- Home

- »

- Food Safety & Processing

- »

-

Batter And Breader Premixes Market Size Report, 2030GVR Report cover

![Batter And Breader Premixes Market Size, Share & Trends Report]()

Batter And Breader Premixes Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Batter Premix, Breader Premix), By End-use Industry (Food Manufacturing, Food service), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-231-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Batter And Breader Premixes Market Summary

The global batter and breader premixes market size was estimated at USD 4,078.3 million in 2024 and is projected to reach USD 5,669.6 million by 2030, growing at a CAGR of 5.8% from 2025 to 2030. The increasing demand for ready-to-cook and convenient food products is a key factor driving the demand for the global market.

Key Market Trends & Insights

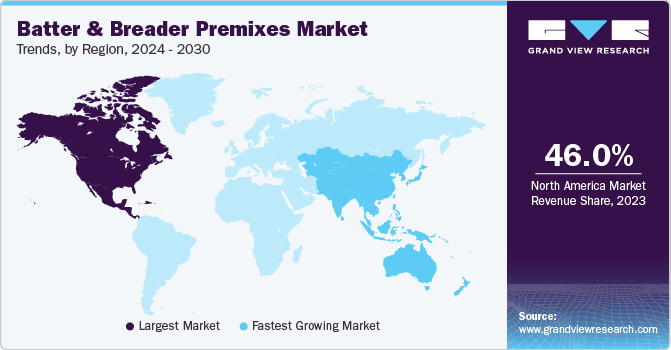

- The North America dominated the market with the revenue share of over 35.11% in 2024.

- The U.S. is projected to grow at the fastest CAGR of 5.1% from 2025 to 2030.

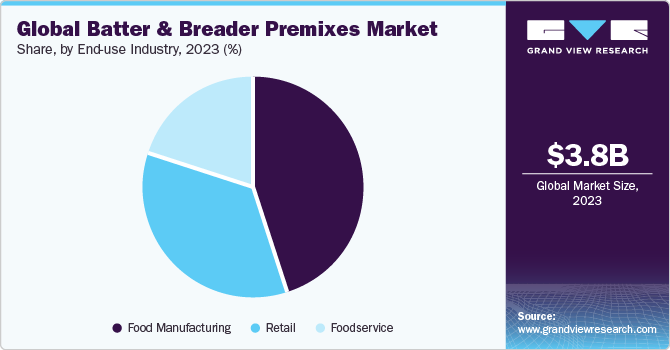

- Based on end-use industry, the food manufacturing segment held the market with the largest revenue share of 51.74% in 2024.

- Based on type, the batter mix segment led the market with the largest revenue share of 51.20% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,078.3 Million

- 2030 Projected Market Size: USD 5,669.6 Million

- CAGR (2025-2030): 5.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumers across the globe are experiencing busy lifestyles resulting in the need for meal solutions that are quick and hassle-free, leading to demand for premixes that simplify the cooking process, thus contributing to the market growth. Batter & breader premixes are not only hassle-free but offer delicious and consistent coating solutions for various dishes.Fried and fast foods, such as chicken tenders, fish fillets, and onion rings are some of the popular choices and widely consumed foods among consumers across the globe. The batter and breader premixes are versatile and allow food manufacturers and chefs to create a wide range of fried and breaded products with different flavors and textures. Thus, the demand for crispy and flavorful coatings in fried foods contributes significantly to the increased adoption of premixes in the food industry. Changing consumer preferences, along with an increasing willingness to experiment with different flavors and textures in food, have further driven the demand for batter and breader premixes.

The quick-service restaurant (QSR) industry plays a pivotal role in driving the market. QSRs often rely on premixes to ensure consistency in taste and texture across their outlets. The ability of premixes to streamline the cooking process and enhance the overall quality of fried and breaded items aligns with the operational efficiency goals of QSRs, contributing to the market's growth. Manufacturers are increasingly offering a variety of premix options, including those with unique spice blends, herbs, and ethnic flavors. This flexibility allows chefs and home cooks to create diverse and exciting dishes, meeting the evolving taste preferences of consumers.

Consumers across various countries, including the U.S., UK, and Germany, among others, have increased concerns regarding fried and processed foods. With an increasing awareness of health and wellness, consumers are seeking fresh, cleaner, and healthier food options, which are expected to pose a challenge for the global market. However, as consumers explore a variety of global cuisines such as tempura, the demand for batter and breeder premixes that enable the easy preparation of international dishes has increased, driving the market growth.

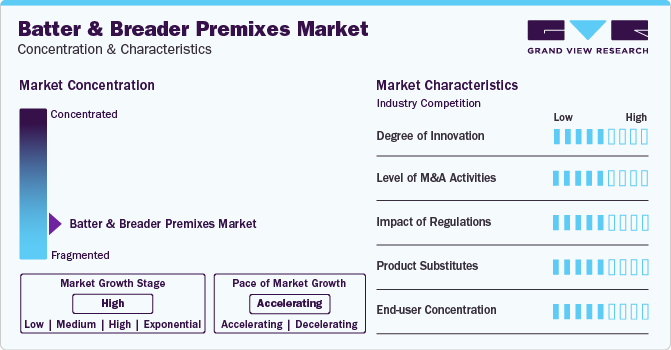

Market Concentration & Characteristics

The market demonstrates a medium to high degree of innovation, with companies consistently introducing new-innovations such as clean-label products, gluten-free and allergen-free products, inclusion of various flavors & textures, among others. In addition, mergers and acquisitions are in the range of low to medium in the batter & breader premixes industry. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths.

