- Home

- »

- Medical Devices

- »

-

Bathroom And Toilet Assist Devices Market Size Report, 2030GVR Report cover

![Bathroom And Toilet Assist Devices Market Size, Share & Trends Report]()

Bathroom And Toilet Assist Devices Market Size, Share & Trends Analysis Report By Product (Commodes, Bath Lifts, Bath Aids, Shower Chairs & Stools, Handgrips & Grab Bars, Toilet Seat Raisers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-519-9

- Number of Report Pages: 146

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global bathroom and toilet assist devices market size was estimated at USD 4.76 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. The increasing prevalence of chronic illnesses and the growing aging & disabled population are the major factors expected to drive the market. According to several NCBI studies, individuals aged over 65 are at a greater risk of developing chronic illnesses and disabilities, such as Parkinson’s disease & nervous system disorders. According to WHO, the global population aged 60 and above significantly increased from around 1 billion in 2020 to about 1.4 billion in 2030 and is expected to almost double to around 2.1 billion by 2050.

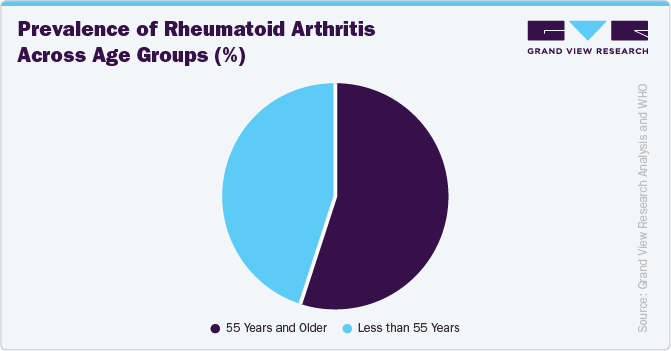

Furthermore, the increasing prevalence of age-related disorders, such as dementia, Alzheimer’s, and osteoporosis, is expected to propel market growth. Due to greater flexibility, adjustability, portability, and reduced dependency on caregivers, the adoption of bathroom & toilet assist devices is expected to increase in the coming years. In addition, various initiatives being undertaken by the government to address the needs of disabled people and supportive reimbursement scenarios are expected to foster industry growth over the forecast period. Aging heightens the susceptibility of an individual to developing target diseases, such as rheumatoid arthritis and osteoporosis.

For instance, as per the Arthritis Society, about 6 million Canadians (1 in 5 adults) have arthritis, and this number is estimated to grow to 9 million by 2040 (1 in 4 in 2040). The elderly population is also more susceptible to chronic conditions such as diabetes, cardiovascular disorders, and other lifestyle-associated disorders, which is expected to impel market growth. As per a fact sheet published by the WHO in October 2022, the worldwide proportion of the population above 60 years of age is estimated to almost double from 12% in 2015 to 22% in 2050. Consequently, the expanding geriatric population is expected to broaden the patient pool for the manufacturers of bathroom and toilet assist devices.

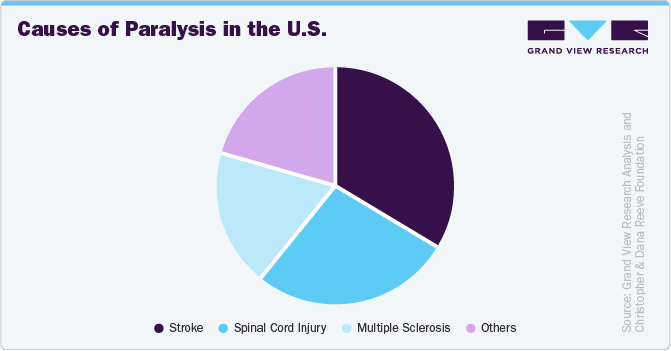

Moreover, the disabled population is also increasing as a result of a rise in the incidence of injuries due to sports, road accidents, and chronic neurological impairment, which is anticipated to drive the handgrips and grab bars market in North America. As per a study published in Lancet Neurology in March 2024, neurological disorders are now the leading cause of ill health and disability worldwide, affecting 3.4 billion people globally. In addition, with the rising incidence of stroke, spinal cord injury, and multiple sclerosis, the risk of paralysis is increasing.

