- Home

- »

- Electronic Devices

- »

-

Barcode Printers Market Size & Share, Industry Report, 2030GVR Report cover

![Barcode Printers Market Size, Share & Trends Report]()

Barcode Printers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Desktop, Mobile, Industrial), By Technology (Thermal Transfer, Direct Transfer, Laser, Impact, Inkjet), By End-user, By Region, And Segment Forecasts

- Report ID: 978-1-68038-220-4

- Number of Report Pages: 97

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Barcode Printers Market Summary

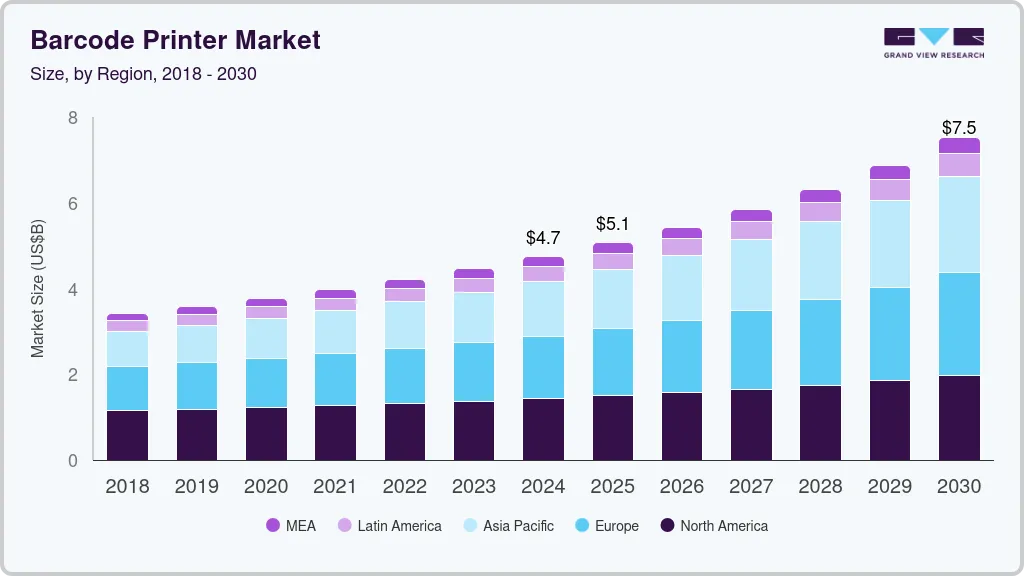

The global barcode printers market size was estimated at USD 4,743.62 million in 2024 and is projected to reach USD 7,521.7 million by 2030, growing at a CAGR of 8.2% from 2025 to 2030. The barcode printers market is projected to be driven by the rising demand for industrial printers across various industrial sectors.

Key Market Trends & Insights

- North America barcode printers led the overall market in 2024, with a market share of 30.1%.

- The Barcode Printers market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030.

- By product, the industrial printers segment dominated the overall market, gaining a market share of 66.2% in 2024.

- By technology, the thermal transfer technology segment is expected to dominate in 2024, gaining a market share of 38.3%.

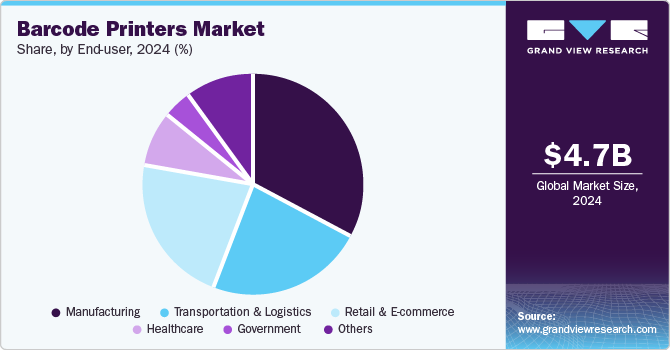

- By end-user, the manufacturing segment dominated the overall market, gaining a market share of 33.5% in 2024 and witnessing a CAGR of 6.2% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,743.62 Million

