- Home

- »

- Advanced Interior Materials

- »

-

Battery Anode Materials Market Size & Trends Report, 2030GVR Report cover

![Battery Anode Materials Market Size, Share & Trends Report]()

Battery Anode Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Lithium, Silicon, Graphite), By Application (Consumer Electronics, Automotive, Industrial, Telecommunication), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-273-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Anode Materials Market Summary

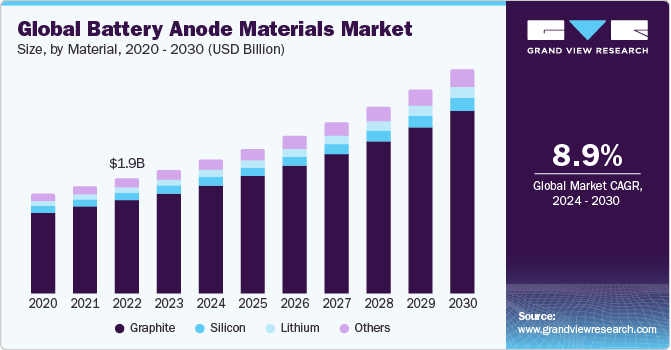

The global battery anode materials market size was estimated at USD 2.06 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. The surge in electric vehicles (EVs) and the need for energy storage solutions has amplified the demand for high-performance batteries.

Key Market Trends & Insights

- Asia Pacific dominated the market for battery anode materials and accounted for 35.6% of the global revenue in 2023.

- By material, the graphite segment led the market and accounted for 81.1% of the global revenue in 2023.

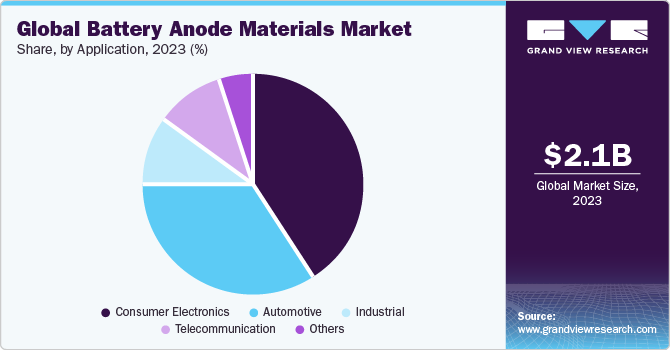

- By application, the consumer electronics segment dominated the industry with the highest revenue share of 41.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.06 Billion

- 2030 Projected Market Size: USD 3.72 Billion

- CAGR (2024-2030): 8.9%

- Asia Pacific: Largest market in 2023

Lithium-ion batteries dominate the EV market, and rely on anode materials like graphite, silicon, and other carbon-based materials to store and release energy efficiently. Hence, with the growing electric vehicles market, the demand for battery anode materials is also expected to grow rapidly.

Growing inclination towards renewable energy sources, such as solar and wind, necessitates efficient energy storage solutions to address intermittency issues. Battery storage systems are crucial for storing excess energy generated during peak production periods and supplying it during low production or high demand periods, thus stabilizing the grid. This requires a significant increase in the production of battery materials, including anode materials.

Furthermore, advancements in technology and material science are driving the development of next-generation batteries with higher energy densities, faster charging capabilities, and longer lifespans. These advancements often are dependent on novel anode materials that can store more energy per unit volume or weight, such as silicon-based anodes or lithium-metal anodes.

With depleting reserves of fossil fuels as well as their increasing prices, the demand for electric vehicles has gone up. These vehicles are almost soundless and offer high fuel efficiency as compared to vehicles running on fossil fuels. The growing market for electric vehicles (EVs) is a significant driver behind the increasing demand for battery anode materials. As the automotive industry undergoes a monumental shift towards electrification to reduce greenhouse gas emissions and combat climate change, the demand for high-performance batteries capable of powering EVs efficiently and reliably is rising.

Moreover, the increase of portable electronic devices like smartphones, tablets, and laptops, along with the growing Internet of Things (IoT) market, has led to an increased demand for batteries with higher energy densities and longer cycle lives. As a result, manufacturers are continuously seeking improvements in anode materials to meet these evolving consumer needs.

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. The industry is fragmented on account of the involvement of many large players with high production capacities. Presence of many large-scale manufacturers, functioning at a regional or global level with large product portfolios, making the industry highly competitive. The companies lay high emphasis on increasing the area of operation to increase revenue share in the industry.

These companies in the market have ventured into research and development for the manufacturing of advanced batteries and high-quality products in a bid to manufacture superior products with advanced characteristics as compared to the competitors. To gain a competitive advantage, the companies are continuously investing in various strategies such as expansions, product launches, collaborations, mergers & acquisitions, and research & development.

