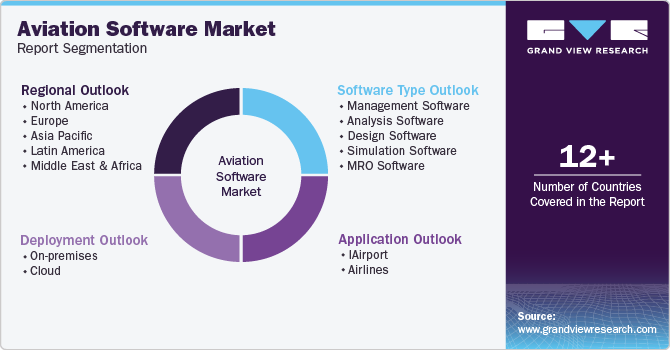

Aviation Software Market Size, Share & Trends Analysis Report By Application (Airline, Airport), By Software (Design Software, Simulation Software, MRO Software), By Deployment, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-432-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Aviation Software Market Size & Trends

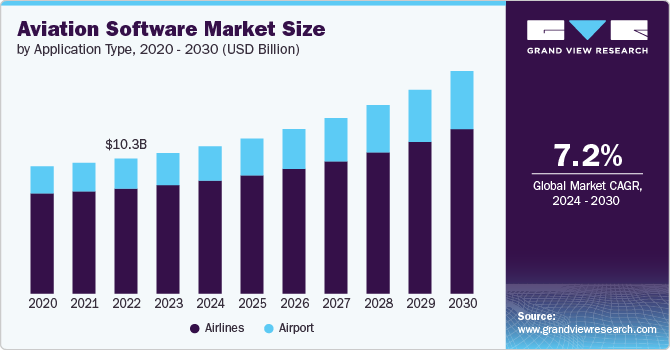

The global aviation software market size was estimated at USD 10.68 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030. The market is driven by the increasing demand for advanced flight management systems, integrated aircraft communication systems, and real-time data analytics tools. Aviation companies are increasingly adopting software solutions to enhance operational efficiency, improve safety, and reduce costs. The growing trend of digital transformation in the aviation industry, coupled with the need for predictive maintenance and fuel efficiency optimization, propels the demand for aviation software.

Technological advancements are pivotal in shaping the software aviation market. Innovations such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are being integrated into aviation software to offer more accurate data analytics, predictive maintenance, and enhanced flight planning capabilities. The development of cloud-based solutions and mobile applications for pilots and ground staff is also contributing to the growth of the market, enabling seamless communication and real-time updates.

Governments around the world are taking initiatives to promote the adoption of advanced software solutions in the aviation industry. Regulatory bodies are introducing policies and frameworks to ensure the safety and security of aviation software, which is driving the market growth. Additionally, governments are investing in research and development (R&D) programs aimed at fostering innovation in the aviation sector. These initiatives not only encourage the adoption of software solutions but also support the development of new technologies that enhance the overall efficiency of the aviation industry.

Manufacturers in the aviation software market are increasingly focusing on developing innovative solutions that cater to the industry's evolving needs. They are investing in R&D to create software that offers enhanced functionality, user-friendly interfaces, and seamless integration with existing aviation systems. The focus is also on developing software that complies with regulatory standards and provides robust security features to protect against cyber threats.

The software aviation market presents significant opportunities for growth, particularly in emerging markets where the aviation industry is rapidly expanding. The increasing demand for commercial and private aircraft, coupled with the need for efficient air traffic management, is creating opportunities for software providers to offer tailored solutions. Furthermore, the rising emphasis on sustainability and reducing carbon emissions in aviation is opening up avenues for the development of software that optimizes fuel efficiency and minimizes environmental impact. Companies that can innovate and adapt to these trends are well-positioned to capitalize on the growing demand in the software aviation market.

