- Home

- »

- Advanced Interior Materials

- »

-

Battery Vents Market Size, Share And Trends Report, 2030GVR Report cover

![Battery Vents Market Size, Share & Trends Report]()

Battery Vents Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two Wheelers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-467-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Vents Market Size & Trends

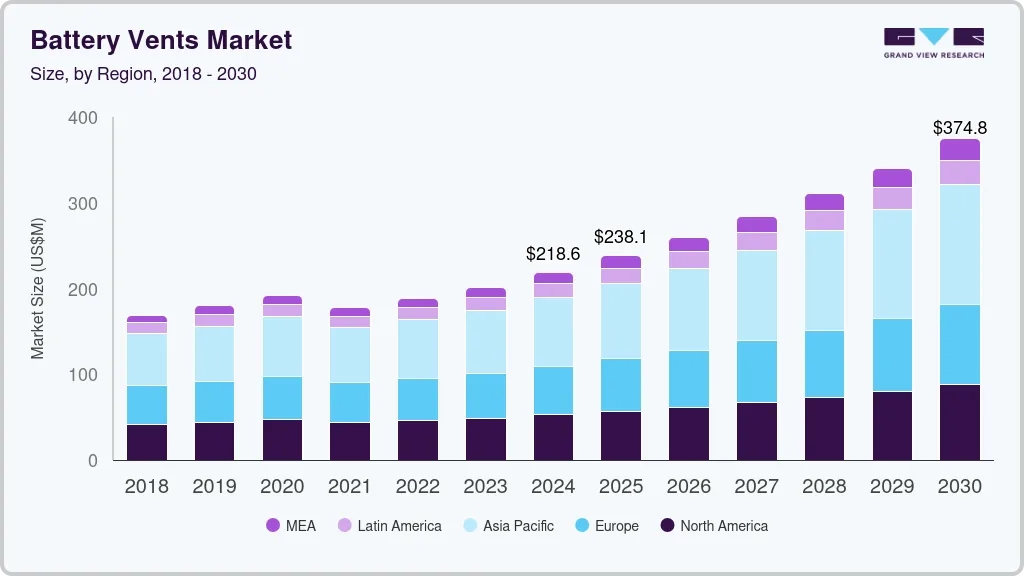

The global battery vents market size was estimated at USD 218.6 million in 2024 and is projected to grow at a CAGR of 9.5% from 2025 to 2030. This demand for battery vents is growing significantly in tandem with the rise of the global automotive sector, especially as electric vehicles (EVs) and hybrid vehicles continue to gain traction. The shift of automotive manufacturers from traditional internal combustion engine (ICE) vehicles to greener alternatives like EVs, are driving the demand for battery components, including vents.

The increasing global adoption of electric vehicles is one of the primary growth factors in the battery vents market. The EV market is growing rapidly due to consumer preferences for eco-friendly alternatives and government incentives to reduce carbon emissions. As EV production scales up, the need for advanced battery management systems, including vents, becomes critical. These vents help mitigate the risks associated with thermal runaway and gas buildup, which are particularly concerning in the high-energy-density batteries used in EVs.

In regions like Europe and North America, governments are incentivizing EV purchases through subsidies and tax breaks. Moreover, as automakers such as Tesla, General Motors, and traditional manufacturers’ ramp up EV production, the demand for components that ensure battery safety-such as vents-is growing proportionally. This trend is also evident in China, the world’s largest EV market, where companies like BYD and NIO are leading the charge in producing EVs equipped with advanced battery systems.

The commercial vehicle sector is also increasingly adopting hybrid and fully electric powertrains, further boosting the battery vents market. Commercial electric vehicles (such as trucks and buses) typically require larger packs to meet the high energy demands of longer-range driving. These larger systems generate more heat and need efficient venting to ensure operational safety and durability. The rapid adoption of electric buses and delivery fleets, particularly in urban areas, is driving demand for more sophisticated battery vent technologies.

As battery technology evolves, manufacturers are focusing on improving efficiency, lifespan, and safety. Battery vents are a crucial component of this safety framework, preventing dangerous pressure buildup within battery cells that could lead to malfunctions or explosions. With the growing popularity of lithium-ion batteries in EVs, which can be volatile under certain conditions, the need for efficient venting mechanisms has become even more pronounced.

