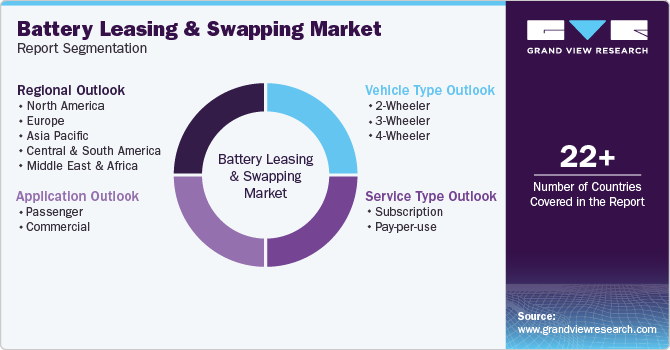

Battery Leasing & Swapping Market Size, Share & Trends Analysis Report By Vehicle Type (2-Wheeler, 3-Wheeler, 4-Wheeler), By Service Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-460-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Battery Leasing & Swapping Market Trends

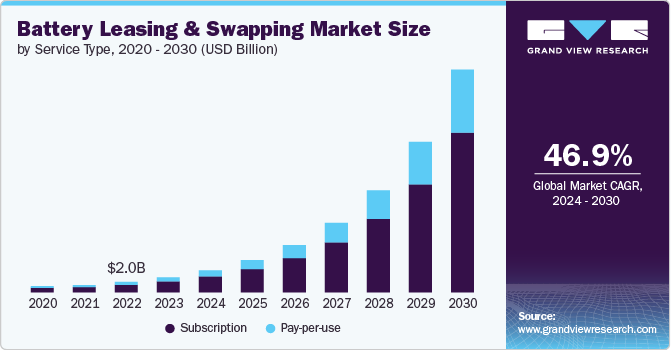

The global battery leasing & swapping market size was estimated at USD 2.90 billion in 2023 and expected to grow at a CAGR of 46.9% from 2024 to 2030. The market growth is primarily driven by the increasing demand for efficient and accessible electric vehicle (EV) solutions. As urbanization accelerates and the need for sustainable transportation grows, battery swapping offers a rapid alternative to traditional charging methods, allowing users to exchange depleted batteries for fully charged ones in a matter of minutes. This model significantly reduces the downtime associated with charging, making it particularly appealing for micromobility solutions, such as electric scooters and bikes, which are prevalent in densely populated areas.

Furthermore, the "Battery as a Service" (BaaS) model is gaining traction, as it allows consumers to lease batteries rather than purchase them outright, lowering the initial cost of EVs and promoting wider adoption. Additionally, the expansion of battery swapping infrastructure, especially in regions like Asia, is supported by government initiatives aimed at electrifying transportation. This infrastructure not only facilitates battery management but also helps alleviate pressure on power grids by enabling centralized charging and energy distribution.

Drivers, Opportunities & Restraints

Government incentives and policies promoting electric mobility further bolster this market, as they encourage the establishment of battery swapping infrastructure and support the growth of leasing models. As battery technology continues to improve and prices decrease, the market is projected to expand significantly, with forecasts suggesting a growth rate of over 24% annually through the end of the decade.

The battery leasing and swapping market faces significant restraints, primarily due to high initial setup costs for swapping stations and the lack of standardization across battery technologies. Establishing a battery swapping infrastructure requires substantial investment in land, equipment, and battery inventory, which can deter potential operators. Additionally, the diversity in battery designs and specifications complicates the development of a universal swapping system, making it challenging for stations to accommodate various electric vehicle models.

The battery leasing and swapping market presents significant opportunities driven by the growing demand for electric vehicles (EVs) and the need for efficient charging solutions. As urbanization increases, battery swapping stations can be strategically deployed in densely populated areas, addressing the challenge of limited public charging infrastructure. The battery-as-a-service (BaaS) model is gaining traction, allowing consumers to lease batteries separately from vehicle purchases, thus reducing upfront costs and enhancing affordability.

