- Home

- »

- Plastics, Polymers & Resins

- »

-

Battery Packaging Market Size, Share & Growth Report 2030GVR Report cover

![Battery Packaging Market Size, Share & Trends Report]()

Battery Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Cardboard, Metal), By Packaging Type, By Casing Type, By Level of Packaging, By Battery Type, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-310-8

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Packaging Market Size & Trends

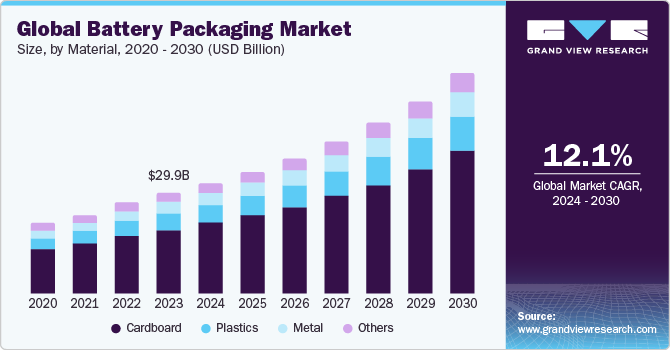

The global battery packaging market size was estimated at USD 29.88 billion in 2023 and is expected to expand at a CAGR of 12.10% from 2024 to 2030. The growing adoption of electric vehicles due to environmental concerns and government regulations is driving the demand for battery packs, which in turn is triggering the demand for specialized battery packaging to ensure safety, efficiency, and longevity.

The surging demand for electric vehicles (EVs) and renewable energy storage systems is a primary driving force for the market. As governments worldwide implement stricter emission regulations and incentivize the adoption of clean energy technologies, the need for efficient and reliable battery solutions has skyrocketed in recent years. Lithium-ion batteries, in particular, have become the preferred choice for powering EVs and energy storage systems, necessitating robust packaging solutions to ensure safety, performance, and longevity.

The consumer electronics industry's relentless pursuit of portable and compact devices has further fueled the demand for battery packaging. Smartphones, laptops, tablets, and wearable technologies rely heavily on high-performance batteries, which require specialized packaging materials and designs. These packaging solutions must strike a balance between protecting the battery from external factors and optimizing space utilization within the device's compact form factor.

Advances in battery chemistry and technologies have also contributed to the growth of the market. Innovations such as solid-state batteries, lithium-sulfur batteries, and sodium-ion batteries present unique packaging challenges and opportunities. Manufacturers must adapt their packaging solutions to accommodate the specific requirements of these emerging battery technologies, ensuring safe handling, transportation, and integration into various applications.

Moreover, the increasing emphasis on sustainability and environmental responsibility has led to a surge in demand for eco-friendly battery packaging solutions. Manufacturers are exploring biodegradable and recyclable materials, as well as implementing circular economy principles in their packaging designs. This not only aligns with regulatory requirements but also caters to the growing consumer preference for environmentally conscious products.

Market Concentration & Characteristics

Prominent battery packaging companies operating in the market include NEFAB GROUP, Wellplast AB, C.L. Smith, DGM, Söhner Kunststofftechnik GmbH, GWP Protective, Manika Plastech Pvt. Ltd., Covestro AG, Labelmaster, VIKING PLASTICS, Trinseo, CHEP, EaglePicher Technologies, Anchor Bay Packaging, TOPPAN Inc., Corplex, Air Sea Containers (US), Econovus, Epec, LLC, Great Northern Corporation, and Amperex Technology Limited.

Companies are increasingly focusing on expanding their product portfolio and geographical presence by undertaking a merger & acquisition strategy in the market. For instance, in April 2024, Nefab Group acquired Precision Formed Plastics, Inc. to expand its sustainable thermoformed packaging and cushioning solutions, including battery packaging. This acquisition aligns with Nefab's strategic goal of enhancing its product offerings in sustainable packaging solutions, particularly in the realm of thermoformed packaging and cushioning.

In September 2023, Orbis presented customized battery packaging at The Battery Show, which took place in Michigan, U.S. The company, known for its expertise in reusable packaging, showcased a comprehensive range of packaging solutions tailored to the specific needs of the battery and EV sectors.

Material Insights

Cardboard dominated the overall market with a revenue share of over 63.0% in 2023 and is anticipated to withstand the growth at the fastest CAGR of 12.8% from 2024 to 2030. Cardboard is an inexpensive and readily available material, making it a cost-effective choice for battery packaging compared to other materials like plastics or metals. In addition, cardboard offers a good surface for printing product information, branding, and labeling, allowing manufacturers to convey important details and comply with regulatory requirements.