Another factor positively supporting growth is the rising number of online stores. Product penetration through online networks is promptly increasing as it lets the end users compare & select appropriate products based on their brand, type, price, and point of sales. For instance, Amazon, Joom, Walgreen, and Carex are some of the leading online providers of in-home, self-care medical products, including bath safety equipment, mobility aids, & pain management devices. In addition, these online stores provide product warranty with support, access to exclusive deals, and a return policy if any product does not meet the expectations of the patient. Thus, the easy availability of different bathroom and toilet assist devices on online platforms is expected to drive the market in the coming years.

The demand for bathroom and toilet assist devices is expected to grow in the U.S. owing to rise in the number of disabled patients and people with reduced mobility because of obesity, old age, arthritis, and other health issues. Moreover, rapid technological advancements and frequent launches of new & innovative products are expected to be the key factors fueling growth during the forecast period. In addition, growing awareness regarding improved patient assist devices, coupled with increasing life expectancy, is anticipated to drive the market. Furthermore, the presence of well-defined regulatory guidelines and reimbursement policies for the treatment of disabled patients is driving revenue.

In addition, aging demographic has created the demand for long-term care centers and old-age homes, which, in turn, drives the need for handgrips and grab bars. Furthermore, older adults are more vulnerable to falls from the stairs, bed, ladder, or in the bath, supporting the rising demand for handgrips and grab bars. For instance, according to a CDC report, an estimated 36 million older adults are hospitalized every year as a result of falls, and about 3 million seniors are treated in emergency departments for fall injuries. Thus, the rising geriatric population has boosted the demand for assistive products, such as handgrips & grab bars. According to an article published by WHO, 2.5 billion people worldwide need at least one or more assistive products to improve their daily functioning. Moreover, due to the increasing older population & noncommunicable diseases, this number is expected to increase to 3.5 billion by 2050. These factors are expected to further boost industry growth.

Market Concentration & Characteristics

The industry growth stage is medium, and pace of the market growth is accelerating. The bathroom and toilet devices industry is characterized by a high degree of innovation. In recent years, the global bathroom and toilet assist devices market has witnessed a significant degree of innovation. This innovation is driven by advancements in technology and research & development of new products. Companies are constantly striving to introduce novel products and delivery methods to meet the evolving needs and preferences of consumers.

Technological innovations have led to the development of more advanced solutions to enhance accessibility, safety, & convenience for individuals with mobility impairments, the elderly population, and those with disability. Advancements such as sensor fixtures, adjustable height toilets, remote-controlled devices, and customization & adaptation have impelled the demand for these devices. For instance, in September 2023, TIDI Products, LLC launched a wireless toilet sensor that is expected to aid caregivers in preventing falls in the bathroom. Moreover, this sensor adds to the company’s broader patient safety portfolio. The wireless toilet sensor can be paired with an alarm, On Cue PRO. The integration of these devices allows caregivers to maintain the patient’s privacy while alarming healthcare providers if a noncompliant patient is trying to exit the toilet.

The bathroom and toilet assist devices industry is characterized by a moderate level of merger and acquisition activity by the leading players. Companies within the industry are engaging in strategic partnerships, acquisitions, and collaborations to strengthen their product portfolios, expand their market presence, and leverage complementary capabilities. For instance, in September 2022, Sunrise Medical completed two acquisitions in Europe. The Helping Hand Company, renowned for its expertise in pressure management seating, positioning products, and independent living solutions in the UK, and Now Tech, based in Hungary, have become integral parts of Sunrise Medical’s commitment to strategic advancements & sustained growth.

Regulations play a crucial role in shaping the bathroom and toilet assist devices market. In North America, the regulatory framework for these devices is primarily overseen by agencies such as the U.S. FDA and Health Canada. These agencies set standards for the safety, efficacy, and quality of medical devices, including bathroom assist products. Manufacturers must adhere to these regulations to obtain necessary approvals. Moreover, accessibility standards set by laws such as the Americans with Disabilities Act (ADA) influence the design and installation of assistive devices in public spaces.

Product expansion is a key strategy employed by companies operating in the bathroom and toilet assist devices industry to cater to diverse consumer needs & preferences. Manufacturers are continuously introducing new formulations, variations, and combinations of the assist devices to address specific concerns such as sensor fixtures, adjustable height toilets, mobility limitations solutions, and remote-controlled devices. The expansion of product lines allows companies to differentiate themselves from competitors, target niche markets effectively, and capitalize on emerging trends in the market.

