- Home

- »

- Consumer F&B

- »

-

Baby Drinks Market Size And Share, Industry Report, 2030GVR Report cover

![Baby Drinks Market Size, Share & Trends Report]()

Baby Drinks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Baby Formula, Juice, Electrolyte), By Distribution Channel (Hypermarket & Supermarket, Pharmacies, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-176-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Baby Drinks Market Summary

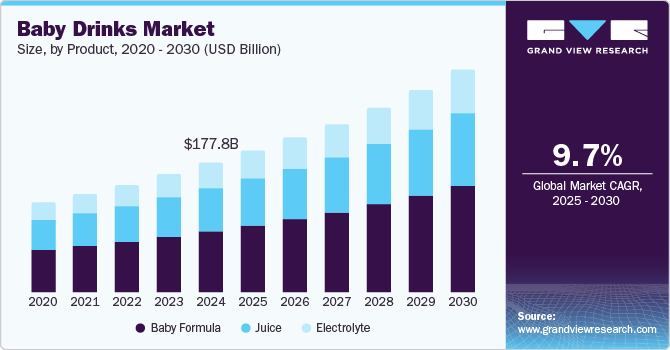

The global baby drinks market size was estimated at USD 177.80 billion in 2024 and is projected to reach USD 307.49 billion by 2030, growing at a CAGR of 9.7% from 2025 to 2030. The increasing penetration of e-commerce and quick commerce services, the growing population in various regions, the rising awareness regarding the role of nutrition in the growth of children since early childhood, and the availability of multiple alternatives offered by the key companies operating across regions are primarily adding to the growth opportunities.

Key Market Trends & Insights

- The Asia Pacific baby drinks market dominated the global industry with a revenue share of 56.2% in 2024.

- The Europe baby drinks market is projected to experience the fastest CAGR from 2025 to 2030.

- Based on products, the baby formula segment dominated the global baby drinks market with a revenue share of 46.6% in 2024.

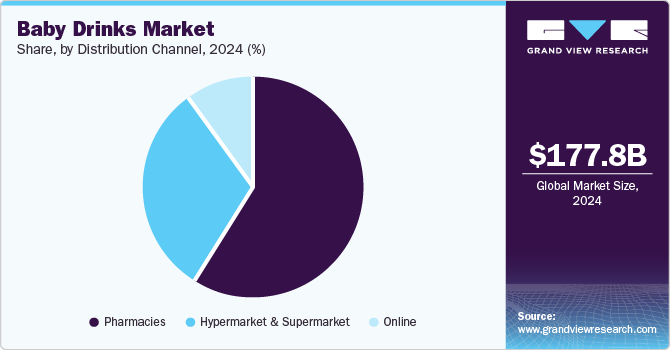

- Based on distribution channel, the pharmacies held the largest revenue share of the baby drinks market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 177.80 Billion

- 2030 Projected Market USD 307.49 Billion

- CAGR (2025-2030): 9.7%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

The growing participation of parents in the workforce has resulted in increasing demand for convenient and easy-to-adopt feeding solutions. In addition, the inclination towards including nutritional dietary alternatives, primarily characterized by natural ingredients and organic formulations, also adds to the upsurge in demand for the baby drinks market.

Product features such as availability in multiple flavors or tastes, convenience-based packaging, use of suitable ingredients for infants, and inclusion of nutrition-rich ingredients are adding to the growth of this market. In addition, the total number of births every year also contributes to the rise in demand. For instance, according to UNICEF, in 2023, 3,657,476 births were recorded in the U.S., and India recorded 23,219,489 births.

The entry of multiple consumer goods businesses in this market, the addition of newly formulated products, effective marketing strategies accompanied by the inclusion of modern technologies, and strategies such as vast distribution, diversified portfolio development, product differentiation, attractive packaging, and more are fueling the growth of this market.

Urbanization and substantial growth in disposable income levels also contribute to the growing demand for baby drinks worldwide. According to the World Bank Group estimations based on the United Nations Population Division's World Urbanization Prospects, the urban population was 4.6 billion in 2023. In addition, the presence of clean-label products, accessibility to baby drinks through quick commerce, and parents' focus on ensuring the availability of necessary nutrition are expected to drive the growth of this market in the approaching years.

Product Insights

Based on products, the baby formula segment dominated the global baby drinks market with a revenue share of 46.6% in 2024. Products, also referred to as infant formula or formula milk, are specially designed with a formulation suitable for feeding babies of certain ages or infants. The products are usually available in powdered form or liquid state. The baby formula products are diligently infused with vitamins, iron, calcium, and other necessary ingredients for nutritional value addition and enhancement of support to healthy microbiota in the gut. The product attracted the major attention of consumers in the Asia Pacific and Europe regions. This product is marketed by multiple industry participants in different packaging forms, such as glass jars, composite cans, bottles, cups, tubes, and cartons.

The juices segment is expected to experience a significant CAGR from 2025 to 2030. This segment is mainly driven by aspects such as growing awareness among parents regarding the inclusion of nutritional drinks, availability of healthy alternatives to sugary products, inclusion of natural fruit content by manufacturers, ease of use, convenience offered by the product, variety, flavor diversity, and increased accessibility through pharmacies, grocery store, quick commerce applications and more.