On the other hand, plastics can be easily molded, extruded, or thermoformed into various shapes and sizes required for battery packaging. This flexibility in manufacturing processes makes it easier and more cost-efficient to produce a wide range of packaging solutions for different battery types and sizes.

Packaging Type Insights

The corrugated packaging segment dominated the market and accounted for the largest revenue share of over 75.0% in 2023 and is projected to experience the fastest growth with a CAGR of 12.3% from 2024 to 2030. Corrugated cardboard provides excellent cushioning and protection for batteries during transportation and handling. The fluted (corrugated) layer between the two liners creates an air cushion that absorbs impacts and prevents damage to the batteries inside during transit and handling.

Compared to corrugated packaging types, blister packs are relatively inexpensive to produce, especially for small to medium-sized battery packs. This cost-effectiveness contributes to their widespread adoption in the battery packaging industry. In addition, they are designed for effective product display and merchandising on retail shelves. Their compact size and ability to be hung or stacked make them space-efficient and visually appealing for retailers.

Casing Type Insights

The cylindrical segment dominated the market and accounted for the largest revenue share of over 57.0% in 2023 and is projected to experience the fastest growth with a CAGR of 12.4% from 2024 to 2030. The cylindrical shape provides excellent mechanical stability and resistance to external forces, making these cells less susceptible to swelling or deformation during charging and discharging cycles. This robustness is particularly important in applications where batteries are subjected to vibrations or impacts.

On the other hand, the prismatic casing type is expected to witness robust growth in the foreseeable future due to its extensive usage for packaging batteries employed in consumer electronics such as laptops, tablets, and smartphones.

Level of Packaging Insights

The cell & pack packaging segment dominated the market and accounted for the largest revenue share of over 65.0% in 2023 and is projected to experience the fastest growth with a CAGR of 12.4% from 2024 to 2030. Cell & pack packaging allows customized designs to accommodate different battery chemistries, sizes, and configurations. This flexibility enables battery manufacturers to optimize packaging solutions for their specific requirements.

Batteries, especially lithium-ion batteries, are classified as hazardous materials during transportation. Robust and specialized transportation packaging is necessary to ensure the safe and secure transport of batteries, preventing any leakage, short-circuiting, or damage during transit. Hence, transportation packaging is designed to protect batteries from external factors such as shock, vibration, temperature fluctuations, and moisture during the shipping process. This is crucial to maintain the integrity and performance of the batteries.

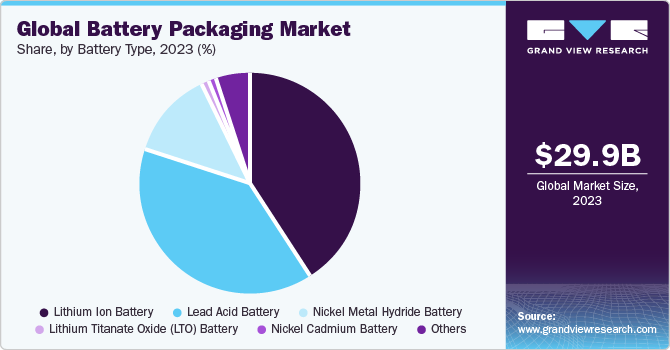

Battery Type Insights

Lithium-ion batteries accounted for the largest revenue share of over 41.0% in 2023 and are expected to withstand robust growth with a CAGR of 13.3% from 2024 to 2030. Lithium-ion batteries can store a large amount of energy per unit weight and volume, making them ideal for applications where size and weight are critical factors, such as portable electronics and electric vehicles. This positive demand outlook for the lithium-ion batteries drives the demand for the specialized battery packaging.

Lead-acid batteries are relatively inexpensive to manufacture compared to other battery types, making them an economical choice for automotive applications. The automotive industry is a major consumer of lead-acid batteries, as they are used in almost every vehicle for starting the engine and providing power to electrical systems. The consistent demand from this sector drives the need for battery packaging.

Regional Insights

The North America battery packaging market held a significant market share in 2023. The region's dominance is attributed to major battery producers such as Tesla, Panasonic, and LG Chem, which are driving market expansion. Additionally, the increasing demand for lithium-ion batteries in various applications such as consumer electronics, electric vehicles, and energy storage systems is fueling growth in the market.