The market has been experiencing significant regional expansion due to various factors such as increasing urbanization, rising disposable income, changing lifestyle, and growing awareness about hygiene. In regions such as Asia Pacific, particularly in countries such as China & India, the market for bathroom and toilet devices is expanding rapidly due to population growth & improving standards of living. These countries are witnessing a surge in construction activities, including residential and commercial buildings, which is driving the demand for modern bathroom fixtures & accessories. The regional expansion in the market for bathroom and toilet assist devices is also influenced by trends like eco-friendly products, luxury bathroom designs, and technological advancements that enhance convenience & efficiency.

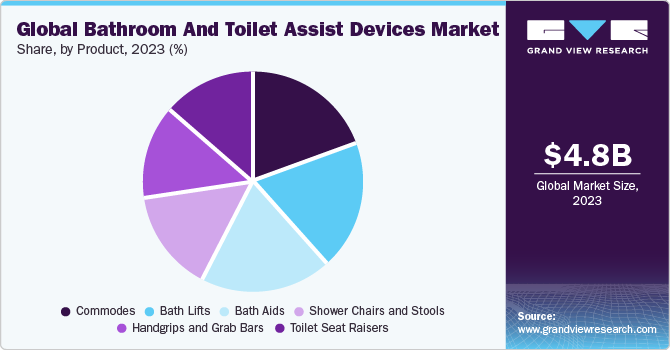

Product Insights

The commode segment accounted for the largest share of 19.1% in 2023. Commodes reduce the need for caregivers and assistance during toileting. They come with a box fitted on a chair for storage of the waste product. The product provides comfort to the disabled & people with reduced mobility and is easy to clean. These commodes are flexible and adjustable, aiding people with reduced mobility. They can be used on the toilet or over the toilet or can also be used as a shower seat.

Furthermore, technological advancements have led to the development of innovative commode features. Smart commodes with sensors, adjustable height settings, and remote-control capabilities are becoming prevalent. These technologies cater to the diverse needs of users, providing a more user-friendly and personalized experience. For instance, in August 2023, SYNSOL, a growing health-monitoring brand supported by Geometry Healthtech, introduced its latest smart toilet lineup, marking the second generation of its innovative products. These smart toilets have medical-grade health monitoring features, such as electrolyte detection and 6-lead Electrocardiogram (ECG) monitoring.

The bath lifts segment is expected to grow at the fastest CAGR of 8.2% during the forecast period. People with reduced mobility can face several challenges in bathrooms, and bath lifts help as well as comfort to such individuals. The user-friendly design of such products is likely to boost segment growth during the forecast period. Bath lifts are available with hydraulic levers, which can be used by disabled or aging people or by an attendant. The person being lifted sits on the fabric seat or sling. Bath lifts are segmented into fixed, reclining, and lying designs. Reclining devices are estimated to be in more demand than others owing to the additional advantages they offer

Regional Insights

The North America bathroom and toilet assist devices market dominated the overall market with a revenue share of 36.6% in 2023, owing to high investment in research & development and favorable government initiatives. In addition, factors such as growing awareness, well-established healthcare facilities, and technological advancements leading to the introduction of novel devices with wide applications in the field of rehabilitation are also responsible for the estimated growth in the region. Technological advancements, such as smart sensors, IoT integration, and innovative materials, drive the development of advanced & user-friendly bathroom & toilet assistive devices. These features enhance functionality and appeal to a broader consumer base. For instance, in April 2023, TIDI Products, LLC launched a wireless toilet sensor, Posey. The product allows caregivers in healthcare facilities to monitor patients at risk of fall injuries in toilets.

According to a research article published by the American Medical Association in March 2023, health spending in the U.S. had increased by 2.7% in 2021, and overall health spending accounted for 18.3% of GDP compared to 19.7% in 2020. Similarly, according to the Canadian Institute for Health Information data published in November 2022, the total healthcare expenditure of Canada was estimated to reach USD 331 billion in 2022, representing the overall healthcare spending of 12.2% of the total GDP. Thus, growing healthcare expenditure is further contributing to industry growth in North America. In addition, an increase in the geriatric population & people with reduced mobility and easy availability & high adoption of bathroom and toilet assist devices are expected to boost industry growth.

