Bar Soap Market Size, Share & Trends Analysis Report By Type (Organic, Synthetic), By Application (Hair Care, Body/Skin Care, Facial Care, Specialized), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-123-6

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global bar soap market size was valued at USD 30.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. Rising awareness regarding personal hygiene and cleanliness among consumers is a major factor driving the growth of the market for bar soap. Moreover, there is a growing consumer demand for high-quality artisanal bar soaps with unique scents, visually appealing designs, and premium ingredients.

The personal care market has witnessed significant growth in value sales, primarily due to the easy accessibility of these products through various sales channels, including specialty stores, pharmacies, and beauty salons. Moreover, the market is expected to experience further expansion as male consumers increasingly prioritize skincare and grooming to improve their physical appearance and overall skin health. Additionally, the market is positively influenced by increased investments in R&D, leading to the introduction of new and effective products that cater to diverse consumer demands and preferences.

Consumers are increasingly demanding vegan, natural, organic, clean, reef-friendly, GMO, gluten-free, soy-free, transparently sourced, and recyclable products. Manufacturers in the market are focusing on sustainability and introducing innovative products that fulfill consumer demands. For instance, Vibey Soap Co.'s eco-friendly and plant-based soaps are available in a wide range of colors and fragrances. All the soaps, from ‘Cucumber & Melon’ to ‘Almond Mahogany’, are vegan and packaged in plastic-free clamshells.

Consumers value skincare routines as a positive part of their daily rituals to maintain their personal hygiene as well as self-care. According to an article in the Global Cosmetic Industry magazine in March 2019, a significant percentage of people follow multi-step routines, washing their face and applying moisturizer at least twice daily. The growing emphasis on facial cleansing is driving the global demand for bar soap. Bar soap is a convenient and effective way to maintain personal hygiene. In commercial establishments or public places, using bar soap may offer a sense of hygiene to individuals.

In addition, bar soaps are typically less expensive than individual bottles or dispensers for toiletries. They last longer and consume less amount of soap at once, which enables hotels to reduce costs. According to a survey conducted by the Boston University School of Hospitality Administration in March 2019, it was found that soaps were the most widely used amenity at hotel chains in the U.S. Around 86% of guests who stay at a hotel for 1-2 nights utilize the provided soap, surpassing the usage rates of other popular amenities such as the in-room TV (84%), hair dryer (36%), and valet parking (28%).

Type Insights

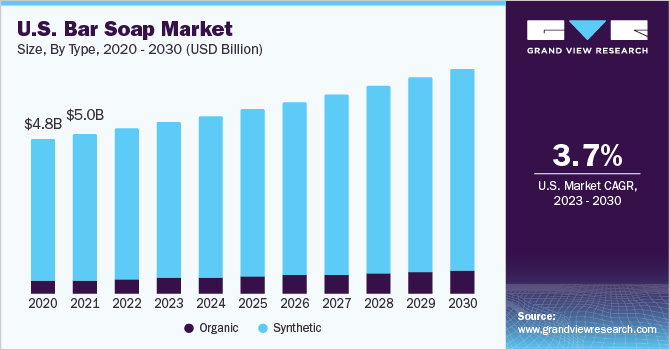

The synthetic bar soap segment held a market revenue share of 91.94% in 2022. One of the primary factors driving the market for synthetic bar soap is its cost-effectiveness. Synthetic soap brands have also evolved significantly over the years thanks to modern production techniques and scientific advancements, offering compelling reasons for consumers to consider these products. For instance, Neutrogena’s ‘Original Formula The Transparent Facial Bar’ is time-tested and dermatologist-recommended and contains no harsh detergents or dyes. It includes Triethanolamine and TEA stearate, which are common emulsifying and surfactant agents, along with sodium metabisulfite, an antioxidant agent that also improves the appearance of hyperpigmentation on the skin.

The organic soap demand is anticipated to expand at the fastest CAGR of 6.6% over the forecast period from 2023 to 2030. Many bar soap companies are meeting customer needs by introducing environment-friendly products through environment-friendly manufacturing processes. For instance, in January 2022, Oregon Soap Company, a prominent manufacturer of bar and liquid soaps, announced its partnership with the Carbonfund.org Foundation to register its entire product line in the Carbonfree Product Certification Program.

Application Insights

The skin/body care bar soaps segment led the market and accounted for a 57.7% share of the global revenue in 2022. Bar soaps infused with moisturizing ingredients such as shea butter, cocoa butter, coconut oil, and essential oils are in high demand. These soaps not only cleanse the skin but also provide hydration and nourishment, leaving the skin feeling soft and supple. Companies like Organic Bath Co. promote skincare by offering products that nurture consumers’ skin care routines. The company offers a bar soap that contains lavender powder for gentle exfoliation, as well as organic shea butter and organic oils. These soap bars are available in scents like zesty and java, as well as unscented ones.

The specialized bar soaps segment is anticipated to expand at the fastest CAGR of 5.6% from 2023 to 2030. Specialty bar soaps include soaps that treat specific skin issues or are used for exfoliation and more such specific functions. These soap bars are distinct from traditional cleansing bars due to their unique formulations, ingredients, and intended purposes. For instance, OilBlends offers a variety of specialty soap bars under its section ‘Soaps That Heal’. The collection includes soap bars made from turmeric, tea tree oil, pumpkin seed oil, carrots, and more.

