- Home

- »

- Consumer F&B

- »

-

Bakery Premixes Market Size, Share & Trends Report, 2030GVR Report cover

![Bakery Premixes Market Size, Share & Trends Report]()

Bakery Premixes Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Complete Mix, Dough Mix), By Application (Cakes & Pastries, Cookies & Biscuits), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-343-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bakery Premixes Market Summary

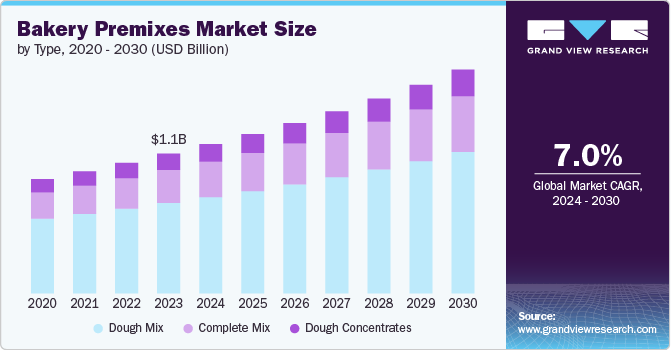

The global bakery premixes market size was estimated at USD 1.14 billion in 2023 and is projected to reach USD 1.82 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. The growth in the market is primarily driven by the emerging trend of incorporating functional ingredients to enhance nutritional value.

Key Market Trends & Insights

- The Europe accounted for a market share of 31.0% in 2023.

- Based on type, the dough mix segment accounted for a market share of 64% of the global revenues in 2023.

- Based on application, the cookies & biscuits premixes segment accounted for a market share of 58% of the global revenue in 2023.

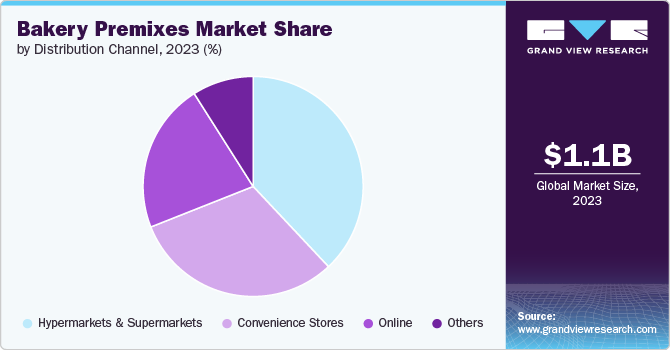

- Based on distribution channel, the supermarkets & hypermarkets accounted for a share of 38.0% of the global revenues in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.14 Billion

- 2030 Projected Market Size: USD 1.82 Billion

- CAGR (2024-2030): 7.0%

- Europe: Largest market in 2023

As consumers become increasingly health-conscious, there is a rising demand for premixes that deliver not only taste and convenience but also added health benefits. Ingredients such as ancient grains, superfoods, and natural sweeteners are being integrated into premix formulations, aligning with the overarching wellness trend in the food industry.

The adoption of bakery premixes is significantly propelled by the inherent convenience and time efficiency they offer to both home and professional bakers. This aspect plays a pivotal role in reshaping the baking landscape, catering to the evolving needs and lifestyles of modern consumers. Bakery premixes simplify the baking process by providing pre-measured and pre-blended ingredients in one convenient package, eliminating the need for bakers to source and measure individual components like flour, leavening agents, and flavorings. This saves considerable preparation time, particularly benefiting busy individuals with limited time for elaborate baking procedures.

Moreover, several notable trends are shaping the bakery premixes industry. The most important factor is the surge in demand for organic, vegan, and gluten-free premixes driven by dietary preferences and health-conscious consumers. Additionally, producers are innovating with new flavors, textures, and formulations to offer artisanal baked goods. Convenience remains pivotal, leading to the development of premixes with reduced preparation time and easier handling. There is also a growing emphasis on eco-friendly packaging solutions in response to environmental concerns. Lastly, the rise of online platforms for purchasing bakery premixes is altering distribution networks and consumer buying habits.

Bread is gaining popularity in developed markets as a convenient and inexpensive food option and is becoming even more popular in emerging nations with specialized and premium breads. The globalization of culinary preferences, driven by increased travel and exposure to diverse cuisines, has further boosted the popularity of bread products worldwide. Modern consumers' tastes are evolving, and bakers are quickly adapting. Breads that were once regarded as specialized or traditional are becoming more popular, reflecting a shift towards a more complex and experimental culinary experience. This trend has inspired bakers and manufacturers to be more creative, leading to a wide range of innovative bread products. The dominance of this segment is poised to persist as it aligns with the changing dynamics of consumer lifestyles and preferences, solidifying its position in the global bakery premixes market.

