- Home

- »

- Electronic & Electrical

- »

-

Barbeque Grill Market Size, Share & Trends Report, 2030GVR Report cover

![Barbeque Grill Market Size, Share & Trends Report]()

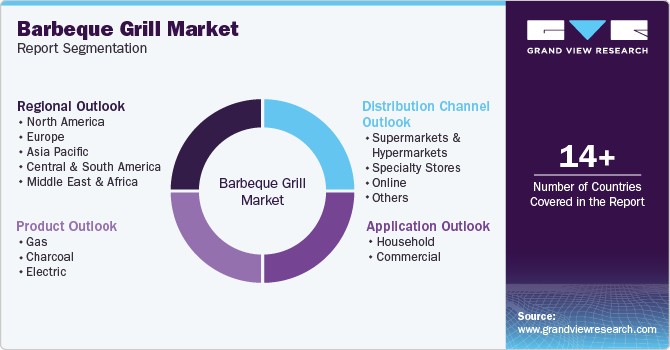

Barbeque Grill Market Size, Share & Trends Analysis Report By Product (Gas, Charcoal, Electric), By Application (Household, Commercial), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-256-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Barbeque Grill Market Size & Trends

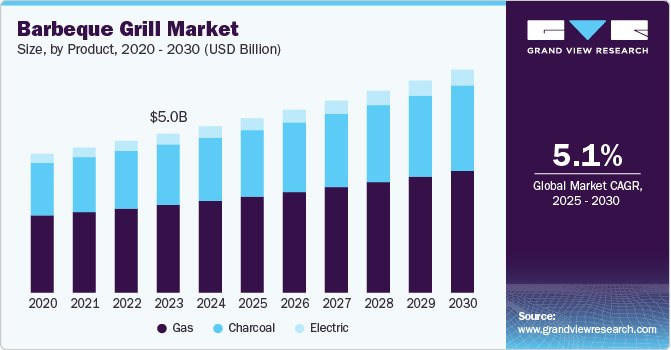

The global barbeque grill market size was valued at USD 5.28 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2030. Shifting lifestyle patterns and changing eating habits among younger consumers, coupled with the rising popularity of outdoor events and social gatherings, have spurred increased demand for slow-cooked barbecue items like brisket, pork shoulder, and ribs. This trend is expected to fuel the industry's growth in the coming years. Unlike many other product categories, the BBQ grill market remained relatively resilient during the pandemic. With restaurants closed or difficult to access due to lockdowns, more individuals turned to home cooking. Research from the Hearth, Patio & Barbecue Association (HPBA), published in November 2021, revealed that 38% of grill owners bought a new grill in the past two years. Of those who made purchases in 2020, 27% cited increased home cooking during the pandemic as their reason for upgrading.

With changing consumer preferences and tastes, restaurants are trying to bring innovative and new dishes to the plates. Earlier, most of the restaurants used to only provide barbeque chicken, seafood, and vegetables; however, nowadays, restaurants have started providing barbeque beetroot and sweet potato as well as those items that were previously only consumed boiled.

The number of quick-service restaurants and eateries continues to grow on account of changing consumer eating habits. Moreover, the number of barbeque restaurants and their popularity continues to increase significantly. Owing to their hectic working schedule, most young consumers prefer eating at outside eateries and restaurants. Consumers, especially the young generation, like to taste and experiment with new and unique food dishes. Most barbeque restaurants are increasingly offering live cooking, extensive buffet spreads, vibrant ambiance, and great music, which is expected to favor the growth of the BBQ grill over the forecast period.

Furthermore, rapid construction in the commercial segment, particularly the hospitality sector, is expected to favor the growth of the barbeque grill industry. Increasing working performance in the hotel industry has resulted in a rise in hotel construction activities, especially in emerging economies of Asia Pacific, including India. According to the report of ‘The Ultimate Indian Travel & Hospitality Report’ complied by Hotelivate in association with CAPA and WTTC India Initiative, the number of hotel rooms in India is projected to outgrow to 3.33 million by 2023 from 18,000 in 1995/96. This massive growth in the number of hotels is driving the demand for easy-to-cook barbeque grill equipment, which not only brings the taste to the table but also health benefits, leading to the growth of the market.

Product Insights

Based on product, the market is segmented into gas, charcoal, and electric. Gas barbeque grill dominated the market with a share of 55.18% in 2024 and is projected to grow considerably over the forecast period. Gas is the most widely adopted product owing to its ability to run over different types of gases, including propane, butane, and natural gases. These appliances are used for cooking food directly as well as indirectly, i.e., cooking on a platform placed on top of the grill. Moreover, their ability to heat and cool down faster than other barbeque grill products makes them suitable for use during outings, picnics, and other similar events. Gas grills have one to six burners. According to the HPBA, 9% of the owners in the U.S. have natural gas grills.

