- Home

- »

- Consumer F&B

- »

-

Banana Bread Market Size & Share, Industry Report, 2030GVR Report cover

![Banana Bread Market Size, Share & Trends Report]()

Banana Bread Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Unflavored, Flavored), By Distribution Channel (Hypermarket & Supermarket, Convenience Stores, Online), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68038-994-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Banana Bread Market Size & Trends

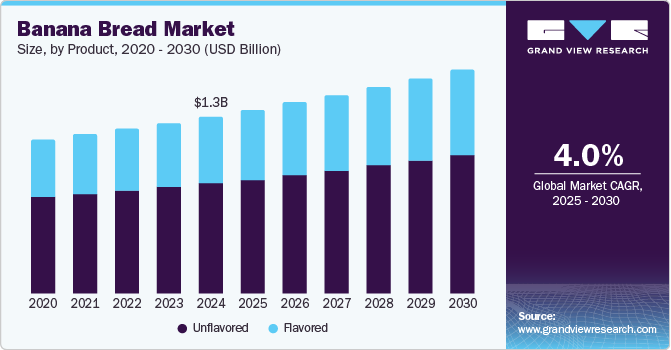

The global banana bread market size was valued at USD 1.30 billion in 2024 and is projected to grow at a CAGR of 4.0% from 2025 to 2030. The rapidly expanding demographic of health-conscious consumers who demand simple and less processed baked goods that incorporate naturally sourced ingredients is a leading factor aiding market developments. Furthermore, increasing awareness regarding this bread type due to promotional activities through social media platforms as well as in-store promotions across major outlets such as Walmart, Tesco, and 7-Eleven is expected to drive product innovations in the coming years. The emergence of the home baking trend that was further boosted during the COVID-19 pandemic has encouraged the preparation of banana bread infused with different healthy ingredients and flavors such as chocolate, strawberry, and vanilla.

Banana is an economical fruit that has a strong nutritional profile, making it a constant presence in kitchens globally. It is considered highly beneficial for maintaining digestive and heart health while encouraging weight management. Additionally, it is an excellent source of vitamin B6, potassium, vitamin C, carbohydrates, and fiber, all of which offer substantial health benefits. For instance, the fiber content in bananas strengthens the digestive system, while Vitamin C boosts immunity. Meanwhile, the high potassium content makes it essential for heart health, while carbs enable optimum weight management. This has helped create a positive perception regarding banana-infused food items. Banana bread is a baked good made of ingredients including bananas, butter or oil, flour, eggs, baking soda, sugar, salt, and cinnamon. The availability of different recipes has compelled both professional and home bakers to incorporate additional flavors and ingredients, increasing the variety of offerings and ensuring its adaptability to different nutritional needs. For instance, there are several banana bread recipes on the Internet that suit paleo, vegan, and low-carb diets.

With the growing consumer focus on sustainability, unflavored banana bread offers an ideal way to use overripe bananas that would otherwise be thrown away. Increasing concerns regarding food wastage have compelled consumers to look for creative cooking and baking techniques to repurpose ingredients, making banana bread a convenient solution to reduce food waste. As bananas ripen quickly, making banana bread ensures efficient usage of this fruit that would otherwise be not consumed, driving its popularity in homes and bakeries that follow sustainable practices in their preparations. Moreover, banana bread is easy to store and has a relatively longer shelf life compared to other baked goods. It can be made in large batches, sliced, and stored for several days, making it an excellent option for meal preparation or for consumers wanting healthy snacking options for a longer period. The popularity of seasonal offerings and limited-time release for baked goods presents an additional avenue for market expansion, with occasions such as Thanksgiving and Christmas aiding manufacturers to launch novel varieties of banana bread in limited quantities.

Product Insights

Unflavored banana bread accounted for a leading revenue share of 62.3% in 2024, aided by extensive awareness among consumers regarding this variety of bread and the availability of a wide range of products in this segment. Unflavored banana bread is considered a comfort food, with consumers preferring simple flavors and easy-to-understand recipes that generally include sugar, flour, and eggs in addition to bananas. Furthermore, unflavored banana bread attracts individuals who prefer to eat products made with more natural ingredients and wish to avoid processed additives that might be found in flavored varieties. The product can also be easily adapted to suit various dietary preferences, such as gluten-free, dairy-free, or vegan diets. The basic recipe allows for easy substitutions without changing the underlying taste or texture, making it an attractive option for those with dietary restrictions.

