- Home

- »

- Advanced Interior Materials

- »

-

Bamboos Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Bamboos Market Size, Share & Trends Report]()

Bamboos Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Raw Material, Industrial Products, Furniture, Shoots), By Region (North America, Europe, Asia Pacific, Middle East & Africa, Central & South America), And Segment Forecasts

- Report ID: GVR-2-68038-819-0

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bamboos Market Summary

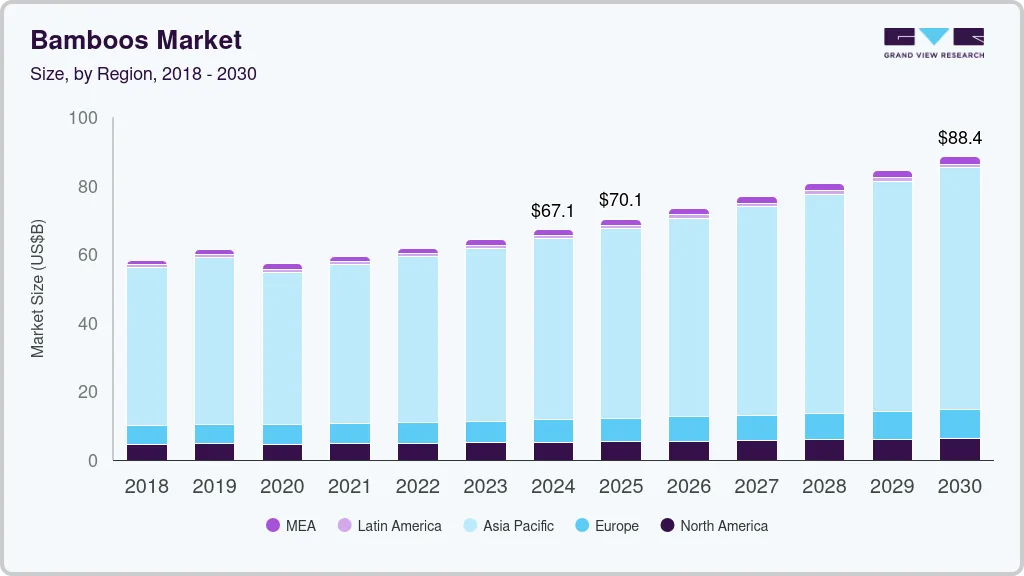

The global bamboos market size was estimated at USD 67.13 billion in 2024 and is projected to reach USD 88.44 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. The growth of the global industry is expected to be driven by the growing investments in infrastructure development and the rising consumer awareness about sustainable, durable, and eco-friendly products.

Key Market Trends & Insights

- Asia Pacific bamboos market dominated with a share of 79.0% in 2024.

- China bamboos market accounts for the largest market share of 59.3% in 2024 in Asia Pacific bamboos market.

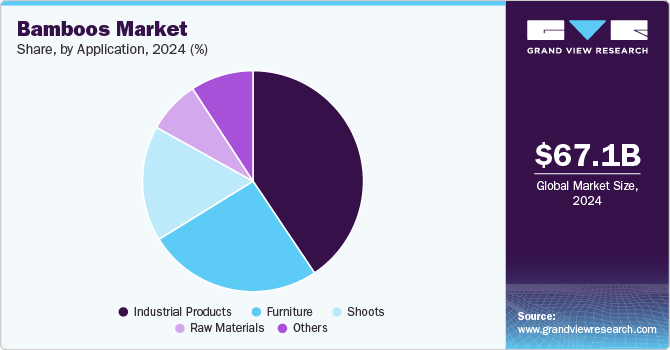

- Based on application, industrial segment dominated the industry with a major revenue share of 40.6% in 2024 and is forecasted to grow rapidly from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 67.13 Billion

- 2030 Projected Market Size: USD 88.44 Billion

- CAGR (2025-2030): 4.7%

- Asia Pacific: Largest Market in 2024

Bamboos have various applications like textile, kitchenware, indoor and outdoor furniture, decking, flooring, fencing, interior designs, and pulp and paper. Bamboo is a sustainable, eco-friendly, and durable fiber that can replace other harmful products such as plastic, wood, and steel. An increasing number of consumers prefer eco-friendly natural products, which has led to an increase in the demand for bamboo which is largely used in the manufacturing of sustainable products. Bamboo fibers can be used in the manufacturing of clothing because bamboo textiles are soft, comfortable, wrinkle-resistant, provide long-term freshness, and are cost-effective.

