- Home

- »

- Clinical Diagnostics

- »

-

Bacterial And Viral Specimen Collection Market Report, 2030GVR Report cover

![Bacterial And Viral Specimen Collection Market Size, Share, & Trends Report]()

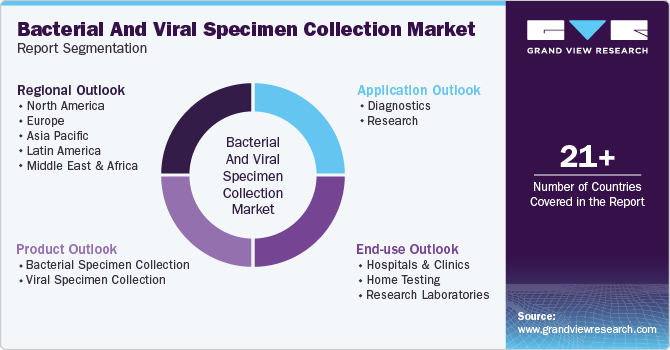

Bacterial And Viral Specimen Collection Market (2025 - 2030) Size, Share, & Trends Analysis Report By Product (Bacterial Specimen Collection, Viral Specimen Collection), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-044-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

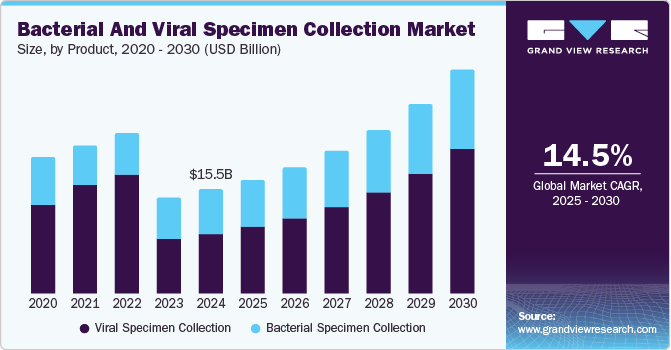

The global bacterial and viral specimen collection market size was valued at USD 15.49 billion in 2024 and is expected to grow at a CAGR of 14.5% from 2025 to 2030, driven bythe increasing prevalence of infectious diseases and rising awareness and adoption of preventive healthcare. The demand for diagnostic testing to detect infections early is increasing with intensifying global health challenges. This has led to a surge in the need for efficient specimen collection tools and techniques. In addition, heightened awareness about hygiene, vaccination, and disease prevention fuels the market, encouraging individuals and healthcare facilities to invest in proper specimen collection for accurate diagnosis and treatment.

The growing adoption of molecular diagnostics and advancements in diagnostic technologies are expected to drive the bacterial and viral specimen collection industry. Molecular diagnostic methods, such as PCR and next-generation sequencing, enable faster and more accurate detection of pathogens. These innovations increase the demand for high-quality specimen collection tools to ensure sample integrity. Moreover, the continuous evolution of diagnostic technologies facilitates the detection of a broader range of infections, prompting healthcare providers to invest in advanced specimen collection systems to support these diagnostic processes.

Market Concentration & Characteristics

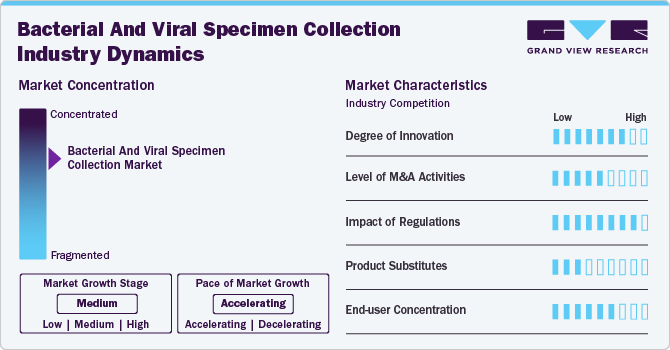

The market growth stage is medium, and the pace of growth is accelerating. Ongoing efforts by major market participants, including pharmaceutical companies and research organizations, have resulted in concentrated market scenarios. Key players increasingly focus on innovations in specimen collection technologies, strategic acquisitions, and collaborations to expand their product portfolios and enhance market reach. This consolidation allows the companies to leverage economies of scale, streamline distribution channels, and offer comprehensive solutions. The competitive landscape has intensified, with leading players shaping industry standards and pushing for greater efficiency and accuracy in specimen collection processes, thus driving market growth.For instance, BD collaborated with Babson Diagnostics in February 2020 to introduce small-volume blood collection solutions for retail pharmacies. Under the partnership, they combined BD’s blood collection device with Babson’s automated sample handling and analytical technologies to make blood testing more accessible and convenient.

