- Home

- »

- Next Generation Technologies

- »

-

Avionics Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Avionics Market Size, Share & Trends Report]()

Avionics Market (2024 - 2030) Size, Share & Trends Analysis Report By System (Navigation Systems, Communication, Flight Management), By Component (Hardware, Software), By Platform, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-348-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Avionics Market Summary

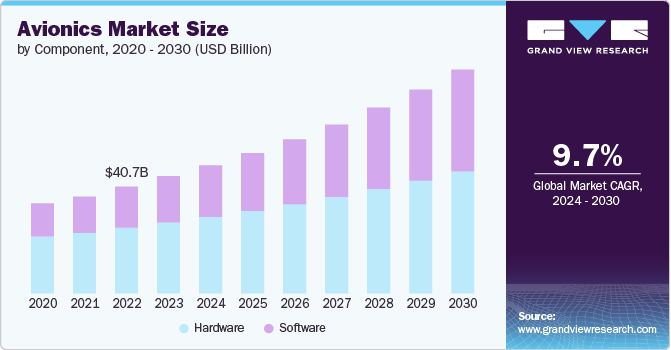

The global avionics market size was estimated at USD 44.68 billion in 2023 and is projected to reach USD 85.29 billion by 2030, growing at a CAGR of 9.7% from 2024 to 2030. The market growth can be attributed to increased demand for connected and economical aircraft systems.

Key Market Trends & Insights

- North America dominated the global avionics market with the largest revenue share of 33.22% in 2023.

- The avionics market in the U.S. accounted for the largest revenue share in North America in 2023.

- By system, the navigation systems segment led the market with the largest revenue share of 34% in 2023.

- By component, the hardware segment accounted for the largest market revenue share in 2023.

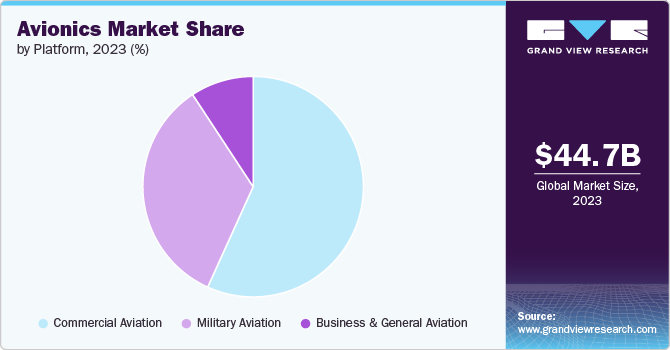

- By platform, the military aviation segment is expected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 44.68 Billion

- 2030 Projected Market Size: USD 85.29 Billion

- CAGR (2024-2030): 9.7%

- North America: Largest market in 2023

The rising global demand for domestic and international air travel across developing countries has increased orders for new commercial aircraft. This demand fuels the need for advanced avionics systems that ensure compliance with stringent safety regulations and enhance passenger experience. Airlines are investing in modernizing their fleets with updated and innovative avionics to remain competitive, improve fuel efficiency, and reduce operational costs. Thus, the expansion of the commercial aviation sector significantly boosts the market growth.Moreover, the ongoing advancements in avionics technology, including integrating touchscreen interfaces, next-generation flight management systems, and advanced connectivity solutions, are significant growth drivers. These upgrades enhance aircraft operations' safety, efficiency, and performance, compelling both commercial and military sectors to update their avionics systems. This constant evolution and upgrade in technology attract airline companies to upgrade their fleets, driving market growth.

Stringent regulatory standards and safety requirements imposed by aviation authorities like the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) drive the demand for advanced avionics. These regulations mandate adopting cutting-edge avionics systems to ensure safety, reliability, and compliance. For instance, mandates such as ADS-B (Automatic Dependent Surveillance-Broadcast) equipage for enhanced air traffic management compel airlines and aircraft manufacturers to upgrade their avionics. This regulatory pressure accelerates the adoption of new technologies, contributing to market growth.