Additionally, advancements in battery technologies, such as solid-state batteries, which are expected to replace traditional lithium-ion batteries in the future, will require more precise venting systems to handle the unique pressures associated with these innovations. As EV manufacturers push for faster charging times and longer ranges, battery systems are being pushed to their limits, increasing the importance of venting solutions to maintain safety and performance.

Governments worldwide are driving the adoption of EVs as part of broader efforts to reduce carbon emissions and combat climate change. Policies such as the European Union's Green Deal and the U.S. Inflation Reduction Act are directly supporting the transition to electric mobility. These initiatives not only boost the production of EVs but also promote the development of supportive infrastructure and components, including battery safety systems like vents.

Vehicle Type Insights

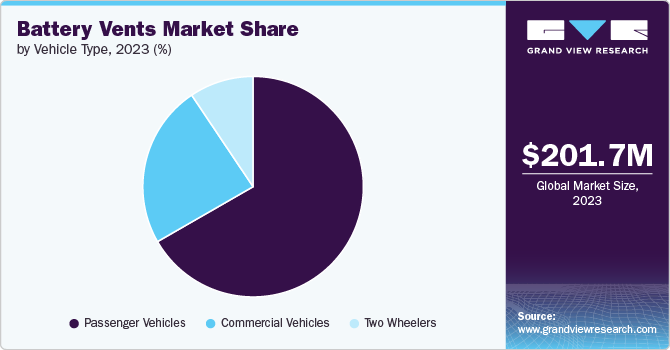

The passenger vehicles segment led the market with the largest revenue share of 66.7% in 2023 and is forecasted to grow at a significant CAGR from 2024 to 2030. This growth in passenger vehicle segment is primarily driven by the increasing adoption of electric vehicles (EVs) and hybrid vehicles. As consumers and governments worldwide push for greener alternatives to traditional combustion engines, EVs are seeing a massive surge in demand. With this transition comes the need for robust technologies to power these vehicles, and battery vents play a crucial role in ensuring the safety and longevity of these systems. Vents prevent overheating, manage pressure, and improve battery performance by allowing controlled gas release. The demand is particularly high in regions like Europe, North America, and Asia-Pacific, where EV infrastructure development is accelerating.

The commercial vehicle segment is expected to grow at a significant CAGR over the forecast period. This segment includes heavy-duty trucks, buses, and light commercial vehicles. This sector’s growth is tied to the increasing use of electric powertrains in commercial fleets, driven by regulations on emissions and the shift toward sustainable transportation. Fleet operators opt for electric commercial vehicles to reduce operational costs, driven by lower fuel and maintenance costs associated with EVs. Battery vents in commercial vehicles are critical, as these vehicles typically have larger batteries that generate more heat and require more efficient venting systems to ensure safety and reliability, especially in high-load conditions.

Regional Insights

In North America, the demand for battery vents is growing due to the region’s accelerating adoption of electric vehicles and renewable energy projects. The U.S., in particular, is seeing a surge in electric vehicle production as companies like Tesla, Rivian, and traditional automakers expand their electric vehicle offerings. The U.S. government has implemented policies like the Inflation Reduction Act, which incentivizes the production and purchase of electric vehicles, further fueling demand for battery systems equipped with reliable safety components like vents

Asia Pacific Battery Vents Market Trends

The Asia Pacific battery vents market dominated the industry with the largest revenue share of 36.3% in 2023. The demand for such vents in this region is experiencing robust growth due to the rapid expansion of electric mobility, renewable energy projects, and industrial applications. Asia Pacific, particularly countries like China, Japan, and South Korea, dominates the production of lithium-ion batteries, which are widely used in electric vehicles (EVs) and consumer electronics. As the largest global EV market, China leads the region's demand for battery components, including vents, as manufacturers focus on ensuring battery safety, performance, and longevity in high-volume production.

In addition, Japan and South Korea are major players in battery innovation and manufacturing, with companies like Panasonic and LG Energy Solution developing next-generation battery technologies. These countries are also expanding their renewable energy infrastructure, requiring large-scale energy storage solutions, further driving the need for efficient battery venting systems. The region's focus on clean energy and sustainable transportation aligns with global emission reduction goals, creating a favorable environment for the battery vents market to grow

China is the epicenter of the global electric vehicle and battery manufacturing industries. As the largest producer and consumer of electric vehicles, China’s demand for battery vents is closely tied to its thriving EV sector. In 2023, China accounted for a significant portion of global EV sales, driven by both government mandates to reduce emissions and consumer interest in sustainable transport. Advanced venting systems are essential to ensure the safety and reliability of the lithium-ion batteries used in these vehicles.