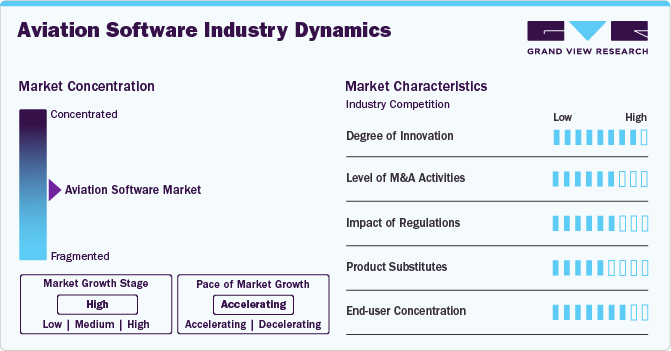

Market Concentration & Characteristics

Aviation software market is the growing due to rising efficiency and optimization in aviation operations. As airlines and maintenance organizations face increasing pressure to reduce costs and enhance operational efficiency, the adoption of advanced software solutions becomes essential. These software solutions facilitate predictive maintenance, streamline fleet management, and optimize route planning, thereby reducing operational disruptions and improving profitability.

The level of mergers and acquisitions (M&A) activities in the aviation software market is expected to be high. The market has witnessed significant consolidation as companies seek to enhance their capabilities, expand their product offerings, and gain a competitive edge. For instance, IFS's acquisition of EmpowerMX and AI-powered aviation software provider shows a strategic move to bolster their offerings in the aviation sector. Similarly, CAMP Systems International's acquisition of World Kinect Corporation aviation software businesses portfolio, demonstrates the trend of consolidating resources to provide comprehensive solutions to the market.

The impact of regulations on the aviation software market is expected to be moderate. Aviation software providers must comply with various international standards and regulations that ensure safety, security, and operational efficiency. While these regulations drive the adoption of specialized software to meet compliance requirements, they also impose constraints on innovation and flexibility. However, the moderate impact is due to the industry’s adaptive capabilities, where software vendors are increasingly developing solutions that not only comply with existing regulations but also anticipate future regulatory changes. This balance between regulatory compliance and technological innovation helps to maintain a steady growth trajectory for the market.

Competition from product substitutes in the aviation software market is expected to be low. Aviation operations are highly specialized, requiring software solutions that cater to specific industry needs such as flight operations, maintenance, repair, and overhaul (MRO), and air traffic management. The complexity and critical nature of these operations mean that generic or non-specialized software alternatives are not viable substitutes.

End user concentration in the aviation software market is low, reflecting a diverse range of users across different segments, including commercial airlines, MRO providers, OEMs (Original Equipment Manufacturers), and defense organizations. This diversity in the customer base mitigates risks for software providers and allows for a stable revenue stream from various sectors.

Software Type Insights

The management software segment accounted for the largest market share in 2023. Management software is essential for airlines, airports, and other aviation stakeholders to manage their day-to-day activities effectively. From flight scheduling, crew management, and maintenance operations to ticketing and customer service, management software helps streamline various processes, reducing costs and improving overall operational efficiency. The high demand for such comprehensive and integrated solutions has led to the management software segment capturing a substantial portion of the aviation software market. As airlines continue to expand their operations and seek ways to optimize performance, the reliance on advanced management software is expected to remain strong, reinforcing its dominant position in the market.

The simulation software segment in the aviation software market is experiencing tremendous growth, driven by the increasing need for advanced training solutions and operational planning. Simulation software is integral to pilot training, allowing for realistic, risk-free environments where trainees can practice and perfect their skills. Apart from training, it is also used for testing new aircraft designs, developing flight procedures, and optimizing airport operations.

Application Type Insights

The airlines segment in the market registered the largest share of 77.3% in 2023, due to their extensive operational needs and the critical role that software plays in ensuring safety, efficiency, and customer satisfaction. As the backbone of global air travel, airlines require advanced software solutions for a range of functions, including flight operations, crew management, maintenance, and customer service. The growing demand for real-time data analytics, predictive maintenance, and enhanced passenger experience has further propelled the adoption of advanced software systems by airlines.