With rising concerns among consumers about eco-friendly products, bamboo product manufacturers are coming forward to change the way we lived earlier by replacing everyday use products with bamboo materials such as toothbrushes, wet wipes, sheets, pillows, mattresses, cotton swabs, spoons, cutlery, and towels which will drive the overall demand for the bamboos market over the forecast year.

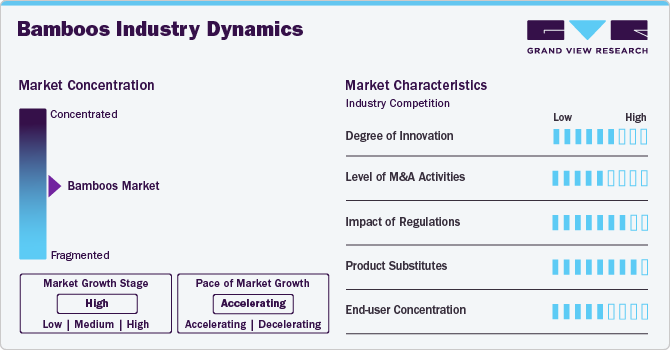

Market Concentration & Characteristics

Bamboos market growth stage is high, and pace of the market growth is accelerating. The rising number of applications of bamboo in different industries and changing customer preference for non-plastic products provide a huge opportunity for new entrants in the market. Although, it is challenging for new companies to enter the market as they need a strong and efficient supply chain to compete with the existing players. However, the industry does not require high capital investments or technical knowledge, increasing the threat of new players. Hence, the threat of new entrants will be moderate over the forecast period.

The market is characterized by intense competition because of several domestic and international players trying to enter unexplored or less explored markets through mergers and acquisitions. Some players are involved in vertical integration which gives them a competitive advantage by cutting the cost of acquiring raw materials. It poses difficulty for the other competitors who acquire raw materials from other suppliers to reduce the cost of bamboo products. Hence, the market competition is expected to be high over the forecast period.

The ongoing environmental problems indicate the need to replace the environmentally detrimental raw materials in products used in everyday life with sustainable alternatives, and bamboo is one such material that helps fight environmental problems. It is durable, sustainable, environment friendly, and reduces CO2 levels, which makes it attractive in countries around the world. This is expected to drive the demand for bamboo over the forecast period.

Bamboo is more advantageous than other woods as it can be replenished at a faster rate and is readily available. There has been an increasing awareness about environmental sustainability among consumers around the world, which has positively impacted the bamboos market. Bamboo products are completely renewable and biodegradable. The cultivation of bamboo requires minimal supervision, and no fertilizers are required during its growth period.

Despite the growing adoption of digital technologies, the demand for paper is growing globally. Bamboo pulp is used to make high-grade culture paper, offset paper, and typing paper, which have a high market demand. Bamboo pulp is mixed with wood pulp to manufacture products like cement bag paper, insulation paper, and cable paper. Companies like EcoPlanet Bamboo have heavily invested in R&D projects to find more applications for bamboo paper across different industries.

Application Insights

Based on application, industrial application dominated the industry with a major revenue share of 40.6% in 2024 and is forecasted to grow rapidly from 2025 to 2030. The industrial products segment of bamboo market is projected to grow more progressively compared with raw materials, furniture, and shoots application segments of the market during the forecast period owing to the surge in demand for paper and board packaging products due to the flourishing e-commerce sector across the world.

Industrial products segment of bamboo market is projected to grow at a CAGR of 5.5% in terms value, respectively during the forecast period owing to more demand for bamboo fibers than cotton fibers as they are highly robust and their yield per hectare is also high. China-based textile manufacturers are supporting bamboo-made rexine and cloth as a potential replacement for cotton cloth in the future. Bamboo fabrics offer a nice luster, are extremely soft, have improved water absorption, and are antibacterial, cool, bio-degradable, and resistant to UV radiation.