The electric BBQ grill segment is expected to register the fastest CAGR of 6.0% from 2025 to 2030. The growing trend of cookouts on weekends and holidays among the millennial population and the rising popularity of home cooking as a hobby and leisure activity are projected to drive barbeque grill market growth. Electric grills have gained popularity in the recent past and are considered to be the most environment-friendly, healthiest, and easily accessible way to grill. They are suitable for various purposes and available in different sizes, from personal-sized, serving for one countertop grill to a large outdoor setup for social gatherings and parties. The advantages of electric grills, such as ease of use, increased safety, and convenience, are anticipated to fuel the demand during the forecast period.

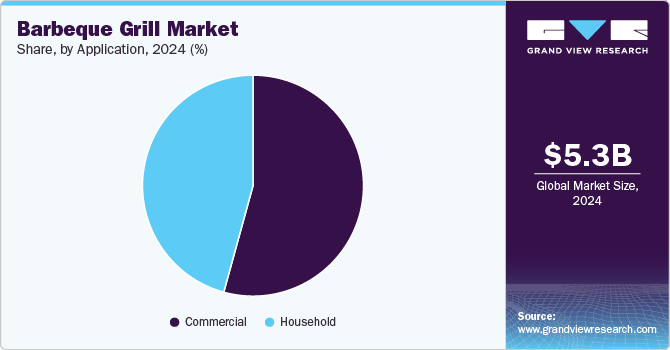

Application Insights

Based on application, the commercial segment dominated the market in 2024. The obsession with barbeques has become a global trend. During the beginning of the decade, only barbeque restaurants could be seen serving barbeque food. But with growing popularity, most dining places can be increasingly seen incorporating barbeques in their menu. In countries including the U.S., Portugal, Brazil, the UK, Mexico, the Philippines, and South Korea, barbeque has become mass food, leading to higher adoption of barbeque grills.

Meanwhile, the growing love of consumers for barbequed food from emerging economies, including India, China, and others, is predicted to shape well the growth of the segment. A rise in glamping, camping, and trekking activities is further expected to boost the demand for barbeque grills.

Household applications held a significant share of the market in 2024. Hosting barbeque parties has become a vogue in many countries, including the U.S., Canada, Mexico, the U.K., Germany, China, and India. Along with barbeque meat, a preference for various other dishes cooked on barbeque grill has gained popularity in get-togethers of family and friends, house parties, and picnics. A large number of posts on Instagram and Facebook, including preparing barbeques as well as trying these dishes, are driving the adoption of barbeque grills in several households, driving the growth of the segment.

Regional Insights

North America barbeque grill market accounted for a revenue share of 56.7% in 2024. For consumers in countries such as the U.S., Canada, and Mexico, when celebrating any kind of holiday, the main part of the celebration is often delicious meals and eating big. Eating barbequed gill food is a major part of their culture, and they often have cookouts on most celebrations and festive occasions.

U.S. Barbeque Grill Market Trends

The barbeque grill market in the U.S. is expected to grow at a CAGR of 5.1% from 2025 to 2030. According to the study by Hearth, Patio, and Barbeque Association (HPBA), Almost two-thirds (64%) of U.S. adults own a grill or smoker, while over 72%, i.e., 7 in 10 Canadian adults own a grill or smoker. They enjoy cookouts on various occasions including wherein 68% on Independence Day, 56% on Memorial Day, 56% on Labor Day, 42% on Father’s Day, and 29% on Mother’s Day.

Year-round grilling remains highly popular in these countries, with 73% of owners grilling in the winter, 23% on Super Bowl Sunday, 13% on Thanksgiving Day, and 9% on New Year’s Day. Not only holidays but also birthday parties, camping trips, vacations, or tailgating at a sporting event are some of the other times of the year when Americans prefer to have barbeque-grill food. Cinco De Mayo serving barbeque and grills is a popular trend.

Some of the similar dishes consumed in Mexico are grilled shrimp tacos, Mexican BBQ chicken, grilled Chile salmon, carne asada, guacamole turkey burger, Mexican grilled steak salad, and grilled tofu torta. Beef, goat, pork, and chicken are the preferred meats for barbeques during parrilladas, a picnic-like event.

Asia Pacific Barbeque Grill Market Trends

The barbeque grill market in Asia Pacific is expected to grow at the highest CAGR of 5.9% during the forecast period. This growth of the market is attributed to the growing consumption of street food coupled with the rising popularity of barbeque grills in countries such as India, Japan, Korea, Philippines, China, Macau, Hong Kong, Singapore, Malaysia, Thailand, Indonesia, and Taiwan. Shaokao, Chuanr, Char-siu, Yakitori, Mongolian barbeque, Satay, and Filo are some of the popular grilled barbeque dishes in Asia, including Southeast Asia.