Additionally, the global expansion of the bakery premixes and the growing popularity of online sales channels fuels the market. E-commerce platforms have become instrumental in reaching a wider consumer base, allowing manufacturers to tap into new markets and regions. This digital shift has facilitated accessibility and enabled consumers to explore a variety of bakery premix options from the comfort of their homes.

Type Insights

Dough mix accounted for a market share of 64% of the global revenues in 2023. Dough mixes provide a hassle-free solution for both home bakers and commercial bakeries, significantly reducing preparation time and effort by offering pre-measured and pre-blended ingredients. Using dough mixes ensures consistent quality and results in baked goods, which is crucial for both professional bakers aiming to maintain product standards and home bakers seeking reliable outcomes.

Complete mix segment is expected to grow at a significant CAGR from 2024 to 2030. Complete mixes provide a one-stop solution that includes all necessary ingredients, making the baking process significantly easier and faster for both home bakers and professional bakers. This convenience is especially appealing to those with busy lifestyles. Additionally, the rise in home baking, fueled by factors such as the COVID-19 pandemic, has led to increased demand for easy-to-use baking solutions. Complete mixes cater to this trend by simplifying the baking process and making it accessible to a wider audience, including novice bakers.

Application Insights

Cookies & biscuits premixes accounted for a market share of 58% of the global revenue in 2023. Cookies and biscuits mixes offer a quick and easy way to prepare fresh baked goods at home without the need for extensive baking skills or time-consuming preparation. These mixes allow consumers to personalize their baked goods by adding their favorite ingredients, such as nuts, chocolate chips, or dried fruits, catering to individual tastes and dietary preferences.

Breads & rolls premixes segment is expected to grow at a significant CAGR from 2024 to 2030. There is an increasing demand for healthier bread options, including whole grain, gluten-free, and high-fiber varieties. Premix manufacturers are catering to these health-conscious consumers by offering a variety of nutritious and specialty bread mixes. Bread and roll mixes provide a simplified baking process by offering pre-measured and pre-blended ingredients, saving time and effort for both home bakers and commercial bakeries. This convenience is especially appealing to busy consumers and professionals.

In March 2024, King Arthur Baking Company launched a new line of Savory Bread Mix Kits, catering to the growing demand for easy and approachable homemade bread options. The kits include four versatile offerings: Pull-Apart Garlic Bread, Soft & Chewy Pretzel Bites, Crisp & Airy Focaccia, and Perfectly Tender Flatbread.

Distribution Channel Insights

Sales of bakery premixes through supermarkets & hypermarkets accounted for a share of 38.0% of the global revenues in 2023. Many supermarkets and hypermarkets have in-store bakeries that produce fresh bakery premixes daily. This ensures higher quality and freshness compared to pre-packaged options.Additionally, these stores typically offer a wide variety of bakery premix flavors, styles, and sizes, catering to diverse tastes and preferences. Customers can choose from traditional options to specialty or seasonal flavors.

The online channel segment is expected to grow at a significant CAGR from 2024 to 2030. The convenience offered by online shopping has played a pivotal role in the industry's growth. Customers can explore a diverse selection of bakery premix flavours from their homes, eliminating the necessity of visiting brick-and-mortar stores. This accessibility has expanded their appeal to a wider audience, including those in regions where access to premium products may be limited.

Regional Insights

North America accounted for a market share of 24.5% in 2023. North America is experiencing robust growth in bakery premix demand due to evolving consumer preferences for innovative indulgence food products. Nowadays, more Americans are opting to bake at home rather than purchase from stores. Using premixes for home baking enables consumers to oversee the quality of ingredients, ensuring their baked goods are fresher and potentially healthier than store-bought alternatives.

U.S. Bakery Premixes Market Trends

There is a growing demand for healthier bakery premix options in the U.S. Many consumers in the U.S. are increasingly choosing bakery premixes that feature whole grains, reduced sugar content, or include natural ingredients such as fruits, nuts, and seeds. These healthier options appeal to health-conscious individuals seeking nutritious snacks or breakfast choices. Furthermore, bakery premixes have become integral to American food culture, often enjoyed as comforting and indulgent treats. They are frequently served at breakfast or brunch gatherings, further enhancing their popularity and cultural importance.

Europe Bakery Premixes Market Trends

Europe accounted for a market share of 31.0% in 2023. Baking holds a significant place in European culinary traditions and culture. Many European countries have rich histories of baking artisanal breads, pastries, and cakes, often passed down through generations. Baking at home allows Europeans to connect with their cultural heritage and enjoy traditional recipes.This allows them to customize recipes to their taste preferences and dietary needs, such as using organic or gluten-free ingredients.

