- Home

- »

- Plastics, Polymers & Resins

- »

-

Barrier Films Market Size, Share And Growth Report, 2030GVR Report cover

![Barrier Films Market Size, Share & Trends Report]()

Barrier Films Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Polyethylene, Polypropylene, Ethylene Vinyl Alcohol), By Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-330-4

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Barrier Films Market Summary

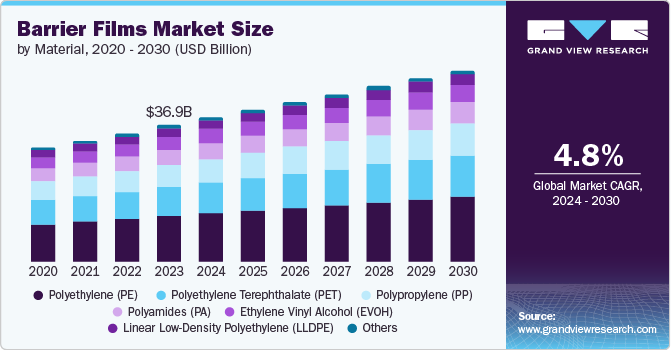

The global barrier films market size was estimated at USD 36.91 billion in 2023 and is projected to reach USD 51.74 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. The market is expected to experience significant growth in the coming years.

Key Market Trends & Insights

- Asia Pacific dominated the barrier films market with a revenue share of 39.61% in 2023

- The barrier films market in North America is expected to grow at a significant CAGR of 4.9% over the forecast period.

- The barrier films market in the U.S. accounted for the largest market share of over 5.2% of North America in 2023s.

- Based on type, the metalized barrier films segment led the market with the largest revenue share of 47.98% in 2023.

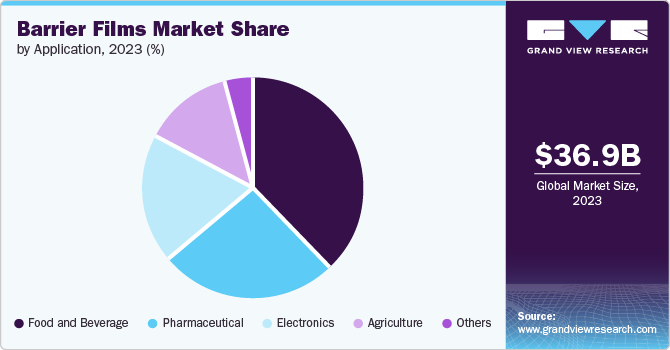

- Based on application, the market is segmented into food and beverage, pharmaceutical, electronics, agriculture, and others.

Market Size & Forecast

- 2023 Market Size: USD 36.91 Billion

- 2030 Projected Market Size: USD 51.74 Billion

- CAGR (2024-2030): 4.8%

- Asia Pacific: Largest market in 2023

The market growth is driven by a growing shift from traditional rigid packaging such as glass and cans to lightweight, portable, flexible packaging using barrier films. Barrier films help prevent quality degradation, making them suitable for pharmaceutical applications to increase shelf life. The market growth is also driven by the rise in modern retail formats such as supermarkets, hypermarkets and convenience stores. The food and beverage industry is moving away from traditional packaging formats towards lightweight, transportable packaging. This is expected to boost the market growth.

Drivers, Opportunities & Restraints

The global market is driven by the growing international trade (imports and exports), increased online purchasing trends, and increasing penetration of packaging in pharmaceutical, food & beverage, consumer goods, chemical, and industrial sectors. Various material-based packaging such as glass, plastic, metals, and paper is available based on packaging requirements. This is expected to further contribute to the market growth.

The market offers several opportunities for companies and individuals. The growing online purchasing trend is also driving packaging manufacturers to develop packaging products suitable for the e-commerce industry. Moreover, rising penetration and access to the Internet in developing economies have created potential opportunities for e-commerce providers to enter untapped markets and gain significant growth.

Material Insights

Based on material, the market has been segmented into polyethylene, polyethylene terephthalate, polypropylene, polyamides, ethylene vinyl alcohol, linear low-density polyethylene, and others. The polyethylene segment led the market with the largest revenue share of 33.23% in 2023. Polyethylene-based barrier films help extend the shelf life of products by providing protection from oxygen, moisture, and other environmental factors. The rising usage of polyethylene based barrier films in food & beverage industry, owing to their preservative characteristics, is exacted to propel the market growth.

The polyethylene terephthalate segment is expected to grow at a significant CAGR of 5.0% during the forecast period. PET has grown popular in the e-commerce industry due to their durability, good impact resistance, abrasive resistance, water resistance, and lightweight, making it suitable for manufacturing barrier films for wrapping and other applications.

Type Insights

Based on type, the market is segmented into metalized barrier films, transparent barrier films, and white barrier film. The metalized barrier films segment led the market with the largest revenue share of 47.98% in 2023. Metallized films act as a barrier against the passage of gas, oxygen, water vapor, and light. They are used in several applications including paper and paper board laminations, gift wrapping and decorative applications.

The transparent barrier films segment is expected to grow at the fastest CAGR of 5.1% during the forecast period. The transparent barrier film offers superior moisture barrier and oxygen barrier properties, making it suitable for several applications such as industrial, medical, food & beverage packaging, and display applications.

