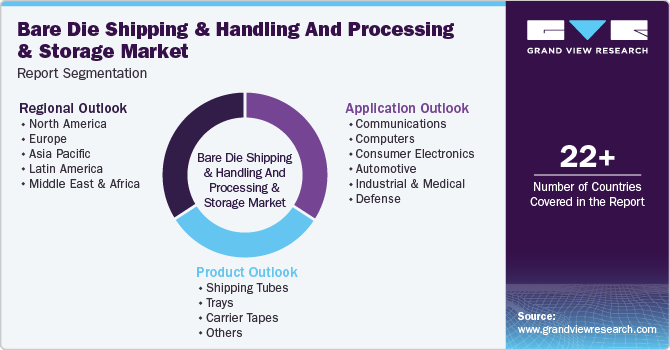

Bare Die Shipping & Handling and Processing & Storage Market Size, Share & Trends Analysis Report By Product (Shipping Tubes, Trays, Carrier Tapes, Others), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-674-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

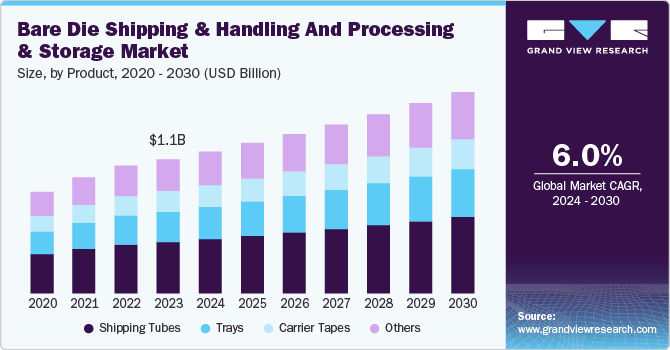

The global bare die shipping & handling and processing & storage market size was valued at USD 1.07 billion in 2023 and is projected to grow at a CAGR of 6.0% from 2024 to 2030. The primary growth factor for this market is the increasing demand for interconnected circuits (ICs) across industries such as consumer electronics, automotive, and healthcare, coupled with the growing adoption of advanced technologies such as the Internet of Things (IoT) and others. The increasing complexity of semiconductor devices leads to the need for specialized handling and processing techniques.

The trend towards miniaturization and higher functionality in electronic devices further increased the demand for bare dies, which allows manufacturers to create custom solutions tailored to specific needs. Moreover, the growing automotive industry, particularly the shift towards electric vehicles (EV) and autonomous driving systems, has resulted in semiconductor components that come in bare die form, necessitating the need for reliable shipping and handling processes, driving the market growth.

The growing use of materials manufacturers, such as polytetrafluoroethylene (PTFE) and high-density polyethylene (HDPE), has increased reliance on carrier products. This has led to the rising use of shipping carrier tapes, trays, and tubes. The increased complexity associated with the electronics industry and the use of miniature elements with enhanced capacities and powerful characteristics have contributed to its growth.

An unceasing growth in demand for semiconductors from the automotive industry is expected to influence the development of this market in the next few years. The growing inclination of manufacturers to include advanced technology tools in their offerings and the rising demand for smart technologies such as advanced driver assistance systems (ADSD) has developed an unprecedented upsurge in the use of semiconductors in the automotive industry. This has resulted in the increasing demand for bare dies.

Increasing research and development activities supported by governments and other organizations also play a vital role in the growth of this market. For instance, after the introduction of the CHIPS and Science Act by the U.S. government in 2022 to ensure manufacturing incentives and necessary investments while aiming at solidifying the nation’s economy, national security capabilities, and supply chains, key companies worldwide have responded with announcements of semiconductor ecosystem development projects that mark private investments of nearly USD 200 billion.

Product Insights

Based on products, the shipping tubes accounted for the largest revenue share of 38.2% in 2023. The growth of this segment is attributed to its effectiveness in ensuring the safe and reliable transportation of bare dies. Shipping tubes offer a secure and protective environment for bare die, preventing damage from mechanical stress, contamination, electrostatic discharge and other potential threat during transport. Shipping tubes are designed to accommodate a wide range of die sizes and shapes, making it a versatile solution for various applications. These tubes are relatively cost-effective and easy to use. These aspects have been driving growth for this segment in recent years.