The airport segment of the aviation software market is experiencing tremendous growth, fueled by the increasing complexity of airport operations and the need for enhanced efficiency and security. Airports are evolving into sophisticated hubs that require integrated software solutions to manage air traffic control, baggage handling, passenger processing, and facility management. With the surge in global air travel and the expansion of airport infrastructure, there is a heightened demand for software that can streamline operations, reduce delays, and enhance the overall passenger experience.

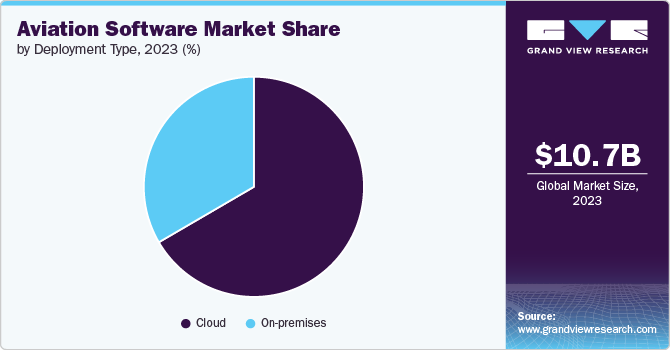

Deployment Type Insights

The cloud segment captures a significant share due to its numerous advantages over traditional systems. Cloud-based solutions offer greater scalability, flexibility, and cost-effectiveness, allowing aviation companies to efficiently manage their operations with reduced infrastructure costs. The ability to access data in real-time from anywhere in the world enhances operational efficiency and supports better decision-making. Moreover, the cloud facilitates easier integration with other technologies, such as AI and IoT, which are increasingly becoming integral to aviation operations.

The on-premises segment of the aviation software market is experiencing tremendous growth. due to the industry's need for high security, control, and compliance, which on-premises systems are uniquely positioned to provide. Aviation companies with stringent regulatory requirements or sensitive data often prefer on-premises solutions to ensure full control over their IT environments. Additionally, on-premises software allows for customized solutions tailored to the specific needs of an organization.

Regional Insights

North America accounted for a major revenue share of 35.5% in the aviation software market in 2023. The market is experiencing robust growth, driven by the increasing adoption of advanced technologies such as AI, IoT, and big data analytics. The region's emphasis on improving operational efficiency, enhancing passenger experience, and ensuring safety is fueling demand for innovative software solutions. Additionally, the presence of major aviation software companies and a strong aviation infrastructure in the United States and Canada contribute to the market's expansion.

U.S. Aviation Software Market Trends

The aviation software market in the U.S. is projected to grow at a CAGR of 7.4% from 2024 to 2030. The market is witnessing significant growth, supported by the country's strong aviation industry and its focus on technological advancements. The increasing demand for real-time data analytics, predictive maintenance, and efficient flight management systems is driving the adoption of aviation software across commercial airlines and airports.The U.S. government's initiatives to enhance air traffic management and modernize the National Airspace System (NAS) are also contributing to the market's rapid expansion. Furthermore, the presence of leading aviation software providers and a well-established aerospace sector are key factors bolstering the market's growth in the United States.

Europe Aviation Software Market Trends

The aviation software market in Europe is anticipated to grow at a CAGR of nearly 8% from 2024 to 2030.The region's commitment to enhancing aviation safety, efficiency, and sustainability is propelling this growth. The European Union's initiatives to develop a Single European Sky and improve air traffic management are major drivers of this growth.

The U.K. aviation software market is anticipated to grow at a CAGR from 2024 to 2030.The market is experiencing substantial growth, driven by the country's focus on modernizing its aviation infrastructure and adopting cutting-edge technologies. The increasing demand for efficient flight management systems, passenger information systems, and predictive maintenance solutions is boosting the market's growth.