China also heavily invests in renewable energy storage systems, which require efficient and durable battery solutions. These vents are critical for these energy storage systems to function effectively under various operating conditions, such as fluctuating energy demands. With the government’s focus on green energy initiatives, such as carbon neutrality goals by 2060, the demand for battery components, including vents, is set to increase steadily. Furthermore, China’s dominance in the global supply chain for batteries and related components positions it as a major driver of demand for battery vents.

Europe Battery Vents Market Trends

Europe is at the forefront of the global push for electric vehicles and sustainability, driving significant demand for battery vents. The European Union's Green Deal and stringent CO2 emission regulations are compelling automakers to shift from internal combustion engine (ICE) vehicles to electric and hybrid models. Europe’s automotive industry is undergoing a transformation, with major automakers such as Volkswagen, BMW, and Renault committing to producing fully electric fleets in the coming years. This transition to electric mobility necessitates advanced battery technologies, including robust venting systems to ensure the safety and longevity of batteries.

Key Battery Vents Company Insights

Some key players operating in the market include Donaldson Company, Inc., and Porex:

-

Porex is a global leader in the design and manufacturing of porous polymer solutions, including battery vents. The company has over 50 years of experience in advanced material technologies, providing innovative venting solutions for a wide range of industries, including automotive, consumer electronics, and healthcare. Porex’s expertise lies in the development of porous materials that enhance safety and performance in lithium-ion batteries and other energy storage systems.

-

Donaldson Company, Inc. is a world leader in filtration systems and technologies, and its expertise extends into the battery vents market. Donaldson has a global footprint, with operations in over 44 countries, and serves a broad client base that includes major automotive manufacturers and industrial enterprises. Its continued focus on innovation and sustainability in energy storage applications makes Donaldson a key player in the battery vent market, contributing to the growth and development of safer battery technologies.

Sang-A Frontec and IPRO is one of the emerging market participants in the market.

-

IPRO is a growing name in the field of venting and filtration technologies, especially within the automotive sector. The company offers a range of products that cater to the safety and operational efficiency of electric vehicle battery systems. IPRO’s venting solutions are designed to control pressure buildup and prevent hazardous conditions in batteries, such as overheating or explosion.

-

Sang-A Frontec, based in South Korea, is an emerging player in the global battery vents market. The company specializes in the manufacturing of advanced materials and components, focusing on producing venting solutions for various industries, including automotive and electronics. Its expertise lies in developing high-performance venting technologies that enhance the safety and durability of battery systems, particularly for electric vehicles (EVs) and hybrid vehicles.

Key Battery Vents Companies:

The following are the leading companies in the battery vents market. These companies collectively hold the largest market share and dictate industry trends.

- Porex

- Donaldson

- GORE

- MicroVent

- IPRO

- Dongguan PUW EPTFE Material

- Parker

- Sang-A Frontec

- SMJ Venture Private Limited.

Recent Developments

-

In June 2024, Donaldson Company, Inc. has extended its range of battery venting systems with the Dual-Stage Jet, a-new design that takes electric vehicle (EV) safety to higher level by offering the industry’s fastest degassing capabilities, while streamlining the installation process for OEMs.

Battery Vents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 238.1 million

Revenue forecast in 2030

USD 374.6 million

Growth rate

CAGR of 9.5% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan;; Brazil; Saudi Arabia

Key companies profiled

Porex; Donaldson Company Inc.; GORE; MicroVent; IPRO; Dongguan PUW EPTFE Material; Parker; Sang-A Frontec; SMJ Venture Private Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Vents Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global battery vents market based on the vehicle type and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

Two Wheelers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global battery vents market size was estimated at USD 201.7 million in 2023 and is expected to reach USD 218.8 million in 2024.

b. The global battery vents market is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030 to reach USD 374.6 million by 2030.

b. Among vehicle type, passenger vehicles accounted for the largest market in 2023 with a revenue share of 66.7% and the growing demand electric vehicles among the younger population groups.

b. Some key players operating in the battery vents market include Porex, Donaldson Company Inc., GORE, MicroVent, IPRO, Dongguan PUW EPTFE Material, Parker, Sang-A Frontec, and SMJ Venture Private Limited.

b. The key factors that are driving the battery vents market are growing automotive industry in developing countries in Asia Pacific.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.