U.S. Bathroom And Toilet Assist Devices Market Trends

The bathroom and toilet assist devices market in the U.S. held the largest share of 82.5% in 2023 in the North American region, owing to high population of older individuals.According to a Population Reference Bureau article published in January 2024, the projected growth indicates that the number of Americans aged 65 and older is anticipated to rise from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. Simultaneously, the share of the total population represented by the 65-and-older age group is expected to rise from 17% to 23%. Moreover, as per the American Heart Association, about 70% of individuals aged 70 and above are anticipated to suffer from Cardiovascular Disease (CVD), which is one of the key factors contributing to cognitive disability. Moreover, the U.S. market presents lucrative opportunities for the manufacturers of bathroom and toilet assist devices. According to an article published by Healio in April 2021, an estimated 5 million geriatric population in the U.S. reported difficulty in performing self-care tasks or were at high fall risk.

Europe Bathroom And Toilet Assist Devices Market Trends

The bathroom and toilet assist devices market in Europe is expected to witness lucrative growth over the forecast period. The rising incidence of CVDs in the European Union (EU) emerges as a key growth driver for the market. Vascular Contributions to Cognitive Impairment and Dementia (VCID) is a cognitive impairment that is caused due to cardiovascular factors such as hypertension, diabetes, and atherosclerosis. According to the European Environment Agency, more than 6 million new cases are diagnosed annually, and over 1.7 million individuals die due to circulatory system diseases-constituting about 37% of all deaths. This surge in CVD incidence highlights the indispensable role of assistive devices.

The bathroom and toilet assist devices market in the UK held a significant share in Europe. According to the British Heart Foundation, the latest figures revealed that over 39,000 individuals in England died due to cardiovascular conditions in 2022, interpreting to an average of 750 lives lost weekly, highlighting the urgent need for advanced interventions & assist devices. As CVDs, including heart attack, Coronary Heart Disease (CHD), and stroke, continue to pose a significant health threat, the demand for innovative solutions, such as bathroom and toilet assist devices, increases. CVDs and Alzheimer's disease share common risk factors such as hypertension, diabetes, high cholesterol, and smoking. Therefore, the increasing prevalence of CVDs is expected to drive the incidence of cognitive diseases like Alzheimer's.

The Germany bathroom and toilet assist devices market is a major contributor to the European market. Various factors such as ongoing advancements in technology and improving healthcare infrastructure in the country drive market growth. According to Statistisches Bundesamt (Destatis), nearly 7.8 million people in the country were living with a severe disability in 2021. Of the severely disabled population, physically handicapped individuals represented nearly 58%, and people with cerebral disorders constituted nearly 23%. Moreover, the severely disabled population represented 9.4% of the country’s total population, with men accounting for 50.3% of the population. The presence of a significant disabled population in the country is expected to drive market growth over the forecast period.

The bathroom and toilet assist devices market in France is anticipated to witness significant growth due to increase in the employment rate and allowance for disabled individuals. According to Oak Tree Mobility Ltd article in 2022, the average disability allowance in France was £751.71 or USD 903.13. According to the French law on disabled persons, at least 6% of disabled workers must be employed by any French company with more than 20 employees. Moreover, nearly 12 million people, or 17% of the total population, suffer from motor, sensory, cognitive, or mental disabilities. In addition, the country has registered to conduct the 2024 Olympic and Paralympic Games, which focuses on conducting sports events for the disabled. The event is expected to create robust opportunities for the France personal mobility devices market. In addition, the increasing incidence of obesity in the country is another key factor expected to drive the personal mobility devices market growth during the forecast period.

Asia Pacific Bathroom And Toilet Assist Devices Market Trends

The bathroom and toilet assist devices market in Asia Pacific is expected to grow at the fastest CAGR of 8.6% during the forecast period. The presence of a large patient pool presents noteworthy growth opportunities for regional market growth. Moreover, an increase in the geriatric population in the Asia Pacific region, especially in countries with large untapped opportunities, such as Japan, India, and China, is expected to drive the market during the forecast period. According to the Asian Development Bank, the number of older people aged above 60 is expected to triple to reach 1.3 billion by 2050. Therefore, with the increasing geriatric population, short- and long-term healthcare needs are also expected to grow, which is anticipated to facilitate the industry’s growth in this region during the forecast period. Furthermore, the presence of various financial aids and provisions for disabled patients in the country is expected to fuel growth.