Vehicle Type Insights

The 4-wheeler segment held the largest revenue share of 40.88% in 2023. The 4-wheeler battery leasing and swapping market is rapidly evolving, driven by the increasing adoption of electric vehicles (EVs) and the need for efficient charging solutions. This market allows EV owners to exchange depleted batteries for fully charged ones in under ten minutes, significantly reducing downtime compared to traditional charging methods. Key drivers include the rising demand for low-emission vehicles and government initiatives promoting electric mobility. However, challenges such as high initial setup costs and the lack of standardization in battery technology may hinder widespread adoption

The 2-wheeler battery leasing and swapping market is witnessing significant growth, fueled by the rising demand for electric two-wheelers (E2Ws) and the need for efficient charging solutions. This model allows users to lease batteries, reducing the upfront costs associated with purchasing electric vehicles. Battery swapping provides a quick and convenient alternative to traditional charging, enabling users to exchange depleted batteries for fully charged ones in minutes.

Service Type Insights

The subscription segment held the largest market share of 72.82% in 2023. The subscription-based battery leasing and swapping market is characterized by its flexibility and cost-effectiveness, allowing consumers to access electric vehicle (EV) batteries without the high upfront costs associated with ownership. This model enables users to pay a monthly fee for battery access, facilitating easier upgrades to newer technologies as they become available. The market is gaining traction among younger consumers, particularly Gen Z and Millennials, who prefer flexible pricing and ownership models.

The pay-per-use battery leasing and swapping market growth is driven by the growing demand for flexible and cost-effective electric vehicle (EV) solutions. This model allows users to pay only for the battery usage, significantly lowering the upfront costs associated with EV ownership. As consumers seek affordable alternatives to traditional vehicle ownership, the pay-per-use approach addresses concerns over battery degradation and maintenance costs. Additionally, the convenience of quick battery swaps-typically completed in under ten minutes-helps alleviate range anxiety, making EVs more appealing. The increasing deployment of battery swapping infrastructure in urban areas further supports this model, catering to the needs of commuters and logistics companies requiring efficient vehicle operation.

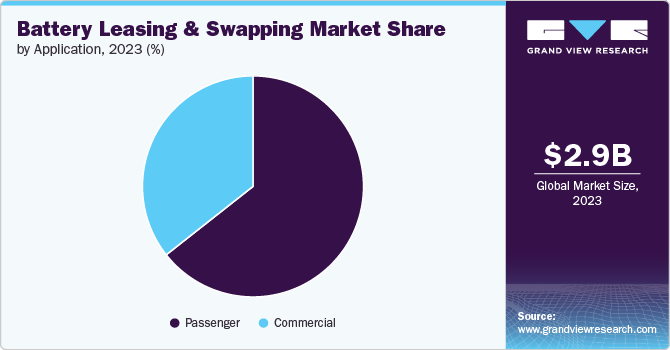

Application Insights

The passenger segment held the largest revenue share of 64.38% in 2023. The passenger vehicle battery leasing and swapping market segment’s growth is driven by the increasing demand for electric vehicles (EVs) and the high upfront costs associated with battery ownership. By decoupling battery costs from vehicle prices, leasing models make EVs more affordable for consumers, facilitating wider adoption. Government incentives and policies promoting electric mobility further enhance market growth, while advancements in battery technology improve performance and reduce costs.

The commercial vehicle battery leasing and swapping market is driven by the increasing demand for electric commercial vehicles (ECVs) and the need for cost-effective solutions to manage high battery costs. As businesses seek to transition to sustainable transportation, battery leasing allows them to reduce upfront investments by decoupling battery costs from vehicle purchases. This model enhances operational flexibility and enables fleet operators to upgrade to the latest battery technologies without significant financial burdens.