- 2030 Projected Market Size: USD 7,521.7 Million

- CAGR (2025-2030): 8.2%

- North America: Largest market in 2024

The growing adoption of barcode printers streamlining logistics operations is driving the growth of the market. While barcode printers provide an efficient way to monitor products during their movement along the supply chain, they are also helping in storing IoT numbers and serial numbers to handle the information while the product moves through different channels, thereby encouraging the adoption of barcode printers.Barcode printers are also called specialty printers, which print barcode tags, receipts, and labels to be directly printed on or attached to physical objects. They are generally used to label cartons and receipts; and label retail, medical, and food items with the European Article Numbers (EANs) or Universal Product Codes (UPCs) before shipment. Moreover, increased adoption of radio frequency identification (RFID), which extends numerous advantages over barcodes, is expected to hinder the growth of the industry.

Aggressive investments by the government to encourage the industry incumbents to adopt the latest technologies, including barcode technology, bode well for the growth of the market. Barcode technology is increasingly being used for robotics, which means the continued implementation of robots across various industries and industry verticals translates into a growing demand for barcode printers. For instance, as per the statistics provided by the International Federation of Robotics (FIR), almost 21,700 industrial robots have been deployed across the industrial sector in the UK.

Several manufacturing entities are adopting modern technologies to rake in various benefits, such as simplified workflows, reduced prices, and increased quality assurance, thereby driving the adoption of barcode printers across the globe. Market players are responding to the situation by introducing innovative solutions in line with the evolving demands from the incumbents of various end-use industries and industry verticals. Moreover, the growing demand for packaged food in countries, such as China and India, is particularly expected to fuel the demand for barcode printers over the forecast period.

For instance the packaged food business in India is projected to exceed USD 70 billion in next 5-10 years according to the statistics published by India Brand Equity Foundation, making it the world's one of the top processed food market which is further expected to increase the demand of barcode technology in developing economies such as India which is opportunistic for the market.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic took a severe toll on the global economy. However, it played a decisive role in driving the growth of the barcode printers market. While the launch and distribution of several products had to be deferred owing to the lockdowns and restrictions on the movement of people and goods forced owing to stop the spread of coronavirus, the installation of barcode systems gained noticeable traction in the manufacturing industry, where barcodes were installed to maintain social distancing without compromising the efficiency of the inventory management. Incumbents of the retail and e-commerce industries also adopted barcode printers aggressively to cater to the unabated growth of e-commerce sales in the wake of the lockdowns and restrictions on the movement of people.

Given the outbreak of the pandemic, several companies had to confront challenges, such as new safety requirements, unpredictable production volumes, and lower operational headcount. These companies went on to deploy barcodes to maintain the production of essential products and support the supply chain. As such, several manufacturers reevaluated their labeling functions to eliminate any human interference. Benefits, such as scalability, accuracy, automation, efficiency, and security, among others, associated with barcode technology encouraged these manufacturers to adopt barcode printers. Incumbents of the pharmaceutical & healthcare industry particularly adopted barcode printers following the outbreak of the COVID-19 pandemic to ensure that the efficiency of the production of certain medicines and drugs is not compromised.

Product Insights

In terms of product, the market is classified into desktop printers, mobile printers, and industrial printers. The industrial printers segment dominated the overall market, gaining a market share of 66.2% in 2024 and witnessing a CAGR of 8.4% during the forecast period. Industrial barcode printers are specialized computer printers used to print high-quality, long-lasting barcodes onto labels, tags, packages, and other items. They tend to be rugged and reliable as they are often deployed in demanding environments, such as warehouses, manufacturing plants, and retail stores. They are also easy to use as the printing process is usually automated to facilitate faster turnaround times. Apart from printing barcodes, they can also be used for tracking inventory, labeling products, and keeping track of customer data, among other applications.