Meanwhile, the flavored segment is anticipated to grow at the highest CAGR during the forecast period. Bakery companies are increasingly aiming to address the taste preferences of consumers, who may prefer flavors such as strawberry, chocolate, peanut butter, vanilla, and oats in their banana bread purchases. Consumers globally are moving towards healthy lifestyle practices by incorporating food items in their diet that appeal to their taste buds, offering opportunities for market growth. Consumers, particularly working professionals, prioritize convenience in their food habits, so flavored banana bread can serve as an easy snack or breakfast option that can be enjoyed on the go. Its portability and ability to be made in batches for easy consumption contribute to its increasing demand, especially for individuals looking for quick but satisfying options.

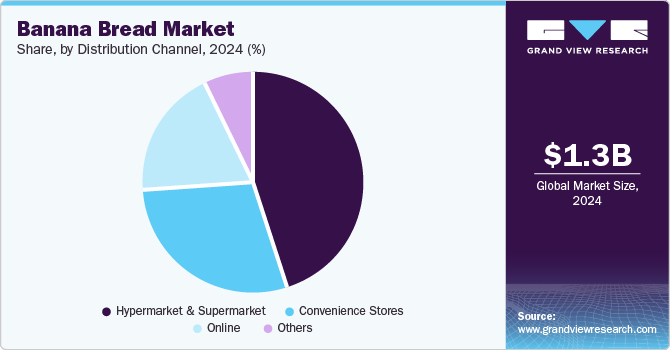

Distribution Channel Insights

The hypermarket & supermarket segment accounted for a leading revenue share in the global banana bread industry in 2024, aided by the increasing number of banana bread manufacturers and the intensifying competition among them. This has made it crucial for companies to launch their products across major retail store chains that attract a significant number of customers daily. These companies strive to ensure increased sales by offering both flavored and unflavored bread varieties to appeal to a larger consumer base. Furthermore, they are also aiming to improve customer engagement by providing samples of their products and taste tests, which helps increase customer belief in a brand and potentially leads to repeated purchases.

The online segment is anticipated to advance at the fastest growth rate from 2025 to 2030. The e-commerce industry's rapid growth has led people to shift to online platforms for their grocery and food orders. Banana bread makers are capitalizing on this trend by offering fast delivery and local shipping capabilities. Companies also provide subscription services where customers receive freshly baked banana bread regularly, which appeals to those wanting the convenience of home delivery. Banana bread has also emerged as a preferred gift option for holidays, birthdays, and other special occasions, with the use of gift packaging or personalized messages further boosting its appeal. Several home bakers have started using online platforms extensively to sell different varieties of banana bread and leverage social media channels such as Instagram and TikTok to promote their products.

Regional Insights

North America banana bread market accounted for a leading revenue share of 33.4% in 2024. Increasing awareness regarding the taste and health benefits of banana bread among regional citizens and the establishment of several small and large bakeries that specialize in fruit-based breads and other baked goods has driven market expansion. Furthermore, the continued rise in disposable income and steady growth of the working professional demographic in the U.S. and Canada has created a strong demand for banana bread and related bakery products.

U.S. Banana Bread Market Trends

The U.S. banana bread market accounted for a dominant revenue share in the regional banana bread industry in 2024. The growing population of health-conscious consumers and the increasing presence of home bakeries that prepare and sell different types of breads has led to a substantial popularity of banana bread among different demographics. Moreover, celebrities are promoting the various benefits of this product to their followers, which further helps enhance market appeal. For instance, in December 2022, television personality Chrissy Teigen teamed up with The Coffee Bean & Tea Leaf, a global coffee and tea company, to exclusively launch the highly popular ‘Cravings’ banana bread available by the slice at the latter’s outlets across Los Angeles. The partnership followed the launch of home baking mixes by Cravings, which included Chrissy's Ultimate Banana Bread Mix.

Europe Banana Bread Market Trends

Europe banana bread market accounted for significant revenue share in 2024, aided by the strong demand for this product across regional economies such as Germany, France, and the UK. Rising awareness regarding nutritionally balanced baked goods and a shift in individual food preferences have further created opportunities for regional bakeries to launch innovative offerings by infusing healthy ingredients in banana bread. Additionally, the increasing influence of social media and the premiumization of baked goods is expected to sustain the appeal of banana bread among European consumers in the coming years.