Regional Insights

North America Battery Leasing & Swapping Market Trends

North America dominated the global battery leasing & swapping market and accounted for largest revenue share of over 51.18% in 2023. The battery leasing and swapping market in North America is driven by the accelerating demand for electric vehicles (EVs) and the need for efficient charging solutions. As consumers seek alternatives to traditional charging methods to alleviate range anxiety, battery swapping offers a quick and convenient solution, allowing users to exchange depleted batteries in under ten minutes.

The battery leasing and swapping market in North America is driven by the accelerating demand for electric vehicles (EVs) and the need for efficient charging solutions. As consumers seek alternatives to traditional charging methods to alleviate range anxiety, battery swapping offers a quick and convenient solution, allowing users to exchange depleted batteries in under ten minutes. Additionally, the battery-as-a-service (BaaS) model reduces the upfront costs of EV ownership by decoupling battery expenses from vehicle purchases. Government incentives and policies promoting electric mobility further support market growth, positioning battery leasing and swapping as viable options for both consumers and commercial fleets.

U.S. Battery Leasing & Swapping Market Trends

The battery leasing and swapping market in the U.S. is characterized by its focus on reducing the high upfront costs associated with electric vehicle (EV) ownership. By allowing consumers to lease batteries separately, this model enhances affordability and promotes wider adoption of EVs. The market is also marked by the convenience of rapid battery swapping, which can be completed in under ten minutes, addressing range anxiety and minimizing downtime.

Europe Battery Leasing & Swapping Market Trends

The battery leasing and swapping market in Europe is driven by several key factors, primarily the increasing demand for electric vehicles (EVs) as part of the continent's aggressive climate goals. The push for sustainable transportation solutions, supported by government incentives and stringent emission regulations, encourages consumers and businesses to adopt EVs. Battery leasing models reduce the high upfront costs associated with battery ownership, making EVs more accessible.

The battery leasing & swapping market in Germany is driven by several key factors that align with the country's commitment to sustainability and electric mobility. The increasing adoption of electric vehicles (EVs) is a significant driver, as consumers and businesses seek greener transportation options amid stringent emission regulations. The battery-as-a-service (BaaS) model reduces the high upfront costs associated with EV ownership by allowing users to lease batteries separately, making electric mobility more accessible.

The France battery leasing & swapping market growth is driven by the increasing adoption of electric vehicles (EVs) and supportive government policies aimed at reducing carbon emissions. As the French government targets phasing out gasoline and diesel vehicles by 2040, incentives such as subsidies and tax credits are encouraging consumers to transition to EVs. The high upfront costs associated with battery ownership are mitigated through leasing models, making EVs more accessible. Additionally, the convenience of battery swapping stations addresses range anxiety, allowing users to quickly exchange depleted batteries.

Asia Pacific Battery Leasing & Swapping Market Trends

The battery leasing and swapping market in Asia Pacific is thriving, driven by the rapid adoption of electric vehicles, supportive government policies, and a large population demanding affordable transportation solutions. China, India, and Japan are leading the region's development through various battery leasing schemes and swapping infrastructure investments.

The battery leasing & swapping market in China is rapidly expanding, driven by the country's aggressive push towards electric vehicle (EV) adoption and sustainability. Major players like NIO and BAIC are leading the way with battery swapping services, addressing consumer concerns about charging time and battery range. Additionally, supportive government policies and substantial investments in battery infrastructure are fostering market growth, making China a key player in the global battery leasing landscape. As urbanization and environmental awareness rise, the demand for efficient and affordable battery solutions continues to strengthen, positioning China at the forefront of the battery leasing and swapping market.

The Japan battery leasing & swapping market’s growth is driven by several key factors, including the growing demand for electric vehicles (EVs), supportive government policies, and the need for efficient charging solutions. Japan's aggressive goals to phase out gasoline and diesel vehicles by 2035 have led to various incentives and subsidies that promote EV adoption. Additionally, the country's emphasis on efficiency and punctuality aligns well with the time-saving benefits of battery swapping. Collaborations between major Japanese automakers and energy companies, such as the formation of Gachaco by Honda, Kawasaki, Suzuki, Yamaha, and Eneos, are accelerating the development of standardized battery swapping systems and infrastructure.