The growing alternative of barbeque grills over pizza, burgers, and hot dogs in these countries is further supporting the growth of the market. Companies are investing in various projects, including expansion and switching to cloud businesses, to boost their revenue in this growing market. For instance, India’s leading casual dining restaurant Barbeque- Nation Hospitality Limited, launched its IPO (Initial Public Offering) in March 2020. The company experienced an increase in delivery business during the lockdown time in the country and therefore is planning for expansion. Till December 2020, the company has 147 Barbeque Nation Restaurants across 77 cities in India and 6 international Barbeque Nation Restaurants.

Europe Barbeque Grill Market Trends

The barbeque grill market in Europe is expected to grow at a CAGR of 5.2% from 2025 to 2030. The rise of health-conscious eating habits has also played a role, with many preferring grilling as a healthier cooking option. Furthermore, environmental awareness in Europe has driven demand for gas and electric grills, which are seen as more eco-friendly compared to traditional charcoal grills. These trends, coupled with higher disposable incomes and a focus on outdoor leisure activities, are expected to continue driving the growth of the barbecue grill market in the region.

Key Barbeque Grill Company Insights

The global barbeque grill market is characterized by the presence of a few well-established players such as Newell Brand Inc., Spectrum Brands, Inc., The Middleby Corporation, W.C. Bradley Co., Traeger Grills, LANDMANN, Weber-Stephen Products LLC, Transform Holdco LLC, Empire Comfort Systems, and RH Peterson Co. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both, regional and international consumers.

Key Barbeque Grill Companies:

The following are the leading companies in the barbeque grill market. These companies collectively hold the largest market share and dictate industry trends.

- Newell Brand Inc.

- Spectrum Brands, Inc.

- The Middleby Corporation

- W.C. Bradley Co.

- Traeger Grills

- LANDMANN

- Weber-Stephen Products LLC

- Transform Holdco LLC

- Empire Comfort Systems

- RH Peterson Co.

View a comprehensive list of companies in the Barbeque Grill Market.

Recent Developments

-

In January 2023, Weber Inc. launched a new LUMIN electric grill designed for consumers with limited outdoor space and eco-conscious choices. The newly launched product can Reach high heat temperatures of more than 600°F/315°C within 15 minutes.

-

In April 2022, Napoleon announced the launch of Rogue EQ Connected Electric Grill Series. The two-burner Rogue EQ 365 can be controlled through an app on a smartphone, allowing users to monitor temperatures and grill controls on a 7-inch LCD screen.

-

In October 2021, Weber-Stephan, the US manufacturer of electric, charcoal, and gas barbeques, started producing outdoor grills in Zabrze, Upper Silesia (Poland). With this company aims to gain significant logistical and time advantages from its European hub and cover the bulk of European demand from this plant in the medium-term

-

In November 2021, Kenyon International, Inc., a specialty electric grill and cooktop manufacturer, announced the launch of its newest product, the G2 Grill, which uses the same sleek engineering while offering 35 percent more cooking surface than Kenyon International, Inc.’s other portable counterparts

Barbeque Grill Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.53 billion

Revenue forecast in 2030

USD 7.08 billion

Growth Rate (Revenue)

CAGR of 5.1% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., Spain, Italy, France, China, India, Japan, Australia & New Zealand, Brazil, South Africa

Key companies profiled

Newell Brand Inc.; Spectrum Brands, Inc.; The Middleby Corporation; W.C. Bradley Co.; Traeger Grills; LANDMANN; Weber-Stephen Products LLC; Transform Holdco LLC; Empire Comfort Systems; RH Peterson Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Barbeque Grill Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global barbeque grill market report on the basis of product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gas

-

Charcoal

-

Electric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global barbeque grill market size was estimated at USD 5.28 billion in 2024 and is expected to reach USD 5.53 billion in 2025.

b. The global barbeque grill market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 7.08 billion by 2030.

b. North America region dominated the global barbeque grill market with a share of 56.7% in 2024. This is attributable to the barbeque grill being a part of the lifestyle in countries like the U.S. and Canada wherein consumers prefer barbeque food on most celebrations and festive occasions.

b. Some key players operating in the global barbeque grill market include The Coleman Company Inc.; Spectrum Brands, Inc.; The Middleby Corporation LLC.; Char-Broil LLC; Kenmore; Traeger; LANDMANN; Broilmaster; FIRE MAGIC; and Weber-Stephen Barbecue Products India Private Limited.

b. Key factors that are driving the barbeque grill market growth include the rising trend of cookouts on weekends and holidays, especially among the younger population, and changing lifestyle coupled with the adoption of premium products for home and outdoor cooking activities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."