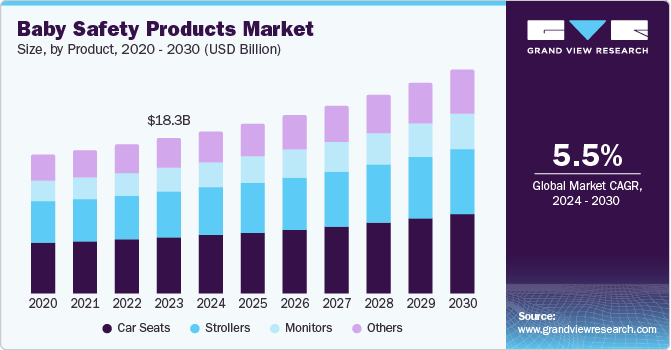

Baby Safety Products Market Size, Share & Trends Analysis Report By Product (Car Seats, Strollers, Monitors), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-123-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Baby Safety Products Market Size & Trends

The global baby safety products market size was valued at USD 18.3 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The growing number of government initiatives to control the rising number of baby death incidents has been driving the market. The significant factors driving the global market are the increasing needs and awareness about infant protection, an inclination towards nuclear families, and growing consumer purchasing power. Moreover, the increasing penetration of online retail platforms is positively influencing the sales of baby monitors among consumers.

The shifts in the population's demographics are contributing to the market's expansion. Rising disposable income levels, particularly in developing economies, allow parents to buy innovative safety items. Parents increasingly purchase high-quality safety products to create a secure environment for their children. Additionally, technologically advanced baby safety products are in high demand. Products such as video monitors, corner cushions, safety harnesses, guards and locks, gates, and gate extensions are gaining popularity.

Government regulations are crucial for shaping the market. Global manufacturers are developing and incorporating additional safety measures into baby products in compliance with strict safety guidelines. This encourages a market environment that prioritizes creating more effective baby safety products.

Product Insights

The car seats segment dominated the market and accounted for a revenue share of 36.4% in 2023. The segment’s growth is attributed to growing parental awareness about child safety while traveling. Child safety regulations are becoming increasingly stringent worldwide, mandating the use of car seats for children under a certain age. Additionally, manufacturers are focusing on innovations that enhance comfort and simplify installation.

The monitors segment is expected to register the fastest CAGR of 6.3% over the forecast period. The increasing number of working parents and the need to monitor infant activities are fueling the desire for this product. The monitor technology is constantly evolving; these monitors offer functions such as high-definition video, two-way communication, movement, and breathing monitoring, providing convenience to parents regarding child safety. The monitors are integrated with smart home systems, allowing control through smartphones and tablets. The rising disposable income allows individuals to spend on these products for their child's safety, further driving the market.

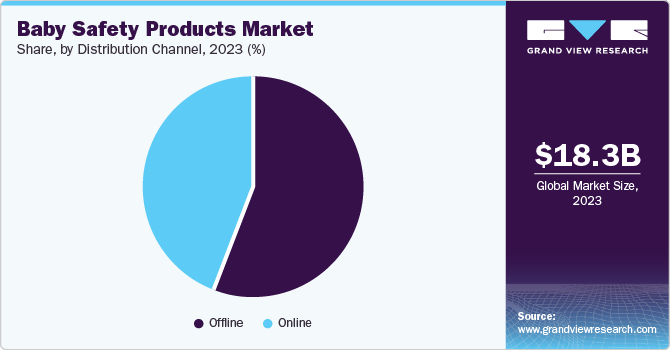

Distribution Channel Insights

The offline distribution channel accounted for the largest market revenue share in 2023. The key factor in the offline distribution channel's dominance is parents frequently seek in-person guidance from experienced sales staff, particularly for complicated items such as car seats or monitors. Additionally, offline distribution channels provide a streamlined distribution system, enabling them to reach a broad audience efficiently without forming numerous partnerships with small retailers. The operational efficiency benefits producers and consumers, helping this distribution channel dominate the market.