Regulations play a crucial role in shaping the market, influencing various aspects such as product formulation, labeling, quality standards, and food safety.

A variety of substitute products is also available, such as homemade batters & breaders, and others are expected to challenge the industry.

End-use Industry Insights

Based on end-use industry, the food manufacturing segment held the market with the largest revenue share of 51.74% in 2024. Ready-to-use batter and breader mixes reduce the time required for preparing coatings. This is especially important in high-volume food manufacturing, where efficiency and speed are critical for meeting demand. Moreover, Premixes are efficient and contribute to overall cost savings in terms of labor, energy, and production time which is advantageous for large-scale food manufacturing operations. In addition, batter and breader mixes are often packaged in controlled quantities, reducing the risk of ingredient waste. This leads to cost savings for manufacturers by optimizing ingredient usage and minimizing excess inventory.

The retail segment is expected to grow with a CAGR of 5.1% from 2025 to 2030. The batter and breader mixes are simple to use and make them accessible to a wide range of home cooks. In addition, they can be used for coating a variety of foods, including chicken, fish, vegetables, and others. This adaptability allows home cooks to explore different recipes and experiment with diverse culinary creations. Moreover, using premixes often results in less mess and cleanup compared to preparing batters and breadings from scratch, making it appealing to individuals seeking simplicity in their cooking routine.

Type Insights

Based on type, the batter mix segment led the market with the largest revenue share of 51.20% in 2024. Batter premixes are ready-to-use and provide convenience, reducing the need for measuring and combining multiple ingredients. Using batter premixes eliminates the need for complex batter recipes. Chefs and home cooks can quickly achieve a consistent and well-balanced batter without spending extensive time on preparation. atter premixes provide a standardized coating, ensuring consistent results across multiple batches. This is crucial for commercial food establishments, such as restaurants and fast-food chains, where maintaining a consistent product quality is essential for customer satisfaction.

The breeder mixes segment is expected to grow with a fastest CAGR of 6.2% from 2025 to 2030. Breader premixes simplify the breading process by offering a ready-to-use blend of flour, breadcrumbs, and seasonings. This eliminates the need for individual ingredient measurement and mixing, saving time in both commercial and home kitchens. Moreover, breader premixes provide a convenient way to achieve a consistent and well-seasoned coating on various food items and are available in various flavor profiles, thus resulting in their increasing demand among consumers across the globe.

Regional Insights

North America dominated the market with the revenue share of over 35.11% in 2024. The fast-paced lifestyle in North America, with busy work schedules and a high demand for convenience, drives the popularity of batter and breader mixes. Consumers appreciate the time savings and ease of use these mixes provide in preparing quick and flavorful meals. There is a significant demand for comfort foods in North America, and batter and breader mixes play a role in creating familiar and indulgent dishes such as fried chicken, onion rings, and fish fillets. The convenience of premixes aligns with the popularity of these comfort foods thus driving the market growth.

U.S. Batter And Breader Premixes Market Trends

The batter & breader premixes market in the U.S. is projected to grow at the fastest CAGR of 5.1% from 2025 to 2030, owing to the growing foodservice industry and the increasing consumption of fried and breaded food products, such as chicken, seafood, and vegetables, have contributed to heightened demand for convenient and consistent batter and breader premixes.

Asia Pacific Batter And Breader Premixes Market Trends

Asia Pacific market is expected to grow with the fastest CAGR of 7.2% from 2025 to 2030. In Asia Pacific, culinary traditions such as Japanese cuisine hold significant importance. Batter and breader mixes are adapted to complement traditional dishes such as tempura. These mixes provide a convenient way to achieve the desired textures and flavors in traditional Asian fried and breaded foods. Moreover, the growing popularity of Western-style foods and the influence of global culinary trends contribute to the adoption of batter and breader mixes across the region. Consumers in Asia Pacific seek convenient solutions to recreate Western-style fried and breaded dishes at home.

The batter & breader premixes market in China is expected to grow at the fastest CAGR of 7.7% from 2025 to 2030. The market growth is attributed to the increasing demand for convenience foods due to urbanization and changing lifestyles. In addition, the growing foodservice industry, including quick-service restaurants and fast-food chains, is driving the demand for breader and batter premixes in China.

Europe Batter And Breader Premixes Market Trends

The batter & breader premixes market in Europe accounted for a share of 26.82% in 2024. The rising trend of home-cooked meals and the increasing preference for convenience foods among busy consumers is driving the market growth in the region. In addition, the regions diverse culinary heritage fuels demand for breader and batter premixes tailored to specific cuisines, such as Italian, French, and Mediterranean.

