Barrier Resins Market Size, Share & Trends Analysis Report By Resin Type (Polyvinylidiene Chloride, Ethylene Vinyl Alcohol), By End-use (Food & Beverage, Pharmaceutical & Medical, Cosmetics, Agriculture, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-537-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Barrier Resins Market Size & Trends

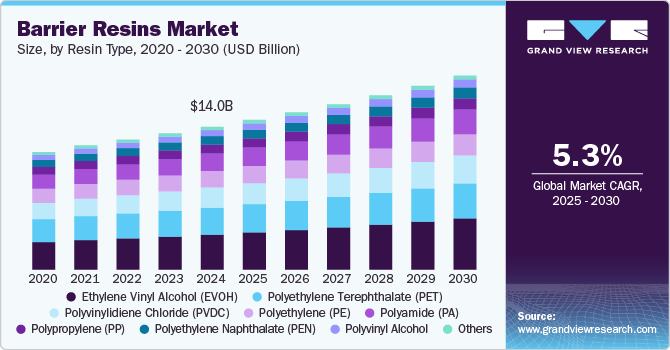

The global barrier resins market size was estimated at USD 14.03 billion in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2030. The market is driven by growing demand for sustainable and high-performance packaging materials in the food and beverage and pharmaceutical industries. A stringent regulatory environment and growing emphasis on sustainability further drive product demand.

Barrier resins, such as ethylene vinyl alcohol (EVOH), polyvinylidene chloride (PVDC), and polyethylene terephthalate (PET), are widely used in food and beverage packaging to extend shelf life by preventing the permeation of oxygen, moisture, and other gases. As consumers increasingly prioritize fresh and minimally processed foods, manufacturers are adopting advanced packaging solutions that ensure product safety and longevity.

Moreover, the rise of e-commerce and online grocery shopping has further fueled the demand for durable and lightweight packaging materials that can withstand transportation while maintaining product integrity. This shift toward innovative packaging solutions is a major driver for the barrier resin market.

Furthermore, the increasing adoption of bio-based and biodegradable barrier resins is gaining traction as companies strive to align with circular economy principles. The pharmaceutical industry also contributes to market growth, as barrier resins are essential for packaging sensitive drugs and medical devices that require protection from contamination and degradation. These factors, combined with technological advancements in resin production, are propelling the barrier resin market forward.

As environmental concerns and regulatory pressures intensify, there is a growing demand for eco-friendly packaging solutions that reduce carbon footprints and align with circular economy principles. Innovations in bio-based resins, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), offer immense potential to cater to this demand.

However, the complexity of recycling multi-layered packaging materials containing barrier resins poses a significant challenge, as it often requires advanced separation technologies that are not widely available. This can hinder the market's alignment with sustainability goals and regulatory requirements. Furthermore, the availability of alternative packaging materials, such as metalized films and nanotechnology-based coatings, may restrain market growth by offering competitive solutions at lower costs. These factors collectively create barriers to the widespread adoption of barrier resins, particularly in developing regions.

Resin Type Insights

Based on resin, the ethylene vinyl alcohol (EVOH) segment led the market with the largest revenue share of 24.57% in 2024 and is projected to grow at the fastest CAGR of 6.6% during the forecast period. EVOH is highly favored in applications like pouches, trays, and bottles, where it helps maintain product freshness and quality. Its compatibility with other materials and ability to be incorporated into recyclable packaging structures align well with sustainability trends. The growing demand for packaged foods, coupled with advancements in EVOH production technologies, is expected to sustain its strong growth trajectory in the market.

Polyethylene Naphthalate (PEN) is gaining traction in the barrier resins industry due to its high thermal stability, chemical resistance, and excellent barrier properties against gases and UV light. It is increasingly used in specialty packaging for beverages, electronics, and industrial applications. The growing demand for high-performance packaging in emerging markets and the development of cost-effective production methods are expected to support PEN's growth in the coming years.

Polyvinylidene Chloride (PVDC) is widely used in food packaging, particularly for perishable goods like meat, cheese, and snacks, where extended shelf life is critical. However, its growth is somewhat restrained by environmental concerns, as PVDC is difficult to recycle and contains chlorine, which raises sustainability issues. Despite this, demand remains strong in applications requiring high-performance barriers, and innovations in PVDC formulations to improve recyclability could further boost its market presence.

