Barbados Healthcare & Medical Tourism Market Size, Share & Trends Analysis Report By Specialty Type (General Surgery, Orthopedics, Cardiology, Fertility & Gynecology, Cosmetics), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-005-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

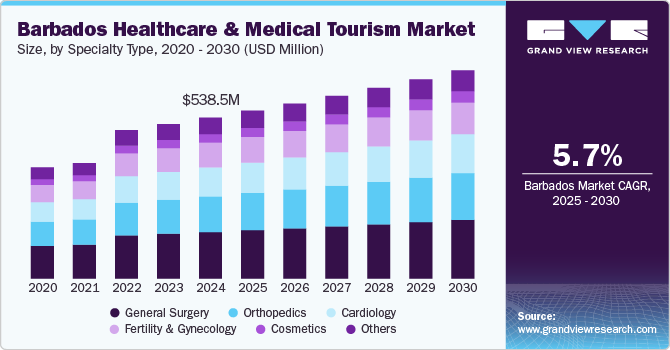

The Barbados healthcare & medical tourism market size was estimated at USD 538.49 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. Growth of the market is attributed to the well-designed healthcare infrastructure, high quality of care at affordable prices, and favorable public health coverage. Moreover, the rising prevalence of noncommunicable diseases and increasing government spending are anticipated to drive market growth.

Rising prevalence of noncommunicable diseases and increasing government spending are anticipated to drive market growth. For instance, the Government of Barbados, through the Ministry of Health and Wellness, implemented the Barbados National Strategic Plan for the Prevention and Control of Non-communicable Diseases 2020 - 2025. This plan highlights health promotion, risk factor reduction, and disease prevention. It aims to strengthen the primary healthcare system and enhance the functioning of Barbados’ network of polyclinics, moving toward universal health coverage.

Furthermore, Barbados’ proximity to North and South America is expected to drive its healthcare and medical tourism market. The majority of its medical tourists come from these regions, taking advantage of the short travel distances and cultural similarities. In 2022, the American University of Barbados (AUB) has opened a 200-bed hospital, which was expected to boost the country’s capacity to accommodate international patients.

However, The COVID-19 pandemic has led to an important change in healthcare in Barbados, especially in medical tourism. After the pandemic, the government focused on improving local healthcare services and invested a lot to make advanced medical care easier for its citizens. This is expected to have positive impact on medical tourism in Barbados.

According to Barbados Statistical Service, visits for healthcare are increasing. In 2023, there were 1,760 healthcare visits, showing a rise compared to the pandemic years (857 in 2021). Overall tourist visits have also returned to 90% of the levels seen in 2019, with a 9.6% increase in the first few months of 2024 compared to the same period in 2019. With better healthcare facilities and a strong tourism sector, it is anticipated that these factors are expected to drive the growth of the medical tourism market in Barbados.

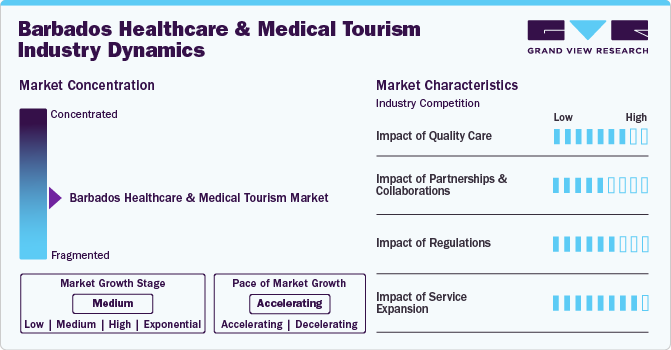

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations activities, degree of innovation, impact of regulations, and regional expansion. Barbados healthcare & medical tourism market is fragmented, with presence of several emerging service providers dominating the market. Impact of quality care is high; level of service expansion activities is moderate. Impact of partnerships & collaborations is moderate, and impact of regulations on the industry is moderate.

