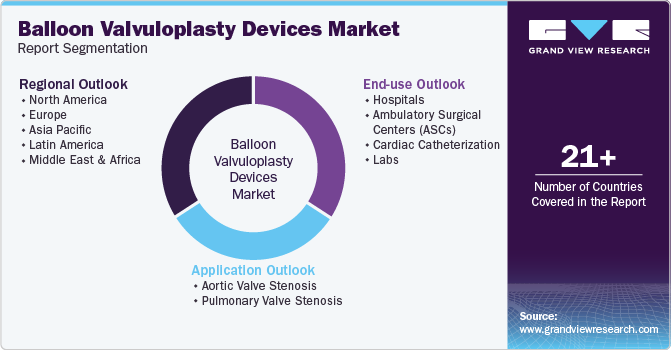

Balloon Valvuloplasty Devices Market Size, Share & Trends Analysis Report By Application (Aortic Valve Stenosis, Pulmonary Valve Stenosis), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-438-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Balloon Valvuloplasty Devices Market Trends

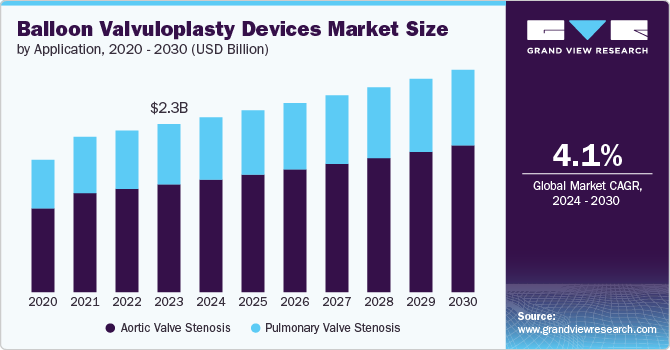

The global balloon valvuloplasty devices market size was estimated at USD 2.37 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. Rheumatic heart disease (RHD) is a serious cardiovascular condition that arises from damage to the heart valves due to rheumatic fever. The increasing prevalence of valvular heart diseases drives the market's growth. According to a World Heart Federation article published in March 2024, about 40 million people are affected globally. Rheumatic heart disease represents a significant health challenge. This condition can lead to severe valve damage, which often necessitates medical interventions. Thus, the demand for balloon valvuloplasty devices is growing.

Technological advancements fuel the market growth. According to Elsevier Inc., an article published in August 2023, advancements in balloon aortic valvuloplasty (BAV) have significantly improved its viability, particularly in the context of its use as a bridge to transcatheter aortic valve replacement (TAVR). Over the past two decades, there have been notable enhancements in balloon catheter designs, including better materials and configurations that improve procedural outcomes. In addition, advancements in ventricular pacing strategies and arterial access techniques, such as improved percutaneous femoral access, have reduced the risks associated with BAV and increased its safety profile. These developments have restored interest in BAV, particularly as a temporary measure in patients unsuitable for TAVR.

Technological progress has also made BAV more feasible, with operators becoming more comfortable with large-bore access and the overall procedure. The refinement of balloon catheters and the precision of modern imaging techniques have contributed to more successful outcomes. However, despite these improvements, there remains ongoing debate regarding the long-term efficacy of BAV, particularly as the success of TAVR raises questions about the optimal role of BAV in current medical practice.

Overview of Heart Valve Disease in the U.S. (2024)