Battery anode materials industry is subjected to regulation and oversight from various governmental and non-governmental bodies at both national and international levels. These regulatory bodies play a crucial role in ensuring the safety, quality, and environmental sustainability of anode materials used in batteries. For instance, the Environmental Protection Agency (EPA) regulates the environmental impact of battery manufacturing processes along with the disposal of batteries at the end of their life cycle.

The battery anode materials market faces threats from various potential substitutes, including alternative anode materials, solid-state batteries, lithium-metal batteries, post-lithium batteries, and flow batteries. While the presence of these substitutes challenges to traditional anode materials, they also offer opportunities for innovation and differentiation in the rapidly evolving battery industry.

Material Insights

The graphite segment led the market and accounted for 81.1% of the global revenue in 2023. It is expected to grow steadily from 2024 to 2030. Graphite is the most widely used anode raw material in battery manufacturing for its safe and reliable performance in the lithium-ion batteries and is highly preferred by rechargeable battery manufacturing companies. Industry demand for graphite is expected to grow rapidly as an anode material with the surge of production of battery cells for use in electric vehicles.

The lithium segment is expected to be propelled at the fastest CAGR from 2024 to 2030. The electrification of transportation, particularly the surge in EV adoption, is a primary driver behind the increasing demand for lithium-ion batteries. EV manufacturers rely heavily on lithium-ion batteries for their energy storage needs due to their high energy density, long cycle life, and relatively lightweight properties. As the automotive industry moves away from internal combustion engines towards electric powertrains, the demand for lithium-ion batteries and consequently, lithium is expected to grow rapidly.

Application Insights

The consumer electronics segment dominated the industry with the highest revenue share of 41.2% in 2023. Rise in demand for mobile phones and laptops using lithium-ion battery is on the rise with the growing middle-income group population increasing worldwide. There is also a rapid increase in the consumer electronics industry on account of increasing younger population groups using smart devices in place of conventional ones. This is expected to trigger the demand for battery anode materials in consumer electronics applications over the forecast period.

The automotive sector is forecasted to grow at the fastest CAGR of 9.4% over the forecast period. The global automotive sector is flourishing ion account of increased spending capacity and rising demand for personal vehicles among the middle-income population in the emerging as well as developed economies. Moreover, the increasing penetration of electric vehicles in the automotive industry is expected to further propel the demand for anode battery materials in the industry.

Regional Insights

The battery anode materials industry in North America is growing on account of the diverse and robust manufacturing sector encompassing industries such as automotive, aerospace, consumer electronics, and telecommunication. These industries rely heavily on batteries and battery materials for energy storage applications further driving demands for battery anode materials in the market.

U.S. Battery Anode Materials Market Trends

The U.S. battery anode materials market is increasing demand for automotive components and consumer electronic devices such as laptops and mobile phones in the country. The increasing adoption of electric vehicles is a major driver of the demand for battery anode materials. As more consumers and governments prioritize sustainability and seek to reduce dependence on fossil fuels, there is a growing demand for lithium-ion batteries, which are essential components in EVs. These batteries require anode materials such as graphite, silicon, and other advanced materials to function efficiently.

Asia Pacific Battery Anode Materials Market Trends

Asia Pacific dominated the market for battery anode materials and accounted for 35.6% of the global revenue in 2023 and is expected to continue the trend over the forecast period. This can be attributed to the growing industrialization and population in this region. The rapid industrialization has resulted in several automotive and its component manufacturers to set up their production facilities in the Asia Pacific region due to the availability of inexpensive labor and raw materials. This is expected to further drive industry demand for battery anode materials in global marketplace.

The China battery anode materials market dominated the Asia Pacific region and accounted for 43.6% of the overall revenue share. It is growing on account of several automotive and consumer electronic manufacturing companies investing in China to establish their production facilities on account of various factors, such as low labor costs, robust business environment, low customs & taxes, and lack of regulatory compliance. This has resulted in the presence of a well-established manufacturing sector in China with production facilities of several industries, including consumer electronic devices, automotive and its components, and telecommunication. This, in turn, has increased the demand for battery anode materials in China.

The battery anode materials market in India is driven by favorable government to boost the growth of various industries under its ‘Make in India’ scheme. For instance, the launch of the Automotive Mission Plan (AMP) 2026 aims at establishing the country as a global manufacturing hub for automotive and its components. This is expected to propel the demand for battery anode materials in India at a CAGR of 9.6% over the coming years.

Europe Battery Anode Materials Market Trends

The battery anode materials industry in Europe accounted for a significant share of the global market in 2023. This region comprises many developed economies, which have established markets for several industries including automotive, aerospace & defense, and telecommunication which positively influences the industry demand for battery anode materials in this region.

