- Home

- »

- Beauty & Personal Care

- »

-

Baby Nail Care Products Market Size And Share Report 2030GVR Report cover

![Baby Nail Care Products Market Size, Share & Trend Report]()

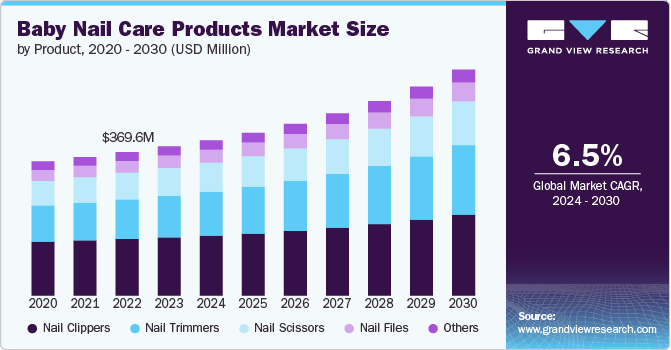

Baby Nail Care Products Market Size, Share & Trend Analysis Report By Product (Nail Clippers, Nail Trimmers, Nail Scissors, Nail Files), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-440-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Baby Nail Care Products Market Trends

The global baby nail care products market size was estimated at USD 384.4 million in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. The increasing parental awareness of infant hygiene is significantly propelling demand for specialized baby nail care products that prioritize safety and gentleness. Parents are now more vigilant about preventing accidental scratches and infections, prompting them to invest in high-quality, ergonomically designed nail clippers, files, and electric trimmers specifically crafted for delicate baby skin. This heightened focus on infant well-being, combined with rising disposable incomes, creates a lucrative opportunity for market growth.

The rise in birth rates drives the market growth by expanding the customer base for infant-specific hygiene products. As more babies are born, the demand for essential care items increases proportionally, including nail clippers, trimmers, and files designed for infants. Higher birth rates, especially in regions like Africa and Southeast Asia, result in higher spending on baby products as parents seek safe, gentle, and effective solutions for grooming their infants. This demographic trend encourages manufacturers to focus on innovation and expand their product lines to meet the growing needs of a rapidly increasing population of newborns, driving sustained market growth.

Innovations in baby nail care products, such as electric nail trimmers, safety-guarded nail files, and ergonomic designs, significantly boost market growth by addressing parents' concerns about safety and convenience. These advancements provide solutions that minimize the risk of injury while making the grooming process faster and easier, which appeals to time-conscious and safety-focused parents. For instance, electric trimmers with rounded edges and low-noise motors allow parents to trim their babies' nails efficiently, even while they sleep. Such innovations differentiate products in a competitive market and drive higher consumer demand by offering enhanced functionality and peace of mind, contributing to overall market expansion.

Platforms like Instagram, YouTube, and parenting blogs provide a space for parents to share recommendations, product reviews, and personal experiences, often shaping purchasing decisions. Influencers and pediatricians endorsing safe and innovative baby nail care products further boost consumer trust and demand. As modern parents are more digitally connected, they are increasingly exposed to new products and trends, driving awareness and adoption of advanced, safety-focused baby grooming tools. This digital exposure accelerates market growth by broadening product visibility and fostering consumer engagement across diverse demographics.

Product Insights

Baby nail clippers accounted for a share of 38.98% in 2023. The demand for baby nail clippers is driven by heightened parental awareness regarding infant safety and hygiene. Parents seek tools that ensure precision and reduce the risk of injury, particularly given the delicate nature of a baby's nails. Product innovations like ergonomic designs, safety features like rounded edges, and electric options further appeal to safety-conscious consumers. Furthermore, rising disposable incomes and increased access to premium baby care products via e-commerce channels enhance the demand. As modern parenting trends emphasize convenience and safety, baby nail clippers that offer these attributes are increasingly favored by consumers.