Government initiatives promoting the use of renewable energy sources like solar and wind energy are also contributing to the region's market share growth. Furthermore, the rapid adoption of electric vehicles in North America, supported by environmental concerns, government incentives, and improved charging infrastructure, is a significant driver of the region's battery packaging market expansion.

U.S. Battery Packaging Market Trends

The battery packaging market in the U.S. is growing due to a strong R&D ecosystem and the growing demand for EVs. The U.S. is home to many leading research institutions and universities focused on energy storage technologies. This fosters a robust ecosystem for research and development, leading to the emergence of cutting-edge battery packaging techniques and materials.

Canada batterypackaging market held a significant revenue share in 2023. Canada has abundant natural resources such as lithium, nickel, cobalt, and graphite, which are crucial raw materials for manufacturing lithium-ion batteries. This resource availability gives Canada a significant advantage in the battery supply chain, thus positively influencing the battery packaging market.

Asia Pacific Battery Packaging Market Trends

The battery packaging market in the Asia Pacificaccounted for the largest revenue share of over 42.0% in 2023. Asia Pacific countries such as China, Japan, South Korea, and India have a massive consumer base and are major manufacturing hubs for consumer electronics products such as smartphones, laptops, and tablets. These devices require batteries, driving the demand for battery packaging solutions in the region.

Several leading battery manufacturers, such as Contemporary Amperex Technology Co. Limited (CATL), LG Chem, Samsung SDI, and Panasonic, are headquartered or have major manufacturing facilities in the Asia Pacific region. These companies require advanced battery packaging solutions to protect their products during transportation and storage.

China battery packaging market is a global leader in battery production, particularly for lithium-ion batteries used in electronics and electric vehicles. The significant presence of a domestic battery manufacturing industry creates a high demand within China. Moreover, it is the world's largest EV market. The increasing production and sales of EVs have fueled the demand for high-performance battery packaging solutions to ensure the safe and efficient transportation of EV battery packs.

Europe Battery Packaging Market

The battery packaging market in Europe is expected to withstand robust growth with a CAGR of 12.8% from 2024 to 2030 due to several factors. Firstly, European car manufacturers and policy makers have strong economic and strategic incentives to ensure local battery production, as the market for electric vehicle (EV) batteries has withstood consistently high growth rates over the past few years.

Germany Battery packaging market is primarily driven by the presence of many major automotive companies, including Volkswagen, BMW, Daimler, and others. The automotive sector is a significant consumer of battery packaging solutions for electric vehicles (EVs) and hybrid electric vehicles (HEVs). The strong presence of this industry in Germany drives demand for battery packaging materials and solutions.

Central & South America Battery Packaging Market

The battery packaging market in Central & South America is projected to expand at a significant CAGR from 2024 to 2030 due to rising demand for lithium-ion batteries and growing automotive industry. Countries from this region, particularly Brazil, Mexico, and Chile, have witnessed a surge in demand for lithium-ion batteries. These batteries are widely used in consumer electronics, electric vehicles, and renewable energy storage systems, fueling the need for specialized battery packaging solutions.

Brazil battery packaging market is expected to register a healthy growth rate from 2024 to 2030 primarily owing to renewable energy initiatives and presence of major battery manufacturers. Brazil has been actively promoting renewable energy sources, such as wind and solar power. This has led to an increased demand for batteries used in energy storage systems, further driving the need for battery packaging solutions. In addition, several major global battery manufacturers have established production facilities in Brazil, such as BYD, Moura, and Baterias Zap. These companies require reliable and high-quality battery packaging solutions, which has contributed to the growth of the battery packaging market in the country.

Middle East & Africa Battery Packaging Market

Battery packaging market in Middle East & Africa market dynamics are influenced by growing automotive industry, renewable energy projects, and favorable rising demand for the consumer electronics. Several countries in these regions are investing in infrastructure projects, including the construction of buildings, transportation systems, and utilities, which require backup power solutions and, consequently, batteries and their packaging. Moreover, the Middle East and Africa are experiencing an increasing demand for consumer electronics, such as smartphones, laptops, and portable devices, all of which require batteries. This growing consumer demand drives the need for battery packaging solutions.

UAE battery packaging market growth can be ascribed to its strategic location and logistics. The UAE's strategic location at the crossroads of global trade routes and its well-developed logistics infrastructure make it an attractive hub for the distribution of battery packaging products to neighboring regions, such as the Middle East, Africa, and parts of Asia. Besides, several major battery manufacturers, such as Tesla and Saft, have established operations or partnerships in the UAE, further boosting the demand for battery packaging solutions in the country.