Impact of quality care is high. Barbados is gaining recognition for its high-quality healthcare system, which is expected to boost the country’s healthcare & medical tourism sector. For instance, Barbados has made developments in mental health services, elder care, and services for persons with disabilities. The Psychiatric Hospital, Geriatric Hospital, and Albert Cecil Graham Development Centre are key facilities providing specialized care. The Best-Dos Santos Public Health Laboratory, opened in 2018, offers advanced testing services and collaborates with regional & international organizations to enhance public health capabilities.

Impact of partnerships and collaborations is moderate. Healthcare providers in Barbados are actively engaging in collaborative initiatives to introduce new services and facilities aimed at combating non-communicable diseases (NCDs) while ensuring high-quality care for tourists. For instance, in 2023, Bayview Hospital plans to collaborate with organizations such as the Rotary Club of Barbados, Sagicor, and Ross University to address the non-communicable diseases (NCDs) in Barbados.

The industry's level of service expansion is high. Barbados has a well-developed healthcare system with several private hospitals and clinics offering many medical services. For instance, in April 2024, The Queen Elizabeth Hospital BARBADOS expanded its services by opening additional space within its Accident and Emergency Department (AED).

The market is experiencing moderate regulations due to the Barbados government has undertaken several initiatives to promote medical tourism, such as extending the Tourism Development Act to allow the Barbados Fertility Centre to import medical equipment duty-free. It enabled the clinic to use "Barbados" in its name, a marketing advantage usually reserved for publicly held corporation.

Medical Tourism Potential

Barbados is well-positioned geographically to attract medical tourists from North America, Europe, and the Caribbean region. By offering cutting-edge technology (e.g., robotic surgeries, minimally invasive procedures) and combining it with the island’s tourism appeal, the hospital could draw patients seeking affordable but high-quality surgical care. Assuming the hospital captures 700-1,000 international patients annually, medical tourism could generate USD 17.5-25 million in gross revenue, thereby contributing to market growth.

Specialty Type Insights

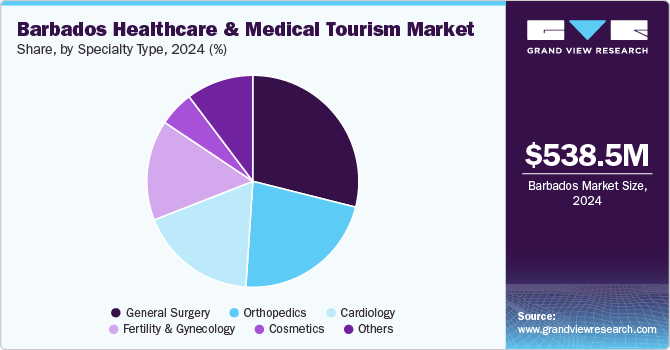

Based on specialty, general surgery segment held the largest revenue share of over 28% in 2024. This growth is attributed to the increasing prevalence of gastrointestinal diseases and the rising demand for laparoscopic procedures. According to the Barbados Ministry of Health and Wellness, around 1,052 general surgeries were reported in 2018. Furthermore, the Queen Elizabeth Hospital performed a total of 4,043 surgeries in 2019.

The cardiology segment is anticipated to grow significantly over the forecast year. Increasing burden of CVDs and the opening of dedicated walk-in chest clinics are expected to drive segment growth. Furthermore, government initiatives in Barbados are contributing significantly to the growth of cardiology services and improving cardiovascular health. In May 2022, Barbados launched public awareness campaigns for World Hypertension Day, encouraging citizens to “Know Your Numbers” by getting their blood pressure, weight, and blood sugar checked. This initiative-initiated community-based blood pressure monitoring and training of NCD ambassadors.

