in AI, ML, and big data analytics are supporting the development of sophisticated software solutions that can facilitate automation, predictive analysis, and improved cybersecurity, which is further propelling segmental growth.

End Use Insights

Based on end use, the army segment led the market with the largest revenue share of 47.41% in 2023. The growth is attributed to the ongoing technological advancements, including integration of sensing, AI, and IoT into the land-based battlefield management systems to enhance real-time data processing capabilities, improve situational awareness. These systems facilitate effective decision-making during military operations, homeland security, and border surveillance which is further driving the segmental growth. The need for integrated command systems to manage complex army operations and facilitate coordinated responses to emergencies is stimulating market growth.

The navy segment is expected to grow at the fastest CAGR from 2024 to 2030, on account of the ongoing modernization initiatives to enhance naval operations, maritime security, and coastal surveillance amidst the rising geopolitical tensions and evolving maritime threats. As a result, advanced battle management systems are gaining massive traction to enable more efficient management of naval fleets by enhancing real-time tracking, communication, and coordination, which is critical for naval defense and surveillance. The rising demand for these systems is expected to stimulate the market growth over the coming years.

Regional Insights

North America dominated the battlefield management systems market for largest revenue share of 39.06% in 2023. The increasing number of government initiatives to modernize its defense and homeland security is creating significant demand for battle management systems, providing substantial growth opportunities for the market. Moreover, the strong presence of several major players in the region, such as Lockheed Martin Corporation, Northrop Grumman, RTX Corporation, etc., is further favoring the market expansion in the region.

U.S. Battlefield Management Systems Market Trends

The battlefield management systems market in U.S. is estimated to witness at a significant CAGR from 2024 to 2030. The U.S. government's focus on upgrading its military capabilities, including the integration of AI and ML in defense systems, is significantly driving the market growth in the U.S.

Asia Pacific Battlefield Management Systems Market Trends

The battlefield management systems market in Asia Pacific is expected to grow at the fastest CAGR of 7.0% from 2024 to 2030. The increasing geopolitical tensions and border disputes in the region have urged the government to increase their focus on national security, creating significant demand for advanced battlefield management systems. Moreover, increasing inclination toward design and manufacturing of indigenous battlefield management systems to reduce dependence on imports is creating lucrative opportunities for the regional market.

The India battlefield management systems market is estimated to grow at a notable CAGR from 2024 to 2030 on account of increasing investments by the government in defense sector and expansion of various major market players in the country.

The battlefield management systems market in China accounted for a significant revenue share in 2023, owing to increasing focus on the development of proprietary defense technologies and strengthening self-reliance.

The Japan battlefield management systems market is expected to witness at a significant CAGR from 2024 to 2030, owing to increasing inclination to strengthen defense capabilities driven by rising concerns over geopolitical tensions and national security.

Europe Battlefield Management Systems Market Trends

The battlefield management systems market in Europe accounted for a notable revenue share of in 2023 and is expected to witness a notable CAGR over the forecast period. This can be attributed to the increasing awareness and implementation of the North Atlantic Treaty Organization (NATO) standards in member states that are raising interoperability and modernization of military assets, including command and control systems. Moreover, the European Union's investment in research and development for defense technology innovation, particularly in AI and cyber defense, is propelling the adoption of battlefield management systems.

The UK battlefield management systems market is expected to witness at a significant CAGR during the forecast period. The government initiatives toward defense spending, adhering to the NATO guidelines, ensuring sustained investment in modernizing military capabilities, is driving the market growth.

The battlefield management systems market in Germany is estimated to record a notable CAGR from 2024 to 2030, owing to significant investments aimed at transforming the country’s military infrastructure through comprehensive digitization initiatives.

Middle East and Africa Battlefield Management Systems Market Trends

The battlefield management systems market in the Middle East and Africa is estimated to record a considerable CAGR from 2024 to 2030. The growth is credited to the growing necessity for robust battlefield capabilities due to rising border disputes and geopolitical tensions in the region. Several countries in the region are recognizing the significance of enhancing their military capabilities. As the battlefield management systems provide real-time data, communication, and coordination tools, improving overall situational awareness, they are witnessing heightened demand among the defense organizations. The increasing defense budgets to include these systems is contributing to the regional market growth.

The Saudi Arabia battlefield management systems market accounted for a considerable revenue share in 2023, owing to increasing military budget for modernizing the armed forces amid rising geopolitical tensions.