Central & South America Battery Leasing & Swapping Market Trends

Major countries like Brazil and Argentina are leading the charge, with Brazil expected to dominate due to its significant consumer demand and investments in electric mobility. The region's abundant lithium reserves further enhance the market's potential, positioning Central and South America as a key player in the global battery leasing and swapping landscape.

Middle East & Africa Battery Leasing & Swapping Market Trends

The battery leasing and swapping market in the Middle East and Africa is poised for significant growth, driven by increasing demand for electric vehicles (EVs) and supportive government initiatives aimed at promoting sustainability. Key factors include declining lithium-ion battery prices, rising adoption of renewable energy, and the need for efficient energy storage solutions. Countries like the UAE and South Africa are leading the way, implementing battery swapping infrastructure to alleviate range anxiety and enhance EV accessibility. As urbanization accelerates and environmental concerns mount, the battery leasing and swapping market is expected to expand, offering innovative solutions for both consumers and businesses in the region.

Key Battery Leasing & Swapping Company Insights

The battery leasing & swapping market is a highly competitive industry with several key players operating globally. The market features several prominent companies driving innovation and growth in the sector. Key players include NIO, which has pioneered battery swapping technology in China, allowing users to quickly exchange depleted batteries for charged ones, significantly reducing downtime. Gogoro, known for its electric scooters, has established a robust battery swapping network, particularly in urban areas.

Key Battery Leasing & Swapping Companies:

The following are the leading companies in the battery leasing & swapping market. These companies collectively hold the largest market share and dictate industry trends.

- NIO Power

- Gogoro

- Immotor

- Aulton

- Sun Mobility

- Bounce Infinity

- E-Charge Up Solutions Private Limited

- Numocity Technologies Private Limited

- Ocotillo Power Systems

- Renault Group

Recent Developments

-

In August 2024, Hindustan Petroleum Corporation Limited (HPCL) has partnered with Mooving, a battery swapping network backed by Livguard and the SAR Group, to establish automated battery swapping stations at over 22,000 HPCL retail outlets across India. This strategic alliance aims to significantly enhance electric vehicle (EV) infrastructure and accelerate the adoption of electric mobility in the country.

-

In June 2024, SUN Mobility and Indian oil collaborated to set up 10,000 battery swapping stations across 40+ cities in India by 2030 to facilitate the adoption of electric vehicles through “Battery as a Service” model.

Battery Leasing & Swapping Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.23 billion |

|

Revenue forecast in 2030 |

USD 42.63 billion |

|

Growth rate |

CAGR of 46.9% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Service type, vehicle type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

NIO Power; Gogoro; Immotor; Aulton; Sun Mobility; Bounce Infinity; E-Charge Up Solutions Private Limited; Numocity Technologies Private Limited; Ocotillo Power Systems; Renault Group |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Battery Leasing & Swapping Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented battery leasing & swapping market report based on vehicle type, service type, application, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2-Wheeler

-

3-Wheeler

-

4-Wheeler

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Subscription

-

Pay-per-use

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global battery leasing & swapping market size was estimated at USD 2.90 billion in 2023 and is expected to reach USD 4.23 billion in 2024.

b. The global battery leasing & swapping market is expected to witness a compound annual growth rate of 46.9% from 2024 to 2030 to reach USD 42.63 billion by 2030.

b. The 4-Wheeler segment occupied the largest battery leasing & swapping market share of about 40.88% in 2023. The 4-wheeler battery leasing and swapping market is rapidly evolving, driven by the increasing adoption of electric vehicles (EVs) and the need for efficient charging solutions.

b. Some key players operating in the battery leasing & swapping market include NIO Power, Gogoro, Immotor, Aulton, Sun Mobility, Bounce Infinity and others.

b. The battery leasing and swapping market is primarily driven by the increasing demand for efficient and accessible electric vehicle (EV) solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."