- Home

- »

- Network Security

- »

-

Aviation Cyber Security Market Size & Share Report, 2030GVR Report cover

![Aviation Cyber Security Market Size, Share & Trends Report]()

Aviation Cyber Security Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Endpoint Security, Cloud Security), By Deployment (Cloud-based, On-premises), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-339-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aviation Cyber Security Market Summary

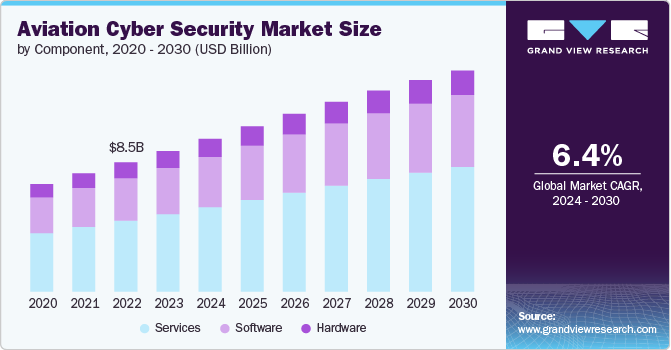

The global aviation cyber security market size was valued at USD 9.24 billion in 2023 and is expected to reach USD 14.51 billion by 2030, growing at a CAGR of 6.35% from 2024 to 2030. The market is expected to grow significantly over the next decade, driven by technological advancements, increasing cyber threats, and the continuous push for more secure aviation operations.

Key Market Trends & Insights

- North America market held a market share of over 38% in 2023.

- By component, the services segment accounted for the largest market share of over 50% in 2023.

- By type, the infrastructure protection segment accounted for the largest market share in 2023.

- By deployment, the on-premises segment accounted for the largest market share in 2023.

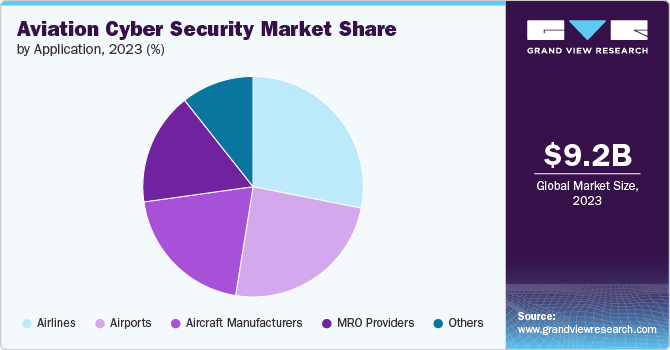

- By application, the airlines segment accounted for the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.24 Billion

- 2030 Projected Market Size: USD 14.51 Billion

- CAGR (2024-2030): 6.35%

- North America: Largest market in 2023

Companies in this sector are investing heavily in research and development to stay ahead of emerging threats and to meet regulatory requirements. The integration of advanced technologies and the development of innovative solutions will be key to the market's growth and effectiveness in safeguarding the aviation industry.

The global increase in air traffic, driven by rising passenger numbers and the expansion of commercial aviation fleets, exposes more systems and data to potential cyber threats. In 2023, European airport passenger traffic surged by 19% from the previous year, reaching nearly 95% of pre-pandemic levels. Europe’s airports welcomed 2.3 billion passengers, just 5.3% below 2019 figures. International travel, particularly within the EU+, drove this growth. Smaller and regional airports outperformed, while larger hubs saw a slower recovery, primarily due to the slow return of corporate travel and Asian markets. As airlines and airports expand their operations, they require advanced cybersecurity measures to safeguard their growing digital infrastructure and ensure uninterrupted services. The anticipated growth in global air traffic further underscores the importance of investing in cybersecurity.

The development and deployment of next-generation aircraft, such as the Boeing 787 Dreamliner and Airbus A350, which are highly reliant on interconnected digital systems, amplify the need for robust cybersecurity. These modern aircraft incorporate advanced avionics, in-flight entertainment systems, and connectivity features that are vulnerable to cyber-attacks. Ensuring the cybersecurity of these sophisticated systems is critical for safe and reliable operations.

International regulatory bodies, such as the International Civil Aviation Organization (ICAO), the European Union Aviation Safety Agency (EASA), and the Federal Aviation Administration (FAA), have established stringent cybersecurity standards and guidelines. Compliance with these regulations is mandatory for aviation stakeholders, including airlines, airports, and air traffic management (ATM) providers. These regulations necessitate the adoption of comprehensive cybersecurity measures, thereby driving market growth.