Key Battlefield Management Systems Company Insights

Some of the key players operating in the market include General Dynamics Corporation, BAE Systems plc, Leonardo S.p.A., and Northrop Grumman among others.

-

General Dynamics Corporation is a global aerospace and defense company delivering a wide range of products and services in business aviation, land combat vehicles, ship construction and repair, weapons systems and munitions, and technology solutions.The company has four major business segments: Aerospace, Combat Systems, Marine Systems, and Technologies

-

Northrop Grumman delivers a broad range of products, services, and solutions to the U.S. and global customers, mainly to the U.S. Department of Defense (DoD) and intelligence community. The company’s major segments include aeronautics systems, defense systems, mission systems, and space systems

-

BAE Systems plc delivers advanced defense and aerospace systems. The company manufactures military aircraft, submarines, surface ships, radar, communications, avionics, electronics, and guided weapon systems. Its major business segments include electronic systems, platforms & services, air, maritime, and cyber & intelligence

-

Leonardo S.p.A. is an industrial group that offers technological capabilities in the aerospace, defense, and security sectors. The company plays a crucial role in several major international strategic programs and serves as a technological partner for governments, defense agencies, enterprises, and institutions. The major business segments of the company include helicopters, defense electronics & security, aircraft, aerostructures, and space

Key Battlefield Management Systems Companies:

The following are the leading companies in the battlefield management systems market. These companies collectively hold the largest market share and dictate industry trends.

- Aselsan A.S.

- BAE Systems plc

- RTX Corporation

- Elbit Systems Ltd.

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Saab AB

- Thales Group

- Rheinmetall AG

- Kongsberg Gruppen

- Northrop Grumman

- Lockheed Martin Corporation

Recent Developments

-

In March 2024, RTX Corporation successfully conducted live-fire for its Lower Tier Air and Missile Defense Sensor, or LTAMDS during the U.S. Army test program. The series of exercises with rising complexity effectively demonstrated the LTAMDS radar's performance and integration with the Integrated Battle Command System

-

In March 2024, Northrop Grumman signed a Memorandum of Understanding (MOU) with Diehl Defense GmbH & Co. KG to support Germany’s innovative layered air and missile defense capabilities. The former’s expertise in IAMD and control capabilities, such as the Integrated Battle Command System, complements Diehl’s ground-based air and missile defense systems

-

In January 2024, BAE Systems plc delivered the first Amphibious Combat Vehicle Command and Control (ACV-C) variant as a part of the contract received from the U.S. Marine Corps. This variant will provide marines with a mobile command center that facilitates operations planning and situational awareness in battlespace

-

In November 2023, Lockheed Martin Corporation successfully integrated Patriot Advanced Capability - 3 (PAC-3) with the Lower Tier Air and Missile Defense Sensor radar to protect against an Air Breathing Threat. The new solution builds upon the existing PAC-3 capability with the U.S. Army’s Integrated Battle Command System

Battlefield Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.22 billion

Revenue forecast in 2030

USD 16.25 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Aselsan A.S.; General Dynamics Corporation; L3 Harris Technologies, Inc.; Northrop Grumman; RTX Corporation; Thales Group; Elbit Systems Ltd.; BAE Systems plc; Leonardo S.p.A.; Saab; Rheinmetall AG; Kongsberg Gruppen; Lockheed Martin Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battlefield Management Systems Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global battlefield management systems market report based on system, component, end use, and region.

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Navigation and Mapping

-

Communication

-

Command and Control

-

Computing

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Army

-

Navy

-

Air Force

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global battlefield management systems market size was estimated at USD 11.68 billion in 2023 and is expected to reach USD 12.22 billion in 2024.

b. The global battlefield management systems market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 16.25 billion by 2030.

b. The North America region dominated the industry with a revenue share of 39.1% in 2023. This can be attributed to increasing inclination of government authorities to modernize defense and homeland security.

b. Some key players operating in the battlefield management systems market include Aselsan A.S., BAE Systems plc, RTX Corporation, Elbit Systems Ltd., General Dynamics Corporation, L3Harris Technologies, Inc., Leonardo S.p.A., Saab AB, Thales Group, Rheinmetall AG, Kongsberg Gruppen, Northrop Grumman, and Lockheed Martin Corporation

b. Key factors that are driving battlefield management systems market growth include increasing military budgets, technological innovation, and the rising need to strengthen communication network amid rising geopolitical tensions across different parts of the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.