Market Size & Trends

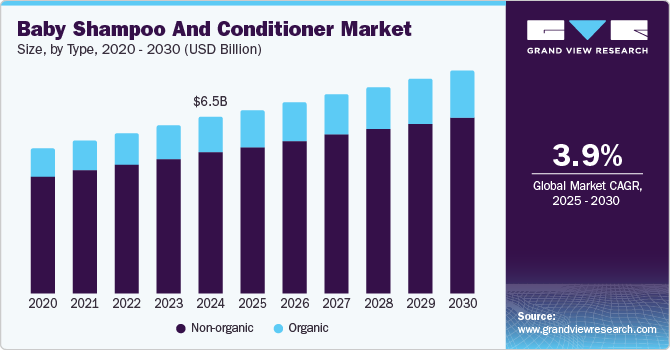

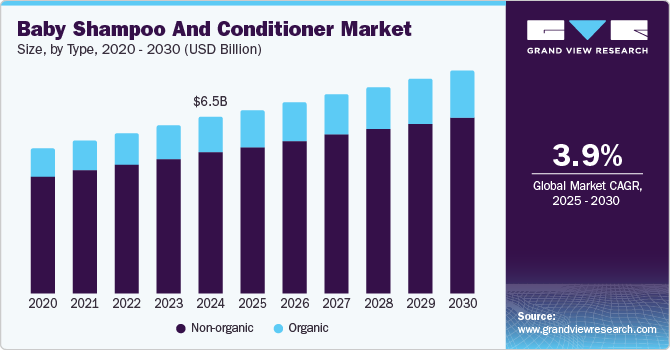

The global baby shampoo and conditioner market size was valued at USD 6.47 billion in 2024 and is expected to grow at a CAGR of 3.9% from 2025 to 2030. The market growth is attributed to the growing expenditure on baby care products, rising birth rate, rapid urbanization, and increasing purchasing power. Moreover, the need to remove flakes, combat tangles & knots in a baby’s hair, and prevent scalp infection drives the market.

Parents use shampoo and conditioner to remove tangles and knots in their baby’s hair, which may lead to hair loss. Shampoo and conditioners also help nourish and hydrate the baby’s hair. Parents are inclined to purchase shampoo and conditioners suitable for all types of hair, which is a major trend in the market.

Moreover, the growing awareness among parents about the importance of using safe and natural ingredients in baby care products has stimulated market growth. The market witnessed a strong preference for baby shampoos and conditioners that are free from harmful chemicals, parabens, and sulfates, with the rising number of health-conscious consumers. This shift towards natural and organic products has prompted manufacturers to reformulate their offerings and highlight the use of gentle, plant-based ingredients. Additionally, the rising disposable incomes have encouraged parents to invest more in high-quality baby care items to ensure their children's well-being.

Furthermore, advancements in product formulation and packaging have driven the market. Innovations in biodegradable packaging, refillable containers, and eco-friendly formulations have considerably appealed to environmentally conscious consumers. Such advancements enhance the sustainability of baby care products and improve their overall appeal and marketability. A recent report suggests that nearly 43% of consumers are willing to pay more for products with recyclable packaging.