Shoots segment of bamboo market is projected to grow significantly during the forecast period owing to increasing global demand for edible bamboo and rising bamboo cultivation worldwide. In addition, the surging usage of bamboo products, including bamboo fiber-based winding pipes and bamboo scrimber for construction applications, is further expected to fuel the farming of bamboo globally. This, in turn, is anticipated to contribute to the growth of shoots segment of the market during the forecast period.

The rising demand for sustainable products is surging the adoption of bamboo furniture worldwide. Bamboo is widely accepted as a wood substitute across the world due to its high mechanical strength, increased durability, and easy availability. Moreover, the furniture developed from it has a high aesthetic appeal.

Bamboo is utilized in hotels, offices, and public spaces such as playgrounds, along with its usage in dwellings. Furniture manufacturers concentrate on producing eco-friendly furniture by employing bamboo as their primary raw material. Increased global demand for woven and crocheted furniture is anticipated to fuel the growth of the furniture segment of the bamboo market with rising preferences of consumers for luxurious, natural, and elegant interior designs.

Regional Insights

Asia Pacific bamboos market dominated with a share of 79.0% in 2024. Asia Pacific is expected to remain the largest regional market for bamboo, witnessing the fastest growth over the forecast period due to the rising consumer awareness regarding the use of sustainable products, growing investment in infrastructure development, and increasing use of sustainable construction resources.

China Bamboos Market Trends

China bamboos market accounts for the largest market share of 59.3% in 2024 in Asia Pacific bamboos market due to owing to favorable climatic conditions, the country's tradition of using bamboo products, and the availability of low-cost labor. China is the largest bamboo cultivator in the world as the land is rich for bamboo cultivation. China has the most abundant bamboo resources in the world. There are over 800 species of bamboo in China. Bamboo grows in southern and central China, where most of the bamboo is found in the country. Bamboo forest in China accounts for about 5% of the total forest area and is mostly grown in mountainous areas such as Jiangxi, Fujian, Guangdong, Sichuan, Anhui, and Guangxi. China has the largest bamboo-planted area along the south Yangtze river, which is also a popular tourist place.

North America Bamboos Market Trends

North America bamboos market is expected to witness fast-paced growth, on account of the growing awareness regarding the uses of bamboo, including its edible shoots and use of older canes in a variety of applications, including landscaping and residential construction. Due to increasing awareness among manufacturers regarding the goods produced from this largely renewable resource, they have started using bamboo in innovative ways such as bamboo disposable cutleries, bamboo bottle prototypes, bamboo-based bathroom sanitary products, bamboo cricket bats, stamps, and electrical products. This is expected to augment the market growth over the forecast period.

U.S. Bamboos Market Trends

The U.S. bamboos market is expected to witness the fastest growth on account of the growing demand for industrial products coupled with the launch of innovative products in the bamboos market. The U.S. is expected to remain a major consumer in the industry owing to the rising product demand from various end-use industries. The country is expected to witness high bamboo demand owing to increasing demand for bamboo-based industrial products, furniture, bamboo shoots, and others.

Europe Bamboos Market Trends

The demand for bamboo is escalating in Europe, as it has observed ever-growing acceptance as a tropical timber replacement. Due to its strength and durability, which represent those of tropical wood while offering a similarly sustainable alternative, value-added bamboo products are growing in popularity. Bamboo plantation in the region is augmenting progressively owing to the rise in demand for bamboo products coupled with favorable growth conditions for bamboo in Spain, Portugal, Italy, and portions of the Balkans.

Benelux bamboos market is growing due to it is an economic union made up of three monarchies that border one another: Belgium, the Netherlands, and Luxembourg. The demand for bamboo is expected to escalate at a CAGR of 5.2% over the forecast period due to rising awareness related to sustainable products; increasing efforts to preserve natural resources like wood and use of bamboo as a substitute

Central & South America Bamboos Market Trends

Central & South America is expected to grow at a CAGR of 2.9% over the forecast period. This growth is attributed to the initiatives taken to protect the environment and improve the lives of poor people by creating jobs through bamboo farming and manufacturing bamboo products. The region has 429 species of bamboo and about 20 genera, which are distributed across the region.

