Battery Testing, Inspection, And Certification Market Size, Share & Trends Analysis Report By Service Type, By Standard & Certification Type, By Sourcing Type, By Battery Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-459-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Battery TIC Market Size & Trends

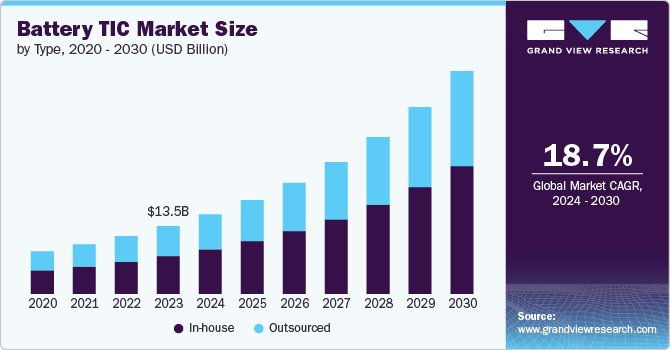

The global battery testing, inspection, and certification market size was estimated at USD 13.48 billion in 2023 and is expected to grow at a CAGR of 18.7% from 2024 to 2030, driven by the increasing adoption of battery-powered technologies across various sectors, including automotive, consumer electronics, and renewable energy. As the demand for high-performance and safe batteries escalates, the need for rigorous testing and certification processes becomes paramount. Battery TIC services ensure that batteries meet regulatory standards and performance criteria, addressing safety concerns and enhancing reliability. The rapid expansion of electric vehicles (EVs) and the rising prevalence of renewable energy storage solutions are key factors propelling market growth.

The advancements in battery technologies, such as solid-state batteries and lithium-sulfur batteries, necessitate specialized testing to validate their performance and safety. Governments and regulatory bodies are also implementing stricter standards and regulations, further boosting the demand for TIC services. The market is characterized by a competitive landscape with numerous players offering a range of services, from performance testing to compliance certification. This growth trajectory is expected to continue as industries seek to innovate and ensure the reliability of their battery systems, driving investment and advancements in the battery TIC sector.

The increasing global adoption of EVs and the expanding use of energy storage systems (ESS) are significantly driving the growth and development of the battery TIC market. Lithium-ion batteries are particularly favored due to their superior energy density and extended lifespan, making them well-suited for both EVs and ESS. As the prevalence of EVs and ESS continues to rise, so does the demand for rigorous testing and certification of these batteries to ensure they comply with safety and performance standards. This growing need for assurance is fueling the expansion of the TIC market.

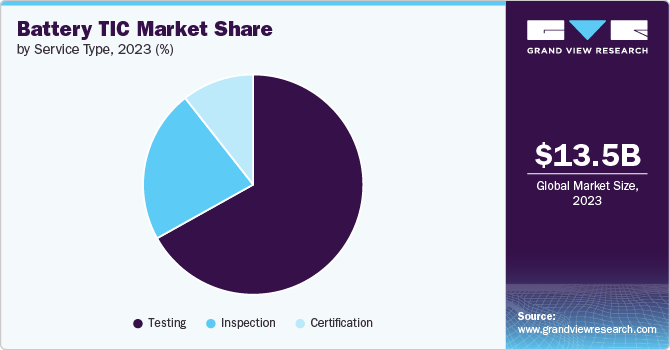

Service Type Insights

The testing segment led the market in 2023, accounting for over 66.0% share of the global revenue. This high share is attributed to the escalating demand for rigorous evaluation of battery performance, safety, and reliability across various applications, including EVs and ESS. As battery technologies advance and regulatory standards become more stringent, comprehensive testing becomes essential to ensure compliance and optimal performance. The rise in battery-related incidents and the need for high-quality assurance further drives the demand for specialized testing services. This focus on thorough assessment to meet safety standards and enhance battery lifespan highlights the significant role of the testing segment in the TIC market.

The inspection segment is predicted to foresee significant growth in the coming years. As battery technologies evolve and their applications expand, the need for meticulous inspection processes becomes increasingly critical. Ensuring that batteries meet stringent safety, performance, and quality standards requires advanced inspection techniques. In addition, regulatory bodies are imposing more rigorous requirements, further boosting demand for thorough inspections. The rise in battery recalls and safety concerns underscores the importance of proactive inspection to prevent failures and enhance reliability. This growing emphasis on quality assurance and compliance is propelling the rapid expansion of the inspection segment in the battery TIC market.