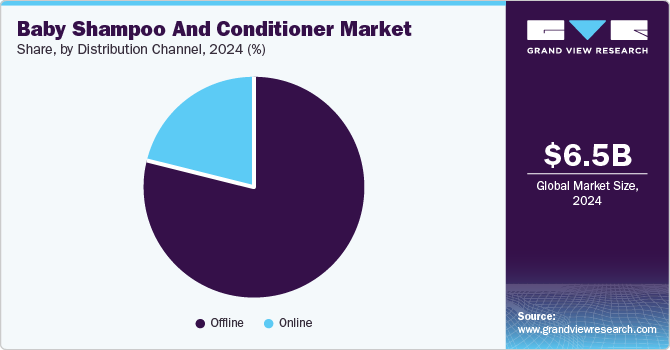

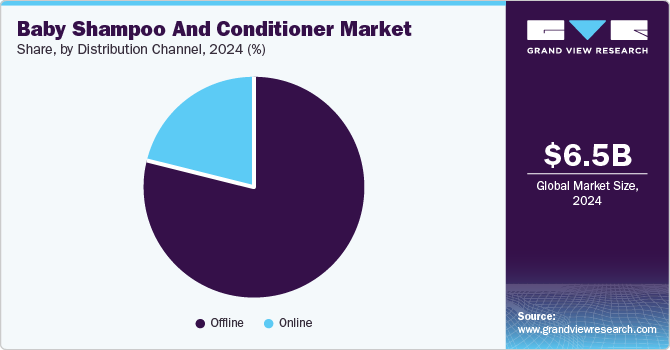

In addition, the rising preference for online shopping has become increasingly popular, providing parents with convenient access to a wide range of baby care products. E-commerce platforms offer competitive pricing, discounts, and customer reviews, making it easier for parents to make informed purchasing decisions.

Type Insights

Non-organic baby shampoo and conditioner dominated the market with an 80.0% share in 2024. The segment is primarily driven by affordability, easy availability, and a lack of awareness among rural consumers about the harmful chemicals in baby skincare products. Moreover, these products are widely available in various retail channels, including hypermarkets, supermarkets, convenience stores, and online platforms. These channels' competitive pricing and promotional offers further drive the market. However, stringent government regulations are expected to hinder the growth of non-organic products.

Organic products are expected to grow during the forecast period due to increasing consumer awareness about the benefits of natural and chemical-free products for infants. Parents have become progressively mindful of the ingredients in baby care products and have actively sought out organic options that are gentle on their babies' sensitive skin. Such a growing shift towards natural ingredients has prompted manufacturers to develop and market organic formulations that cater to this demand.

Distribution Channel Insights

Offline distribution channels held a dominant market share in 2024. Increasing spending on baby care products directly influences the stores' shelf space. Supermarkets, hypermarkets, and modern stores are devoting entire areas by labeling them “baby care centers.” Consumers prefer to purchase these products from drug stores, pharmacies, and health and beauty specialty stores, where they get consulting and assurance of purchasing an appropriate product.

The online channels are projected to grow at a CAGR of 4.7% during the forecast period as these offer convenience and accessibility. Parents can easily browse and purchase a wide range of baby care products from the comfort of their homes, saving time and effort. This convenience is particularly appealing to parents with busy schedules. Additionally, online retailers often offer discounts, bundle deals, and loyalty programs that attract price-sensitive consumers. These incentives encourage parents to choose online shopping over physical stores.

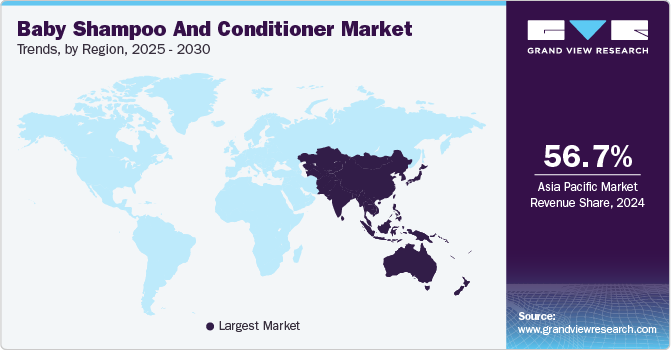

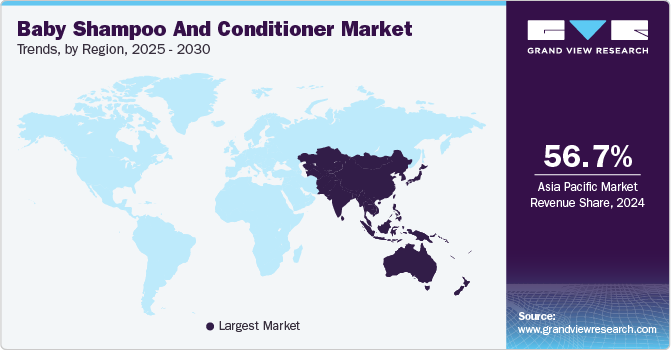

Regional Insights

The Asia Pacific (APAC) baby shampoo and conditioner market registered the dominant market share of 56.7% in 2024 and is expected to grow over the forecast period. The growth can be attributed to the rising birth rate in the region, which has led to an increased demand for baby-care products.