The desktop printers segment is anticipated to witness the fastest growth, growing at a CAGR of 6.8% throughout the forecast period. Desktop barcode printers help businesses in printing labels, tags, and cards quickly, accurately, and efficiently. They can be an ideal tool for businesses that need to produce large volumes of barcoded items. Desktop barcode printers are available in a variety of sizes, styles, and colors; and businesses can choose the appropriate model for their needs. Apart from printing labels and tags, these printers can also print receipts, ID cards, invoices, and other documents. Moreover, these printers are compatible with a variety of software programs that can allow businesses to easily design, print, and manage their barcoded items.

Technology Insights

In terms of technology, the market is classified into thermal transfer, direct transfer, laser, impact, and inkjet. Among these, thermal transfer technology segment is expected to dominate in 2024, gaining a market share of 38.3%. It is expected to grow at the fastest CAGR of 8.2% throughout the forecast period. Thermal transfer is a process of printing that uses heat to transfer ink onto a substrate. The process involves using a thermal printhead to heat a thin layer of wax-based or resin-based ink on a transfer ribbon. A heat source, such as an infrared heating element, is used to heat the ribbon and melt the wax-based ink onto the label or substrate.

When the heated ink touches the paper, it melts and transfers the image onto the substrate. Thermal transfer is commonly used in barcode printers to create barcodes on labels, tags, tickets, and other products in an efficient and cost-effective manner requiring minimal maintenance. It is a relatively fast process and can produce clear, high-quality barcodes resistant to abrasion, chemicals, water, and fading.

The direct transfer technology segment is anticipated to grow at a considerable CAGR of 9.4% throughout the forecast period. Direct transfer technology isused to print barcodes onto labels and other surfaces quickly and reliably using direct transfer technology. Direct transfer printers use a thermal transfer process to print barcodes. The printer applies heat to the label or surface, which causes a wax or resin-based ribbon to melt and transfer the barcode onto the surface. This method of printing is very reliable and produces high-quality barcodes with a long lifespan.

Direct transfer printers are ideal for businesses that require fast, accurate barcode printing as they can quickly produce barcodes in large numbers. They are also very versatile, as they can be used to print on a variety of surfaces, including plastic, paper, and metal. Direct transfer barcode printers are often used in retail and warehouse settings owing to their ability to print barcodes onto products and labels quickly and accurately.

End-user Insights

In terms of end user, the market is classified into healthcare, manufacturing, retail & e-commerce, transportation & logistics, government, and others. The manufacturing segment dominated the overall market, gaining a market share of 33.5% in 2024 and witnessing a CAGR of 6.2% during the forecast period. The strong emphasis on industrial automation being pursued by several manufacturers worldwide to streamline manufacturing operations and make those more efficient as part of their efforts to enhance output while reducing wastage is driving the adoption of barcode printers in the manufacturing process.

Each product/part in the assembly line is allocated a specific barcode, which is recorded at every step of the manufacturing process to track the progress of the product/part in real time. Barcode printers have a potent role to play in printing the barcodes on the product/part. For instance, several automotive manufacturers use a QR code, a form of a barcode, which can be read easily by cameraphones or dedicated QR barcode readers.

The retail and e-commerce segment is projected to witness highest growth, growing at a CAGR of 10.5% throughout the forecast period. The use of barcodes allows retailers to track their inventories; compare sales of similar products; track product attributes, such as size and color; automate product re-ordering; identify the buying preferences of customers; and customize targeted promotions based on the buying habits of customers. Increasing demand of direct thermal technology which produces barcodes using heat on a heat-sensitive substrate which mainly serves the retail industry is fuelling the growth of the market.

Regional Insights

North America barcode printers led the overall market in 2024, with a market share of 30.1%. North America region have well-developed infrastructure and spends large amount on extensive research and development base, which makes the region to be the top revenue contributor in the barcode printers market during the projected period. The unabated growth of the retail and e-commerce industries in line with the growing preference for online shopping in the U.S. and Canada is also expected to drive the demand for barcode printers across North America as industry incumbents put a strong emphasis on automating various functions to enhance operational efficiency.

According to the U.S. Census Bureau’s 2021, the e-commerce industry is expanding at significant rate. According to which the retail sales for U.S. has increased 17.1% resulting into USD 6,522.6 billion in 2021.The substantial presence of SMEs in North America region, which offer components and services to the giants such as Zebra Technologies Corp., Honeywell International Inc, and SATO Holdings Corporation, has also propelled the market growth.

