Ballast Water Treatment Systems Market Size, Share & Trends Analysis Report By Vessel Type (Bulk Carriers, Oil Tankers, Container Ships, General Cargo Ships, Gas Carriers), By System Type, By Application, By Capacity, By Geography, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-523-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

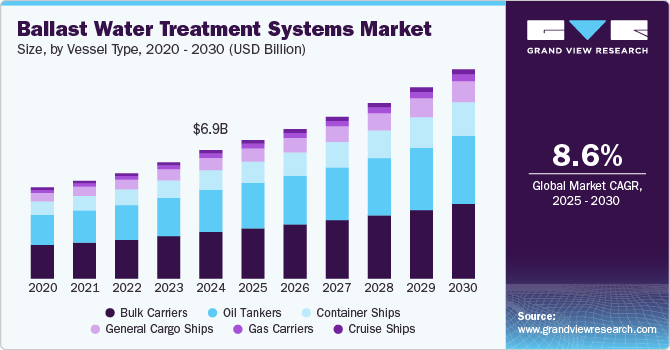

The global ballast water treatment systems market size was estimated at USD 6.94 billion in 2024 and is projected to grow at a CAGR of 8.6% over the forecast period from 2025 to 2030. The global ballast water treatment systems industry’s growth is driven by increasing environmental regulations, particularly the International Maritime Organization's (IMO) Ballast Water Management Convention, which requires ships to treat ballast water to prevent the spread of invasive species. Growing awareness of environmental sustainability and the need for cleaner oceans are also driving demand for advanced ballast water treatment technologies.

The Ballast Water Management Convention (BWM Convention), adopted by the International Maritime Organization (IMO) in 2004, aims to prevent the spread of harmful aquatic organisms and pathogens by regulating the management of ballast water and sediments on ships. As of July 15, 2021, the Convention has been ratified by 86 countries, representing 91.12% of the global merchant fleet's gross tonnage. The Convention came into force on September 8, 2017, and mandates that all ships in international traffic manage ballast water and sediments according to specific standards, with these standards being phased in over time. The ultimate requirement is for all ships to install approved ballast water treatment systems to ensure compliance.

The impact of the BWM Convention on the global ballast water treatment systems industry has been profound, driving substantial growth and innovation in the industry. The treaty has created a strong demand for compliant ballast water treatment solutions as shipping companies worldwide must retrofit or install new systems to meet these international standards. With enforcement of the Convention increasing, shipowners and operators are investing in advanced, reliable, and cost-effective treatment technologies to avoid penalties and ensure sustainable operations. This regulatory pressure continues to fuel innovation, prompting manufacturers to develop systems that are more efficient, environmentally friendly, and adaptable to diverse water conditions. As the global fleet works to comply with the BWM Convention, the ballast water treatment systems market is experiencing sustained growth, spurred by both regulatory compliance and a heightened focus on environmental sustainability.

Market Concentration & Characteristics

The global ballast water treatment system market is consolidated, with a few large multinational companies holding significant market share. This concentration is driven by the high capital investment and specialized technology required to meet the stringent environmental regulations imposed by the International Maritime Organization (IMO) and other national authorities. These major players dominate the market due to their ability to develop and deploy advanced, cost-effective, and regulatory-compliant treatment systems for both new ships and retrofitting existing vessels.

Innovation in the ballast water treatment system industry is primarily focused on improving system efficiency, reducing operational costs, and ensuring compliance with international regulations. As environmental concerns over invasive species and marine biodiversity grow, leading manufacturers are investing in new technologies that offer better performance in varying water conditions and enhanced environmental sustainability. This innovation is crucial for companies looking to stay competitive and maintain their market position in a highly regulated and evolving industry.

Despite the dominance of large players, regional suppliers are finding success in niche markets, particularly in emerging economies where the demand for ballast water treatment systems is growing. These smaller players often offer more affordable solutions and cater to specific regional needs. However, the complexity of the systems and the regulatory requirements act as barriers to entry for new companies. To maintain their competitive advantage, the leading players in the market must continue innovating and adapting to regulatory changes, ensuring their systems are both efficient and environmentally friendly.