Middle East & Africa Bamboos Market Trends

Middle Eastern countries import most of the bamboo from other regions. There has been a growing demand for sustainable and eco-friendly products in the Middle East, such as everyday-use products, textiles, flooring, furniture, handicrafts, bamboo shoots, and bamboo poles. This is expected to drive the demand for bamboo in Middle Eastern countries. Furthermore, companies like Dubai Silicon Oasis are planting bamboo to fight climate change and achieve zero emissions. Such initiatives are expected to contribute to the growth of the bamboos market in the Middle East.

Key Bamboos Company Insights

Some key companies in the bamboo industry including EcoPlanet Bamboo Group, BambooLogic Europe B.V., Guadua Bamboo, Bambu Batu, and The Best Bamboo. These companies have their own bamboo plantations worldwide to meet their product requirements and manage the cost of raw materials. Companies are involved in backward integration and tie-ups with manufacturers which allows a consistent supply of bamboo that leads to the growth of bamboo cultivators.

-

MOSO International B.V. was founded in 1997 and is headquartered in Zwaag, Netherlands. It develops and produces bamboo products for interior and exterior uses that comply with stringent technical specifications and quality guidelines, enhance aesthetic appeal of applications, and are made from sustainable, renewable resources.

-

Bamboo Australia was established in 1989 and is headquartered in Belli Park, Queensland, Australia. It is a commercial bamboo farming company that produces various bamboo products such as bamboo flooring and fencing. The company offers different variety of bamboo products, which are categorized into 3 segments such as garden, flooring, and construction. Bamboo Australia has more than 250 species of bamboo plants. Some of the species are clumping bamboo species, running bamboo species, hedging bamboo species, and edible bamboo species, out of which clumping species are the most popular among them

Key Bamboos Company Companies:

The following are the leading companies in the bamboos market. These companies collectively hold the largest market share and dictate industry trends.

- MOSO International B.V.

- Bamboo Australia

- Bamboo Village Company Limited

- Shanghai Tenbro Bamboo Textile Co., Ltd

- Simply Bamboo PTY LTD

- Xiamen HBD Industry & Trade Co., Ltd

- dassogroup

- Smith & Fong

- ANJI TIANZHEN BAMBOO FLOORING CO. LTD

- Fujian HeQiChang Bamboo Product Co., Ltd.

Recent Developments

-

In March 2020, MOSO International B.V. acquired a Germany-based company named Bambeau Becker und Groβgarten GmbH. This acquisition will allow both companies to have a more powerful presence in the international bamboos market.

-

In 2019, dassogroup established Fujian Dazhuang Bamboo Industry Co., Ltd. and Zhejiang Daocheng Bamboo Industry Co., Ltd. to increase its production capacity to keep up with the increasing market demand.

Bamboos Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 70.14 billion

Revenue forecast in 2030

USD 88.44 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Benelux; China; India; Japan; Indonesia; Vietnam; Brazil

Key companies profiled

MOSO International B.V.; Bamboo Australia; Bamboo Village Company Limited; Shanghai Tenbro Bamboo Textile Co., Ltd; Simply Bamboo PTY LTD; Xiamen HBD Industry & Trade Co. Ltd; dassogroup, Smith & Fong, ANJI TIANZHEN BAMBOO FLOORING CO. LTD; Fujian HeQiChang Bamboo Product Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bamboos Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bamboos market report based on, application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Raw Materials

-

Industrial Products

-

Furniture

-

Shoots

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Benelux

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Vietnam

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global bamboos market size was estimated at USD 67.13 billion in 2024 and is expected to reach USD 70.14 billion in 2025.

b. The global bamboos market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 88.44 billion by 2030.

b. The industrial application segment dominated the bamboos market with a share of 40.6% in 2024 due to increasing infrastructure spending worldwide to use sustainable building and construction materials.

b. Some of the key players operating in the bamboos market include MOSO International B.V., Bamboo Australia, Bamboo Village Company Limited, Shanghai Tenbro Bamboo Textile Co., Ltd, Simply Bamboo PTY LTD, Xiamen HBD Industry & Trade Co., Ltd, dassogroup, Smith & Fong, ANJI TIANZHEN BAMBOO FLOORING CO. LTD, Fujian HeQiChang Bamboo Product Co., Ltd.

b. The key factors that are driving the bamboos market include growing investments in infrastructure development and rising consumer awareness for sustainable, durable, and eco-friendly products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.