Europe Baby Shampoo And Conditioner Market Trends

The European baby shampoo and conditioner market held a 15.3% share in 2024. With parents becoming more conscious of the ingredients in baby products, the market witnessed a growing demand for natural, hypoallergenic, and chemical-free baby care products. Parents have increasingly preferred advanced formulations with mild surfactants, tear-free claims, and added vitamins or natural extracts, including chamomile and aloe vera, therefore driving the market growth.

North America Baby Shampoo And Conditioner Market Trends

The North America baby shampoo and conditioner market is expected to grow in the coming years owing to the growing awareness of the prevalence of skin conditions such as eczema and cradle cap in infants, driving demand for hypoallergenic and dermatologically tested products. Parents in North America have increasingly prioritized natural, organic, and chemical-free baby care products. They have sought formulations free from sulfates, parabens, phthalates, and other synthetic ingredients that can harm babies’ sensitive skin.

U.S. Baby Shampoo And Conditioner Market Trends

The U.S. baby shampoo and conditioner market in 2024 was primarily driven by premiumization and brand trust. U.S. consumers, particularly millennials and Gen Z parents, have become increasingly willing to pay a premium for high-quality baby care products. Premium brands such as Johnson & Johnson and Chicco that emphasize safety, purity, and clinical testing have gained considerable consumer trust.

Key Baby Shampoo And Conditioner Company Insights:

Key players operating in the market include Johnson & Johnson, The Himalaya Drug Company, Unilever, Burt’s Bees, and others. Large consumer goods companies have recognized the robust potential of the market and have been continuously modifying products and their proposition.

- Mothercare specializes in products for expectant mothers and children up to eight years old. The company offers various products, including clothing, nursery furniture, and baby care essentials. It provides a seamless in-store and online shopping experience, ensuring parents have access to the best products.

Key Baby Shampoo And Conditioner Companies:

The following are the leading companies in the baby shampoo and conditioner market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Himalaya Wellness Company

- Unilever

- Burt’s Bees

- Beiersdorf

- L’Oreal

- Mothercare

- Earth Mama Organics

- PZ Cussons

- Weleda

Recent Development

-

In January 2024, Ooume announced its brand launch. It is dedicated to offering effective, natural, and gentle hair care products that enhance the curls of people of all ages. It launched Hydrating Baby Shampoo (USD 22), Hydrating Baby Bundle (USD 44), and Hydrating Baby Conditioner (USD 22), which are available on its website.

-

In June 2023, Plum forayed into the baby care segment by launching Baby Plum. The new range is clinically tested by pediatricians and offers tear-free and pH-balanced formulas in the range, including baby shampoo, body wash, baby lotion, and massage oil.

-

In July 2022, Johnson & Johnson launched Vivvi & Bloom, a new skin and hair care line for babies and toddlers. This brand was developed with a focus on simplicity, purposeful ingredients, and scientific integrity to address the specific needs of Millennial and Gen-Z parents and caregivers.

Baby Shampoo And Conditioner Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 6.75 billion

|

|

Revenue forecast in 2030

|

USD 8.17 billion

|

|

Growth Rate

|

CAGR of 3.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Report updated

|

October 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, Distribution Channel, and Region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Australia, South Korea, Brazil, South Africa

|

|

Key companies profiled

|

Johnson & Johnson Services, Inc.; Himalaya Wellness Company; Unilever; Burt’s Bees; Beiersdorf; L’Oreal; Mothercare; Earth Mama Organics; PZ Cussons; Weleda

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Baby Shampoo And Conditioner Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baby shampoo and conditioner market report based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)