- Home

- »

- Consumer F&B

- »

-

Barley Tea Market Size, Share And Trends Report, 2030GVR Report cover

![Barley Tea Market Size, Share & Trends Report]()

Barley Tea Market (2025 - 2030) Size, Share & Trends Analysis Report By Flavor (Original, Flavored), By Form (Instant, Ready-to-Drink), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-407-2

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Barley Tea Market Size & Trends

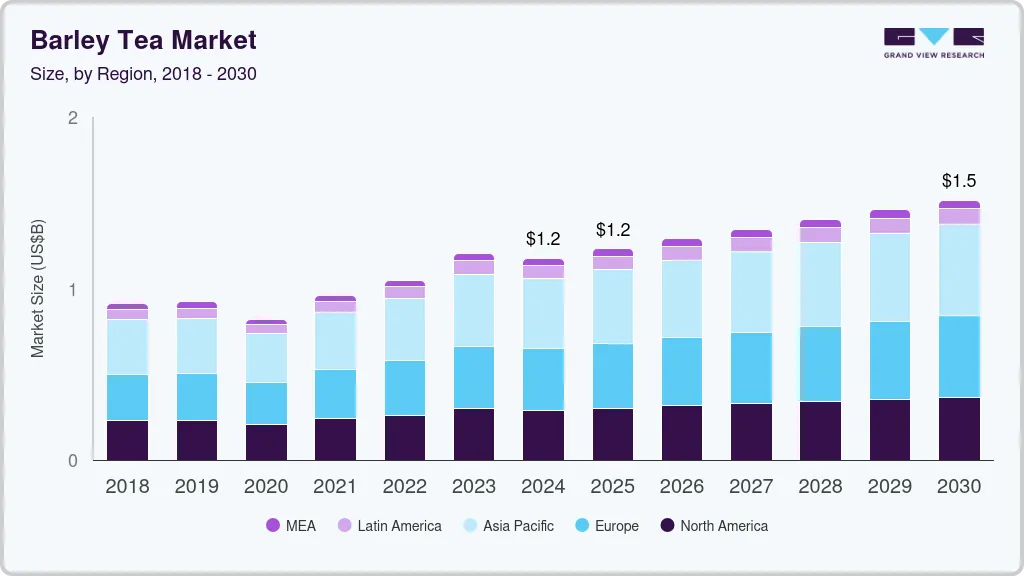

The global barley tea market size was estimated at USD 1,175.6 million in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. Barley tea, also known as mugicha in Japan and boricha in Korea, is a caffeine-free beverage made from roasted barley grains. It's celebrated for its unique flavor and potential health benefits, making it a popular choice among consumers looking for healthy beverage options. The barley tea industry, primarily concentrated in Asia but expanding globally, is experiencing notable growth due to increasing health consciousness, cultural influences, and innovations in product offerings.

Barley tea is caffeine-free and rich in antioxidants, which appeal to health-conscious consumers. It's known for aiding digestion, promoting relaxation, and potentially helping to manage blood sugar levels. The trend towards specialty beverages such as craft beers and artisanal drinks has paved the way for herbal tea blends to be recognized as a premium and healthy beverage option. The growing interest in Asian culture and cuisine has spurred demand for traditional nutty-flavored detox drinks in Western markets.

There is a growing trend towards sustainable and eco-friendly packaging to appeal to environmentally conscious consumers. Barley tea is increasingly marketed as a functional beverage with health benefits, aligning with the wellness trend in the food and beverage industry. Companies are introducing barley tea in various convenient packaging options, such as ready-to-drink bottles, tea bags, and instant powders.

Manufacturers are developing RTD barley tea in convenient, portable packaging to cater to on-the-go consumers. They are introducing unique flavors and blends to attract different consumer segments. There is significant potential for barley tea to expand into new markets, particularly in Western countries where it is not yet widely consumed. Barley tea holds cultural significance in Asian countries and is an integral part of traditional diets. As a caffeine-free, antioxidant-rich beverage, barley tea fits well into the health and wellness segment.

The market is set for sustained growth, driven by innovations in product formulations, campaigns and collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Flavor Insights

Based on flavor, the flavored barley tea segment led the market with the largest revenue share of 65.42% in 2023. Modern consumers often seek variety in their beverage choices. Flavored segment offers a wide range of options, from fruity flavors to herbal infusions, catering to diverse taste preferences. Flavored versions can enhance the natural taste of barley tea, making it more appealing to those who may find the original flavor too subtle or bland. There is a rising demand for naturally flavored and organic beverages, which flavored barley tea can cater to by using natural flavorings and organic ingredients. Flavored segment appeals to a broader demographic, including younger consumers and those new to barley tea who may be more accustomed to flavored beverages.

