Baler Market Summary

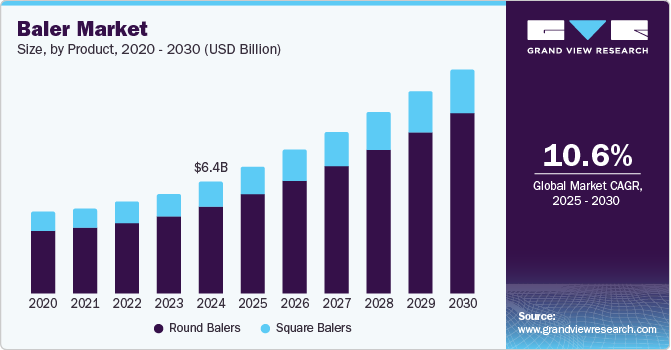

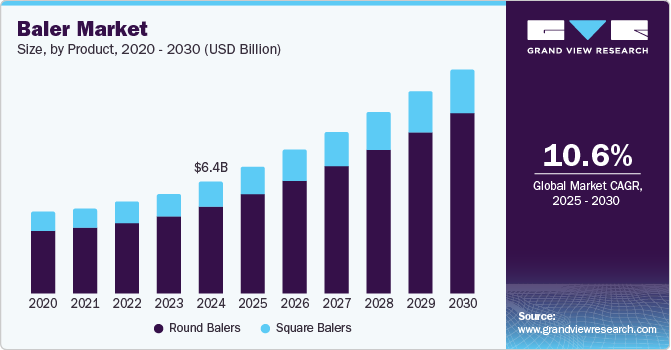

The global baler market size was estimated at USD 6,404.7 million in 2024 and is projected to reach USD 11,902.8 million by 2030, growing at a CAGR of 10.6% from 2025 to 2030. Balers are used for baling hay and compressing raked and cut crops.

Key Market Trends & Insights

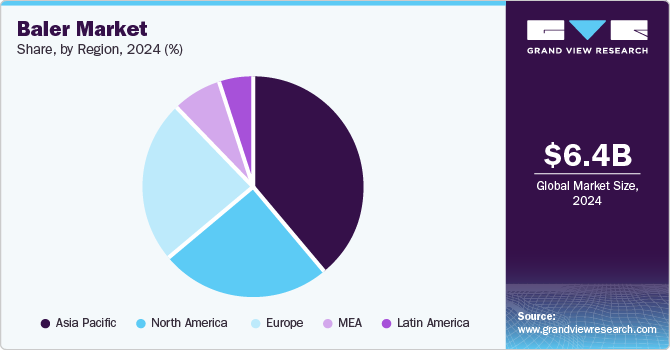

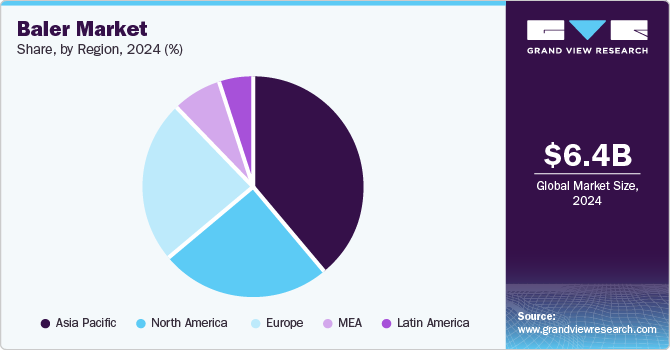

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, round balers accounted for a revenue of USD 4,128.7 million in 2024.

- Round Balers is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 6,404.7 Million

- 2030 Projected Market Size: USD 11,902.8 Million

- CAGR (2025-2030): 10.6%

- Asia Pacific: Largest market in 2024

Technological advancements in the agricultural industry aim at improving farm yield and fulfilling the increasing demand for food are driving the market. The increasing demand for efficient waste management solutions is a major driver, as balers help compact recyclable materials such as cardboard, plastic, and paper, making storage and transportation more efficient. Additionally, evolving agricultural practices and the growing need for bioenergy production are contributing to the market's expansion.

Agricultural balers play a crucial role in ensuring feed supply for livestock animals. Similarly, they provide added convenience to the farmers by aiding transportation, storing straw and hays, and ensuring enough fodder for the livestock. The aforementioned benefits of balers in livestock farming are encouraging livestock farmers to opt for agricultural balers.