Component Insights

The services segment accounted for the largest market share of over 50% in 2023. The growth of the segment is driven by the increasing complexity of cyber threats, regulatory compliance requirements, digital transformation, and the shortage of skilled cybersecurity professionals. The need for continuous monitoring, incident response, managed security services, and specialized training further fuels the demand for cybersecurity services. As the aviation industry continues to evolve and integrate advanced technologies, the reliance on comprehensive cybersecurity services will continue to grow, ensuring the protection and resilience of critical aviation infrastructure.

The software segment is expected to grow at a CAGR of 6.2% during the forecast period. The growth of the hardware segment in the aviation cybersecurity market is driven by the need to protect physical devices and infrastructure from increasing cyber threats, regulatory requirements, advancements in hardware security technologies, and the digital transformation of the aviation industry. Investments in aviation infrastructure, collaborative efforts, and increased awareness and training further contribute to the demand for secure hardware solutions.

Type Insights

The infrastructure protection segment accounted for the largest market share in 2023. The digital transformation of the aviation industry, exemplified by the development of smart airports and next-generation air traffic management (ATM) systems, plays a crucial role in enhancing operational efficiency and safety. Smart airports incorporate IoT, AI, and automated systems to streamline processes, improve passenger experience, and optimize resource management. However, these advancements also introduce new cyber vulnerabilities due to the increased interconnectivity and reliance on digital systems. Similarly, modern ATM systems utilize digital technologies to improve safety, efficiency, and traffic management. To safeguard these critical infrastructures from cyber threats, robust cybersecurity measures are essential. These measures include advanced threat detection, secure communication protocols, and continuous monitoring to ensure the integrity and reliability of aviation operations.

The cloud security segment is expected to grow at a CAGR of 9.5% during the forecast period. Technological advancements in cloud security, enhanced collaboration and information sharing, and the importance of disaster recovery and business continuity further fuel the demand for robust cloud security solutions. As the aviation industry continues to embrace digital transformation, the necessity of securing cloud environments becomes paramount, ensuring the protection and integrity of critical aviation operations and data.

Deployment Insights

The on-premises segment accounted for the largest market share in 2023. Aviation organizations often handle sensitive data, including passenger information, flight schedules, and operational data. On-premises solutions provide greater control over data security and privacy, ensuring that sensitive information remains within the organization's physical boundaries. Similarly, strict regulatory requirements, such as data sovereignty laws and industry-specific standards, necessitate keeping certain data on-premises to ensure compliance and mitigate legal risks helping market growth.

The cloud-based segment is expected to grow at a CAGR of 7.43% over the forecast period. Cloud-based cybersecurity solutions offer scalability, allowing aviation organizations to scale resources up or down based on demand. This flexibility is crucial for handling fluctuations in traffic, data volume, and operational requirements within the aviation sector. Cloud solutions enable rapid deployment of cybersecurity measures and updates, supporting agile responses to emerging threats and regulatory changes in real-time. Cloud providers offer robust security features such as encryption, identity and access management (IAM), and network segmentation. These features help protect sensitive aviation data and applications from cyber threats while ensuring compliance with industry regulations and standards.

Application Insights

The airlines segment accounted for the largest market share in 2023. Airlines rely on complex systems for flight operations, aircraft maintenance, and safety management. Securing these critical systems from cyber threats is crucial to ensure flight safety, operational efficiency, and compliance with aviation regulations (e.g., FAA, EASA). Airlines are increasingly digitizing their operations to enhance efficiency, customer experience, and operational agility. This includes digital booking systems, in-flight entertainment, loyalty programs, and mobile apps, all of which require robust cybersecurity measures to protect customer data and ensure operational continuity.

The air traffic management segment is expected to grow at a CAGR of 8.3% during the forecast period. ATM systems process and transmit sensitive data, including aircraft positions, flight plans, and communications between air traffic controllers and pilots. Ensuring the confidentiality, integrity, and availability of this data is essential for maintaining trust and compliance with aviation regulations. Air traffic management systems face evolving cyber threats, including ransomware, phishing attacks, and supply chain vulnerabilities. Proactive threat intelligence gathering, risk assessment, and mitigation strategies are critical to preemptively addressing these threats.

Regional Insights

North Americaaviation cyber security market held a market share of over 38% in 2023. North America experiences a high frequency of cyber-attacks targeting aviation infrastructure, including airlines, airports, and air traffic management systems. The region's advanced technological infrastructure and interconnected aviation networks make it a prime target for cybercriminals seeking to exploit vulnerabilities for financial gain or disruption. Instances of ransomware attacks and data breaches in the aviation sector underscore the critical need for robust cybersecurity measures to protect sensitive passenger data, operational systems, and intellectual property.