The China bathroom and toilet assist devices market held the largest revenue share in the region and is expected to grow at the fastest rate. The rising elderly demographic signifies a growing market for bathroom and toilet assist devices as age-related conditions, such as orthopedic diseases, become more dominant among this segment of the population. According to a population-based survey in Beijing, China, published in Springer Nature Limited in May 2022, the prevalence of radiographic knee joint Osteoporosis (OA) in women was 42.8%, and for men, it was 21.5%. Moreover, the study highlighted that Chinese women had a higher prevalence of OA than men in Massachusetts, U.S.

The bathroom and toilet assist devices market in Australia is expected to experience lucrative growth owing to the growing geriatric population and the rising number of people with disability.According to an article published on Informa UK Limited in October 2022, nearly 2.5 million to 3 million people in the country suffer from a disability, and nearly 94% of them are registered in the government-run disability system. Moreover, nearly 48.4% of individuals suffer from physical disability, and the proportion of the elderly with a disability was estimated at 46.6%. Consequently, 36.8% of the people reported severe disability, with the rest reporting mild disability. In addition, chairs for showers, baths, and toilet items were among the most needed products in the Korean disabled population.

The India bathroom and toilet assist devices market is expected to grow at a lucrative rate. The growing number of elderly in India creates a higher demand for healthcare solutions. Hence, the increase in individuals aged 60 and above generates a demand for advanced medical interventions, such as bathroom and toilet assist devices, to address movement challenges prevalent in this demographic. According to a CNBC article published in October 2023, in India, the elderly population is expected to double by 2050, greater than the number of children, increasing from 149 million in 2022 to 347 million, highlighting a broader trend in Asia. The demographic shift toward an older population signifies an increased prevalence of age-related health issues, which necessitate the use of these devices.

Latin America Bathroom And Toilet Assist Devices Market Trends

Thebathroom and toilet assist devices market in Latin America is driven by the economic development and presence of government initiatives for developing an inclusive infrastructure. Major players compete in offering innovative, user-friendly, and technologically advanced solutions. However, challenges such as affordability & uneven healthcare access in some regions may hinder widespread adoption. Growing life expectancy & awareness about home healthcare services, increasing prevalence of disabilities, and rising demand for medical devices for long-term care are key factors expected to boost market growth over the forecast period.

The bathroom and toilet assist devices market in Brazil is expected to grow significantly owing to the increasing geriatric population. The rising number of people with disabilities countrywide is also boosting the demand. For instance, over 16 million people in Brazil suffer from a disability. Moreover, rising cases of accidental injuries are also contributing to the market growth in Brazil. For instance, over 40,000 people are killed in road accidents in Brazil every year. These factors are anticipated to fuel market growth over the forecast period. A research study published in BMJ indicated that the prevalence of Parkinson's among individuals aged 65 years and above in Brazil is approximately 3.3%, and this figure is projected to double by 2030. These factors are anticipated to drive the adoption of bathroom and toilet assist devices, thereby fostering market growth.

Middle East And Africa Bathroom And Toilet Assist Devices Market Trends

The bathroom and toilet assist devices market in MEA is expected to grow due to the increasing elderly population and the rising prevalence of chronic diseases & physical disability. Around 4.7% of people in this region is 65 or older. With age, susceptibility to diseases, such as arthritis, also increases. A rise in public awareness about mobility devices and increasing efforts by governments to improve access to healthcare are expected to attract global medical device companies. Improving healthcare expenditure, coupled with a rising geriatric population & growing cases of disability, can augment the market over the forecast period.

The South Africa bathroom and toilet assist devices market witnessed a significant increase in demand for bathroom and toilet assist devices. The growing geriatric population in the country is contributing to this market share. For instance, according to Census 2022 by the Republic of South Africa, around 5 million people were aged more than 60, constituting 9.2% of the total population in the country. The rising number of people with disabilities countrywide is also boosting demand. For instance, over 7.5% population of South Africa suffers from disability. In addition, the rising incidence of injuries due to accidents and violence is fueling market growth in South Africa. Moreover, the elderly population is more susceptible to chronic conditions such as diabetes, cardiovascular disorders, and other lifestyle-associated disorders, which is expected to propel market growth.