Barbados Medical Tourism Insights

Barbados medical tourism held a significant market share in 2024. Barbados has made significant progress in medical tourism development over the past 10 years. With substantial investments from the government in healthcare infrastructure, it has become a leading destination in the Caribbean for medical services. This has led to the creation of advanced medical facilities specializing in various services, including cosmetic surgery, dentistry, and fertility treatments.

For instance, in June 2021, The European Investment Bank (EIB) collaborated with the Government of Barbados to allocate USD 60 million for emergency healthcare spending for expenses related to COVID-19, focusing on both medical treatment and initiatives to control spread of the virus.

Furthermore, the cost of cosmetic surgeries, dental treatments, and fertility procedures in Barbados is notably lower 40% to 60% cheaper compared to the expenses in the U.S. and other developed countries, making it an attractive option for international patients in search of cost-effective healthcare solutions. For instance, a dental implant that could cost between USD 3,000 and USD 4,500 in the U.S. costs between USD 1,500 and USD 2,500 in Barbados.

Key Barbados Healthcare & Medical Tourism Company Insights

The market is moderately fragmented, with the presence of medium-sized organizations. Some of the strategies undertaken by key companies to strengthen their market presence include mergers & acquisitions, collaborations, facility & service expansions, and adoption of the latest healthcare technologies. Some emerging market players in the Barbados healthcare & medical tourism market include Cariburol Inc, Cuervo Medical & Diagnostic Services Inc, Caribbean Dermatology & Laser Centre, and Edge Skincare & Laser Centre.

Key Barbados Healthcare & Medical Tourism Companies:

- The Sparman Clinic

- FMH Emergency Medical

- Sandy Crest Medical Centre

- Barbados Fertility Centre

- Premiere Surgical Centre

- The Queen Elizabeth Hospital BARBADOS

- Bayview Hospital

Recent Developments

-

In February 2024, the Ophthalmology Department at Queen Elizabeth Hospital started to provide a new diagnostic test to improve the detection of various diseases affecting the back of the eye, such as sickle cell disease, diabetes, and retinal vein occlusion. This test, known as Fundus Fluorescein Angiography (FFA), was first performed in Barbados at QEH.

-

In May 2019, Queen Elizabeth Hospital started providing round-the-clock services at its Clinical Risk Management Unit (CRMU) to better serve patients.

Barbados Healthcare & Medical Tourism Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 566.64 million |

|

Revenue forecast in 2030 |

USD 748.58 million |

|

Growth rate |

CAGR of 5.7% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Specialty type |

|

Country scope |

Barbados |

|

Key companies profiled |

The Sparman Clinic; FMH Emergency Medical; Sandy Crest Medical Centre; Barbados Fertility Centre; Premiere Surgical Centre; The Queen Elizabeth Hospital BARBADOS; Bayview Hospital. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Barbados Healthcare & Medical Tourism Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Barbados healthcare & medical tourism market report based on specialty type:

-

Specialty Type Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Orthopedics

-

Cardiology

-

Fertility & Gynecology

-

Cosmetics

-

Others

-

Frequently Asked Questions About This Report

b. The global Barbados healthcare and medical tourism market is expected to grow at a compound annual growth rate of 5.73% from 2025 to 2030 to reach USD 748.58 million by 2030.

b. General Surgery segment is dominated the market, with a share of over 28% in 2024. This growth is attributed to the increasing prevalence of gastrointestinal diseases and the rising demand for laparoscopic procedures.

b. Some key players operating in the Barbados healthcare & medical tourism market include the Sparman Clinic, FMH Emergency Medical, Sandy Crest Medical Centre, Barbados Fertility Centre, Premiere Surgical Centre, The Queen Elizabeth Hospital BARBADOS, and Bayview Hospital.

b. Key factors that are driving the Barbados healthcare & medical tourism market growth include high quality of care, proximity to key source markets, lower cost of medical procedures compared to developed countries

b. The global Barbados healthcare & medical tourism market size was estimated at USD 538.49 million in 2024 and is expected to reach USD 566.64 million in 2025.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."