Asia Pacific Banana Bread Market Trends

The Asia Pacific region is anticipated to advance at the fastest CAGR from 2025 to 2030. Improving standards of living, increasing disposable income of regional consumers, and the growing influence of Western food culture have opened new avenues for market growth, particularly in economies such as China, Japan, and India. Australia has contributed substantially to the regional market, as this type of bread is very popular among Australian consumers, owing to its better taste and health profile when compared to other forms. Furthermore, the region's bakery and food product companies are investing in R&D activities to further elevate baked goods' taste and nutritional value in a highly competitive market, aiding regional expansion.

China banana bread market accounted for the largest revenue share in the Asia Pacific market in 2024. According to Volza, which provides import export trade data for global economies, China was the second-largest exporter of banana bread between February 2023 and January 2024, witnessing a growth of 143% in its trading activity when compared to the preceding 12 months. The country has witnessed significant advancements in its food & beverage industry, with technological advancements and innovative processes ensuring improvements in the nutritional profile of food products. Furthermore, the continued rise of e-commerce, increasing social media influence on the younger demographic, and the growing preference for health-conscious and sustainable eating practices is expected to maintain positive advancements in the Chinese market.

Key Banana Bread Company Insights

Some major companies involved in the global banana bread industry include General Mills, Banana Bread Company, and Mama Kaz Bakery, among others.

-

General Mills is a global manufacturer and marketer of consumer food products. The company’s portfolio includes grains, savories, fruits, frozen hot snacks, nutrition bars, and ready-to-eat cereals. Other products include natural pet foods, refrigerated and frozen dough, baking mixes, yogurt, and ice cream. General Mills further offers convenient meal options such as meal kits, pizza, soup, frozen breakfast items, side dish mixes, and frozen entrees. With regard to banana bread, General Mills offers various products designed to make the baking process easier for consumers. For instance, the Betty Crocker Banana Bread Mix allows consumers to prepare banana bread by simply adding a few ingredients such as bananas, water, and oil. It is available in different variations, such as classic and low-fat versions.

-

The Banana Bread Company, located in Melville, New York, specializes in creating banana bread, generally focusing on high-quality, unique, or artisanal varieties. Besides bread, the company also has a line of signature cookies and pound cakes that are prepared using other ingredients such as zucchini, pumpkin, and apple. Some notable products include banana bread, banana dark chocolate bread, banana nut bread, banana s’mores bread, hot chocolate and Oreo cookie bread, and lemon crumb pound cake. Banana Bread Company also makes gluten-free products such as gluten-free banana bread and gluten-free banana nut bread.

Key Banana Bread Companies:

The following are the leading companies in the banana bread market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills Inc.

- Banana Bread Company

- Mama Kaz Bakery

- King Arthur Baking Company, Inc.

- Papa Joe's Bakehouse

- The Elegant Farmer

- Dank Banana Bread

- The Essential Baking Company

- Simple Mills

- DD IP Holder LLC

Recent Developments

-

In February 2024, Dunkin’ announced the launch of its Banana Chocolate Chip Bread to coincide with National Banana Bread Day in the U.S. The company further announced that Dunkin’ Rewards members would receive 250 bonus points for tasting this particular product on National Banana Bread Day, which falls on 23rd February annually.

-

In July 2023, Pillsbury, a brand of General Mills, introduced the Pillsbury Banana Bread Batter, which offers a quick and convenient way to prepare banana bread. The company stated that the batter incorporates real bananas and takes 60-70 minutes to fully prepare freshly-baked bread without needing any mixing or measuring. The product was made available at Albertsons, Kroger, Safeway, and Publix at the time of its release, along with additional retailers across the U.S.

Banana Bread Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.35 billion

Revenue forecast in 2030

USD 1.65 billion

Growth Rate

CAGR of 4.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia & New Zealand, Brazil, Argentina, UAE, South Africa

Key companies profiled

General Mills Inc.; Banana Bread Company; Mama Kaz Bakery; King Arthur Baking Company, Inc.; Papa Joe's Bakehouse; The Elegant Farmer; Dank Banana Bread; The Essential Baking Company; Simple Mills; DD IP Holder LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Banana Bread Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global banana bread market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & Supermarket

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.