The trays segment is anticipated to witness the fastest CAGR during the forecast period. One of the key growth driver for this segment enhanced safety and security coupled with cost-effectiveness. An increasing demand for semiconductor devices has resulted in growing need of efficient and safe handling of bare dies during shipping, processing, and storage. Trays provide a secure and organized way to transport and store bare dies while reducing damage and contamination risks. In addition, the growing adoption of IoT devices, artificial intelligence, and 5G technology is driving the demand for smaller, more complex semiconductor devices, which require specialized trays for handling and processing. Furthermore, the need for precise alignment and orientation of bare dies during processing drives the demand for advanced tray designs and materials.

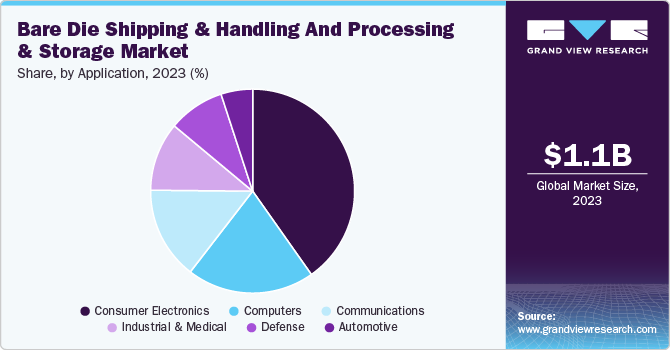

Application Insights

Based on applications, the consumer electronics segment dominated the global market for bare die shipping & handling and processing & storage in 2023. The growth of this segment is primarily influenced by the high demand for semiconductor devices in various consumer electronic products such as smartphones, laptops, tablets, and smart home devices. These devices require complex structures and the use of processors, memory chips, and sensors, which necessitate precise handling and processing of bare dies. The growing adoption of Internet of Things (IoT) devices has further increased consumer electronics as multiple devices used by consumers in routine lives are interconnected through networks and systems. In addition, consumer electronics manufacturers are increasingly adopting just-in-time inventory practices to reduce costs and improve efficiency. This trend necessitates effective shipping and handling solutions for bare dies to ensure timely delivery without compromising quality.

The defense segment is expected to experience the fastest CAGR over the forecast period. The increasing demand for advanced semiconductor technologies in defense applications has driven innovation and investment in this sector. Modern military systems and equipment increasingly rely on sophisticated electronics, necessitating high-performance chips that can be efficiently shipped and processed as bare dies. Geopolitical tensions and national security concerns have been prompting multiple governments to invest heavily in defense capability enhancements, leading to a surge in the procurement of advanced electronic components.

Regional Insights

North America held a significant revenue share of the global bare die shipping & handling and processing & storage market in 2023. Presence of multiple semiconductor manufacturers and robust industrial growth experienced by the multiple sectors such as defence, automotive, consumer electronics, medical equipment and others have been driving the demand for semiconductors characterized with advanced capabilities. The U.S. in particular, home to multiple technology enterprise that operate on global scale and play prominent role in technology and innovation industry. These companies have been influencing the demand for advanced bare die shipping, handling, processing, and storage solutions. The region's thriving consumer electronics market, driven by unceasing demand and presence key market participants such as Apple, fuels the demand for semiconductor devices. These aspects are expected to generate an upsurge in demand for the regional industry of bare die shipping & handling and processing & storage.

U.S. Bare Die Shipping & Handling and Processing & Storage Market Trends

The U.S. bare die shipping & handling and processing & storage market dominated the regional industry in 2023. The growth of this market is primarily driven by its robust semiconductor industry, which is characterized by a high concentration of integrated circuits (ICs) manufacturers and advanced technological capabilities. The significant investments in research and development by government and multiple organizations, coupled with a strong demand for innovative electronic devices across various sectors such as consumer electronics, automotive, defence and telecommunications, drive the need for efficient bare-die logistics solutions.

Asia Pacific Bare Die Shipping & Handling and Processing & Storage Market Trends

Asia Pacific bare die shipping & handling and processing & storage market dominated the global industry and accounted for the revenue share of 36.0% in 2023. The rapid growth of semiconductor manufacturing in areas such as China, South Korea, and Japan has significantly increased the demand for bare die and essential components in various electronic devices. The growing consumer electronics market in Asia Pacific drives demand for bare die solutions as manufacturers seek to optimize performance while minimizing device size and weight. Growth of this regional industry is also driven by the increasing automotive applications, particularly in EV and ADAS, and technological advancements such technology industry as emergence of 5G and increased adoption of technologies such as Artificial Intelligence (AI), IoT (Internet of Things), machine learning and others.