The aviation software market in Germany is expected to grow at a CAGR from 2024 to 2030. The increasing adoption of digital technologies, such as artificial intelligence and big data analytics, is driving demand for advanced software solutions in the aviation sector. Germany's focus on improving operational efficiency, reducing carbon emissions, and enhancing passenger experience is fueling the market's growth.

France aviation software market is projected to grow at a CAGR from 2024 to 2030. The France aviation software market is driven by the country's emphasis on advancing its aviation industry through digital transformation. The adoption of software solutions for flight management, maintenance, and air traffic control is increasing as France seeks to enhance the efficiency and safety of its aviation operations. The country's strong aerospace sector, along with its commitment to reducing environmental impact, is fueling the demand for innovative aviation software. Additionally, France's efforts to develop smart airports and integrate new technologies into its air traffic management systems are contributing to the market's growth.

Asia Pacific Aviation Software Market Trends

The aviation software market in the Asia Pacific region accounted for a significant revenue share in 2023 and is expected to grow at a fastest CAGR of over 10% from 2024 to 2030. The Asia Pacific aviation software market holds a considerable share of the global market, driven by the region's rapid growth in air travel and the expansion of its aviation industry. Besides, the region's focus on airport modernization, coupled with the adoption of advanced technologies in aviation operations, is fueling the demand for aviation software. Additionally, the presence of emerging markets and the continuous expansion of airline fleets are contributing to the Asia Pacific region's dominant position in the global aviation software market.

The China aviation software market is projected to grow at a CAGR from 2024 to 2030. The country's booming aviation industry and rapid economic growth support its growth. China's focus on modernizing its airports, expanding its airline fleets, and adopting cutting-edge technologies in air traffic management and flight operations is contributing to the market's high share.

The aviation software market in Japan is expected to grow at a CAGR from 2024 to 2030. The adoption of advanced software solutions for flight management, air traffic control, and maintenance operations is increasing as Japan seeks to enhance the safety and reliability of its aviation infrastructure.

The India Aviation Software market is expected to grow at a CAGR from 2024 to 2030. The government's initiatives to develop new airports, modernize existing ones, and enhance air traffic management systems are driving the adoption of advanced aviation software solutions. India's focus on improving operational efficiency, safety, and passenger experience is further contributing to the market's growth.

Middle East & Africa Aviation Software Market Trends

The aviation software market in the Middle East and Africa is expected to grow at a CAGR of over 3.0% from 2024 to 2030. The region's focus on expanding its aviation infrastructure and adopting new technologies is driving this growth. The increasing number of airline passengers, coupled with the development of new airports and the modernization of existing ones, is fueling the demand for aviation software.

The Saudi Arabia aviation software market is anticipated to grow at a CAGR from 2024 to 2030. The increasing demand for air travel, coupled with the development of new airports and the expansion of existing ones, is fueling the adoption of advanced aviation software solutions. Saudi Arabia's focus on improving air traffic management, enhancing passenger experience, and ensuring safety is further contributing to the market's expected growth.

Key Aviation Software Company Insights

Some of the key players operating in the Aviation Software market include The Boeing Company, and Airbus SE, among others.

-

The Boeing Company is one of the leading global aerospace firms with extensive expertise in aircraft manufacturing. Boeing's software solutions leverage big data and predictive analytics to enhance flight efficiency, safety, and maintenance. The company’s focus on real-time data integration and AI-powered decision-making tools has disrupted the traditional aviation software landscape, setting new standards for operational excellence and fleet management.

-

Airbus SE is one of the key players in the aerospace industry and offers a range of data-driven technologies. Airbus’s software solutions are designed to optimize flight operations, improve fuel efficiency, and enhance aircraft performance by harnessing the power of big data and machine learning. The company’s commitment to digital transformation and its ability to provide comprehensive, data-centric solutions have disrupted the market, enabling airlines to achieve higher levels of operational efficiency and safety

Indra Avitech GmbH and Veryon, among others, are some of the emerging market participants in the Aviation Software market.

