- Home

- »

- Automotive & Transportation

- »

-

Barge Transportation Market Size And Share Report, 2030GVR Report cover

![Barge Transportation Market Size, Share & Trends Report]()

Barge Transportation Market (2025 - 2030) Size, Share & Trends Analysis Report By Type Of Cargo (Liquid Cargo, Gaseous Cargo, Dry Cargo), By Barge Fleet, By Application, By Barge Activities, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-456-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Barge Transportation Market Size & Trends

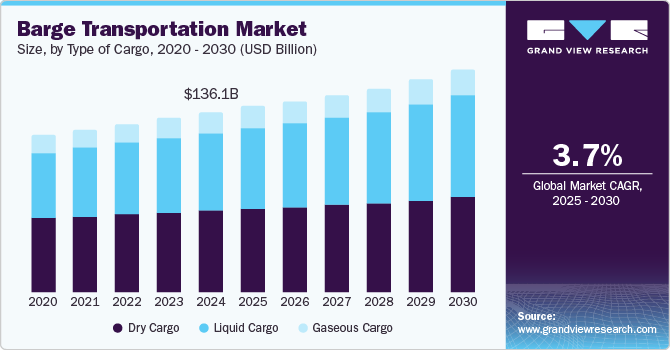

The global barge transportation market size was valued at USD 136.10 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2030. Some of the key growth drivers for this market include the cost-effectiveness of barge transport systems, increasing use of internal waterways for domestic trade in multiple countries, growing focus of companies on cost reductions, and rise in new investments for enhancement of inland water infrastructures.

Immense pressure experienced by road freight transportation systems, changing demand of the transportation industry stimulated by the e-commerce market and rising penetration of online shopping, increasing demand for effective domestic barge transportation services by multiple businesses, unceasing growth in road traffic congestions, especially new prime cities in various countries, and unavailability of efficient storage spaces closer to the national highways in multiple regions are directly influencing the demand for barge transportation market.

The flat deck of barges facilitates direct on-deck load skidding while eliminating the requirement of project-specific skid tracks. Barges with electric ballast systems offer higher-level convenience and ensure seamless loading operations. In addition, using hybrid barges to transport energy supply solutions, goods, and other materials facilitates the decarbonization initiatives of multiple businesses. Easier energy transitions allowed by barges are expected to significantly increase demand for barge transport.

For instance, in August 2024, Cepsa, one of the key companies in the marine fuel supply industry in Spain, successfully delivered second-generation biofuels to Atlas Leader, a vessel operated by Japanese shipping company Nippon Yusen Kabushiki Kaisha (NYK Line) in the Bay of Algeciras. To minimize the carbon impact of its energy delivery operations, Cepsa used the Bahía Levante. This hybrid barge uses 100% renewable diesel (HVO) for sailing and delivering battery power when docked.

Type of Cargo Insights

Based on the type of cargo, the dry cargo segment dominated the barge transportation market with a revenue share of 45.6% in 2024. Businesses prefer shipping dry cargo through barge transports for multiple benefits, including energy efficiency, environmental benefits, cost savings, reliability, less vulnerability to inclement weather, flexibility, safety, and more. Furthermore, government encouragement for inland dry cargo shipping to ensure reduced environmental impacts is adding to the growth opportunities for this market. For instance, the Government of India launched the Sagarmala Programme with ambitious transformation goals of shifting a substantial share of road and rail transport of bulk cargo such as coal, cement, iron ore, fertilizer, and food grains to inland water transport, reducing logistic coast, improve port efficiency, and more.

The liquid cargo transport segment is expected to experience the fastest CAGR of from 2025 to 2030. Increasing trade of petrochemicals, growing demand for liquid fertilizers such as anhydrous ammonia, continuous transport of jet fuels, and other liquid cargo items such as oils are contributing to the growing demand for this market. Barge transport is highly preferred for liquid cargo as it offers enhanced safety and security compared to rail or road transport.

Barge Fleet Insights

The tank barge segment held the largest revenue share of the global barge transportation market in 2024. Demand for this segment is driven by the trade of bulk liquids. Tank barges are designed to transport liquid cargo safely and efficiently. Businesses often prefer tank barges equipped with double hulls, firefighting equipment, and emergency shutdown systems for their safety and quick response capabilities.