The global market is characterized by a high degree of innovation owing to the growing adoption of modern healthcare technologies. Advanced diagnostic tools, such as automated collection devices and rapid molecular testing, are improving the accuracy and speed of specimen processing. These technologies streamline workflows, reduce human error, and enhance the overall efficiency of diagnostic processes. In addition, integration with digital health platforms allows for better tracking and analysis of specimens, further boosting market demand. This shift toward more efficient, precise methods is contributing to the market’s rapid expansion and evolution.

New regulations significantly shape the bacterial and viral specimen collection industry by ensuring standardization and improving safety protocols. Stringent guidelines for specimen collection, handling, and transportation enhance the accuracy and reliability of diagnostic results. Regulatory approvals also drive innovation by setting clear quality benchmarks and encouraging manufacturers to develop more advanced, efficient collection devices. Furthermore, regulatory frameworks ensure compliance with health and safety standards, promoting trust in the market. These developments are fostering growth in the industry, with healthcare providers prioritizing regulated, high-quality specimen collection solutions.

Product Insights

The viral specimen collection segment dominated the market with the largest revenue share of 57.3% in 2024 due toincreasing demand for precise and rapid diagnostic solutions. The growing prevalence of viral infections has driven healthcare facilities to prioritize advanced collection methods, ensuring accurate detection and treatment. Technological advancements in specimen transport and preservation have strengthened this segment's dominance. Rising global awareness about infectious diseases and the need for early intervention have encouraged investments in efficient collection systems, solidifying viral specimen collection’s position in the market.

The bacterial specimen collection segment is anticipated to grow at a significant CAGR of 11.0% from 2025 to 2030, driven by rising concerns over antibiotic-resistant infections and emerging bacterial diseases. The surge in healthcare initiatives promoting early bacterial detection has amplified demand for advanced collection methods. Innovations in microbiological testing and enhanced regulatory support are accelerating the adoption of bacterial specimen collection kits. Increased research and disease surveillance funding is propelling the growth of this segment, making it a key field for the expanding diagnostic market.

Application Insights

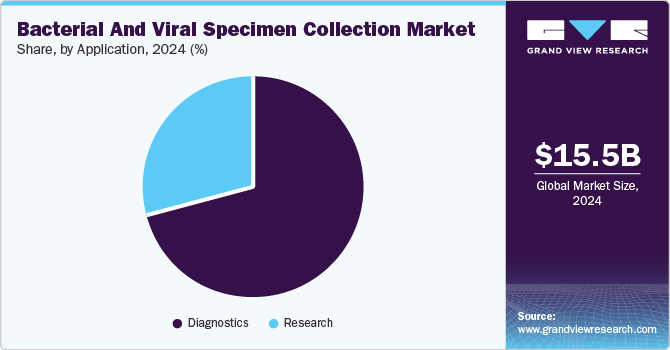

The diagnostics segment accounted for the largest market share in 2024, attributed tothe increasing need for accurate and rapid disease detection. The rising prevalence of infectious diseases has impelled the demand for efficient diagnostic tools, reinforcing the segment’s dominance. Technological advancements in molecular testing and point-of-care diagnostics have improved collection and analysis methods. Greater investments in healthcare infrastructure and government initiatives supporting early disease identification have further strengthened its position.

The research segment is expected to experience significant growth during the forecast period, driven by the global focus on emerging pathogens and antimicrobial resistance. Expanding efforts in epidemiological studies and vaccine development have increased the demand for high-quality specimen collection. Advancements in microbiological techniques and genomic sequencing enhance research capabilities, driving the adoption of specialized collection kits. Increased funding from the public and private sectors for infectious disease studies also propels this segment.

End Use Insights

The hospitals & clinics segment held the largest revenue share in 2024 due to their crucial role in disease diagnosis and patient care. The high patient influx of these healthcare facilities has driven demand for efficient specimen collection methods, ensuring accurate and timely testing. Investments in advanced diagnostic infrastructure and stringent infection control measures have further strengthened this segment’s position. Increasing awareness of early disease detection and the need for reliable laboratory results continue to reinforce hospitals and clinics as the primary hubs for specimen collection and testing services.