|

Category |

Statistics/Information |

|

Prevalence of Heart Valve Disease |

2.5% of the U.S. population |

|

Prevalence in Older Adults |

13% of individuals born before 1943 |

|

Rheumatic Heart Disease Impact |

It primarily affects the mitral valve; it can also affect the aortic valve. |

|

Bicuspid Aortic Valve Prevalence |

1% to 2% of the population; more common in men |

|

2021 Rheumatic Heart Valve Disease Deaths |

3,631 deaths |

|

2021 Non-Rheumatic Heart Valve Disease Deaths |

23,143 deaths |

|

Total Non-Rheumatic Heart Valve Disease Deaths Annually |

Over 23,000 deaths in the U.S. each year |

Increasing awareness and screening programs fuel the market's growth. According to a Healio article published in February 2022, Heart Valve Disease Awareness Week, an initiative by the Global Heart Hub, plays a crucial role in promoting awareness about heart valve disease. This annual campaign, held from September 16 to 22, 2024, emphasizes the importance of routine stethoscope examinations, particularly for those over 65, to enable early detection of heart valve conditions. The campaign aims to improve early diagnosis and treatment outcomes by highlighting symptoms such as breathlessness and fatigue-commonly mistaken for signs of normal aging. Such awareness initiatives are increasing the demand for diagnostic and treatment solutions, such as balloon valvuloplasty devices, promoting early detection and timely intervention.

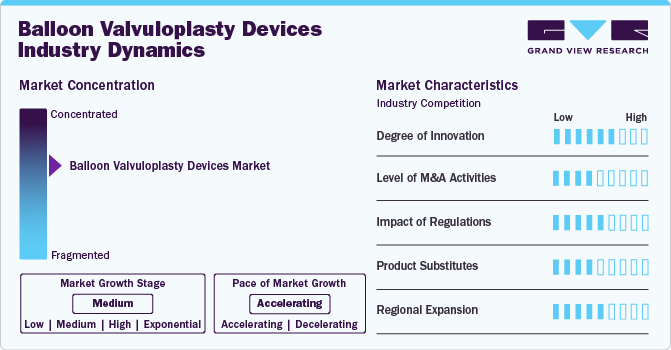

Market Concentration & Characteristics

The balloon valvuloplasty devices industry is witnessing rapid innovation, with companies introducing advanced balloon valvuloplasty devices that offer improved safety, efficacy, and patient outcomes. These innovations are crucial for the continued adoption of these devices in various healthcare settings.

Several market players, such as B. Braun Interventional Systems, Inc., BD Interventional, Edwards Lifesciences, and Boston Scientific Corporation, are involved in merger and acquisition activities. Through M&A activity, these companies employ vital strategies such as product innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for minimally invasive cardiovascular interventions. For instance, In February 2022, Boston Scientific Corporation finalized its acquisition of Baylis Medical Company Inc., which provides advanced transseptal access solutions, guidewires, sheaths, and dilators for catheter-based left-heart procedures.

Regulations significantly impact the balloon valvuloplasty devices industry by ensuring safety, efficacy, and quality standards. Stringent regulatory requirements can delay product approvals, affecting market entry and innovation. However, they also enhance patient confidence and device reliability, ultimately supporting the market's growth by ensuring that only safe and effective devices are available for clinical use.

There are currently no direct substitutes. Their role in cardiac care is critical, ensuring accurate diagnosis and effective management of valvular heart diseases.

Market players in the balloon valvuloplasty devices sector are expanding their presence by entering new geographical markets, forming strategic partnerships with local distributors, and tailoring their product offerings to align with specific regional healthcare requirements.

Application Insights

Based on application, the aortic valve stenosis segment led the market with the largest revenue share of 64.42% in 2024. The global rise in the incidence of valvular heart diseases and technological advancements drive the segment's growth. Aortic stenosis (AS) involves the narrowing of the aortic valve, often linked to processes like atherosclerosis, leading to stiffening and potential heart failure. According to an Oxford University Press article published in January 2024, severe aortic stenosis (AS) was identified in 1,069 community residents, with an incidence rate of 52.5 cases per 100,000 patient years. Men exhibited a slightly higher prevalence than women. Although the incidence of severe AS has remained stable over the past 20 years, the total number of cases has increased due to population growth. This trend highlights the growing need for balloon valvuloplasty devices, reflecting the widespread nature of aortic stenosis.