Asia Pacific Bakery Premixes Market Trends

Asia Pacific is expected to grow at a CAGR of 7.9% from 2024 to 2030. As urbanization increases in the Asia Pacific region, many consumers have busy lifestyles that may limit their time for baking from scratch. Premixes provide a solution that fits into their schedules. Baking trends and influences from Western cultures have made baking a popular hobby and social activity in many parts of Asia Pacific. This cultural exchange has driven interest in baking and using premixes as a convenient way to participate in this trend.

Key Bakery Premixes Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the largest bakery premix manufacturers including Cargill, Incorporated., Archer Daniels Midland (ADM), Kerry Group have entered into the market. Along with that, in order to improve their efficiency and by using the international distribution channel, the companies have been ruling the industry.

Key Bakery Premixes Companies:

The following are the leading companies in the bakery premixes market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland (ADM)

- Puratos Group

- Kerry Group

- Dawn Food Products

- General Mills, Inc.

- Cargill, Incorporated.

- Corbion

- CSM Bakery Solutions

- AB Mauri

- Lallemand

Recent Developments

-

In May 2024, Dawn Foods, a global leader in bakery manufacturing and distribution, is launching two new products as part of its Total Cake Solutions concept. The first is the Dawn Yogurt Cake Mix, which delivers a tender and fluffy texture with a hint of yogurt flavor. This versatile mix can be used to make a variety of baked goods, from loaf cakes to muffins. The second product is the Dawn Exceptional Yuzu Compound, a flavoring paste that brings the unique taste of yuzu, a blend of lemon and grapefruit with herbal and floral notes, to bakers' recipes.

-

In March 2024, Pillsbury Baking, a renowned baking brand, has launched two new product lines. The first is the Creamy Cake Mix Line, featuring two flavors: Moist Supreme Creamy Almond Cake Mix and Moist Supreme Creamy Vanilla Cake Mix. These cake mixes offer a sophisticated and creamy indulgence, with the almond cake having a slightly fruity and sweet flavor and the vanilla cake being a creamy, dreamy sensation.

-

In September 2023, Puratos India, a global provider of bakery, patisserie, and chocolate ingredients, has introduced its latest innovation: the Easy Curry Masala Bread Mix. This versatile product offers a range of culinary possibilities, including bread loaves, burger buns, rusks, paninis, pizza bases, crusty bread, and hot dog buns. Infused with a curated blend of premium Indian spices, it guarantees an authentic and flavorful culinary experience.

-

In July 2023, Puratos expanded its presence in the Kosovo market by entering into a strategic joint venture with Korabi Corporation, a local supplier of bakery and patisserie ingredients. This partnership aims to sustain the distribution of Puratos's wide array of products, ensuring that customers in Kosovo have consistent access to top-quality ingredients for their baking requirements.

Bakery Premixes Market Report Scope

Report Attribute

Details

Market application value in 2024

USD 1.22 billion

Revenue forecast in 2030

USD 1.82 billion

Growth Rate (Revenue)

CAGR of 7.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, Spain, Italy, France, China, India, Japan, South Korea, Australia & New Zealand, Brazil, UAE

Key companies profiled

Archer Daniels Midland (ADM); Puratos Group; Kerry Group; Dawn Food Products; General Mills; Inc.; Cargill; Incorporated.; Corbion; CSM Bakery Solutions; AB Mauri; Lallemand

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bakery Premixes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bakery premixes market report based on type, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Complete Mix

-

Dough Mix

-

Dough Concentrates

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cakes & Pastries

-

Cookies & Biscuits

-

Breads & Rolls

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bakery premixes market size was estimated at USD 1.14 billion in 2023 and is expected to reach USD 1.22 billion in 2024.

b. The global bakery premixes market is expected to grow at a compounded growth rate of 7.0% from 2024 to 2030 to reach USD 1.82 billion by 2030.

b. Dough mix accounted for a share of 64.7% in 2023. Packaged muffins offer unmatched convenience. Dough mixes provide a hassle-free solution for both home bakers and commercial bakeries, significantly reducing preparation time and effort by offering pre-measured and pre-blended ingredients.

b. Some key players operating in bakery premixes market include Archer Daniels Midland (ADM), Cargill, Incorporated., Kerry Group, General Mills, Inc., and others

b. Key factors that are driving the market growth include rising demand for specialty bakery products, growth in the bakery industry, and urbanization and changing lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.