Rising demand from the Asia Pacific is anticipated to be a prominent factor in augmenting market growth in the next seven years. The increasing regional demand is attributed to the government's and OEMs' growing investments in developing advanced mechanization in the agriculture sector in India, Australia, and Southeast Asia. The growing need for technological development in the agricultural sector is also responsible for driving the regional market.

Product Insights

Round balers dominated the market with the largest revenue share of 57.1% in 2024. his is attributed to the lower power requirement of mini round bales as compared to the square balers. Round balers are very popular among farmers as they are easy to use and require lesser operation adjustments. Additionally, round balers produce bales with higher weather resistance than square bales, making them a preferred choice among farmers who need to store bales for a more extended period.

The square balers are expected to grow at a significant CAGR of 9.6% over the forecast period. This growth is largely driven by their ability to produce compact, uniform bales that are easier to handle, store, and transport compared to round bales. They are particularly favored in regions with limited storage space, and bale size precision is crucial for efficient stacking and storage. Advances in baler technology, such as automation and improved durability, are also contributing to the increasing adoption of square balers in the agricultural industry.

Regional Insights

Asia Pacific baler industry dominated the global market with the largest revenue share of 39.4% in 2024. This dominance can be attributed to the region's extensive agricultural activities and the increasing adoption of advanced farming technologies. Countries like China, India, and Japan are major contributors to this growth, driven by their large agricultural sectors and the need for efficient waste management solutions. The growing focus on sustainable farming practices and government initiatives to support modern agricultural techniques also play a crucial role in the market's expansion in this region.

Europe Baler Market Trends

Europe baler industry held a considerable share in 2024. The region's strong agricultural sector, advancements in farming technologies, and a heightened focus on sustainability and waste management. Countries such as Germany, France, and the UK have been at the forefront of adopting modern baler technologies, which enhance efficiency and productivity. The support from government initiatives aimed at promoting sustainable agricultural practices and efficient waste handling has also played a crucial role in the industry's growth in Europe.

North America Baler Market Trends

The North American baler industry is expected to grow at a significant CAGR of 11.0% over the forecast period. This surge is driven by the increasing adoption of advanced baling technologies and the growing emphasis on efficient waste management and recycling processes. The agricultural sector in North America is also witnessing a shift towards more sustainable and productive farming practices, including modern balers.

The U.S. baler industry is expected to grow significantly over the forecast period owing to the increasing demand for efficient agricultural practices, advancements in baler technology, and a strong emphasis on recycling and waste management. The U.S. agricultural sector's need for effective crop management solutions and the rising awareness of sustainable practices are also contributing to this positive outlook.

Key Baler Company Insights

Some key companies in the baler market include AGCO Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, and others.

-

AGCO Corporation offers a range of hay and forage solutions, including the MF LB 2200 Large Square Baler Range, Fendt Rotana V Round Baler Range, and MF SB 1840 Small Square Baler Range. It also provides various mowers, tedders, rakes, forage harvesters, and windrowers designed for different scales of operations, ensuring high-quality, nutrient-rich hay and efficient field operations.

-

CLAAS KGaA mbH is known for its innovative and high-quality balers. It offers round and square balers equipped with advanced technologies such as GPS tracking, moisture sensors, and automatic density adjustment to enhance operational efficiency.

Key Baler Companies:

The following are the leading companies in the baler market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- IHI Corporation

- KUHN SAS

- KUBOTA Corporation

- Maschinenfabrik Bernard KRONE GmbH & Co.KG

- Mahindra & Mahindra Ltd.

- SDF Group

Baler Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 7.18 billion

|

|

Revenue forecast in 2030

|

USD 11.90 billion

|

|

Growth Rate

|

CAGR of 10.6% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE

|

|

Key companies profiled

|

AGCO Corporation; CLAAS KGaA mbH; CNH Industrial N.V.; Deere & Company; IHI Corporation; KUHN SAS

KUBOTA Corporation; Maschinenfabrik Bernard KRONE GmbH & Co.KG; Mahindra&Mahindra Ltd.; SDF Group

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Baler Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baler market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Round Balers

-

Square Balers

-

Small Square Balers

-

Large Square Balers

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)