-

Indra Avitech GmbH is known for its cutting-edge software solutions that revolutionize air traffic management and flight operations. The company’s expertise in integrating data analytics and artificial intelligence into its software offerings has disrupted the aviation market by providing unparalleled insights into airspace management and flight safety. Indra Avitech’s focus on data-driven decision-making tools has enabled airlines and airports to optimize their operations, reduce costs, and enhance safety standards, making it a key player in the aviation software industry.

-

Veryon specializing in providing data-driven solutions that enhance maintenance and operational efficiency. The company's software platforms utilize advanced analytics to provide real-time insights into aircraft performance, enabling proactive maintenance and reducing downtime.

Key Aviation Software Companies:

The following are the leading companies in the aviation software market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus SE

- Bigscal Technologies Pvt. Ltd.

- CHAMP Cargosystems

- General Electric Company

- Honeywell International Inc.

- IFS

- Indra Avitech GmbH

- Leonardo S.p.A.

- Ramco Systems Limited

- RTX Corporation

- SITA

- Veryon

- Thales Group

- The Boeing Company

Recent Developments

-

In August 2024, Surf Air Mobility introduced Surf Air Technologies, a subsidiary that offers solutions for hybrid and electric aircraft. The subsidiary company and Palantir Technologies will work together to develop software tools for new aircraft manufacturers and operators.

-

In June 2024, the University of Michigan revealed the Future Aircraft Sizing Tool (FAST). It is MATLAB-based software suitable for the design and analysis of electrified and conventional aircraft.

-

In May 2024, NASA announced the launch of the new Aviary modeling tool for simulating conceptual aircraft designs. The tool digitally tests the aircraft concepts before introducing them into the real world, saving the costs associated with flight testing.

Aviation Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.18 billion |

|

Revenue forecast in 2030 |

USD 16.93 billion |

|

Growth rate |

CAGR of 7.2% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Billion/Million and CAGR from 2024 to 2030 |

|

Report Component |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, software type, deployment type, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E. |

|

Key companies profiled |

Airbus SE; Bigscal Technologies Pvt. Ltd.; CHAMP Cargosystems; General Electric Company; Honeywell International Inc.; IFS; Indra Avitech GmbH; Leonardo S.p.A.; Ramco Systems Limited; RTX Corporation; SITA; Thales Group; and The Boeing Company; Veryon; among others |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Aviation Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aviation software market report based on deployment type, application, software type, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Airport

-

Airlines

-

-

Software Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Management Software

-

Analysis Software

-

Design Software

-

Simulation Software

-

MRO Software

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aviation software market size was estimated at USD 10.68 billion in 2023 and is expected to reach USD 11.18 billion in 2024.

b. The global aviation software market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 16.93 billion by 2030.

b. The airlines segment in the market registered the largest share of over 77.2% in 2023, due to their extensive operational needs and the critical role that software plays in ensuring safety, efficiency, and customer satisfaction. As the backbone of global air travel, airlines require advanced software solutions for a range of functions, including flight operations, crew management, maintenance, and customer service. The growing demand for real-time data analytics, predictive maintenance, and enhanced passenger experience has further propelled the adoption of advanced software systems by airlines.

b. Some key players operating in the aviation software market include Aerotech US, CHAMP Cargosystems, CS SOFT a.s., Bigscal - Software Development Company, General Electric Company, Thales, Airbus, Boeing, Honeywell International Inc., and Indra Avitech among others

b. The aviation software market growth is driven by increasing demand for advanced flight management systems, integrated aircraft communication systems, and real-time data analytics tools. Aviation companies are increasingly adopting software solutions to enhance operational efficiency, improve safety, and reduce costs. The growing trend of digital transformation in the aviation industry, coupled with the need for predictive maintenance and fuel efficiency optimization, propels the demand for aviation software.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."