The original barley tea segment is expected to grow at the fastest CAGR of 4.1% from 2024 to 2030. In countries like Japan and Korea, where barley tea (mugicha and boricha, respectively) is a staple, the original, unflavored version is deeply rooted in daily life and traditional practices. Consumers seeking health benefits often prefer the original version due to its simplicity and lack of additives or artificial flavors. With increasing awareness about the health benefits of natural and unprocessed foods, consumers are more likely to choose the original version. Original segment is being marketed as a functional beverage with health benefits, which appeals to the growing health and wellness consumer base.

Form Insights

Based on form, the ready-to-drink segment led the market with the largest revenue share of 70.37% in 2023. RTD barley tea offers the ultimate convenience as it is pre-brewed and ready for immediate consumption. This appeals to busy consumers who want a quick and easy beverage option without any preparation. Available in bottles, cans, and tetra packs, RTD barley tea can be easily carried and consumed on the go, making it ideal for busy lifestyles and outdoor activities. Manufacturers are introducing a variety of flavors to cater to diverse consumer tastes, including options like lemon, honey, and herbal infusions. This variety helps attract and retain a wider audience.

The instant segment is expected to grow at the fastest CAGR of 5.3% from 2024 to 2030. The portability of instant tea packets makes it easy for consumers to enjoy barley tea anywhere, whether at work, while traveling, or during outdoor activities.The availability of single-serve packets caters to individual consumption needs, reducing waste and ensuring freshness. Many instant barley tea products emphasize natural and minimal ingredients, aligning with the trend towards clean eating and transparency in food labeling. Manufacturers are continually innovating with new flavors and formulations, making instant barley tea more appealing to a broader audience.

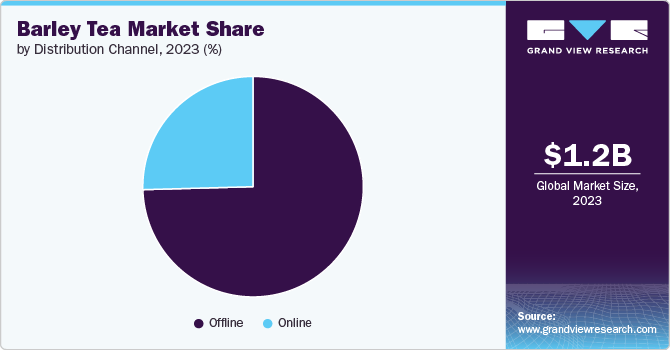

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 74.57% in 2023. Companies producing barley tea have established partnerships with major retail chains such as supermarkets, hypermarkets, and convenience stores. These collaborations ensure that barley tea is widely available to a broad consumer base. Through these partnerships, barley tea brands can penetrate markets more effectively and establish a strong presence in both urban and rural areas. This widespread availability helps in maintaining a majority market share. Offline channels like supermarkets and convenience stores offer consumers the ease of picking up barley tea during their regular shopping trips. This convenience encourages repeat purchases.

The online segment is expected to grow at the fastest CAGR of 5.2% from 2024 to 2030. Online shopping offers unparalleled convenience, allowing consumers to purchase barley tea from the comfort of their homes at any time. Brands can leverage digital marketing tools to target specific demographics, increasing the effectiveness of advertising campaigns. Platforms like Instagram, Facebook, and Twitter are used to promote barley tea products, engage with customers, and drive traffic to online stores. Moreover, online reviews and ratings help potential buyers make informed decisions based on the experiences of other consumers.

Regional Insights

North America dominated the barley tea market with a revenue share of 24.79% in the market. The popularity of barley tea in Asian cultures is influencing North American consumers, especially in metropolitan areas with diverse populations and a growing interest in Asian cuisine and wellness practices. Brands are emphasizing sustainable sourcing of barley and environmentally friendly packaging to appeal to eco-conscious consumers. Health professionals, nutritionists, and wellness influencers are advocating for barley tea as a healthy alternative to sugary and caffeinated drinks, further boosting its popularity.