The online distribution channel is expected to register the fastest CAGR during the forecast period due to convenience, information accessibility, targeted marketing, subscription models, and global reach. Online retail offers convenience and accessibility. Online platforms provide detailed product information, including product usage and benefits. These platforms remove location limitations, enabling global producers to access new markets and customers to explore different types from various regions.

Regional Insights

North America baby safety products market dominated the market with a revenue share of 34.2% in 2023. Parental awareness about child safety, strict regulations, and a thriving economy that supports investment in high-quality products are all factors contributing to the region's dominance. Parents are prioritizing the safety needs of babies by purchasing high-quality car seats, cribs, monitors, and other safety equipment, further propelling market growth.

U.S. Baby Safety Products Market Trends

The U.S. dominated the North America baby safety products market in 2023.The U.S. has a significantly larger population than Canada and Mexico and is economically developed. Parents are highly aware of child safety and willing to spend on the latest and most trustworthy safety equipment for their kids.

Europe Baby Safety Products Market Trends

Europe baby safety products market was identified as a lucrative region in 2023.The rising disposable incomes in the region enable parents to allocate more funds towards non-essential purchases such as advanced safety equipment. The growing urbanization in Europe leads to smaller living spaces with higher accident risks. This leads to using effective baby monitors, gates, and corner protectors to mitigate these accidents.

The UK baby safety products market is expected to grow rapidly in the coming years. The country's strong emphasis on child well-being, well-established retail infrastructure, and active parental approach to child safety contribute to its significant growth.

Asia Pacific Baby Safety Products Market Trends

Asia Pacific baby safety products market is anticipated to witness the fastest CAGR over the forecast period. The key factors of the region's significant growth are rising birth rates, growing disposable incomes, increasing urbanization, child safety awareness, and stricter regulations. These factors create a favorable environment for the Asia Pacific baby safety products market, which is poised for continued significant growth in the coming years.

The China baby safety products market held a substantial market share in 2023. The growing awareness of child safety, fueled by media exposure and public health initiatives, is driving the market in China. Furthermore, the government is introducing more stringent rules on child safety products, emphasizing their significance.

Key Baby Safety Products Company Insights

Some of the key companies in the baby safety products market include Britax., Artsana S.p.A., Dorel Industries, Baby Jogger, LLC., Baby Trend, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Artsana Group is the top Italian company in the parenting sector globally, with a focus beyond just baby care. Artsana Flagship Brand is the most recognized baby care brand in Italy. The brand prioritizes sustainability, which involves caring for the future, including future generations, society, and the environment.

-

Baby Jogger LLC designs and produces strollers for rough terrain. The company manufactures and sells baby strollers, bicycle trailers, specialized carriages, and accessories. Its products are sold to retailers across globally.

Key Baby Safety Products Companies:

The following are the leading companies in the baby safety products market. These companies collectively hold the largest market share and dictate industry trends.

- Britax.

- Artsana S.p.A.

- Dorel Industries

- Baby Jogger, LLC.

- Baby Trend

- Bugaboo International B.V

- Compass Diversified

- DEX Products Inc.

- Goodbaby International Holdings Ltd.

- Nuna Intl BV

Recent Developments

-

In March 2024, Britax announced an update in its product range, upgrading its infant car seat, stroller, and travel system offerings. Britax has expanded its range to incorporate not only advanced safety features and fashionable designs but also effortless incorporation into the everyday life of contemporary families.

-

In February 2024,Britax made two new products available, the POPLAR and POPLARS convertible car seats. These car seats have a practical 2-in-1 design that easily switches from rear-facing to forward-facing.

Baby Safety Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 19.1 billion |

|

Revenue forecast in 2030 |

USD 26.4 billion |

|

Growth rate |

CAGR of 5.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

Britax.; Artsana S.p.A.; Dorel Industries; Baby Jogger, LLC.; Baby Trend; Bugaboo International B.V.; Compass Diversified; DEX Products Inc.; Goodbaby International Holdings Ltd.; Nuna Intl BV |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Baby Safety Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baby safety products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Car Seats

-

Strollers

-

Monitors

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."