Application Insights

Based on application, the market is segmented into food and beverage, pharmaceutical, electronics, agriculture, and others. The food and beverage segment led the market with the largest revenue share of 38.04% in 2023. This shift to flexible barrier packaging is driven by consumer demand for more convenient and user-friendly food and beverage products. Moreover, the growing popularity of packaged, ready-to-eat food and beverage products delivered online is driving demand for barrier films in the industry.

The agriculture segment is anticipated to grow at the fastest CAGR of 5.4% during the forecast period. The growing need for advanced farming technologies is driving the demand for barrier films in agriculture. These films are used to protect and extend the shelf life of fungicides fertilizers, pesticides, and seeds. Furthermore, barrier films used in greenhouses help improve the sustainability of agricultural processes by increasing the yield and quality of crops.

Regional Insights

The barrier films market in North America is expected to grow at a significant CAGR of 4.9% over the forecast period. Growing demand for lightweight packaging solutions in the region coupled with consumer lifestyle trends necessitating portability and convenience in products has augmented demand for barrier films in the region.

U.S. Barrier Films Market Trends

The barrier films market in the U.S. accounted for the largest market share of over 5.2% of North America in 2023, and it is expected to grow at a significant CAGR over the forecast period, backed by the growing demand for packaging of food & beverage and healthcare products. Lifestyle and demographic factors in the country is also expected to propel demand for barrier films in the country.

Asia Pacific Barrier Films Market Trends

Asia Pacific dominated the barrier films market with a revenue share of 39.61% in 2023 and is expected to grow at a significant CAGR over the forecast period. There has been a significant growth in domestic demand for barrier films in the Asia Pacific, owing to the growing urbanization in rising nations such as China and India. The rising growth in several end-use industries including food & beverage, agriculture, and pharmaceuticals across the region is the need for increased barrier films.

Europe Barrier Films Market Trends

The barrier films market in Europe is anticipated to grow at a significant CAGR during the forecast period. The European market is seeing a growing focus on sustainability and the development of biodegradable barrier films. The rising trend to replace traditional rigid packaging formats such as glass and cans with lightweight, portable flexible packaging using barrier films is expected to drive the market growth in the region.

Key Barrier Films Market Company Insights

The market is a highly competitive industry with several key players operating globally, who have strong distribution networks and good knowledge about suppliers and regulations. Major players, in particular, compete on the basis of application development capability and new technologies used for product formulation.

Key Barrier Films Companies:

The following are the leading companies in the barrier films market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor Plc

- Berry Global Inc.

- Cosmo Films Ltd.

- Dupont Teijin Films

- Flair Flexible Packaging Corporation

- HPM Global Inc

- Jindal Poly Films Ltd.

- Mondi plc

- Sealed Air Corporation

- Toppan Inc

Recent Developments

-

In March 2024, Toppan and India's Toppan Specialty Films (TSF) developed a barrier film, GL-SP, which uses bi-axially oriented polypropylene (BOPP) as a substrate. The company initiated their production and sales in April 2024

-

In March 2024, Jindal Films announced the launch of 30 MBH568 and BICOR 25 mono-material barrier film. The new PE and PP material are designed to help the industry implement packaging that complies with new mechanical recycling guidelines across Europe

-

In April 2022, Toppan expanded its line of clear barrier films with the launch of "GL-ME-RC." a new variety that provides both light protection and high barrier properties. GL-ME-RC, which expands the use ability of GL BARRIER films. GL-ME-RC exhibits exceptional flex resistant barrier properties, along with vapor deposition and vapor coating technologies

Barrier Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.99 billion

Revenue forecast in 2030

USD 51.74 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Sweden, Norway, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Amcor Plc; Berry Global Inc.; Cosmo Films Ltd.; Dupont Teijin Films; Flair Flexible Packaging Corporation; HPM Global Inc; Jindal Poly Films Ltd.; Mondi plc; Sealed Air Corporation; Toppan Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barrier Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented global barrier films market report based on material, application, type, and region:

-

Material Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)

-

Polypropylene (PP)

-

Polyamides (PA)

-

Ethylene Vinyl Alcohol (EVOH)

-

Linear Low-Density Polyethylene (LLDPE)

-

Others

-

-

Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Metalized Barrier Films

-

Transparent Barrier Films

-

White Barrier Film

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Food and Beverage

-

Pharmaceutical

-

Electronics

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global barrier films market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 51.74 billion by 2030

b. Asia Pacific dominated the barrier films market with a share of over 39.61% in 2023. The rising growth in several end-use industries, including food & beverage, agriculture, and pharmaceuticals, across the region is the need for increased barrier films

b. Some key players operating in the barrier films market include Amcor Plc; Berry Global Inc.; Cosmo Films Ltd.; Dupont Teijin Films; Flair Flexible Packaging Corporation; HPM Global Inc, among others

b. The market growth is driven by the growing shift from traditional rigid packaging such as glass and cans to lightweight, portable flexible packaging using barrier films

b. The global barrier films market size was estimated at USD 36.91 billion in 2023 and is expected to reach USD 38.99 billion in 2024

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.