In addition, with growing geopolitical tensions globally, defense spending has significantly increased, particularly in upgrading and expanding military aircraft capabilities. This investment in enhanced avionics systems for surveillance, communication, and combat missions is a significant driver for the market. It signifies a shift towards implementing the latest and upgraded avionics that provide a strategic advantage, thereby boosting market growth.

Furthermore, the growing adoption of unmanned aerial vehicles (UAVs) for various applications, including surveillance, reconnaissance, and commercial uses, is a considerable growth driver for the market. UAVs require advanced avionics for navigation, control, and communication to perform their missions effectively. The increasing utilization of UAVs in sectors like agriculture, logistics, and defense stimulates demand for specialized avionics systems, fostering market expansion. The rapid development and deployment of UAV technology are expected to contribute to the continued market growth in the coming years.

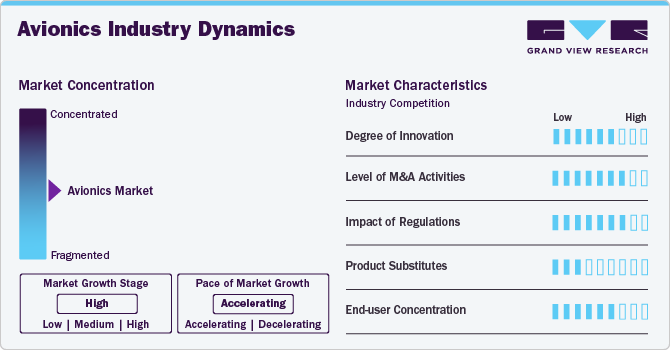

Market Concentration & Characteristics

The market is experiencing a high degree of innovation, primarily driven by the expanding use of unmanned aerial vehicles (UAVs) in various sectors, including agriculture, defense, and logistics. This surge in UAV deployment necessitates advanced avionics for navigation, control, and communication, leading to significant technological advancements and market expansion.

Stringent regulatory standards ensure the safety and reliability of avionic systems, especially in the burgeoning field of UAVs, but can also pose challenges by potentially slowing down the introduction of new technologies and increasing development costs.

The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The presence of product substitutes can significantly impact the market by introducing competitive pressures and driving innovation. As alternative technologies or products emerge, companies in the avionics industry are compelled to enhance their offerings, improve cost-efficiency, and deliver superior performance to maintain market share and meet customer demands.

The market exhibits a moderate to high end-user concentration, particularly dominated by sectors such as defense, commercial aviation, and, increasingly, unmanned aerial vehicles (UAVs) for applications like surveillance and logistics. This concentration underscores the reliance of the market's growth on these key sectors' evolving needs and investments, driving demand for advanced avionic systems.

System Insights

The navigation systems segment dominated the market in 2023 with a market share of around 34% due to the increasing emphasis on flight safety, efficiency, and precision. Advances in GPS technology and the integration of satellite-based augmentation systems enhance route planning and situational awareness. These systems help reduce fuel consumption and emissions by optimizing flight paths, which is crucial for commercial and military aviation. In addition, regulatory mandates for upgraded navigation capabilities to ensure compliance with airspace modernization initiatives further drive the segment growth.

The traffic and collision management segment is expected to record the highest CAGR of over 11% from 2024 to 2030. The segment growth is attributed to the increasing need for enhanced safety and efficiency in air traffic management. With the rise in global air traffic, there is a larger demand for advanced systems that can prevent mid-air collisions and manage aircraft separation. Regulatory mandates, such as the implementation of ADS-B technology, further drive the adoption of these systems. In addition, advancements in communication and surveillance technologies enhance the capabilities of traffic and collision management systems, contributing to the segment growth.

Component Insights

The hardware segment held the highest revenue share in 2023 due to the increasing demand for advanced, reliable, high-performance components for modern aircraft systems. Innovations in flight control, navigation, and communication systems necessitate the latest hardware, driving upgrades, and replacements in existing fleets. In addition, the increase of commercial and military aircraft, alongside the rise of UAVs, boosts the need for advanced avionics hardware to enhance safety, efficiency, and operational capabilities. This surge in demand for innovative technology accelerates the growth of the hardware segment.