Standard And Certification Type Insights

The safety testing segment accounted for the largest market revenue share in 2023 primarily due to the critical importance of safety in battery technology, particularly with the widespread adoption of EVs and ESS. As these technologies become more prevalent, stringent safety standards are essential to mitigate risks and ensure reliable operation. The increasing complexity of battery systems and heightened regulatory scrutiny drive the demand for comprehensive safety testing and certification. Ensuring compliance with rigorous safety standards helps prevent accidents and failures, making this segment a key focus for the industry and a significant contributor to market revenue.

The performance testing segment is predicted to foresee significant growth in the coming years. As battery technologies advance, there is an increasing demand for batteries that deliver superior performance in terms of efficiency, energy density, and longevity. The push for innovation in battery materials and design necessitates comprehensive performance testing to validate new technologies. This focus on optimizing battery performance and meeting evolving industry requirements is propelling the rapid growth of the performance testing segment.

Sourcing Type Insights

The in-house segment accounted for the largest market revenue share in 2023. Companies increasingly prefer in-house testing and certification to maintain greater control over the quality and consistency of their battery products. In-house facilities allow for more efficient testing processes, quicker turnaround times, and the ability to tailor testing procedures to specific product requirements. In addition, in-house sourcing reduces dependency on external providers and enhances confidentiality, which is crucial for proprietary technologies. As battery technology advances and regulatory requirements become more stringent, the demand for in-house testing and certification solutions is expected to remain strong, contributing to this segment’s leading market share.

The outsourced segment is anticipated to witness significant growth in the coming years. As battery technologies become more complex and global regulatory requirements intensify, many companies are increasingly turning to specialized third-party providers for TIC. Outsourcing offers access to advanced technologies and expertise that might only be available in some places, reducing the need for substantial capital investment in testing infrastructure. In addition, third-party providers can offer scalability and flexibility, accommodating fluctuating demand and evolving industry standards more efficiently.

Battery Type Insights

The lithium-ion segment accounted for the largest market revenue share in 2023. This dominance is primarily due to the widespread use of lithium-ion batteries across various applications, including EVs, consumer electronics, and ESS. Their high energy density, long lifespan, and reliability make them the preferred choice for many industries. As demand for these batteries grows, so does the need for rigorous testing and certification to ensure safety and performance standards are met. The significant market share of lithium-ion batteries reflects their critical role in powering modern technologies and the corresponding emphasis on comprehensive TIC services to support their deployment.

The lead-acid segment is anticipated to witness significant growth in the coming years. Lead-acid batteries, known for their reliability and cost-effectiveness, are increasingly being used in various applications, including backup power systems, automotive, and renewable energy storage. Their established technology and recycling capabilities make them a sustainable choice as industries seek affordable and environmentally friendly solutions. In addition, advancements in lead-acid battery technology, such as improved performance and longer life cycles, are further fueling their adoption.

Application Insights

The Electric Vehicles (EVs) segment accounted for the largest market revenue share in 2023 primarily due to the rapid growth of the electric vehicle industry, driven by increasing consumer demand, government incentives, and a global shift towards sustainable transportation solutions. EVs rely heavily on advanced battery technologies, making rigorous testing and certification crucial to ensure safety, performance, and compliance with regulatory standards. As EV adoption continues to rise, the emphasis on battery reliability and safety becomes more critical, further driving the demand for comprehensive TIC services.

The consumer electronics segment is anticipated to exhibit the highest CAGR over the forecast period. The rapid advancement in consumer electronics, including smartphones, tablets, laptops, and wearable devices, necessitates high-performance batteries with enhanced energy density and longer life cycles. As these devices become more integral to daily life, the demand for reliable and safe battery solutions escalates. In addition, the continuous innovation and introduction of new consumer electronics products drive the need for stringent testing and certification to ensure compliance with safety standards and optimal performance.

Regional Insights

The battery TIC market in the North America region is anticipated to register rapid growth over the forecast period. Government incentives and regulatory frameworks aimed at promoting clean energy and reducing carbon emissions are accelerating the demand for high-performance and safe battery solutions. In addition, substantial investments in battery technology innovation and the expansion of manufacturing capabilities by major industry players in the U.S. and Canada are enhancing the region’s capacity for battery TIC.

Asia Pacific Battery Testing, Inspection, And Certification Market Trends

Asia Pacific dominated with a revenue share of over 33.0% in 2023. This high share is primarily due to the region's significant role as a major hub for battery manufacturing and innovation. Countries such as China, Japan, and South Korea are leading producers of advanced batteries used in EVs, consumer electronics, and energy storage systems. The rapid growth in these sectors, combined with increasing investments in battery technology and stringent regulatory standards, drives high demand for TIC services. In addition, the region's expansive industrial base and robust infrastructure support the large-scale adoption and rigorous testing of battery technologies, further contributing to its dominant market share.