Key Battery Packaging Company Insights

The market consists of a significant number of companies producing battery packaging products. The battery packaging industry has witnessed significant acquisitions and expansions over the past few years.

-

In November 2023, Dai Nippon Printing (DNP), acquired land in Linwood, Davidson County, North Carolina, U.S., to construct a factory for producing battery pouches that encase and protect lithium-ion batteries, in response to the growing demand for electric vehicles (EVs) in the U.S. This move aligns with the global trend towards combating climate change and the increasing adoption of EVs in countries such as Japan, European nations, U.S., and China. DNP aims to start operating a battery pouch slitting line for automotive lithium-ion batteries in the U.S. by 2026, with an investment of approximately USD 92.0 million.

-

In June 2023, NEFAB GROUP acquired PolyFlex Pro, a major American industry player with expertise in eco-friendly returnable solutions. This strategic move is aimed at reinforcing Nefab's global market standing and its dedication to conserving resources within supply chains.

Key Battery Packaging Companies:

The following are the leading companies in the battery packaging market. These companies collectively hold the largest market share and dictate industry trends.

- NEFAB GROUP

- Wellplast AB

- C.L. Smith

- DGM

- Söhner Kunststofftechni GmbH

- GWP Protective

- Manika Plastech Pvt. Ltd.

- Covestro AG

- Labelmaster

- VIKING PLASTICS

- Trinseo

- CHEP

- EaglePicher Technologies

- Anchor Bay Packaging

- TOPPAN Inc.

- Corplex

- Air Sea Containers (US)

- Econovus

- Epec, LLC

- Great Northern Corporation

- Amperex Technology Limited

Battery Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.80 billion

Revenue forecast in 2030

USD 65.09 billion

Growth rate

CAGR of 12.10% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, Competitive Landscape, Growth Factors and Trends

Segments covered

Material, packaging type, casing type, level of packaging, battery type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Southeast Asia; Brazil; Columbia; Saudi Arabia; South Africa; UAE

Key companies profiled

NEFAB GROUP; Wellplast AB; C.L. Smith; DGM; Söhner Kunststofftechnik GmbH; GWP Protective; Manika Plastech Pvt. Ltd.; Covestro AG; Labelmaster; VIKING PLASTICS; Trinseo; CHEP; EaglePicher Technologies; Anchor Bay Packaging; TOPPAN Inc.; Corplex; Air Sea Containers (US); Econovus; Epec, LLC; Great Northern Corporation; Amperex Technology Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global battery packaging market report based on the material, packaging type, casing type, level of packaging, battery type, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardboard

-

Plastics

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyamide (PA)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Metal

-

Aluminum

-

Steel

-

-

Others

-

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Corrugated Packaging

-

Blister Packaging

-

-

Casing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cylindrical

-

Prismatic

-

Pouch

-

Others

-

-

Level of Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell & Pack Packaging

-

Transportation Packaging

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lead Acid Battery

-

Lithium Ion Battery

-

Nickel Metal Hydride Battery

-

Nickel Cadmium Battery

-

Lithium Titanate Oxide (LTO) Battery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Columbia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global battery packaging market was estimated at around USD 29.88 billion in the year 2023 and is expected to reach around USD 32.80 billion in 2024.

b. The global battery packaging market is expected to grow at a compound annual growth rate of 12.10% from 2024 to 2030, reaching around USD 65.09 billion by 2030.

b. The corrugated packaging segment dominated the market and accounted for the largest revenue share of over 75.0% in 2023. Corrugated cardboard provides excellent cushioning and protection for batteries during transportation and handling. The fluted layer between the two liners creates an air cushion that absorbs impacts and prevents damage to the batteries inside during transit and handling.

b. The key players in the battery packaging market include NEFAB GROUP; Wellplast AB; C.L. Smith; DGM; Söhner Kunststofftechnik GmbH; GWP Protective; Manika Plastech Pvt. Ltd.; Covestro AG; Labelmaster; VIKING PLASTICS; Trinseo; CHEP; EaglePicher Technologies; Anchor Bay Packaging; TOPPAN Inc.; Corplex; Air Sea Containers (US); Econovus; Epec, LLC; Great Northern Corporation; Amperex Technology Limited.

b. Advances in battery chemistry and technologies have also contributed to the growth of the battery packaging market. Innovations such as solid-state, lithium-sulfur, and sodium-ion batteries present unique packaging challenges and opportunities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.