U.S. Barcode Printers Market Trends

The Barcode Printers market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030, driven by the widespread adoption of digital technologies in industries such as retail, logistics, and healthcare. The U.S. e-commerce sector's rapid growth necessitates efficient inventory management and tracking systems, boosting the demand for barcode printers. Furthermore, advancements in barcode printing technology, such as the integration of IoT and RFID, are enhancing operational efficiency and precision. Government regulations requiring accurate product labeling and the increasing focus on traceability in supply chain operations are additional growth drivers. Industries such as automotive and pharmaceuticals are also contributing significantly due to the need for robust labeling solutions. As enterprises continue to prioritize automation and cost optimization, barcode printers are becoming indispensable tools in the U.S. market, with a clear trend toward advanced, cloud-enabled, and portable devices.

Asia Pacific Barcode Printers Market Trends

Asia Pacific barcode printers market is poised for the fastest growth as several manufacturing entities in the region are adopting modern printing technologies to rake in various benefits, such as simplified workflows, reduced prices, and increased quality assurance, thereby driving the adoption of barcode printers across Asia Pacific. Market players are responding to the situation by introducing innovative solutions in line with the evolving demands from the incumbents of various end-use industries and industry verticals.

The growing demand for packaged food in countries, such as China and India, is particularly expected to fuel the demand for barcode printers over the forecast period. For instance, the packaged food business in India is projected to exceed USD 70 billion in next 5-10 years according to the statistics published by India Brand Equity Foundation, making it the world's one of the top processed food market which is further expected to increase the demand of barcode printers in developing economies such as India which is opportunistic for the market.

The Barcode Printers market in India is expected to grow at a significant CAGR from 2025 to 2030, fueled by the rapid digitization of industries and the expansion of organized retail and logistics sectors. The Indian government's focus on boosting manufacturing through initiatives like "Make in India" and "Digital India" is spurring the demand for efficient inventory and supply chain management tools. In addition, the country's booming e-commerce industry is driving the adoption of barcode printers for tracking, sorting, and inventory management. SMEs are increasingly embracing barcode printing technologies as they modernize their operations. Furthermore, sectors such as healthcare and pharmaceuticals are leveraging barcode solutions for regulatory compliance and enhanced traceability. The affordability of barcode printers and the introduction of technologically advanced, user-friendly devices are making them accessible to a broader range of businesses, positioning India as a high-growth market in the coming years.

The Barcode Printers market in Japan is expected to grow at a significant CAGR from 2025 to 2030, supported by the country’s advanced manufacturing sector and technological innovation. Japan’s automotive and electronics industries are leading adopters of barcode printing technologies, which are integral to streamlining production and supply chain processes. The integration of barcode systems with robotics, IoT, and AI-driven platforms is further boosting demand. In addition, Japan’s aging population is driving growth in the healthcare and pharmaceutical sectors, where accurate and efficient labeling is critical. Strict quality control standards and a focus on operational efficiency are key drivers of market expansion. As businesses aim to enhance automation and adopt sustainable practices, investments in eco-friendly and energy-efficient barcode printing technologies are on the rise. The emphasis on durability, precision, and seamless integration with existing systems makes Japan a hub for innovation in the barcode printer market.

Europe Barcode Printers Market Trends

The Barcode Printers market in Europe is expected to grow at a significant CAGR from 2025 to 2030, driven by advancements in supply chain management and the growing need for traceability in industries such as food and beverage, automotive, and pharmaceuticals. Increasing regulatory requirements for product labeling and serialization are propelling the adoption of barcode printers across the region. The rise of e-commerce and omni-channel retailing is further fueling demand for efficient inventory tracking and management solutions. Europe’s focus on sustainability is leading to the development of eco-friendly printing technologies, including recyclable label materials and energy-efficient devices. Countries such as Germany, France, and Italy are witnessing significant adoption of barcode systems in manufacturing and logistics. In addition, the shift towards automation and smart warehouses is accelerating the demand for portable and high-performance barcode printers, positioning Europe as a key market for innovation and growth.

