- Home

- »

- Consumer F&B

- »

-

Barley Flakes Market Size, Share & Trends Report, 2030GVR Report cover

![Barley Flakes Market Size, Share & Trends Report]()

Barley Flakes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Conventional, Organic), By Distribution Channel (Supermarket/Hypermarket, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-461-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Barley Flakes Market Size & Trends

The global barley flakes market size was valued at USD 8.08 billion in 2024 and is expected to grow at a CAGR of 5.0% from 2025 to 2030. Shifting consumer preferences towards healthy and nutritious on-the-go snacks due to their convenience features is expected to boost the industry's growth in the coming years. Furthermore, barley flakes are expected to gain utility owing to their rich nutritional properties including fiber, vitamins, minerals, copper, magnesium, selenium, and antioxidants.

Over the past few years, barley flakes have found many applications in the food industry, including biscuits, breakfast cereals, energy bars, and bread, owing to their easily digestible properties. Moreover, these flakes can provide excellent nutritional properties with high dietary fiber content as compared to conventional cereals, including wheat and cornflakes.

These factors are expected to encourage consumers to include barley flakes in their daily meals to gain a sustainable healthy diet and prevent chronic health issues. Regular consumption of these barley flakes improves metabolic activity and reduces the risk of high blood pressure, cardiovascular diseases, cancer, and diabetes. As a result, processed snack manufacturers are shifting their focus to healthy and sustainable ingredients for preparing snacks.

The rising prevalence of chronic diseases, including diabetes, high blood pressure, and cardiovascular diseases (CVDs), has fueled the demand for barley-based flakes in daily meals. Barley is itself a rich source of soluble fiber beta-glucan, which helps to promote the absorption of nutrients in the human body. This helps to lower the bad cholesterol and blood sugar levels of the body as well as increase the good bacteria, which helps to improve the digestive system of the human body.

According to the Centers for Disease Control and Prevention (CDC), around 95 million people in the U.S. aged 20 or older have total cholesterol levels higher than 200mg/dL. Increasing concerns over adverse effects associated with cholesterol levels in the human body are expected to promote the utility of barley flakes in indirect human consumption.

Product Insights

The conventional segment dominated the global market, with the largest revenue share of 73.8% in 2024. Conventional barley flakes are widely recognized and trusted by consumers for their nutritional benefits and versatility in various culinary applications. Their lower cost than organic or specialty variants makes them more accessible to a broader consumer base. Additionally, the established supply chains and distribution networks for conventional barley flakes ensure their availability in a wide range of retail outlets.

The organic segment is expected to grow at the fastest CAGR over the forecast period. Increasing consumer awareness about health and wellness has increased demand for organic products, including barley flakes. These consumers prefer organic products due to their perceived health benefits and the absence of synthetic pesticides and fertilizers. Additionally, the growing trend of clean labels and sustainable food choices further boosts the demand for organic barley flakes. The rise in vegan and plant-based diets also supports the market, as organic barley flakes are considered a nutritious and natural food option.

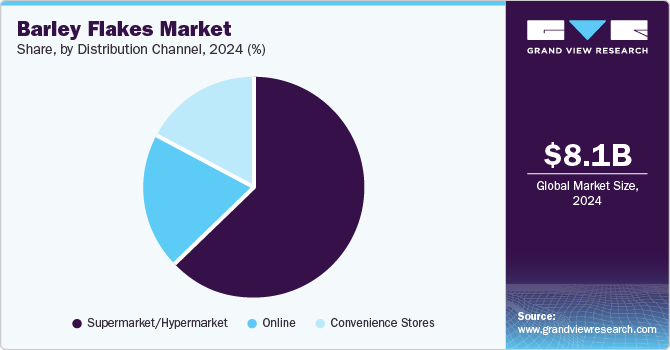

Distribution Channel Insights

The supermarket/hypermarket segment dominated the market with the largest revenue share of 63.2% in 2024. Supermarkets and hypermarkets provide a wide variety of products, allowing consumers to conveniently compare and choose from numerous brands. The accessibility and extensive reach of these retail channels ensure that barley flakes are available to a large consumer base. Additionally, in-store promotions and discounts offered by supermarkets and hypermarkets attract price-sensitive customers. The ability to physically inspect and purchase products also enhances the shopping experience, contributing to the strong market position of this segment.

The online retail segment is expected to grow at the fastest CAGR over the forecast period owing to the convenience of online shopping, which allows consumers to easily browse and purchase barley flakes from the comfort of their homes. The increasing penetration of smartphones and internet access has made e-commerce more accessible to a broader audience. Online platforms often provide detailed product descriptions, customer reviews, and competitive pricing, enhancing the shopping experience. Additionally, the ability to compare different brands and products quickly and the option for home delivery contribute to the rising popularity of online shopping for barley flakes.