The pulmonary valve stenosis segment is expected to show at a lucrative CAGR during the forecast period. The rapid increase in the elderly population, rising incidence of cardiovascular cases, and technological advancements. According to the NCBI article published in June 2023, isolated pulmonary valve stenosis occurs in approximately 1 out of every 2,000 live births globally. While it appears alone in 7% to 12% of instances, it is more frequently linked with other congenital heart defects, present in 25% to 30% of such cases. This prevalence emphasizes the need for specialized treatments and advances in balloon valvuloplasty devices, particularly for managing pulmonary valve stenosis. The associated congenital conditions and the varying presentation of pulmonary stenosis highlight a significant demand for innovative, minimally invasive solutions in this market segment, driving growth and development in balloon valvuloplasty technologies.

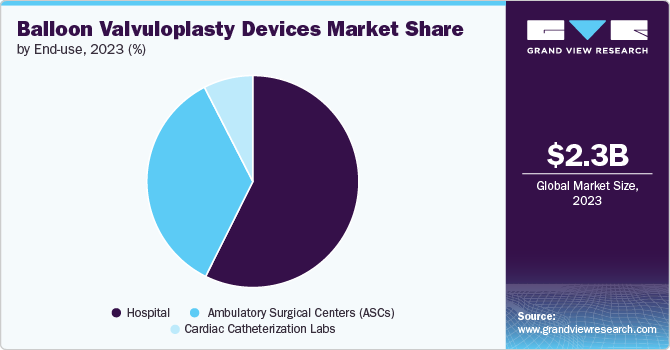

End Use Insights

Based on end use, the hospital segment led the market with the largest revenue share of 57.4% in 2024. The rising incidence of valvular heart diseases globally necessitates advanced solutions within hospitals to manage patient care effectively. Hospitals play a crucial role in intricate valvuloplasty procedures, including mitral valvuloplasty for treating mitral valve stenosis. This minimally invasive procedure is usually conducted in a hospital environment by skilled interventional cardiologists. According to an article published by the Icahn School of Medicine at Mount Sinai, balloon valvuloplasty is increasingly utilized for elderly patients who suffer from severe aortic or mitral valve stenosis. It allows patients to avoid more invasive treatments while typically requiring only a one-night hospital stay. Treating effectively high-risk patients with minimal recovery time improves hospital efficiency and optimizes resource allocation, leading to a greater demand for balloon valvuloplasty devices in the medical field.

The cardiac catheterization labs center segment is expected to grow at the fastest CAGR during the forecast period. These specialized labs are equipped to perform intricate procedures, including balloon valvuloplasty, which involves inflating a balloon to treat narrowed heart valves. According to the article by Elsevier Inc., in January 2024, the growth of cardiac catheterization labs (CCLs) is driven by the development and implementation of quality assurance (QA) and quality improvement (QI) initiatives that enhance patient safety and optimize care. The establishment of national registries and quality metrics, such as appropriate use criteria (AUC) for revascularization, enables CCLs to benchmark performance against national standards and identify areas for improvement. In the context of value-based payment systems, the focus on quality metrics by payors further supports the expansion of CCLs as they strive to meet high standards of care and continuously improve patient outcomes.

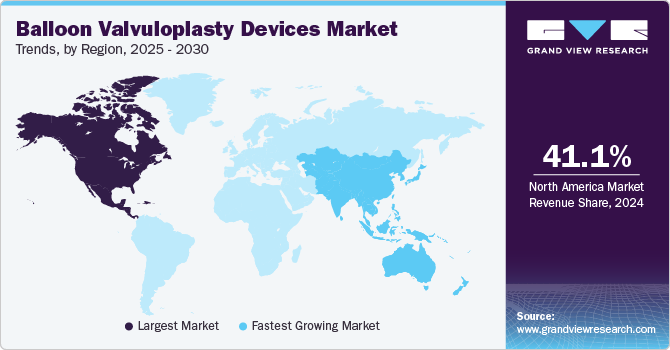

Regional Insights

North America balloon valvuloplasty devices industry dominated the market with the largest revenue share of 41.1% in 2024. The rising cases of cardiovascular diseases, including valvular heart diseases, product launches, regulatory approvals, and advanced healthcare infrastructure, drive the demand for balloon valvuloplasty devices in North America. According to an American Heart Association, Inc., article published in April 2024, valvular heart disease (VHD) is one of the most common diseases in the U.S., affecting approximately 2.5% of adults. Among the various types of VHD, aortic and mitral valvular diseases are the most frequently diagnosed.