The Barcode Printers market in the UK is expected to grow at a significant CAGR from 2025 to 2030, driven by the rapid expansion of e-commerce and the increasing adoption of digital solutions in retail and logistics. The growing demand for accurate labeling and tracking systems across supply chains is a major factor driving market growth. Regulatory requirements in sectors such as healthcare and food & beverage are also encouraging businesses to invest in advanced barcode printing solutions. The UK’s focus on automation and sustainability is fostering the adoption of innovative, energy-efficient, and environmentally friendly barcode printers. In addition, the rise of small and medium-sized enterprises (SMEs) embracing digital transformation is contributing to market growth. The introduction of portable and cloud-enabled barcode printers is further enhancing their utility across industries, making the UK a dynamic market with strong growth potential in the coming years.

Key Barcode Printers Company Insights

The market is consolidated and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on research and development activities to integrate advanced technologies in industrial barcode printers used by several industries, such as manufacturing, has led to intensified competition among market players. Some prominent players in the market include Zebra Technologies Corp, Toshiba Tec Corporation, Honeywell International Inc., Canon, Inc., SATO Holdings Corporation, Dascom, and Oki Electric Industry Co., Ltd., among others. These companies are also collaborating with local & regional players to gain a competitive edge over their peers and capture a significant market share.

Several key market players are progressively undergoing mergers and acquisitions along with the new industry entrants so as to capture the escalating market potential and extend their geographic presence. For instance, in January 2023, AVERY DENNISON CORPORATION signed an agreement to acquire Thermopatch, under which it will expand its Apparel Solutions division including Retail Branding and Information Solutions (RBIS). In addition, leverage Thermopatch's know-how and services to drive growth in external embellishments.

Some of the key companies operating in the barcode printer market include Canon Inc., Honeywell International Inc., and Zebra Technologies Corp, among others.

-

Canon Inc.’s competitive edge in the barcode printer market lies in its expertise in imaging and printing technologies, offering highly reliable and innovative solutions tailored to diverse industries. Leveraging decades of experience in precision engineering, Canon develops barcode printers with superior print quality, speed, and durability, meeting the high standards of manufacturing, retail, and healthcare sectors. Canon's integration of advanced software capabilities, such as easy customization and compatibility with enterprise systems, enhances its appeal to businesses seeking seamless operations. Furthermore, the company’s focus on sustainability, through energy-efficient designs and eco-friendly consumables, aligns with growing market demand for green technologies. Canon’s strong global presence and robust after-sales support further solidify its position as a trusted brand in the barcode printer market.

-

Honeywell International Inc. stands out in the barcode printer market due to its comprehensive approach to industrial automation and logistics optimization. Honeywell’s printers are renowned for their rugged design, high performance, and advanced connectivity features, making them ideal for demanding environments such as warehouses, manufacturing plants, and retail. The company integrates its barcode printers with cutting-edge technologies, including IoT and cloud-based solutions, offering businesses end-to-end tracking and asset management capabilities. Honeywell’s focus on user-friendly designs and intuitive interfaces enhances operational efficiency, while its emphasis on cybersecurity ensures data integrity. With a strong emphasis on innovation and a wide range of products catering to different price points, Honeywell maintains a significant competitive edge in the barcode printer market.

-

Zebra Technologies Corp. is a leader in the barcode printer market, distinguished by its extensive portfolio of solutions that cater to a variety of industries, including healthcare, retail, and logistics. Zebra’s printers are renowned for their durability, high print speeds, and advanced functionality, including RFID-enabled printing and real-time analytics integration. The company’s proprietary software and tools, such as ZebraDesigner and Link-OS, provide seamless customization and connectivity, offering customers greater control over their operations. Zebra’s commitment to innovation is evident in its push for smart solutions, including cloud-based monitoring and predictive maintenance capabilities. In addition, the company’s global service network and focus on customer-centric solutions have established it as a trusted partner for businesses worldwide, ensuring a lasting competitive edge.