U.S. Aviation Cyber Security Market Trends

The aviation cyber security Market in the U.S. is expected to grow significantly at a CAGR of 4.48% from 2024 to 2030. The U.S. aviation industry continues to adopt cutting-edge technologies, including IoT, AI, cloud computing, and big data analytics, to enhance operational efficiency, passenger experience, and airspace management. Securing these technologies against evolving cyber threats requires innovative cybersecurity solutions that align with industry-specific requirements.

Asia Pacific Aviation Cyber Security Market Trends

The aviation cyber security market in Asia Pacific is expected to grow significantly at a CAGR of 8.26% from 2024 to 2030. Asia Pacific has seen a substantial increase in air travel demand, driven by economic growth, rising middle-class populations, and increased tourism. This growth necessitates robust cybersecurity measures to protect expanding aviation infrastructure. The region is investing heavily in the construction of new airports and the expansion of existing ones. These developments require advanced cybersecurity solutions to secure new digital systems and infrastructure from cyber threats.

Europe Aviation Cyber Security Market Trends

The aviation cyber security market in Europe is expected to grow significantly at a CAGR of 6.30% from 2024 to 2030. Europe is at the forefront of developing smart airports with interconnected systems, IoT devices, and automated processes. These advancements enhance operational efficiency but also introduce new cybersecurity vulnerabilities that need to be addressed. The integration of advanced technologies such as AI, machine learning, cloud computing, and big data analytics in aviation operations necessitates robust cybersecurity solutions to protect against evolving cyber threats.

Key Aviation Cyber Security Company Insights

Some of the key players operating in the market include Thales Group, Raytheon Technologies Corporation, BAE Systems, Airbus SE, IBM Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Honeywell International Inc., Booz Allen Hamilton Inc., Cisco Systems, Inc. among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024, Thales Group, announced it will be establishing an avionics maintenance, repair, and operations (MRO) facility in Gurgaon by March 2025. This investment will support Indian airlines like Air India and IndiGo by maintaining and upgrading avionics systems. Thales also plans to double its engineering workforce in India within two years to meet rising export demands in cybersecurity and aviation solutions.

-

In September 2023, Everbridge Inc. launched Everbridge 360, a comprehensive critical event management and public warning software, at the Global Security Exchange (GSX) 2023 conference. The new platform consolidates risk intelligence, communications, collaboration, and coordination capabilities into a single interface, enhancing organizational response to crises. Key benefits include faster critical communications, reduced errors, and quicker onboarding for new users. Everbridge 360 aims to improve operational resilience by enabling seamless application transitions and accelerating response times during critical events.

-

For instance, in December 2022, Motorola Types, Inc. announced the acquisition of Rave Mobile Safety, a software services provider. The cloud-native, adaptable platform from Rave supports emergency management for state and municipal governments, businesses, and hospitals.

Aviation Cyber Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.03 billion

Revenue forecast in 2030

USD 14.51 billion

Growth Rate

CAGR of 6.35% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, deployment, deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; and South Africa.

Key companies profiled

Thales Group; Raytheon Technologies Corporation; BAE Systems; Airbus SE; IBM Corporation; Lockheed Martin Corporation; Northrop Grumman Corporation; Honeywell International Inc.; Booz Allen Hamilton Inc.; Cisco Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Aviation Cyber Security Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global aviation cyber security market report based on component, type, deployment, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Unified Threat Management (UTM)

-

IDS/IPS

-

DLP

-

IAM

-

SIEM

-

DDoS

-

Risk & Compliance Management

-

Others

-

-

Services

-

Professional Services

-

Risk and Threat Assessment

-

Design, Consulting, and Implementation

-

Training & Education

-

Support & Maintenance

-

-

Managed Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Endpoint Security

-

Cloud Security

-

Network Security

-

Application Security

-

Infrastructure Protection

-

Data Security

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Application Outlook (Revenue; USD Billion, 2018 - 2030)

-

Airlines

-

Airports

-

Aircraft Manufacturers

-

MRO Providers

-

Air Traffic Management

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aviation cyber security market size was valued at USD 9.24 billion in 2023 and is expected to reach USD 10.03 billion in 2024.

b. The global aviation cyber security market is expected to grow at a compound annual growth rate of 6.35% from 2024 to 2030 to reach USD 14.51 billion by 2030.

b. The services segment accounted for the largest market share of over 50% in 2023. The growth of the services segment in the aviation cybersecurity market is driven by the increasing complexity of cyber threats, regulatory compliance requirements, digital transformation, and the shortage of skilled cybersecurity professionals.

b. Some of the key players operating in the market include Thales Group, Raytheon Technologies Corporation, BAE Systems, Airbus SE, IBM Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Honeywell International Inc., Booz Allen Hamilton Inc., Cisco Systems, Inc. among others.

b. The aviation cybersecurity market is expected to grow significantly over the next decade, driven by technological advancements, increasing cyber threats, and the continuous push for more secure aviation operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.