U.S. Balloon Valvuloplasty Devices Market Trends

The U.S. balloon valvuloplasty devices market accounted for the largest revenue share of 84.0% in North America in 2024. Rising RHD mortality in the U.S. fuels the market growth. According to an American Heart Association article published in January 2024, from 1999 to 2020, the U.S. recorded 141,137 deaths attributed to rheumatic heart disease (RHD), with the mortality rate showing a slight decline from 4.05 per 100,000 population in 1999 to 3.12 per 100,000 in 2020. Despite this overall decrease, there has been a notable increase in the age-adjusted mortality rate (AAMR) between 2017 and 2020, with an annual percent change (APC) of 6.62%. This rising trend in mortality rates emphasizes ongoing concerns about RHD and highlights a growing need for effective treatment solutions. As a result, the demand for balloon valvuloplasty devices in the U.S. is expected to grow, driven by the need to treat severe valvular conditions and enhance patient outcomes.

Europe Balloon Valvuloplasty Devices Market Trends

The balloon valvuloplasty devices market in Europe accounted for the second-largest revenue market share in 2024. The high mortality rate from cardiovascular diseases boosts demand for balloon valvuloplasty devices in Europe. According to the WHO article published in May 2024, cardiovascular diseases (CVDs) are the leading cause of premature death and disability in the European region, responsible for over 42.5% of all deaths annually.

Europe Total Cath Labs (Per Million People in 2023)

|

Country |

Total Cath Labs (Per Million People) |

|

Germany |

11.8 |

|

Italy |

7.3 |

|

Spain |

4.7 |

|

Sweden |

5 |

|

UK |

4.7 |

The Germany balloon valvuloplasty devices market dominated with the largest revenue share of 23.4% in Europe in 2024. The rising number of valvular heart diseases and the technological advancements in balloon valvuloplasty devices drive the market growth. According to the Medscape article published in October 2023, in Germany, deaths from heart valve diseases were 19,872 in 2020 and 20,453 in 2021, reflecting a consistently high level of severity. This persistent need for effective treatment drives demand for balloon valvuloplasty devices as key interventions for managing heart valve conditions.

The balloon valvuloplasty devices market in the UK held the second-largest market share in Europe in 2024. The rise in valvular heart diseases and technological advancements highlight the need for continued innovation and healthcare technology advancements to reduce this trend effectively, according to a BMJ Publishing Group Ltd & British Cardiovascular Society article published in June 2023, a study analyzing data collected from the UK Biobank between 1 January 2000 and 30 June 2020 has provided insights into the incidence rates of valvular heart diseases (VHD) in the UK. The findings indicate that the overall incidence of any VHD is 16.3 cases per 10,000 person-years. Among the various types of VHD, mitral regurgitation (MR) is the most common, with an incidence rate of 8.2 cases per 10,000 person-years, followed by aortic stenosis (AS) at 7.2 cases per 10,000 person-years and regurgitation (AR) with an incidence rate of 5.0 cases per 10,000 person-years.The term "person-years" refers to the cumulative amount of time that all participants in the study were observed.

The France balloon valvuloplasty devices market is anticipated to witness at a significant CAGR of 5.1% over the forecast period. The rising prevalence of cardiovascular diseases and technological advancements fuel market growth. According to the Foundation de France article, In France, cardiovascular diseases are the second leading cause of death, significantly impacting mortality rates. With a cardiovascular event occurring every four minutes, the high incidence of these conditions drives demand for effective treatments.