The covered barges segment is expected to experience significant CAGR during the forecast period owing to their increasing use for transporting liquid cargo, construction materials, and more. They are also extensively utilized for transporting agricultural products, steel products, paper products, minerals, packaged goods, and other products. These barges are usually preferred for the transportation of sensitive cargo shipments.

Application Insights

The crude & petroleum products segment dominated the global industry in 2024. Growing demand for crude and petroleum products and the availability of these products in particular regions and countries has driven the growth of this segment. The transport of crude and petroleum products is highly sensitive due to its chemical properties and potential challenges associated with spillage and water contamination. Barges are preferred for transporting crude petroleum owing to several factors such as cost saving, less environmental impacts, flexibility, easier off-loading compared to tankers, and higher payload capacities.

The liquid chemicals segment is expected to experience the fastest CAGR from 2025 to 2030. Significant demand from industries such as paints and coating, materials, polymers, waste processing, pharmaceuticals, and others generates logistics and transportation requirements. Product innovation and shift in consumer preferences also drive the use of liquid chemicals. The use of a barge is highly preferred for transporting such liquids owing to the safety and seamless transportation offered by barges, large payload capacities, easier loading, cost-effectiveness, sustainable operations, and more.

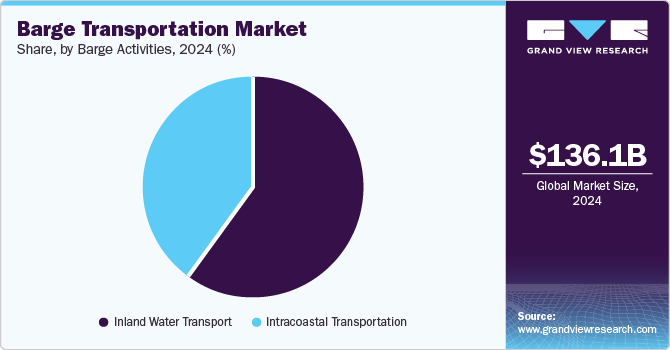

Barge Activities Insights

The inland water transport segment held the largest revenue share of the global market in 2024. Inland water transport includes transporting goods through rivers, canals, lakes, and other places. These waterways are unlike the sea, surrounded by different terrains, cities, ports of various capacities, and lesser depth if compared with the sea. The barge is considered one of the safest alternatives for inland water transport. Encouragement from government agencies and organizations to shift rail or road transportation activities to inland water transport, cost-effectiveness offered by inland water transport through barges, and reduced environmental impact with decreased carbon emissions are some of the growth-driving aspects for this segment.

The intracoastal transportation segment is anticipated to experience the fastest CAGR during the forecast period. The businesses utilize Intracoastal barge transport for the high-functioning and reliable supply chain operations at comparatively lower costs. This mode of transport is increasingly preferred for reduced demurrage fees, shorter transit time, and enhanced infrastructural support offered by multiple local authorities for Intracoastal transport.

Regional Insights

North America barge transportation market is expected to experience the fastest CAGR from 2025 to 2030 owing to factors such as the presence of large-scale domestic trade activities, inland cargo transportation by multiple shipping companies, growing focus of businesses and transportation service providers on reduction of carbon emissions, reduced environmental impacts associated with barge transport, and presence of enhanced infrastructure that facilitates the inland water transportations.

U.S. Barge Transportation Market Trends

The U.S. barge transportation market dominated the regional industry in 2024 owing to large import-export activities associated with businesses in the country, increasing focus on reducing the environmental impact of trade and freight transport, enhanced safety offered by the barge transport, increasing demand for the effective water transport solutions, availability numerous services providers, presence of superior inland waterway infrastructure and more.

Europe Barge Transportation Market Trends

Europe barge transportation market dominated the global industry in 2024, with a revenue share of 34.1%. The traditional roots and history associated with water transport systems in Europe, the presence of multiple shipping businesses, continuous demand for effective water transport solutions, growing government focus on reducing carbon emissions, and the cost-effectiveness offered by barge transport has driven the growth of this market in 2024.