Europe Battery Testing, Inspection, And Certification Market Trends

The battery TIC market in the European region is expected to witness significant growth over the forecast period. The European Union's ambitious climate goals and stringent regulations are accelerating the adoption of EVs and renewable energy storage solutions, which require advanced battery technologies. In addition, significant investments in battery manufacturing and research, particularly in countries such as Germany, France, and Sweden, are fostering innovation and enhancing the region's battery testing, inspection, and certification capabilities.

Key Battery Testing, Inspection, And Certification Company Insights

Key battery TIC companies include UL LLC, SGS SA, Intertek Group plc, and TÜV NORD GROUP. Companies active in the battery TIC market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product development. For instance, in May 2024, UL LLC acquired BatterieIngenieure, a German company specializing in battery testing and simulation. This acquisition expands UL LLC’s capabilities in the battery technology sector, enhancing its expertise in testing and evaluating advanced battery systems. The integration of BatterieIngenieure into UL Solutions strengthens the company’s global reach and technical proficiency in battery testing.

Key Battery Testing, Inspection, And Certification Companies:

The following are the leading companies in the battery testing, inspection, and certification market. These companies collectively hold the largest market share and dictate industry trends.

- UL LLC

- SGS SA

- Intertek Group plc

- TÜV NORD GROUP

- Bureau Veritas

- DEKRA

- DNV GL

- Eurofins Scientific

- TÜV Rheinland

- TÜV SÜD

Recent Developments

-

In August 2024, UL LLC, a global player in applied safety science, inaugurated its Advanced Battery Laboratory in Auburn Hills, Michigan, North America. It represents UL LLC's largest laboratory investment to date and reflects the company's dedication to enhancing the safety and reliability of energy storage products for battery manufacturers. The new lab also strengthens UL LLC's global network of facilities focused on advancing battery technologies.

-

In June 2024, the global expert organization DEKRA commenced construction of a new battery test center in Klettwitz, Germany. This cutting-edge facility will provide comprehensive battery testing services, including validation testing, support during development, and final certification testing. The center will conduct a wide range of tests, encompassing mechanical, performance, and environmental assessments, as well as abuse tests where batteries are exposed to conditions far exceeding their typical usage.

-

In July 2023, TÜV SÜD launched a new electric vehicle environmental laboratory aimed at advancing the safety, reliability, and sustainability of EV technologies. The new laboratory is designed to meet the increasing demand for comprehensive testing in the rapidly evolving electric vehicle market. By providing advanced testing capabilities, TÜV SÜD aims to ensure that EVs are not only high-performing but also environmentally friendly and reliable.

Battery Testing, Inspection, And Certification Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 15.85 billion |

|

Revenue forecast in 2030 |

USD 44.37 billion |

|

Growth rate |

CAGR of 18.7% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, standard and certification type, sourcing type, battery type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

UL LLC; SGS SA; Intertek Group plc; TÜV NORD GROUP; Bureau Veritas; DEKRA; DNV GL; Eurofins Scientific; TÜV Rheinland; TÜV SÜD |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Battery Testing, Inspection, And Certification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global battery testing, inspection, and certification market report based on service type, standard and certification type, sourcing type, battery type, application, and region.

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Testing

-

Inspection

-

Certification

-

-

Standard and Certification Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Safety Testing

-

EMC Testing

-

Performance Testing

-

Others

-

-

Sourcing Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

In-house

-

Outsourced

-

-

Battery Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Lithium-ion

-

Lead-Acid

-

Nickel-Metal-Hydride

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Electric Vehicles (EVs)

-

ICE Vehicles

-

Consumer Electronics

-

Industrial Equipment

-

Medical Devices

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global battery testing, inspection, and certification market size was estimated at USD 13.48 billion in 2023 and is expected to reach USD 15.85 billion in 2024.

b. The global battery testing, inspection, and certification market is expected to grow at a compound annual growth rate of 18.7% from 2024 to 2030 to reach USD 44.37 billion by 2030.

b. Asia Pacific dominated the battery TIC market with a share of 35.7% in 2023. This high share is primarily due to the region's significant role as a major hub for battery manufacturing and innovation. Countries like China, Japan, and South Korea are leading producers of advanced batteries used in EVs, consumer electronics, and energy storage systems.

b. Some key players operating in the battery TIC market include UL LLC, SGS SA, Intertek Group plc, TÜV NORD GROUP, Bureau Veritas, DEKRA, DNV GL, Eurofins Scientific, TÜV Rheinland, TÜV SÜD

b. Key factors that are driving the battery TIC market growth include EV adoption fuels demand for battery testing and safety standards, stricter regulations propel battery inspection and certification, and rising energy storage needs drive battery quality assurance.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."