The software segment is estimated to register the highest growth rate from 2024 to 2030. The growth is attributed to the increasing difficulty and functionality required in modern aircraft systems. Advanced software solutions enable enhanced navigation, communication, and real-time data processing, improving overall flight safety and efficiency. In addition, the push for digital transformation and connectivity within the aviation industry drives the demand for sophisticated software to integrate and manage these advanced avionics systems. This growth is further fueled by the need for continuous updates and upgrades to comply with evolving regulatory standards and technological advancements.

Platform Insights

The commercial aviation segment accounted for the highest market share in 2023. The segment growth is attributed to the rising global demand for air travel. Airlines are investing in advanced avionics to enhance safety, efficiency, and passenger experience, meeting regulatory standards and competitive pressures. In addition, technological innovations in avionics provide better fuel efficiency and operational reliability, making upgrades a priority for commercial carriers. This combination of factors significantly increases the adoption of advanced avionics systems in commercial aviation.

The military aviation segment is anticipated to expand at the highest CAGR from 2024 to 2030. The segment growth is attributed to the rising demand for advanced unmanned aerial vehicles (UAVs) in defense applications. These UAVs are extensively utilized for surveillance, reconnaissance, and other military operations, requiring upgraded avionics systems for enhanced navigation, control, and communication capabilities. Implementing cutting-edge technology in military UAVs ensures effective mission accomplishment in diverse environments, driving the need for advanced avionics. Moreover, the continuous advancements and deployment of UAV technology in defense sectors globally are driving the military aviation segment growth.

Regional Insights

The avionics market in North America accounted for the highest revenue share of 33.22% in 2023. Integrating UAVs into national airspace and increasing defense budgets drive the market in the region.

U.S. Avionics Market Trends

The avionics market in the U.S. is anticipated to grow at a CAGR of 8.9% from 2024 to 2030. The country's increased focus on UAV technology advancements for military and civilian uses will bolster its avionics industry growth.

Asia Pacific Avionics Market Trends

The avionics market in Asia Pacific is anticipated to grow at the highest CAGR of 11.3% from 2024 to 2030. Rapid industrialization and increasing investments in defense and commercial UAV applications fuel market growth in the region.

India avionics market is estimated to grow significantly from 2024 to 2030. Growing defense expenditures and the adoption of UAVs for border surveillance and agriculture boost the market.

The avionics market in China is expected to grow considerably from 2024 to 2030. Substantial investments in UAV development for military and commercial purposes drive the market forward.

Japan avionics market is projected to grow considerably from 2024 to 2030. The country's market benefits from technological innovation and its focus on maintaining a competitive edge in advanced aerospace systems.

Europe Avionics Market Trends

The avionics market in Europe had a share of 27.55% in 2023. Collaborative defense projects, stringent safety regulations, and continuous advancements in aerospace technology bolster it.

The UK avionics market is projected to grow considerably from 2024 to 2030. The UK is seeing growth in its market due to significant investments in defense modernization and its leadership in aerospace research and development.

The avionics market in Germany is expected to record significant growth from 2024 to 2030. Germany's market is driven by a strong industrial base, leading aerospace manufacturers, and continuous technological innovation.

Middle East and Africa (MEA) Avionics Market Trends

The avionics market in the Middle East and Africa (MEA) region is anticipated to grow at a significant CAGR of 10.9% from 2024 to 2030. The growth of the market in the Middle East & Africa is supported by expanding airline fleets, strategic geographic positioning, and rising demand for air travel.

Saudi Arabian avionics market accounted for a considerable revenue share in 2023. The market is growing due to the country's Saudi Vision 2030 initiative, which includes significant investments in aviation infrastructure and technology.

Key Avionics Company Insights

Some of the key players operating in the market are RTX Corporation, L3Harris Technologies, Inc., and Honeywell International Inc.