Asia Pacific Balloon Valvuloplasty Devices Market Trends

The balloon valvuloplasty devices market in Asia Pacific is expected to grow at the fastest CAGR of 6.2% over the forecast period. Increasing research and development (R&D) investments, rising geriatric population, and advanced cardiac care technologies are significant market expansion drivers. The growing elderly population in the Asia Pacific region is another major factor contributing to the market growth. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, approximately 697 million individuals aged 60 years or older live in Asia and the Pacific region, constituting approximately 60% of the global older population.

The China balloon valvuloplasty devices market accounted for the second-largest share in Asia Pacific in 2024. China's growing burden of valvular heart disease fuels the demand for balloon valvuloplasty devices. According to the Chinese Medical Association article published in December 2023, the prevalence of these diseases, estimated at 3.8% and roughly 25 million cases, presents an extensive driver for market growth. This high prevalence underscores the increasing demand for effective, minimally invasive treatment options such as balloon valvuloplasty, driving market expansion and technological advancements in the region.

The balloon valvuloplasty devices market in Japan held the largest market share in the Asia Pacific in 2024. The rising geriatric population is more susceptible to valvular heart disease cases, increasing cardiac surgery patients, and technological advancements. According to theElsevier Inc. article published in July 2023, in Japan, the high prevalence of valvular heart disease (VHD) is a key factor driving the market growth. Among these, aortic stenosis (AS) was the most frequently treated condition. 4% of patients undergo invasive treatments. AS primarily affects older individuals, often those aged 85 and above. The significant number of VHD cases and the aging population highlight the increasing demand for balloon valvuloplasty as a viable treatment option, contributing to the market's expansion in Japan.

The India balloon valvuloplasty devices market is experiencing significant growth, driven by several key factors, such as growing awareness of advanced cardiac care options, increasing incidence of rheumatic heart disease, expanding healthcare infrastructure, and technological advancements. For instance, in August 2024, In India, the substantial prevalence of rheumatic heart disease (RHD), affecting approximately 1.5 million individuals, presents a key driver for the market growth. With a mortality rate of 4.7% per patient-year, the urgent need for effective treatment options is marked. The fact that women constitute around 72% of RHD patients highlights a critical segment of the population requiring advanced, minimally invasive procedures. As the demand for effective management of severe valvular conditions grows, balloon valvuloplasty devices are expected to increase adoption in India, driving market expansion.

Latin America Balloon Valvuloplasty Devices Market Trends

The balloon valvuloplasty devices market in Latin America is growing due to several factors. Increasing investments by key companies in the Latin America market and the rising prevalence of valvular heart diseases fuel the market growth. According to the Scielo article, in November 2023, in Latin America, the growing incidence of valvular disease (VD), currently at 2.5% in the general population, underscores a significant driver for the market growth. The increasing incidence of degenerative VD, particularly among older adults, highlights the rising demand for effective, minimally invasive treatment options.

The Brazil balloon valvuloplasty devices market is expanding due to several distinct growth drivers. Rising healthcare expenditure and government initiatives aimed at improving cardiac care infrastructure. For instance, in September 2023, the Brazilian government and various institutions launched initiatives to enhance care and outcomes for cardiovascular disease (CVD) patients. An important example includes Mount Sinai's collaboration with the Brazilian Clinical Research Institute to advance cardiovascular disease research and medical education. These efforts reflect a concerted push towards improving healthcare standards, fostering innovation, and expanding knowledge in managing CVD within Brazil.

Middle East & Africa Balloon Valvuloplasty Devices Market Trends

The balloon valvuloplasty devices market in the Middle East & Africa is expected to grow at a lucrative CAGR during the forecast period, due to the rising prevalence of valvular heart diseases and the increasing adoption of advanced medical technologies in the region.