The home testing segment is projected to be the fastest-growing segment over the forecast period, propelled by increasing demand for accessible healthcare solutions. Innovations in diagnostic technologies have empowered individuals to conduct reliable testing at home, reducing dependency on clinical visits. Growing awareness about early disease detection and infection control has accelerated the adoption of self-testing kits. The expansion of e-commerce platforms and telehealth services has made home-based specimen collection more convenient, positioning this segment as a key contributor to market growth in the coming years.

Regional Insights

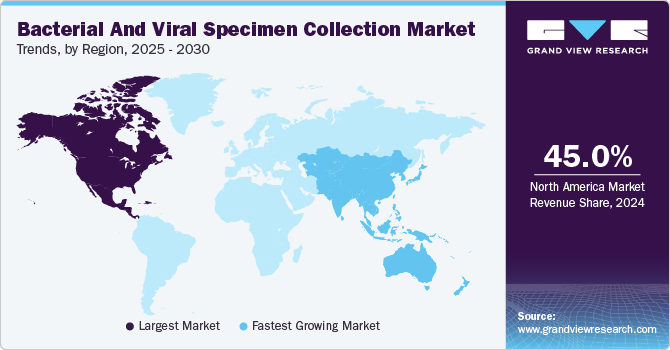

North America bacterial and viral specimen collection market dominated the global market with the largest revenue share of 45.0% in 2024.The rising prevalence of infectious diseases and the surge in home testing adoption are driving the market. Increasing outbreaks and heightened awareness of early disease detection fuel the demand for efficient collection solutions. Innovations in at-home testing kits provide convenience and accessibility, accelerating widespread adoption. Healthcare providers and diagnostic companies in the region are investing in advanced specimen collection technologies to meet the growing consumer needs. Strong government support and telehealth integration further drive the market, making specimen collection a critical component of public health strategies.

U.S. Bacterial and Viral Specimen Collection Market Trends

TheU.S. bacterial and viral specimen collection market accounted for the largest share of the regional market in 2024.Growth in point-of-care testing and heightened efforts in antimicrobial resistance monitoring fuel expansion in the U.S. bacterial and viral specimen collection industry. Rapid diagnostic solutions are streamlining specimen collection, allowing quicker disease detection and treatment decisions. Rising concerns over antibiotic-resistant infections have intensified research efforts, driving demand for specialized specimen handling. Healthcare providers and laboratories are investing in advanced collection technologies to improve accuracy and efficiency. Government initiatives supporting infection control and surveillance are further strengthening market growth, shaping the future of diagnostic specimen collection.

Europe Bacterial and Viral Specimen Collection Market Trends

Europe bacterial and viral specimen collection market is anticipated to witness significant expansion over the forecast period, owing to advancements in diagnostic technologies and increasing automation in laboratories. Cutting-edge molecular testing and AI-driven solutions enhance precision and efficiency in specimen handling. Automated systems reduce human error, streamline workflows, and accelerate disease detection, improving healthcare outcomes. Rising investment in digital and robotics-assisted diagnostics is transforming specimen collection practices. The demand for faster and more reliable results continues to strengthen the adoption of innovative technologies, ensuring sustained growth in the regional diagnostic market.

Asia Pacific Bacterial and Viral Specimen Collection Market Trends

Asia Pacific bacterial and viral specimen collection market is expected to be the fastest-growing region with a CAGR of 16.2% from 2025 to 2030, driven by expanding telemedicine services and increasing investments in healthcare infrastructure. Remote consultations and digital health platforms fuel the demand for advanced specimen collection methods, ensuring accessibility in underserved regions. Governments and private organizations are investing in diagnostic facilities and laboratory modernization, enhancing efficiency and accuracy in disease detection. Strengthened healthcare networks and rising awareness of early testing further accelerate the adoption of innovative specimen collection technologies across the region.

India bacterial and viral specimen collection market is projected to grow at the fastest CAGR during the forecast period.Growing awareness of early disease detection and advancements in biopharmaceutical and vaccine research are set to propel the India bacterial and viral specimen collection industry. Heightened public health initiatives and educational campaigns encourage proactive diagnostic measures, increasing demand for efficient specimen collection methods. Expanding vaccine development and pharmaceutical innovations drive research-focused specimen handling technologies. Government investments and private sector contributions further enhance laboratory infrastructure, supporting streamlined collection and analysis. Strengthened healthcare policies continue to propel market growth, making specimen collection a crucial component in disease prevention.