Distribution Channel Insights

The supermarkets and hypermarkets channel segment dominated the market and accounted for 31.99% of the revenue share in 2022. Consumers prefer shopping from offline stores as they can physically assess the product quality and compare it with other products. In addition, supermarkets often run promotions and discounts on bar soaps, making them a cost-effective choice for consumers. Buying soap bars from supermarkets offers convenience, variety, and potential cost savings for consumers. As per an article published by the Retail Sector in August 2021, 68% of consumers in the U.K. claim to buy personal care products from physical stores due to the experience of buying them in person.

The online retailer channel segment is anticipated to account for a significant share in the global market for bar soaps, advancing with over 5.8% CAGR during the forecast period. Online platforms foster competition, encouraging soap bar sellers to offer competitive pricing. Promotional deals and discounts on e-commerce sites can further entice consumers to make online purchases. For example, during seasonal sale events such as Black Friday, online retailers may offer attractive discounts on soap bars, attracting customers to stock up on their favorite brands. According to Shopify, 80% of clean skin-care brands dominated the Black Friday and Cyber Monday beauty trends.

Regional Insights

The Asia Pacific bar soap market held the largest revenue share of 39.87% in 2022 and is anticipated to expand at the fastest CAGR of 5.5% from 2023 to 2030. The region’s rapidly growing population mainly contributes to the increased demand for personal care products such as bar soaps. Bar soaps remain a preferred choice for personal hygiene and bathing routines in many regional households due to their familiarity.In Asia, consumers prefer local and handmade bar soaps for genuine and distinctive skincare and hair care experiences. These products, which are made by small-scale manufacturers, frequently incorporate ingredients from the region's rich and varied traditional botanical heritage.

On the other hand, the Middle East & Africa region is expected to advance at a strong CAGR of 5.0% from 2023 to 2030. Bar soaps are favored in this region due to their cost-effectiveness and wide availability. They serve as a practical choice for personal hygiene needs, with a more affordable price point compared to liquid soaps. Regional companies have been coming to the forefront by capitalizing on local market insights, meeting cultural preferences, and offering competitive pricing, allowing them to gain prominence and compete with global brands effectively.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retail, to enhance their portfolios. Recent notable developments include:

-

In July 2023, Lush Retail Ltd. launched its partnership with Just Eat Takeaway.com to provide products by Lush to German consumers. With this partnership, Just Eat Takeaway.com can explore the potential of non-food categories along with new delivery opportunities

-

In June 2023, The Body Shop established a new kiosk in Lucknow, India. Situated in the city's Lulu Mall, this branded stall offers a variety of The Body Shop's skincare, makeup, and body care products. This kiosk enables the company to connect with shoppers in Lucknow with a smaller investment compared to launching an exclusive brand outlet

-

In May 2023, Lush announced the successful establishment of its Green Hub in Dorset, U.K. The company is actively engaged in creating circular economies, aiming to close the loop on packaging and water waste. Six core teams at the Green Hub will focus on discovering innovative ways to reuse, repurpose, repair, and recycle materials throughout its business operations

Some of the key players operating in the global bar soap market include:

-

Lush Retail Ltd.

-

Ethique, Inc.

-

Unilever

-

Chagrin Valley Soap & Salve Co.

-

Galderma S.A.

-

The Body Shop

-

Johnson & Johnson

-

KIRK’S NATURAL LLC

-

Tom's of Maine

-

Dr. Bronner's

Bar Soap Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 31.4 billion |

|

Revenue forecast in 2030 |

USD 43.1 billion |

|

Growth rate |

CAGR of 4.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; France; Germany; UK; China; Japan; India; Brazil; South Africa |

|

Key companies profiled |

Lush Retail Ltd.; Ethique, Inc.; Unilever; Chagrin Valley Soap & Salve Co.; Galderma S.A.; The Body Shop; Johnson & Johnson; KIRK’S NATURAL LLC; Tom's of Maine; Dr. Bronner's |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bar Soap Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global bar soap market report on the basis of type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Organic

-

Synthetic

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Hair Care

-

Skin/Body Care

-

Facial Care

-

Specialized

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online Retailers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bar soap market was estimated at USD 30.1 billion in 2022 and is expected to reach USD 31.4 billion in 2023.

b. The global bar soap market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 43.1 billion by 2030.

b. Asia Pacific dominated the bar soap market with a share of 39.5% in 2022. This is attributable to the bar soaps remain a preferred choice for personal hygiene and bathing routines in many households across the region and the presence of ayurvedic and hand-crafted bar soaps in the regional market.

b. Some of the key players operating in the bar soap market include Lush Retail Ltd. (Brand Turnover); Ethique, Inc.; Unilever; Chagrin Valley Soap & Salve Co.; and Galderma S.A.; The Body Shop; Johnson & Johnson; KIRK’S NATURAL LLC; Tom's of Maine; Dr. Bronner's among others.

b. Key factors that are driving the bar soap market growth include the surge in the consumer demand for high-quality artisanal bar soaps with unique scents, visually appealing designs, and premium ingredients.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."