End Use Insights

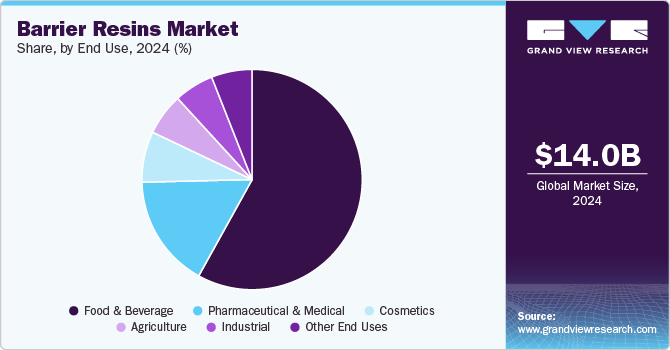

Based on end use, the food & beverage segment led the market with the largest revenue share of 58.06% in 2024 and is projected to grow at the fastest CAGR of 5.7% during the forecast period. Barrier resins like EVOH, PVDC, and PEN are widely used in packaging for meat, dairy, snacks, and beverages to prevent oxygen and moisture ingress, ensuring product quality and safety. The rise of convenience foods, ready-to-eat meals, and e-commerce grocery delivery has further accelerated demand.

The cosmetics industry is emerging as a promising segment for barrier resins, driven by the need for premium and sustainable packaging solutions. Barrier resins are used in tubes, bottles, and jars to protect cosmetic products from oxidation, contamination, and evaporation, ensuring product efficacy and longevity. The growing demand for organic and natural cosmetics, along with the trend toward eco-friendly packaging, is pushing manufacturers to adopt advanced barrier resin materials.

The agriculture sector is witnessing moderate demand growth for barrier resins, primarily in packaging for agrochemicals and fertilizers. Barrier resins like PVDC and PA are used to create durable and chemical-resistant packaging that protects products from moisture, UV light, and contamination. In addition, the development of bio-based barrier resins aligns with the agriculture industry's sustainability goals, offering growth potential in this niche segment. However, the market remains relatively small compared to other industries like food and pharmaceuticals.

Regional Insights

The barrier resins market in North America is a mature yet steadily growing market for barrier resins, driven by the region's advanced food and beverage, pharmaceutical, and cosmetics industries. The rise of e-commerce and online grocery delivery is further accelerating the need for durable and lightweight barrier resin-based packaging. In addition, stringent regulations on food safety and sustainability are pushing manufacturers to adopt innovative barrier resin materials, ensuring continued growth in this region.

U.S. Barrier Resins Market Trends

The barrier resins market in the U.S. growth is majorly driven by its robust food and beverage, pharmaceutical, and cosmetics industries. The country's focus on reducing food waste and extending shelf life is boosting demand for advanced barrier resin solutions like EVOH and PVDC. The growing trend of convenience foods and e-commerce is also contributing to market growth. However, challenges such as high production costs and recycling complexities for multi-layered packaging could pose restraints. Despite this, the U.S. remains a dominant player in the global market due to its technological advancements and strong consumer demand.

Asia Pacific Barrier Resins Market Trends

Asia Pacific dominated the barrier resins market with the largest revenue share of 42.32% in 2024 and is anticipated to grow at the fastest CAGR of 4.9% over the forecast period. Countries like China, India, and Japan are major contributors, with rising demand for packaged foods, pharmaceuticals, and cosmetics. The region's expanding e-commerce sector and growing awareness of food safety and shelf-life extension are further fueling demand. In addition, investments in sustainable packaging solutions and advancements in manufacturing technologies are creating significant growth opportunities for barrier resins in this region.

The barrier resins market in China accounted for a substantial share of regional demand for the year 2024. The country's massive food and beverage industry, coupled with its growing pharmaceutical and cosmetics sectors, is propelling the need for high-performance barrier resins. Government initiatives promoting sustainable packaging and reducing food waste are also boosting adoption. However, challenges such as raw material price volatility and environmental concerns related to recycling multi-layered packaging could moderate growth. Despite this, China remains a critical market for barrier resins due to its large consumer base and industrial expansion.

Europe Barrier Resins Market Trends

The barrier resins market in Europe growth is characterized by stringent regulations on food safety, sustainability, and packaging waste reduction. The region's well-established food and beverage, pharmaceutical, and cosmetics industries are key drivers of demand. Countries like Germany, France, and the UK are leading adopters of barrier resins, particularly for recyclable and eco-friendly packaging solutions. The European Union's circular economy initiatives and bans on single-use plastics are further propelling the adoption of advanced barrier resin materials, ensuring steady growth in this region.