The Saudi Arabia balloon valvuloplasty devices market is expected to grow at a significant CAGR over the forecast period. Increasing valvular heart diseases, rising healthcare expenditure, and the strategic initiatives by the key players contribute to the market expansion. According to the Cureus article published in January 2024, in Saudi Arabia, the prevalence of rheumatic heart disease (RHD) among cardiac patients, reported at 8% in a study involving 1,364 participants, represents a significant growth driver for the market growth. The substantial proportion of patients with RHD, a condition often associated with severe valve stenosis, creates a growing demand for effective treatment options. This market potential is further enhanced by the need for minimally invasive procedures, such as balloon valvuloplasty, to address the high prevalence of RHD and improve patient outcomes.

Key Balloon Valvuloplasty Devices Company Insights

Some of the key players operating in the industry include B. Braun Interventional Systems, Inc., BD, Edwards Lifesciences Corporation., and Boston Scientific Corporation. The key strategies of the companies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. The companies are also investing in their R&D capacities to expand their market footprint.

For instance, in February 2024, Medtronic announced the expansion of its R&D center in Hyderabad, India. It is part of the USD 350 million five year investment plan of the company that aims to expand its global R&D footprint and drive innovation. Moreover, TORAY INTERNATIONAL AMERICA, INC. and Stryker are some of the emerging players in balloon valvuloplasty devices.

Key Balloon Valvuloplasty Devices Companies:

The following are the leading companies in the balloon valvuloplasty devices market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun Interventional Systems, Inc.

- BD

- Edwards Lifesciences Corporation.

- Boston Scientific Corporation

- Getinge

- TORAY INTERNATIONAL, INC.

- Stryker

- BrosMed Medical Co., Ltd.

- Medtronic

- Terumo Corporation

- Koninklijke Philips N.V.

Recent Developments

-

In September 2024, Toray Medical Co., Ltd. introduced the INOUE BALLOON A, a device designed for use in balloon aortic valvuloplasty (BAV) procedures to treat patients with aortic stenosis.

-

In April 2023,the Ministry of Food and Drug Safety (MFDS) announced that it has granted rare medical device status to the Z-med II Percutaneous Transluminal Valvuloplasty Catheter. This balloon-expandable valve catheter is intended to support patients needing an aortic valve replacement.

-

In January 2023, Abbott received FDA approval for its new Navitor TAVI system, designed for patients with severe aortic stenosis who face high or extreme risks with open-heart surgery. This latest addition to Abbott’s transcatheter structural heart portfolio offers a less invasive alternative for treating severe heart conditions.

Balloon Valvuloplasty Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.47 billion |

|

Revenue forecast in 2030 |

USD 3.02 billion |

|

Growth rate |

CAGR of 4.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

B. Braun Interventional Systems, Inc.; BD; Edwards Lifesciences Corporation.; Boston Scientific Corporation; Getinge; TORAY INTERNATIONAL AMERICA, INC.; Stryker; BrosMed Medical Co., Ltd.; Medtronic; Terumo Corporation; Koninklijke Philips N.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Balloon Valvuloplasty Devices Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global balloon valvuloplasty devices market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aortic Valve Stenosis

-

Pulmonary Valve Stenosis

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Cardiac Catheterization Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global balloon valvuloplasty devices market size was estimated at USD 2.37 billion in 2024 and is expected to reach USD 2.47 billion in 2025.

b. The global balloon valvuloplasty devices market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 3.02 billion by 2030.

b. North America dominated the balloon valvuloplasty devices market with a share of 41.1% in 2024. The rising cases of cardiovascular diseases, including valvular heart diseases, product launches, regulatory approvals, and advanced healthcare infrastructure, drive the demand for balloon valvuloplasty devices in North America

b. Some of the key players operating in the industry include B. Braun Interventional Systems, Inc., BD Interventional, Edwards Lifesciences, and Boston Scientific Corporation.

b. Key factors that are driving the market growth include the increasing prevalence of valvular heart diseases and Technological advancements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."