The Netherlands barge transportation market held the largest revenue share of the regional industry in 2024 owing to multiple aspects, such as a large network of inland waterways spanning nearly 6,000 kilometers, various safety rules and regulations, Rhine river passage, and more. According to The Human Environment and Transport Inspectorate (ILT), a Ministry of Infrastructure and Water Management supervisory authority, nine thousand vessels are in the inland shipping fleet operating within the country.

Asia Pacific Barge Transportation Market Trends

Asia Pacific barge transportation market held substantial revenue share of the global industry in 2024. This market is primarily influenced by the government’s emphasis on enhancing inland water transport infrastructure and operations, growing demand for energy efficient transportation services, increasing awareness regarding the reduced carbon footprint offered by the barge transport and others.

China barge transportation market held largest revenue share of the regional industry in 2024. Long ranging rivers such as Yangtze, Yellow, Lancang and others, presence of multiple inland navigable waterways, lasting emphasis of government on establishment and enhancement of waterways, and shortages of road transportation for extremely heavy cargo are some of key growth drivers for this market.

Key Barge Transportation Company Insights

Some of the key players operating in the barge transportation market are Campbell Transportation Company, Inc, A.P. Moller - Maersk, Alter Logistics Company, Kirby Corporation, and others. To address growing competition, major market participants are adopting strategies such as innovation, service differentiations, new barge developments, enhanced support and more.

-

Alter Logistics Company, one of the prominent companies in the transloading and warehousing solutions industry, offers a range of services, including transloading intermodal services, railcar transloading services, barge loading and unloading services, laydown yard and area storage services, heavy life project cargo, fertilizer warehouse facilities, and more.

-

Campbell Transportation Company, Inc. is a major market participant in marine transportation services through inland waterways in the U.S. The company has operating facilities along the Gulf Coast and Ohio River. Its service portfolio comprises dry cargo transportation, liquid cargo transportation, towing, harbor, shipyard repair, tank barge, and others.

Key Barge Transportation Companies:

The following are the leading companies in the barge transportation market. These companies collectively hold the largest market share and dictate industry trends.

- Campbell Transportation Company, Inc

- Alter Logistics Company

- American Commercial Barge Line

- Kirby Corporation

- ATS

- SEACOR Marine

- McAllister Towing and Transportation Co., Inc.

- A.P. Moller - Maersk

- Rooskens Group

- Future Proof Shipping

Recent Developments

-

In February 2024, Future Proof Shipping introduced H2 Barge 2, a vessel powered by hydrogen power designed to operate without carbon emissions through the Rhine River between Duisburg (DE) and Rotterdam (NL). The launch and development were powered by the Flagships project (EU-funded) and the Interreg-funded ZEM Ports NS project.

Barge Transport Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 140.60 billion

Revenue forecast in 2030

USD 168.49 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type of cargo, barge fleet, application, barge activities, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Netherlands; China; Japan; India; South Korea; Australia; Brazil; UAE; KSA; Brazil

Key companies profiled

Campbell Transportation Company, Inc; Alter Logistics Company; American Commercial Barge Line; Kirby Corporation; ATS; SEACOR Marine; McAllister Towing and Transportation Co., Inc.; A.P. Moller - Maersk; Rooskens Group; Future Proof Shipping

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barge Transportation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global barge transportation market report based on type of cargo, barge fleet, application, barge activities, and region:

-

Type of Cargo Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Cargo

-

Gaseous Cargo

-

Dry Cargo

-

-

Barge Fleet Outlook (Revenue, USD Million, 2018 - 2030)

-

Covered Barge

-

Opened Barge

-

Tank Barge

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Coal

-

Crude & Petroleum Products

-

Liquid Chemicals

-

Food Pulp & Other Liquid

-

Agricultural Products

-

Metal Ores and Fabricated Metal Products

-

Pharmaceuticals

-

Dry & Gaseous Chemicals

-

LPG, CNG, and Other Gaseous Products

-

Electronics & Digital Equipment

-

Others

-

-

Barge Activities Outlook (Revenue, USD Million, 2018 - 2030)

-

Intracoastal Transportation

-

Inland Water Transport

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.