The Germany battery anode materials market is growing on account of well-developed automotive sector in the country. Several larger players in the automotive sector have their presence in Germany, which drives industry demand for battery anode materials at a CAGR of 8.7% from 2024 to 2030.

Middle East & Africa Battery Anode Materials Market Trends

The battery anode materials market in the Middle East & Africa is expected to grow at a significant rate over the years owing to automotive, energy, and consumer electronics industries in the region that are key consumers of the product.

The Saudi Arabia battery anode materials market is experiencing rapid growth due to various factors, driven by the country's economic diversification efforts, infrastructure development projects, and expanding manufacturing sector. The combination of economic diversification efforts, expanding manufacturing sector, population growth, and government initiatives is expected to propel industry demand for anode materials.

Central & South America Battery Anode Materials Market Trends

The battery anode materials market in Central & South America is experiencing growth driven by several key factors that contribute to the region’s economic development along with industrialization, and urbanization. Several automotive companies are investing in setting up their production facilities due to inexpensive labor and the availability of raw materials in the region. This is expected to trigger the demand for battery anode materials in this region over the forecast period.

The Brazil battery anode materials market’s growth is driven by large-scale industrialization and strategic investment by manufacturing companies in Brazil. Hence, Brazil's escalating manufacturing sector is also contributing to the growth of the battery anode materials industry.

Key Battery Anode Materials Company Insights

Some of the key players operating in the market are SGL Carbon and Nippon Carbon

-

SGL Carbon is a publicly owned company with a broad shareholder structure. The company has three-business segments including carbon fibers and materials, performance products, and graphite specialties. This company’s global sales network and production sites are located in North America, Asia, and Europe. SGL has 38 production sites around the globe out of which 20 operate in Europe, 12 in North America, & 6 in Asia, and a service network in over 100 countries.

-

Nippon Carbon is involved in the production and sale of carbon products. This company primarily caters to several products including carbon fiber products, carbon specialty, artificial graphite electrodes, silicon carbide continuous fibers, and battery materials.

JFE Chemical Corporation and Anovion LLC are some of the emerging participants in the market.

-

JFE Chemical Corporation operates in several product categories including chemical products, battery materials, fine chemicals and inorganic materials. In battery materials, this company is involved in the production of hard carbon, natural graphite anode materials and MCMB graphite anode materials.

-

Anovion LLC is an advanced materials business and commercial-scale manufacturer of premium, anode-grade synthetic graphite. This company caters to several application industries including powers electric vehicles, energy storage systems, personal electronics, and military & defense.

Key Battery Anode Materials Companies:

The following are the leading companies in the battery anode materials market. These companies collectively hold the largest market share and dictate industry trends.

- SGL Carbon

- Nippon Carbon

- Anovion LLC

- JFE Chemical Corporation

- Showa Denko Materials

- Kureha Corporation

- Shanshan Technology

- POSCO CHEMICAL

- Nippon Carbon

- NEI Corporation

- Jiangxi Zhengtuo New Energy Technology

Recent Developments

-

In May 2022, Nano One Materials Corp., a clean technology innovator in battery materials, announced that it had entered into a binding agreement to acquire all the outstanding shares of Johnson Matthey (JM) Battery Materials Ltd.

-

In Apr 2020, Tohoku University and Sumitomo Chemical revealed a new mechanism for preventing the deterioration of aluminum anode during cyclic battery reactions.

Battery Anode Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.23 billion

Revenue forecast in 2030

USD 3.72 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

SGL Carbon; Nippon Carbon; Anovion LLC; JFE Chemical Corporation; Showa Denko Materials; Kureha Corporation; SGL Carbon; Shanshan Technology; POSCO CHEMICAL; Nippon Carbon; NEI Corporation; Jiangxi Zhengtuo New Energy Technology

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Anode Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global battery anode materials market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium

-

Silicon

-

Graphite

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Industrial

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global battery anode materials market size was estimated at USD 2.06 billion in 2023 and is expected to reach USD 2.23 billion in 2024.

b. The global battery anode materials market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 3.72 billion by 2030.

b. Graphite Material segment dominated the market and accounted for more than 81.1% share of the global revenue in 2023. This is on account of growing adoption of electric vehicles in countries around the world.

b. Some of the key players operating in the battery anode materials market include SGL Carbon, Nippon Carbon, Anovion LLC, JFE Chemical Corporation, Show Denko Materials, Kureha Corporation, SGL Carbon, Shanshan Technology, POSCO CHEMICAL, Nippon Carbon, NEI Corporation, and Jiangxi ZhengtuoNew Energy Technology

b. The key factors driving the battery anode materials market include growing automotive and consumer electronics industry in the developing countries around the world

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.