-

RTX Corporation, Inc. is a major player in defense, aerospace, and technology, known globally for its innovative products and solutions. The company offers a wide range of services, including high-tech radar systems, electronics, and cybersecurity. RTX is also focused on positively impacting global security and leading the way in space technology and communication advancements.

-

L3Harris Technologies, Inc. is a leading technology company specializing in defense and commercial technologies across air, land, sea, space, and cyber domains. Known for its strong innovation in communications and electronic systems, L3Harris aims to make military and civilian operations more efficient and safer. The company is committed to excellence and sustainability and plays a crucial role in global security, space exploration, and air traffic management.

General Electric Company, Honeywell International Inc., and Safran S.A. are some of the emerging market participants.

-

General Electric Company is a global conglomerate that operates across multiple sectors, including aviation, power, renewable energy, and healthcare. Founded in 1892, GE has been at the forefront of innovation, driving significant advancements in technology and industry. Committed to sustainability and digital transformation, GE continues to shape the future through its cutting-edge solutions and expertise in engineering and manufacturing.

-

Honeywell International Inc. is a multinational conglomerate that develops technologies and solutions for building automation, energy and sustainability, industrial automation, and aerospace applications. The company is known for its innovative and diversified technology-based products and services.

Key Avionics Companies:

The following are the leading companies in the avionics market. These companies collectively hold the largest market share and dictate industry trends.

- Thales S.A.

- Honeywell International Inc.

- RTX Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- General Electric Company

- BAE Systems plc

- Northrop Grumman

- Elbit Systems Ltd.

- Safran S.A.

Recent Developments

-

In November 2023, AIBOT US Operations LLC, a company specializing in the design and manufacturing of both manned and unmanned e-VTOL aircraft, partnered with Honeywell International Inc. for its innovative Compact Fly-By-Wire (cFBW) technology. This partnership will equip AIBOT’s electric vertical takeoff and landing (eVTOL) aircraft with Honeywell's advanced avionics system. The compact design grants greater flexibility for AIBOT in developing their eVTOL aircraft, ensuring the integration of efficiency and safety.

-

In October 2023, RTX Corporation, Inc. announced that it has effectively showcased a solid-state circuit breaker designed to boost hybrid-electric propulsion systems in next-generation aircraft. This innovation marks a significant step towards the aviation sector's goal of realizing net-zero carbon emissions by 2050.

-

In May 2023, Lockheed Martin Corporation partnered with IFS Global, an enterprise software solution provider, to strengthen their market position by leveraging each other’s market strengths. This collaboration was directed towards offering a range of services and products to help aerospace and defense groups modernize their equipment and the supporting technological infrastructure.

-

In April 2023, GE Aerospace (General Electric Company) signed the agreement with Lockheed Martin Corporation to support the F-35's avionics and electrical power systems. This contract, spanning four years, encompassed maintenance, repair, and overhaul (MRO) services for the F-35 Lightning II aircraft's GE Aerospace systems.

Avionics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 48.84 billion

Revenue forecast in 2030

USD 85.29 billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, component, platform, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Thales S.A.; Honeywell International Inc.; RTX Corporation; L3Harris Technologies, Inc.; Leonardo S.p.A.; General Electric Company; BAE Systems plc; Northrop Grumman; Elbit Systems Ltd.; Safran S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Avionics Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels and provides an analyzes of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global avionics market report based on system, component, platform, and region:

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Navigation Systems

-

Communication

-

Flight Management

-

Traffic and Collision Management

-

Weather

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Aviation

-

Military Aviation

-

Business and General Aviation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global avionics market size was estimated at USD 44.68 billion in 2023 and is expected to reach USD 48.84 billion in 2024.

b. The global avionics market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 85.29 billion by 2030.

b. The North America region accounted for the largest share of over 33% in the avionics market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the avionics market include Thales S.A., Honeywell International Inc., RTX Corporation, L3Harris Technologies, Inc., Leonardo S.p.A., General Electric Company, BAE Systems plc, Northrop Grumman, Elbit Systems Ltd., Safran S.A.

b. Key factors that are driving the avionics market growth include the rising global demand for air travel, particularly in emerging markets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.