The UK batter & breader premixes market is expected to grow at the fastest CAGR of 4.1% during the forecast period. The UK market is driven by the growing popularity of takeaway foods, including fried chicken, fish, and chips. Moreover, the trend towards healthier eating options has spurred the development of gluten-free and low-sodium premixes to cater to diverse dietary preferences.

Central & South America Batter And Breader Premixes Market Trends

The batter & breader premixes market in Central & South America is expected to grow at the fastest CAGR of 6.7% during the forecast period. The market is propelled by the regions rich culinary traditions and the increasing demand for processed foods. In addition, rapid urbanization and busy lifestyles have led to a surge in the consumption of convenience foods, driving the demand for premixes.

The Brazil batter & breader premixes market is expected to grow at the fastest CAGR of 6.4% during the forecast period. The thriving food processing industry and the rising demand for value-added products in the country are driving the market growth.

Middle East & Africa Batter And Breader Premixes Market Trends

The batter & breader premixes market in Middle East & Africa is expected to grow at the fastest CAGR of 6.0% during the forecast period. The market is driven by the region growing foodservice sector, particularly in countries like UAE, Saudi Arabia, and Qatar. Moreover, the popularity of fried and breaded foods in Middle Eastern cuisine, such as falafel and shawarma, sustains demand for premixes among restaurants and street food vendors.

The South Africa batter & breader premixes market is expected to grow at the fastest CAGR of 5.4% during the forecast period. The prevalence of fried snacks and street foods in South African cuisine contributes to the market growth, with manufacturers offering tailored solutions to meet local tastes and preferences

Key Batter And Breader Premixes Company Insights

The global market is characterized by the presence of a few well-established players such as Kerry Group PLC, Newly Weds, Bowman Ingredients, Breading & Coating Ltd., House-Autry Mills Inc., BRATA Produktions, Shimakyu, Thai Nisshin Technomic Co., Ltd, Arcadia Foods, and Blendex Company. The market players face intense competition from each other as some of them are among the top batter & breader premixes manufacturers with diverse product portfolios for batter & breader premixes. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both, regional and international consumers.

Key Batter And Breader Premixes Companies:

The following are the leading companies in the batter and breader premixes market. These companies collectively hold the largest market share and dictate industry trends.

- Kerry Group PLC

- Newly Weds

- Bowman Ingredients

- Breading & Coating Ltd.

- House-Autry mills Inc.

- BRATA Produktions

- Shimakyu

- Thai Nisshin Technomic Co., Ltd

- Arcadia Foods

- Blendex Company

Recent Developments

-

In February 2021, Mitake Food Manufacturing Co., Ltd., a leading distributor and manufacturer of rice flour in Japan announced the launch of Rice Tempura Flour in U.S.

-

In September 2020, Solina announced the acquisition of Bowman Ingredients, which supplies coating systmes to retail food processors and food services. The company offers products such as batters, breadcrumbs, and marinades

Batter And Breader Premixes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,286.6 million

Revenue forecast in 2030

USD 5,669.6 million

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Kerry Group PLC; Newly Weds; Bowman Ingredients; Breading & Coating Ltd.; House-Autry Mills Inc.; BRATA Produktions; Shimakyu; Thai Nisshin Technomic Co., Ltd; Arcadia Foods; Blendex Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

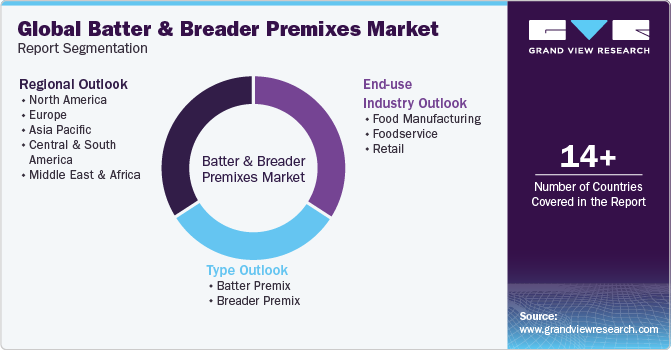

Global Batter And Breader Premixes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global batter and breader premixes market report based on type, end-use industry, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Batter Premix

-

Breader Premix

-

-

End-use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Manufacturing

-

Foodservice

-

Retail

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

- Brazil

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global batter and breader premixes market size was estimated at USD 3,757.1 million in 2023 and is expected to reach USD 3,897.7 million in 2024.

b. The global batter and breader premixes market is expected to grow at a compounded growth rate of 5.1% from 2024 to 2030 to reach USD 5,396.8 million by 2030.

b. Batter premixes dominated the global batter and breader premixes market with a share of 56.0% in 2023. Batter premixes are ready-to-use and provide convenience reducing the need for measuring and combining multiple ingredients resulting in their increased adoption.

b. Some key players operating in batter and breader premixes market include Kerry Group PLC, Newly Weds, Bowman Ingredients, Breading & Coating Ltd., House-Autry mills Inc., BRATA Produktions, Shimakyu, Thai Nisshin Technomic Co., Ltd, Arcadia Foods, and Blendex Company.

b. Key factors that are driving the market growth include the increasing demand for ready-to-cook and convenient food products is a key factor driving the demand for the batter & breader premixes market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.