Key Bacterial And Viral Specimen Collection Company Insights

Some of the key companies in the bacterial and viral specimen collection industry include Puritan Medical Products; Copan Diagnostics Inc.; BD (Becton, Dickinson and Company); Thermo Fisher Scientific Inc.; and QuidelOrtho Corporation.

-

Becton, Dickinson and Company provides medical technology, devices, and laboratory equipment, specializing in diagnostic systems, infection prevention, and drug delivery solutions. It supports healthcare providers with innovative tools for patient care and medical research.

-

Thermo Fisher Scientific Inc. offers laboratory instruments, reagents, and consumables for scientific research, diagnostics, and pharmaceuticals. It provides advanced solutions for life sciences, biotechnology, and clinical applications, supporting innovation in healthcare, environmental analysis, and industrial research.

Key Bacterial And Viral Specimen Collection Companies:

The following are the leading companies in the bacterial and viral specimen collection market. These companies collectively hold the largest market share and dictate industry trends.

- Puritan Medical Products

- Copan Diagnostics Inc.

- BD (Becton, Dickinson and Company)

- Thermo Fisher Scientific Inc.

- QuidelOrtho Corporation

- Longhorn Vaccines and Diagnostics, LLC

- Pretium Packaging

- Trinity Biotech

- Medical Wire & Equipment

- HiMedia Laboratories, LLC

- Hardy Diagnostics

- Wuxi NEST Biotechnology Co., Ltd. (Nest Scientific)

- VIRCELL SL

- DiaSorin S.p.A.

- Titan Biotech

Recent Developments

-

In December 2024, BD and Babson Diagnostics expanded fingertip blood collection technology in the U.S., enabling accurate testing from just six drops of blood. Combining BD’s MiniDraw and Babson’s BetterWay allows easier, less-invasive sampling by any trained healthcare worker, even without phlebotomy experience, in various care settings.

-

In April 2024,BD introduced the BD Vacutainer UltraTouch Push Button Blood Collection Set in India. This new device uses BD RightGauge and BD PentaPoint technologies to allow for thinner needles, which reduce insertion pain during blood collection.

Bacterial And Viral Specimen Collection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.95 billion

Revenue forecast in 2030

USD 33.37 billion

Growth Rate

CAGR of 14.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Puritan Medical Products; Copan Diagnostics Inc.; BD (Becton, Dickinson and Company); Thermo Fisher Scientific Inc.; QuidelOrtho Corporation;Longhorn Vaccines and Diagnostics, LLC; Pretium Packaging; Trinity Biotech; Medical Wire & Equipment; HiMedia Laboratories, LLC; Hardy Diagnostics; Wuxi NEST Biotechnology Co., Ltd. (Nest Scientific); VIRCELL SL; DiaSorin S.p.A.; and Titan Biotech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bacterial And Viral Specimen Collection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global bacterial and viral specimen collection market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacterial Specimen Collection

-

Swabs

-

Bacterial Transport Media

-

Blood Collection Kits

-

Other Consumables

-

-

Viral Specimen Collection

-

Swabs

-

Viral Transport Media

-

Blood Collection Kits

-

Other Consumables

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Research

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Home Testing

-

Research Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bacterial & viral specimen collection market size was estimated at USD 13.6 billion in 2019 and is expected to reach USD 26.12 billion in 2020.

b. The global bacterial & viral specimen collection market is expected to witness a compound annual growth rate of 14% from 2020 to 2027 to reach USD 38.7 billion by 2027.

b. The bacterial segment dominated the bacterial & viral specimen collection market with a revenue share of 58% in 2019 owing to the high prevalence of bacterial diseases coupled with presence of substantial diagnostics kits for screening of bacterial infections.

b. Some key players in the bacterial & viral specimen collection market are Thermo Fisher Scientific, Inc; Becton, Dickinson and Company; Puritan Medical Products; COPAN Diagnostics; Quidel Corporation; Longhorn Vaccines and Diagnostics, LLC; Hardy Diagnostics; Pretium Packaging; Trinity Biotech; Medical Wire & Equipment; HiMedia Laboratories; Nest Scientific; DiaSorin; Titan Biotech; and VIRCELL S.L.

b. Key drivers of the cell therapy bacterial & viral specimen collection market are increasing cases of COVID-19 globally, growing awareness pertaining to early disease testing and treatment, and rising competition among existing players as well as new entrants to grab maximum revenue share in the space.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.