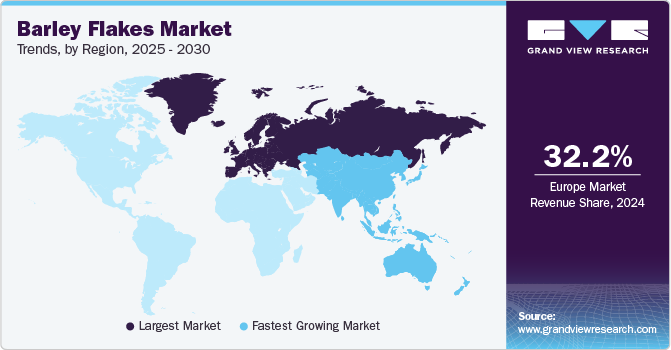

Regional Insights

Europe dominated the global barley flakes market, with a revenue share of 32.2% in 2024. Increasing consumer awareness about the health benefits of barley, such as its high fiber content and low glycemic index, has boosted demand. The region's strong tradition of incorporating whole grains into diets supports this trend. Additionally, the rising popularity of organic and clean-label products has led to greater adoption of barley flakes, particularly among health-conscious consumers.

North America Barley Flakes Market Trends

The North American barley flakes market was identified as a lucrative region in 2024 owing to the increasing option for nutrient-dense and whole-grain foods, making barley flakes a preferred choice. The versatility of barley flakes in various culinary applications, from breakfast cereals to soups and baked goods, has contributed to their popularity. Additionally, the market benefits from the trend towards sustainable and eco-friendly food options.

The U.S. barley flakes market is expected to grow significantly over the forecast period. With an increasing demand for nutritious breakfast options, barley flakes have become popular due to their high fiber content and low glycemic index. Major brands are expanding their product lines to include natural and specialty ingredients, catering to the diverse tastes of consumers. The market is also witnessing a surge in gluten-free barley flakes, appealing to those with dietary restrictions.

Asia Pacific Barley Flakes Market Trends

Asia Pacific barley flakes market is expected to grow at the fastest CAGR of 5.5% over the forecast period, owing to the rising living standards and the adoption of Western food trends. Countries such as India and China are witnessing an increased intake of healthy cereal-based breakfast foods. Local companies are expanding their barley portfolios to target health-conscious consumers, while the availability of barley flakes through online and retail channels is boosting market growth. The region's focus on nutritious and convenient food options is driving the demand for barley flakes.

Key Barley Flakes Company Insights

Some key companies in the barley flakes market includeWK Kellogg Co, Nestlé, The Quaker Oats Company, King Arthur Baking Company, Inc., Honeyville, Inc., and others. Companies are introducing new flavors and ingredients to remain competitive. Furthermore, several key players are pursuing various strategic initiatives, such as mergers, acquisitions, and partnerships with other leading companies.

-

WK Kellogg Co. offers various barley flakes products, catering to various consumer preferences. Some of their notable offerings include Special K Multigrain Flakes, Mueslix, and Eat Your Mouth Off. The company is committed to innovation and quality, ensuring that their barley flakes products meet the evolving needs of consumers.

-

Nestlé's portfolio includes a variety of barley flakes products, emphasizing whole grain nutrition and health benefits. Nestlé's commitment to health and sustainability makes their barley flakes products a popular choice among consumers. Some of the famous offerings includeWhole Grain Cereals, Nutritious Breakfast Options, and Sustainable and Healthy Choices.

Key Barley Flakes Companies:

The following are the leading companies in the barley flakes market. These companies collectively hold the largest market share and dictate industry trends.

- WK Kellogg Co

- Nestlé

- The Quaker Oats Company

- King Arthur Baking Company, Inc.

- Honeyville, Inc.

- Dun & Bradstreet, Inc.

- CEREAL FOOD MANUFACTURING CO

- Briess Malt & Ingredients

- Vitasana Foods Pvt Ltd

- Shiloh Farms

- Bob’s Red Mill Natural Foods

Barley Flakes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.50 billion

Revenue forecast in 2030

USD 10.83 billion

Growth Rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Russia, Turkey, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa, Saudi Arabia

Key companies profiled

WK Kellogg Co; Nestlé; The Quaker Oats Company; King Arthur Baking Company, Inc.; Honeyville, Inc.; Dun & Bradstreet, Inc.; CEREAL FOOD MANUFACTURING CO; Briess Malt & Ingredients; Vitasana Foods Pvt Ltd; Shiloh Farms; Bob’s Red Mill Natural Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barley Flakes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global barley flakes market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Convenience Stores

-

Supermarket/Hypermarket

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.