Distribution Channel Insights

Pharmacies held the largest revenue share of the baby drinks market in 2024. The safety concerns regarding the quality and validity of available products in other stores, such as grocery stores, and the availability of freshly delivered stock for baby drinks and complementary products in pharmacies mainly drive the growth of this segment. In addition, pharmacies allow parents to examine multiple product features, check validity and manufacturing dates, and compare flavors and packaging sizes while ensuring the availability of various payment alternatives and a wide variety. These aspects also contribute to the growing demand for baby drinks through pharmacies.

The online distribution segment is expected to experience substantial growth during the forecast period. The availability of baby drinks on quick commerce platforms that have been gaining extraordinary customer response primarily adds to this market's growth potential. Adding baby drink portfolios through e-commerce websites that deliver groceries and other baby products contributes to growth opportunities. Additional services offered by online shopping platforms, such as doorstep delivery of products, detailed product descriptions, reviews shared by previous buyers, return & refund policy, multiple payment alternatives, seller verifications, and more, contribute to the growing inclination towards online purchase of baby drinks.

Regional Insights

North America baby drinks market is anticipated to experience significant growth during the forecast period. This market is primarily driven by the growing awareness regarding infant health, increasing efforts by pediatricians to educate parents, ease of use and convenience offered by the products, organic ingredients included in the offerings, and the infant population added every year. In addition, the region has robust networks of distribution established by the key companies in this market, which add to growth opportunities.

U.S. Baby Drinks Market Trends

The U.S. dominated the regional baby drinks market in 2024. The U.S. is home to numerous major players in the consumer goods market, baby products industry, and complementary products. In addition, effective distribution and diversified portfolio offerings by these companies add to the growth potential of this market. Early adoption trends, efficient marketing strategies adopted by the key companies, and increasing penetration of e-commerce businesses also contribute to the growth potential.

Asia Pacific Baby Drinks Market Trends

Asia Pacific baby drinks market dominated the global industry with a revenue share of 56.2% in 2024. Growth of this market is primarily influenced by factors such as increasing births every year, a large percentage of the population under the age of 4 years, the presence of high-population countries such as China and India, booming retail industry facilitated by urbanization, and the emergence of quick-commerce platforms and more. The availability of multiple brand products, vast distribution networks effectively managed by the key companies in the region, and the rising focus of numerous organizations on the Asia Pacific market owing to growing economies are likely to fuel the growth of this market in the coming years.

India is projected to experience the fastest growth in regional market over the forecast period. This is mainly influenced by the large number of parents participating in the workforce, enhanced availability and accessibility of multiple brands, increasing awareness regarding the role of nutrition in the well-being of the child at an early age, effective distribution by the key players, and more.

Europe Baby Drinks Market Trends

Europe baby drinks market is projected to experience the fastest CAGR from 2025 to 2030. The rise in personal disposable income levels, growing awareness regarding the inclusion of nutrition-rich dietary alternatives, the significance of vitamins and other necessary ingredients in the meals served to babies, unprecedented growth in urbanization, and availability of multiple products offered by domestic and international brands are some of the key growth driving factors for this market.

The UK held the largest revenue share of the regional industry in 2024 owing to presence of multiple working parents that are seeking for various convenient alternatives for feeding babies, increasing urbanization, growing availability of numerous flavors and special ingredients added in the product portfolios, and focus of major players to ensure effective distribution.

Key Baby Drinks Company Insights

Some of the key companies operating in the global baby drinks market are Nestlé, Abbott, Meiji Holdings Co., Ltd., Danone, HiPP, and others. The major players have adopted strategies such as effective distribution, including natural ingredients, content generation and delivery, collaboration with social media influencers, diversification of portfolio, and more.

-

Nestlé, one of the prominent companies in the food and beverage market, offers a wide range of products associated with multiple product categories. The company's infant nutrition portfolio includes NESTLÉ LACTOGEN, NESTLÉ NAN OPTIPRO, NESTLE Baby Milk Formula, NIDO Growing Up, KLIM, and others.

-

HiPP, a major market participant in the baby food market, offers products such as milk formula, juices, baby water, and others. The brand also provides other products such as oats, semolina, fruits, and vegetable-infused baby foods.

Key Baby Drinks Companies:

The following are the leading companies in the baby drinks market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Abbott

- Danone

- Mead Johnson & Company LLC.

- FrieslandCampina

- Arla Foods amba

- Meiji Holdings Co., Ltd.

- HiPP

- The Kraft Heinz Company

- DANA DAIRY GROUP

Recent Developments

-

In August 2024, Abbott, one of the key companies in the pharmaceutical industry and baby feed & drinks market, announced commencement of its implementation plans including Pure Bliss by Similac, range of organic infant formulas, that ensure availability of variety for parents seeking specific formula for their babies. The brand also announced that it is distributing these products through retailers such as Amazon, Target and Walmart.

-

In April 2024, Else Nutrition, a major player in the plant-based baby cereal and infant formula market, introduced ‘Follow-On’ formula, designed for infants aged 6 to 12 months, in the Australian market. In addition, it also announced the launch of a toddler drink product in Australia, specifically developed for toddlers aged 12-36 months.

Baby Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 195.23 billion

Revenue forecast in 2030

USD 307.49 billion

Growth Rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, Brazil, Argentina, South Africa, UAE

Key companies profiled

Nestlé; Abbott; Danone; Mead Johnson & Company LLC.; FrieslandCampina; Arla Foods amba; Meiji Holdings Co., Ltd.; HiPP; The Kraft Heinz Company; DANA DAIRY GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Drinks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the baby drinks market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Baby Formula

-

Juice

-

RTD

-

Concentrate

-

-

Electrolyte

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarket & Supermarket

-

Pharmacies

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.