U.S. Barley Tea Market Trends

The barley tea market in the U.S. is expected to grow at the substantial CAGR of 3.7% from 2024 to 2030. The U.S. market is experiencing robust growth, fueled by increasing consumer awareness of its health benefits, the rise of wellness trends, and a growing preference for natural and healthy beverages. The preference for clean-label products is rising, and barley tea, made from roasted barley grains without additives, fits this trend perfectly.

Europe Barley Tea Market Trends

The barley tea market in Europe is expected to grow at the fastest CAGR of 4.8% from 2024 to 2030. European consumers are increasingly prioritizing health and wellness, driving demand for functional beverages like barley tea, known for its health benefits such as being caffeine-free, aiding digestion, and providing antioxidants. European consumers are increasingly interested in authentic and traditional Asian beverages, including barley tea, as part of their culinary exploration. Moreover, there is a growing emphasis on sustainable packaging solutions, such as recyclable and biodegradable materials, in response to consumer demand for environmentally friendly products.

Asia Pacific Barley Tea Market Trends

The barley tea market in Asia Pacific is expected to witness at a significant CAGR of 4.4% from 2024 to 2030. Barley tea has deep cultural roots in several Asia Pacific countries, including Japan, South Korea, and China. It is widely consumed as a traditional beverage, enjoyed for its refreshing taste and health benefits. The beverage’s traditional status and widespread consumption are bolstering its market presence in both established and emerging markets within the region. The urbanization trend is driving the demand for convenient and premium beverages in metropolitan areas, contributing to the market growth. Brands are investing in educational campaigns to raise awareness about the benefits of barley tea and its traditional significance. These campaigns are effective in attracting new consumers.

Key Barley Tea Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the global market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace barley tea.

Key Barley Tea Companies:

The following are the leading companies in the barley tea market. These companies collectively hold the largest market share and dictate industry trends.

- Ito En

- Suntory Beverage & Food

- Kirin Holdings

- Otsuka Pharmaceutical

- Jinjja Barley Tea

- Haitai

- The Republic of Tea

- Lotte

- New Mexico Tea Company

- The Canadian Barley Tea Company

Recent Developments

-

In April 2023, Shiga Prefecture, renowned for being home to Japan's largest lake, Lake Biwa, has just unveiled a new release of Omi barley tea. This region is blessed with abundant sunlight and mineral-rich soil, which contributes to the exceptional quality of its barley. The barley is carefully roasted using hot air, resulting in a delightfully rich and aromatic tea that captures the essence of its pristine environment

-

In April 2022, the Canadian Barley Tea Company is proud to announce the launch of its new product, mo'mugi, now available on both Amazon.com and Amazon.ca. Sourced and crafted locally in British Columbia, mo'mugi is made from the highest quality organic Canadian barley. mo'mugi offers a wealth of benefits as a 100% natural beverage. Composed entirely of premium organic barley, it contains no caffeine, sugar, carbs, or calories, making it an ideal choice for health-conscious consumers

Barley Tea Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,232.0 million

Revenue forecast in 2030

USD 1,514.8 million

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; and South Africa

Key companies profiled

Ito En; Suntory Beverage & Food; Kirin Holdings; Otsuka Pharmaceutical; Jinjja Barley Tea; Haitai; The Republic of Tea; Lotte; New Mexico Tea Company; and The Canadian Barley Tea Company

Customization scope

Free Report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Barley Tea Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global barley tea market report based on flavor, form, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original

-

Flavored

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Instant

-

Ready-to-drink

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global barley tea market size was estimated at USD 1,204.1 million in 2023 and is expected to reach USD 1,175.5 million in 2024.

b. The global barley tea market is expected to grow at a compounded growth rate of 4.3% from 2024 to 2030 to reach USD 1,514.9 million by 2030.

b. The flavored segment dominated the barley tea market with a share of 65.42% in 2023. There is a rising demand for naturally flavored and organic beverages, which flavored barley tea can cater to by using natural flavorings and organic ingredients.

b. Some key players operating in the barley tea market include Ito En; Suntory Beverage & Food; Kirin Holdings; Otsuka Pharmaceutical; Jinjja Barley Tea; Haitai; and the Republic of Tea

b. Key factors that are driving the market growth include the trend towards specialty beverages such as craft beers and artisanal drinks has paved the way for barley tea to be recognized as a premium and healthy beverage option. Companies are introducing barley tea in various convenient packaging options, such as ready-to-drink bottles, tea bags, and instant powders. =

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.