The bathroom and toilet assist devices in Saudi Arabia is growing at a rapid rate owing to the rising prevalence of chronic diseases, such as cancer, diabetes, and neurological diseases, which is expected to offer new opportunities for growth. According to the International Diabetes Federation, 4,274.1 thousand people were diagnosed with diabetes in 2021, and 7,537.3 thousand people are expected to be diagnosed by 2045. Thus, the increasing prevalence of chronic diseases is expected to impel the market in Saudi Arabia.

Key Bathroom And Toilet Assist Devices Company Insights

The market is experiencing substantial growth propelled by key companies broadening their product lines and incorporating cutting-edge technologies to secure a larger market presence & engage a broader audience. In January 2023, Prism Medical UK introduced enhancements in the Freeway shower chair series, featuring improved height adjustability and antitangle castors. With its modular design, the upgraded Freeway Height Adjustable shower chair is an assistant-propelled shower, toilet, or commode chair.

Key Bathroom And Toilet Assist Devices Companies:

The following are the leading companies in the bathroom and toilet assist devices market. These companies collectively hold the largest market share and dictate industry trends.

- ArjoHuntleigh

- Carex Health Brands

- Bischoff & Bischoff

- Invacare Corporation

- Prism Medical UK

- Etac AB

- Handicare Group AB

- Sunrise Medical LLC

- GF Health Products, Inc.

Recent Developments

-

In December 2023, Arjo obtained Medical Device Regulation (MDR) and the UK Conformity Assessment (UKCA) certifications for its entire product range. The attainment of these certifications underscores Arjo’s unwavering commitment to maintaining the safety & quality of its products. With these certifications, Arjo ensures the continued availability of its products in the European and UK markets, marked with the CE or UKCA label, including ArjoHuntleigh and Huntleigh Healthcare products.

-

In June 2023, Prism Medical UK added the Freeway Flow, a tilting shower cradle, to its bathing aids portfolio. This innovative cradle enhances the showering experience by offering a secure and stable platform catering to the needs of the elderly or disabled individuals. Specifically designed for those requiring additional support, the Freeway Flow shower cradle is available in various widths, ensuring compatibility with most showers. Its features prioritize comfort & hygiene, making it an advanced and adaptable solution beyond traditional shower chairs.

Bathroom And Toilet Assists Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.09 billion

Revenue forecast in 2030

USD 7.72 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ArjoHuntleigh; Carex Health Brands; Bischoff & Bischoff; Invacare Corporation; Prism Medical UK; Etac AB; Handicare Group AB; Sunrise Medical LLC; GF Health Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country or regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bathroom And Toilet Assist Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bathroom and toilet assist devices market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shower Chairs and Stools

-

Shower chairs

-

Shower stools

-

-

Bath Lifts

-

Fixed bath lifts

-

Reclining bath lifts

-

Lying bath lifts

-

-

Toilet Seat Raisers

-

Commodes

-

Shower and Toilet Commodes

-

Toilet Commodes

-

-

Handgrips and Grab Bars

-

Bath Aids

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the bathroom and toilet assist devices market with a share of 36.6% in 2023. This is attributable to the presence of well-defined regulatory guidelines and reimbursement policies for the treatment of patients with disabilities. Also, the high adoption of home healthcare and remote patient monitoring services is spurring revenue generation in the region.

b. Some key players operating in the bathroom and toilet assist devices market include ArjoHuntleigh, Carex Health Brands, Bischoff & Bischoff, Invacare Corporation, Prism Medical UK, Etac AB, Handicare Group AB, Sunrise Medical LLC, GF Health Products, Inc. among others.

b. Key factors that are driving the market growth include the increasing prevalence of chronic diseases, coupled with a huge number of geriatric population, is resulting in a rise in population with disabilities. Additionally, various initiatives being undertaken by the government to address the needs of disabled people are expected to drive the market growth over the forecast period.

b. The global bathroom and toilet assist devices market size was estimated at USD 4.76 billion in 2023 and is expected to reach USD 5.09 billion in 2024.

b. The global bathroom and toilet assist devices market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 7.72 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."