The demand for baby nail trimmers is expected to grow at a CAGR of 7.8% from 2024 to 2030. The growing preference for baby nail trimmers stems from their enhanced safety, precision, and ease of use compared to traditional clippers. Designed with automatic operation, gentle filing mechanisms, and soft abrasive surfaces, baby nail trimmers minimize the risk of cutting or injuring a baby's delicate skin. Parents appreciate the convenience of these tools, which often come with multiple speed settings and attachments suited for different ages, ensuring long-term utility. In addition, the rise in product innovation and increasing demand for premium, time-saving baby care products further drive this shift towards trimmers over traditional clippers.

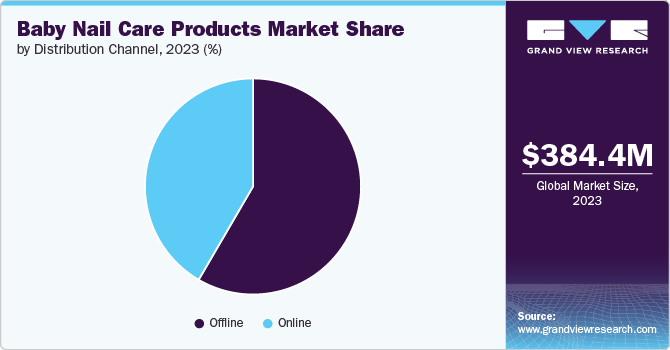

Distribution Channel Insights

Baby nail care products offline sales accounted for a market share of 58.41% in 2023. Consumers often prefer to physically inspect and feel the quality of baby care products before purchase, especially for items like nail care tools where safety and functionality are paramount. In-store shopping also allows for personalized assistance from sales staff, who can provide valuable recommendations and demonstrate product features. Moreover, the immediacy of purchasing in-store satisfies the need for immediate gratification and avoids potential delays associated with online orders, further bolstering the preference for offline sales channels.

The sale of baby nail care products online is expected to grow at a CAGR of 7.4% from 2024 to 2030.E-commerce enables consumers to browse a wide range of products, read detailed reviews, and compare prices from the comfort of their homes, leading to informed purchasing decisions. The availability of subscription services and direct-to-door delivery appeals to busy parents seeking hassle-free shopping experiences. In addition, targeted digital marketing and promotions tailored to online shoppers further enhance the attractiveness of purchasing baby nail care products online, increasing sales.

Regional Insights

The baby nail care products market in North America accounted for a market share of 25.17% in 2023 in the global market. Parents in the region prioritize premium, safety-oriented products like electric nail trimmers and clippers with ergonomic designs, reflecting the demand for convenience and reliability. The rise of e-commerce platforms further bolstered the market, enabling greater access to a wide range of baby care products. Furthermore, the region's strong presence of established baby care brands and continuous product innovation contribute to sustained market growth. Social media trends and endorsements by parenting influencers also play a crucial role in driving consumer engagement and product adoption.

U.S. Baby Nail Care Products Market Trends

The baby nail care products market in the U.S. accounted for a market share of around 78% in 2023 in the North American market. The market in the country is growing steadily, driven by increasing parental focus on infant safety and hygiene. Major companies such as FridaBaby, Safety 1st, and Little Martin's Drawer lead the market with innovative products catering to safety-conscious parents. FridaBaby, known for its user-friendly baby nail clippers and grooming kits, has built a strong brand reputation, while Safety 1st offers affordable and reliable nail care solutions. Little Martin's Drawer specializes in electric nail trimmers emphasizing convenience and safety. The presence of these established brands, coupled with growing e-commerce channels, continues to support market growth.

Asia Pacific Baby Nail Care Products Market Trends

The baby nail care products market in Asia Pacific accounted for a revenue share of 35.56% of global revenue in 2023. Rising birth rates, increasing urbanization, and higher disposable incomes in major countries like China, India, and Japan drive market growth. In China, the government's relaxed one-child policy has led to a surge in birth rates, creating a growing market for infant care products. India’s expanding middle class and focus on child safety further boost demand for specialized baby nail care tools, such as ergonomic clippers and electric trimmers. Moreover, e-commerce growth across these countries also plays a pivotal role in making these products more accessible to consumers, driving overall market expansion in the region.