Drivers, Opportunities & Restraints

The ballast water treatment system market is primarily driven by increasing global trade and shipping activity, which has led to a greater need for efficient systems to prevent the spread of invasive species through ballast water. The International Maritime Organization (IMO) Ballast Water Management Convention, which mandates that vessels treat their ballast water before discharge, has been a significant driver for the adoption of these systems.

The high initial cost of installing ballast water treatment systems and the complexity of retrofitting existing vessels can act as a restraint for the market. Additionally, concerns about system performance under various water conditions and operational challenges could slow adoption rates in certain regions or fleets.

There are significant opportunities in the development of advanced, cost-effective, and energy-efficient ballast water treatment technologies. As international regulations tighten and enforcement becomes more stringent, the need for innovative and compliant systems will grow. Additionally, the expansion of the maritime industry in emerging markets presents opportunities for market growth in regions where shipping and trade are increasing.

Vessel Type Insights

The bulk carriers segment dominated the market accounting for a 36.5% market share in 2024 driven by the global rise in trade of bulk commodities like coal, iron ore, and grain. As bulk carriers frequently travel long distances, the need to comply with the Ballast Water Management Convention (BWM Convention) ensures they adopt effective treatment solutions to prevent the spread of invasive species.

Container ships are crucial to global trade, and with increasing traffic in international shipping lanes, regulatory pressure on ballast water management is intensifying. The demand for treatment systems on container ships is driven by the need to comply with environmental regulations like the IMO's BWM Convention, which necessitates the installation of treatment systems to prevent the transfer of harmful aquatic species.

System Type Insights

The filtration segment dominated the market in 2024 accounting for a 31.5% market share in 2024. Filtration systems for ballast water treatment are in demand due to their ability to effectively remove suspended solids and microorganisms from ballast water, making them a key component of compliant ballast water management. As regulations tighten and the need for efficient and reliable treatment solutions rises, filtration systems offer a cost-effective, low-maintenance option for many vessel operators, especially for ships operating in cleaner water conditions or with lower levels of contamination.

Deoxygenation systems, which remove oxygen from ballast water to prevent the survival of invasive species, are increasingly sought after due to their efficiency in preventing biological contamination. Particularly effective in certain water conditions, these systems are seen as vital for vessels operating in sensitive or environmentally protected areas. The growing emphasis on eco-friendly solutions, coupled with strict regulatory requirements, is pushing vessel operators to adopt deoxygenation systems that offer high performance in minimizing invasive species threats.

Capacity Insights

The 250-500 cubic meters per hour segment dominated the market in 2024 accounting for a 28.5% market share in 2024 driven by the need for medium-sized vessels, such as general cargo ships, to meet regulatory standards while maintaining operational efficiency. This capacity range is suitable for a wide variety of vessels, offering a balance of treatment performance and cost-effectiveness. With rising global trade and the need for more ships to comply with ballast water management regulations, demand for systems in this capacity range is growing rapidly.

Ballast water treatment systems with a capacity of below 250 cubic meters per hour are in demand for smaller vessels and those operating in niche markets. This capacity range is particularly attractive for vessels with limited ballast water volumes, such as smaller freighters, fishing vessels, and cruise ships, where a compact and efficient treatment solution is essential. Regulatory pressure, coupled with the need to adhere to international standards, drives the adoption of these smaller-scale systems.

Application Insights

The stationary segment dominated the market in 2024, accounting for a 74.5% market share in 2024. Stationary ballast water treatment systems are favored for vessels that operate in controlled and consistent environments, such as large cargo ships or oil tankers. These systems are designed for permanent installation, offering high capacity and operational efficiency for long-term use. The growing number of vessels requiring retrofits and upgrades to meet global environmental standards has led to an increase in demand for stationary systems that offer long-term reliability and compliance with the Ballast Water Management Convention.

Portable ballast water treatment systems are gaining traction due to their flexibility, cost-effectiveness, and ease of installation on various vessel types. These systems allow for the retrofitting of smaller vessels or ships operating on less frequent international trade routes, where permanent installations may not be required. As shipping companies seek more adaptable and scalable solutions to meet regulatory requirements without incurring high installation costs, portable systems are becoming an increasingly popular choice.