China bare die shipping & handling and processing & storage market held for largest revenue in 2023. The growth of this market is mainly influenced by the increasing demand for advanced packaging & shipping solutions and technological advancements such as connected cars, cloud computing, Internet of Things, and others. The robust electronic and automobile industry in the country is the leading factor driving the demand for semiconductors.

Latin America Bare Die Shipping & Handling and Processing & Storage Market Trends

Latin America bare die shipping & handling and processing & storage market is anticipated to experience a significant CAGR over the forecast period. The region's growth is primarily driven by the increasing demand for advanced semiconductor technologies across various sectors, including consumer electronics, automotive, and telecommunications. As industries evolve and the complexity of electronic devices increases significantly, the need for efficient and reliable logistics solutions for bare dies has become vital for multiple businesses. Moreover, technological advancements in shipping and handling processes enhance operational efficiency and safety, further propelling market growth. Furthermore, rising disposable incomes and infrastructure investments contribute to the expansion of this market, creating a favorable environment for manufacturing and distribution activities in the region.

Brazil bare die shipping & handling and processing & storage market held a noteworthy revenue share of the regional industry in 2023. Growth of this industry is driven by the growing presence of multiple manufacturing companies from industries such as consumer electronics, automotive, and aerospace industries in the region, which has created a favorable environment for expanding these industries, driving the demand for efficient bare-die management solutions. Furthermore, Brazil's strategic location and well-developed logistics infrastructure have made it an attractive destination for global semiconductor manufacturers, further contributing to its market growth.

Key Bare Die Shipping & Handling and Processing & Storage Company Insights

Some key companies involved in the bare die shipping & handling and processing & storage market include Entegris, Achilles USA Inc., 3M, Thomas H. Lee Partners, L.P. (Brooks Automation, Inc.), Dalau Ltd and others. To address the growing demand and increasing competition, the key market participants have adopted strategies such as enhanced research and development, growing investments in R&D, innovation, new product development and collaborations with other organizations.

-

Entegris, Inc., a global supplier of advanced materials and process solutions, primarily serving the semiconductor and high-tech industries, specializes in various products and services to control micro contamination and improve manufacturing excellence. Key offerings include filtration products, liquid systems, specialty chemicals, wafer handling solutions, and others.

-

Achilles USA Inc., one of the subsidiaries of Achilles Corporation, offers Wafer handling products equipped with abilities to transfer/transport wafers through innovation. Company’s offerings include Horizontal Wafer Shipper (HWS), Film Frame Shipper (FFS), Single Wafer Shipper, Interleaf Inner Foam, Conductive Tape for Semiconductor Process, Transport Bags and others.

Key Bare Die Shipping & Handling and Processing & Storage Companies:

The following are the leading companies in the bare die shipping & handling and processing & storage market. These companies collectively hold the largest market share and dictate industry trends.

- Entegris

- 3M

- ITW-ECPS

- Dalau Ltd

- Thomas H. Lee Partners, L.P. (Brooks Automation, Inc.)

- TT ENGINEERING & MANUFACTURING SDN BHD

- Daitron Incorporated

- Achilles USA Inc.

- Kostat, Inc.

Recent Developments

-

In August 2024, Entegris entered into a long-term supply agreement with Onsemi, focusing on provision of a range of co-optimized chemical mechanical planarization (CMP) solutions specifically for silicon carbide (SIC). The partnership aims to leverage Entegris' advanced CMP technologies, which include slurries, pads, brushes, and others, to enhance the processes of SIC wafers.

-

In March 2024, 3M unveiled a new packaging material as vital alternative for the traditional polyethylene polyethylene. The newly launched Padded Automatable Curbside Recyclable (PACR) is developed with kraft paper that is durable and protective in nature. The offering also features exclusive 3M technology which can provide protection against shipping hazards such as bursts, drops, vibrations and others.

Bare Die Shipping & Handling and Processing & Storage Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.13 billion |

|

Revenue Forecast in 2030 |

USD 1.60 billion |

|

Growth rate |

CAGR of 6.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Entegris; 3M; ITW-ECPS; Dalau Ltd; Thomas H. Lee Partners, L.P. (Brooks Automation, Inc.); TT ENGINEERING & MANUFACTURING SDN BHD; Daitron Incorporated; Achilles USA Inc.; Kostat, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bare Die Shipping & Handling and Processing & Storage Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bare die shipping & handling and processing & storage market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shipping Tubes

-

Trays

-

Waffle packs

-

Metal trays

-

Gel packs

-

-

Carrier Tapes

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Communications

-

Computers

-

Consumer Electronics

-

Automotive

-

Industrial & Medical

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."