Europe Baby Nail Care Products Market Trends

The baby nail care products market in Europe is expected to grow at a CAGR of 7.1% from 2024 to 2030. Key players such as Tommee Tippee (UK), Béaba (France), and Chicco (Italy) dominate the market, offering a wide range of baby nail clippers, files, and electric trimmers with safety features that appeal to health-conscious parents. These companies focus on ergonomic designs and advanced safety technologies to differentiate their products, catering to the preferences of European consumers who prioritize quality and convenience. The growing influence of online retail and increased marketing efforts through social media platforms also contribute to the market's expansion, making these products more accessible across the region.

Key Baby Nail Care Products Company Insights

The market is characterized by established brands and emerging players vying for market share through innovation and product differentiation. Leading companies like Tommee Tippee, Safety 1st, FridaBaby, and Béaba dominate the market with extensive product portfolios emphasizing safety, ease of use, and quality. These key players increasingly focus on incorporating advanced features such as electric trimmers, safety guards, ergonomic designs, and eco-friendly materials to appeal to modern parents. New entrants and smaller brands are also gaining traction by offering niche, customizable products and leveraging e-commerce platforms to reach a wider audience. Intense competition in product innovation, marketing strategies, and distribution networks keeps the market dynamic, while the growing influence of social media influencers and parenting communities further fuels brand competition.

Key Baby Nail Care Products Companies:

The following are the leading companies in the baby nail care products market. These companies collectively hold the largest market share and dictate industry trends.

- Mayborn Group Limited (Tommee Tippee)

- Safety 1st

- Fridababy, LLC.

- Béaba

- Chicco

- PIYO PIYO

- The First Years

- Little Martin's Drawer

- Pigeon

- Philips Avent

Recent Developments

-

The development of electric trimmers, with their advanced safety features and user-friendly designs, drives the baby nail trimmer market by offering a more efficient and risk-reducing solution that appeals to increasingly safety-conscious and convenience-seeking parents. For example, FridaBaby’s “FridaBaby NailFrida the SnipperClipper” is designed with a unique angled blade and a safety guard to prevent accidental cuts, making nail trimming easier and safer. Similarly, Tommee Tippee’s “Closer to Nature Electric Nail Care Set” offers a gentle, battery-operated solution with multiple filing attachments catering to different nail types and ages.

-

Safety enhancements in baby nail trimmers, such as safety guards and rounded edges, drive market growth by addressing parental concerns about injury, thereby increasing consumer confidence and demand for these products. Béaba’s “Nail Care Set” includes a nail file with a safety guard to prevent injury, and Pigeon’s “Baby Nail Scissors” are designed with rounded tips to ensure safe trimming. These designs are tailored to reduce the chance of cutting the baby’s sensitive skin.

Baby Nail Care Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 399.8 million

Revenue forecast in 2030

USD 582.0 million

Growth rate (Revenue)

CAGR of 6.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Mayborn Group Limited (Tommee Tippee); Safety 1st; Fridababy, LLC.; Béaba; Chicco; PIYO PIYO; The First Years; Little Martin's Drawer; Pigeon; Philips Avent

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Nail Care Products Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baby nail care products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nail Clippers

-

Nail Trimmers

-

Nail Scissors

-

Nail Files

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The baby nail care products market was estimated at USD 384.4 million in 2023 and is expected to reach USD 399.8 billion in 2024.

b. The baby nail care products market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 582.0 billion by 2030.

b. North America dominated the baby nail care products market with a share of around 40% in 2023. The baby nail care products market in North America is driven by high parental awareness of infant safety, increasing demand for premium and innovative products, and the widespread availability of these products through e-commerce and retail channels.

b. Key players in the baby nail care products market are Mayborn Group Limited (Tommee Tippee); Safety 1st; Fridababy, LLC.; Béaba; Chicco; PIYO PIYO; The First Years; Little Martin's Drawer; Pigeon, and Philips Avent.

b. Key factors that are driving the baby nail care products market growth include rising parental awareness of infant hygiene and safety, innovations in product design, growing birth rates in emerging markets, and increased accessibility through e-commerce platforms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."