Regional Insights

The ballast water treatment systems industry in Asia Pacific dominated in terms of global revenue share in 2024 accounting for 40.6%. The region is experiencing rapid growth in shipping activity, with countries like China, Japan, and South Korea being major maritime hubs. Increasing regulatory pressure and the region’s rising environmental concerns are driving demand for ballast water treatment systems. The growing maritime industry in countries such as India, along with expanding trade routes, presents a significant opportunity for market growth in this region.

The China ballast water treatment systems market is projected to expand at a CAGR of 9.8% over the forecast period. China, as the largest shipping hub in the world, presents enormous potential for ballast water treatment system growth. The country is gradually increasing its compliance with international maritime regulations, including ballast water management. With a booming maritime trade industry and growing environmental awareness, China is expected to see strong market demand for ballast water treatment systems.

The ballast water treatment systems market in Singapore is projected to grow at a CAGR of 10% over the forecast period. The market is growing rapidly, driven by the country’s strategic position as a global shipping hub. As a key maritime nation, Singapore has stringent environmental regulations in line with the IMO's Ballast Water Management Convention, which compels ships operating in its ports to adopt compliant treatment systems.

North America Ballast Water Treatment Systems Market Trends

In North America, the ballast water treatment systems industry’s growth is driven by strict environmental regulations and the increasing focus on sustainable maritime practices. The United States, in particular, has implemented regulations that align with international standards, leading to a rising demand for ballast water treatment systems. As shipping volumes continue to increase, the market is expected to grow further, with both Filtration fleets and government vessels adopting cleaner technologies to meet compliance.

North America Ballast Water Treatment Systems Market Trends

The U.S. ballast water management industry is projected to expand at a CAGR of 6.7% over the forecast period. The country's market is driven by its stringent regulatory framework and large maritime industry. The U.S. Coast Guard has been actively involved in enforcing ballast water management regulations, prompting shipping companies to invest in compliance technologies. As the market shifts towards more sustainable practices, demand for ballast water treatment systems is expected to increase.

Europe Ballast Water Treatment Systems Market Trends

Europe is a significant player in the ballast water treatment system industry, with its growth driven by the region’s proactive environmental policies and sustainability goals. The European Union’s stringent environmental standards and maritime regulations compel shipping companies to adopt advanced treatment systems. As a result, there is a strong push for compliance, innovation, and the development of eco-friendly technologies across European countries.

The Germany ballast water treatment systems market is projected to expand at a CAGR of 8.6% over the forecast period. German shipping companies are investing in advanced ballast water treatment technologies to comply with both national and international regulations. Germany’s position as a maritime leader in Europe drives significant demand for efficient and eco-friendly solutions.

The ballast water treatment systems market in Greece is expected to grow at a CAGR of 8.3% over the forecast period due to the country’s prominent position in global shipping. Greece has one of the largest merchant fleets in the world, which is subject to stringent international regulations, including the IMO's Ballast Water Management Convention.

Middle East & Africa Ballast Water Treatment Systems Market Trends

In the Middle East and Africa, the ballast water treatment systems industry growth is fueled by the region’s strategic position in global shipping routes and its growing investment in port infrastructure. The adoption of international ballast water treatment regulations is gradually increasing, leading to more widespread implementation of treatment systems in the shipping sector. However, the market may face challenges due to inconsistent enforcement of environmental standards across the region.

The Saudi Arabian ballast water treatment systems market is projected to expand at a CAGR of 9.6% over the forecast period. The nation’s strategic position in global shipping routes and its investment in maritime infrastructure are driving demand for ballast water treatment systems. As the country looks to enhance its environmental standards in line with international regulations, the market for ballast water treatment systems is expected to grow, particularly in the shipping and oil sectors.

Latin America Ballast Water Treatment Systems Market Trends

Latin America is witnessing growth in its ballast water treatment system industry due to expanding shipping routes and increasing international trade. However, some countries in the region are still in the early stages of implementing stringent environmental regulations, creating a gap in demand. As regulatory frameworks strengthen, the market for ballast water treatment systems is expected to expand.

The ballast water treatment systems market in Brazil is projected to grow at a CAGR of 8.8% over the forecast period. Brazil’s growing role in the global shipping network, particularly in the export of commodities like soybeans, iron ore, and oil, has led to higher scrutiny on ballast water management in its ports. As Brazil aligns with the IMO’s Ballast Water Management Convention, there is a rising demand for treatment systems to ensure compliance with international regulations.