Dascom and Printronix are some of the emerging companies in the target market.

-

Dascom’s strength in the barcode printer market stems from its focus on delivering cost-effective and highly reliable printing solutions tailored to specific industry needs. Known for its expertise in business printing systems, Dascom has successfully leveraged its technological capabilities to create compact, durable, and high-performance barcode printers. The company’s emphasis on customization and adaptability allows it to cater to diverse sectors, including logistics, retail, and manufacturing. Dascom’s strategic focus on expanding its global footprint and building strong distribution networks enhances its market presence. In addition, the company’s commitment to innovation, backed by competitive pricing and robust customer support, positions it as a strong contender against more established players in the barcode printer market.

-

Printronix’s position in the barcode printer market is built on its specialization in industrial printing solutions and its reputation for delivering durable and scalable barcode printers. The company focuses on providing solutions that address critical needs such as high-volume printing, advanced connectivity, and compatibility with enterprise systems. Printronix’s strength lies in its innovative thermal printing technology and unique offerings such as RFID-enabled barcode printers, which cater to industries requiring advanced traceability and data accuracy. By emphasizing sustainability through energy-efficient designs and environmentally friendly consumables, Printronix appeals to modern businesses seeking green solutions. The company’s agility in responding to market demands, coupled with strong after-sales service, positions it as a rapidly growing competitor in the global barcode printer market.

Key Barcode Printers Companies:

The following are the leading companies in the barcode printers market. These companies collectively hold the largest market share and dictate industry trends.

- AVERY DENNISON CORPORATION

- Canon Inc.

- Dascom

- Honeywell International Inc.

- Oki Electric Industry Co., Ltd.

- Printronix

- SATO Holdings Corporation.

- Zebra Technologies Corp

- Toshiba Tec Corporation

Recent Developments

-

In September 2024, DNP launched two new thermal transfer ink ribbons globally. The R380 offers improved alcohol resistance for barcode and 2D code printing on tags and labels. The V670 excels in printing on both plastic and paper food packaging, ideal for date and production number printing.

-

In April 2023, Barcodes, Inc. partnered with SVT Robotics to accelerate the deployment of its new AMR portfolio in warehouses and manufacturing facilities. This partnership aims to simplify and speed up the integration of automation and robotics solutions, providing faster ROI and easing labor strain. SVT Robotics' low-code platform enables rapid integration of various robots and automation devices.

Barcode Printers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.06 billion

Revenue forecast in 2030

USD 7,521.7 million

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end user, region

Regional scope

North America; Europe; Asia Pacific; South America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; UAE; KSA; South Africa

Key companies profiled

AVERY DENNISON CORPORATION; Canon Inc.; Dascom; Honeywell International Inc.; Oki Electric Industry Co., Ltd.; Printronix; SATO Holdings Corporation.; Zebra Technologies Corp; Toshiba Tec Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barcode Printers Market Segmentation

This report estimates market shares and CAGR at global, regional, as well as at country levels and offers an analysis on the market trends in each of the segment and sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global barcode printers market based on product, technology, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Desktop Printers

-

Mobile Printers

-

Industrial Printers

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Thermal transfer

-

Direct Transfer

-

Laser

-

Impact

-

Inkjet

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Manufacturing

-

Retail & E-commerce

-

Transportation & Logistics

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global barcode printesr market size was estimated at USD 4,743.6 million in 2024 and is expected to reach USD 5,064.0 million in 2025.

b. The global barcode printers market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 7,521.7 million by 2030.

b. North America dominated the barcode printers market with a share of 30.1% in 2024. This is attributable to growing automation in warehouse management in the region.

b. Some key players operating in the barcode printer market include AVERY DENNISON CORPORATION, Canon Inc., Dascom, Honeywell International Inc., Oki Electric Industry Co., Ltd., Printronix, SATO Holdings Corporation., Zebra Technologies Corp, Toshiba Tec Corporation.

b. Key factors that are driving the market growth include growing automation in manufacturing and warehouse management, increasing e-commerce companies, and use of barcode labeling in the consumer and healthcare sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.