The Germany barrier resins market is primarily driven by its advanced manufacturing sector and strong focus on sustainability. The country's food and beverage, pharmaceutical, and cosmetics industries are key end-users of barrier resins, particularly for high-performance and recyclable packaging solutions. Germany's stringent environmental regulations and commitment to reducing packaging waste are pushing manufacturers to adopt innovative barrier resin materials.

Key Barrier Resins Company Insights

The barrier resins industry is highly competitive, with key players such as Dow, Kuraray Co., Ltd., Mitsubishi Chemical Corporation, and Solvay S.A. dominating the landscape. These companies are focusing on strategic partnerships, mergers, and acquisitions to expand their product portfolios and geographic reach. Innovation is a critical differentiator, with leading players investing heavily in R&D to develop sustainable, bio-based, and high-performance barrier resins that meet evolving regulatory and consumer demands.

Key Barrier Resins Companies:

The following are the leading companies in the barrier resins market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik

- Arkema

- Huntsman International LLC

- BASF SE

- Dupont

- DAIKIN

- Bostik

- H.B. Fuller Company

- Sika AG

- Mitsubishi Chemical Corporation

- DOW

- Solvay S.A

- Kuraray Co., Ltd.

Recent Development

-

In August 2023, Kuraray Co., Ltd. announced an increase in production capacity of ethylene vinyl alcohol copolymer in the U.S. and Europe. In 2024, 5,000 tons/year of production capacity was added to U.S. and European operations, with an additional 5,000 tons/year planned for 2026. This expansion aims to meet the growing demand for EVOH resin, particularly in Asia, where the food packaging market is rapidly expanding.

-

In July 2022, Mitsubishi Chemical Group announced to increase the production capacity of SoarnoL ethylene vinyl alcohol copolymer (EVOH) resin in the UK by 21,000 tons. This is expected to take effect by July 2025. The initiative aims to address the increasing need for eco-friendly products and the growth in global demand for SoarnoL in the coming years.

Barrier Resins Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 14.72 billion |

|

Revenue forecast in 2030 |

USD 19.08 billion |

|

Growth rate |

CAGR of 5.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Resin type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Evonik.; Arkema; Huntsman International LLC; BASF SE; Dupont; DAIKIN; Bostik; H.B. Fuller Company; Sika AG; Mitsubishi Chemical Corporation; DOW; Solvay S.A; Kuraray Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Barrier Resins Market Report Segmentation

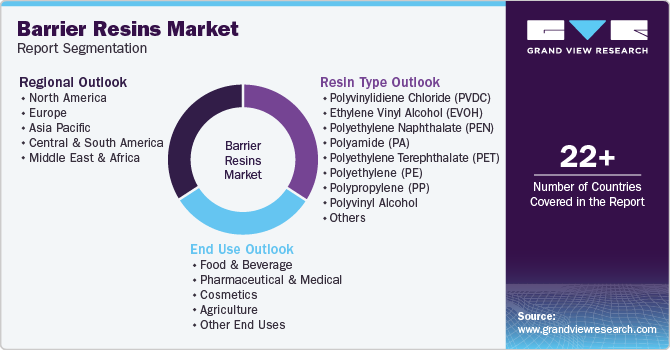

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global barrier resins market report based on resin type, end use, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyvinylidiene Chloride (PVDC)

-

Ethylene Vinyl Alcohol (EVOH)

-

Polyethylene Naphthalate (PEN)

-

Polyamide (PA)

-

Polyethylene Terephthalate (PET)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinyl Alcohol

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical & Medical

-

Cosmetics

-

Agriculture

-

Industrial

-

Other End Uses

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global barrier resins market was estimated at around USD 14.03 billion in the year 2024 and is expected to reach around USD 14.72 billion in 2025.

b. The global barrier resins market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach around USD 19.08 billion by 2030.

b. The food & beverage segment recorded the largest market share of 58.06% in 2024 as EVOH, PVDC, and PEN are widely used in packaging for meat, dairy, snacks, and beverages to prevent oxygen and moisture ingress, ensuring product quality and safety.

b. The key players in the barrier resins market include Evonik., Arkema, Huntsman International LLC, BASF SE, Dupont, DAIKIN, Bostik, H.B. Fuller Company, Sika AG, Mitsubishi Chemical Corporation, DOW, Solvay S.A, and Kuraray Co., Ltd.

b. The barrier resins market is driven by rapid urbanization, infrastructure development, and the growing demand for durable, flexible, and energy-efficient materials. Additionally, advancements in polymer technology and increasing government initiatives for sustainable construction further fuel market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."