Key Ballast Water Treatment Systems Company Insights

Some of the key players operating in the market include Alfa Laval. and Veolia among others.

-

Alfa Laval is a global company engaged in providing specialized products and solutions in heat transfer, separation, and fluid handling. The company operates across three main divisions: Energy, Food & Water, and Marine. It serves various industries including chemicals, oil & gas, food, and wastewater treatment.

-

Veolia is a multinational company engaged in the designing and distribution of water, waste, and energy management solutions. It operates through three business segments, namely water management, waste management, and energy management.

Key Ballast Water Treatment Systems Companies:

The following are the leading companies in the ballast water treatment systems market. These companies collectively hold the largest market share and dictate industry trends.

- Wärtsilä

- ALFA LAVAL

- Evac

- Auramarine Ltd

- Veolia

- Coldharbour Marine Ltd.

- GenSys GmbH

- Damen Shipyards Group

- Hyde Marine Inc.

- MH Systems Inc.

- NEI Treatment Systems

- Optimarin AS

Recent Developments

-

In January 2025, Scienco/FAST and UniBallast B.V. introduced the InTankFITT Container, a containerized version of their filterless Ballast Water Treatment System (BWTS), InTank. This portable system is designed to ensure regulatory compliance and operational efficiency, housing a preassembled treatment system within a standard shipping container, making it suitable for shared use across multiple vessels or for temporary applications.

-

In July 2023, Wärtsilä introduced its Aquarius UV Ballast Water Management System (BWMS) with a brand-new filtration solution. Developed in collaboration with their partner Filtersafe Automatic Screen Filtration, the Manta filter incorporates a unique OneMotion scanner that cleans the screen with just one rotation. Tests have demonstrated that the 'Manta' filter effectively cleans the screen quickly and efficiently, even when faced with high dirt loads.

Ballast Water Treatment Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 7.48 billion |

|

Revenue forecast in 2030 |

USD 11.31 billion |

|

Growth rate |

CAGR of 8.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Vessel type, system type, capacity, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Greece; UK; Germany; France; Italy; Spain; China; India; Japan; Singapore; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Wärtsilä; ALFA LAVAL; Evac; Auramarine Ltd; Veolia; Coldharbour Marine Ltd.; GenSys GmbH; Damen Shipyards Group; Hyde Marine Inc.; MH Systems Inc.; NEI Treatment Systems; Optimarin AS |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Ballast Water Treatment Systems Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ballast water treatment systems market report based on vessel type, system type, capacity, application, and region:

-

Vessel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bulk Carriers

-

Oil Tankers

-

Container Ships

-

General Cargo Ships

-

Gas Carriers

-

Cruise Ships

-

-

System Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Filtration

-

Chemical Disinfection

-

UV Treatment

-

Deoxygenation

-

Heat Treatment

-

Ultrasonic Treatment

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 250 cubic meters per hour

-

250 -500 cubic meters per hour

-

501-750 cubic meters per hour

-

751-1000 cubic meters per hour

-

Above 1000 cubic meters per hour

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Portable

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Spain

-

France

-

Germany

-

Italy

-

Greece

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ballast water treatment systems market size was estimated at USD 6.94 billion in 2024 and is expected to reach USD 7.48 billion in 2025.

b. The global ballast water treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 11.31 billion by 2030.

b. The Asia Pacific market dominated in 2024, accounting for 40.6% of the market share, driven by the region's booming shipping industry and stringent environmental regulations. With major maritime nations like China, Japan, and South Korea adopting stricter compliance standards, the demand for ballast water treatment solutions is expected to rise significantly across the region.

b. Some of the key players operating in the ballast water treatment systems market are Wärtsilä, ALFA LAVAL, Evac, Auramarine Ltd, Veolia, Coldharbour Marine Ltd., GenSys GmbH, Damen Shipyards Group, Hyde Marine Inc., MH Systems Inc., NEI Treatment Systems, and Optimarin AS.

b. The key factors driving the ballast water treatment systems market are strict international regulations like the IMO's Ballast Water Management Convention, which require ships to treat ballast water, and the growing focus on environmental sustainability to prevent the spread of invasive species.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."