- Home

- »

- Next Generation Technologies

- »

-

Aviation Cloud Market Size, Share & Trends Report, 2030GVR Report cover

![Aviation Cloud Market Size, Share & Trends Report]()

Aviation Cloud Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment, By Service Model, By End User, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-442-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aviation Cloud Market Summary

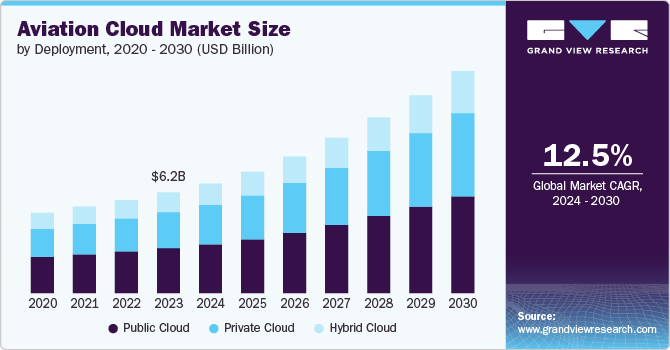

The global aviation cloud market size was estimated at USD 6.19 billion in 2023 and is projected to reach USD 13.64 billion by 2030, growing at a CAGR of 12.5% from 2024 to 2030. Cloud platforms are increasingly incorporating advanced data analytics and artificial intelligence (AI) tools, allowing airlines to leverage large volumes of data for actionable insights.

Key Market Trends & Insights

- The aviation cloud market in North America accounted for a revenue share of above 36% in 2023.

- Based on deployment, the public cloud segment dominated the market in 2023 with a market share of above 44%.

- Based on service model, the SaaS segment held the highest revenue share in 2023.

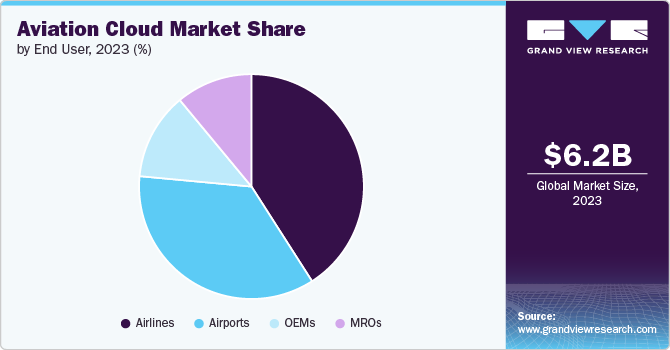

- Based on end user, the airlines segment held the highest revenue share in 2023.

- Based on application, the flight operations segment held the highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.19 Billion

- 2030 Projected Market USD 13.64 Billion

- CAGR (2024-2030): 12.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

AI can optimize flight routes, improve fuel efficiency, and enhance predictive maintenance by analyzing patterns and anomalies in real-time. Data analytics also enable personalized passenger experiences by tailoring services based on individual preferences and behaviors. These capabilities drive more informed decision-making and operational improvements.

The aviation cloud market is increasingly adopting advanced analytics to enhance operational decision-making. Airlines and airports are utilizing cloud-based analytics tools to process vast amounts of data from various sources, enabling them to gain insights into passenger behavior, operational efficiency, and market trends. This data-driven approach allows for more informed strategic planning and resource allocation. As a result, stakeholders can optimize flight schedules, improve customer service, and enhance overall operational performance.

Blockchain is increasingly being integrated into aviation cloud solutions to enhance security and transparency in transactions. It helps in tracking and verifying the authenticity of documents, such as maintenance records and passenger information. This technology can also streamline supply chain management by providing a secure and immutable ledger of transactions. The use of blockchain improves trust and reduces the risk of fraud in the aviation industry.

The integration of AI and machine learning with cloud platforms is transforming various aspects of aviation operations. These technologies enable advanced analytics for predictive maintenance, customer service automation, and operational optimization. For instance, AI-driven chatbots can enhance customer interactions, while machine learning algorithms can analyze operational data to identify inefficiencies. As AI and machine learning capabilities expand, their adoption within cloud solutions will significantly impact the aviation industry.

With the increasing reliance on cloud technology, the aviation sector is prioritizing cybersecurity to protect sensitive data and maintain operational integrity. Cloud service providers are enhancing their cybersecurity offerings and implementing advanced threat detection and response systems. This trend is crucial as the aviation industry faces growing cyber threats, making robust security measures essential for protecting passenger information and operational data. As concerns about cybersecurity continue to rise, the demand for secure cloud solutions will be a significant trend in the aviation cloud market.

Deployment Insights

The public cloud segment dominated the market in 2023 with a market share of above 44%. One of the key drivers of the growing demand for public cloud in the aviation industry is the cost efficiency it offers. Public cloud services eliminate the need for significant capital expenditures on IT infrastructure, allowing companies to convert these costs into more manageable operational expenses. This is especially beneficial for smaller airlines and airports that may not have the resources to invest in large-scale IT systems. Moreover, public cloud providers often offer pricing models that allow aviation companies to only pay for the resources they consume, further enhancing cost savings.

The private cloud segment is estimated to have a significant growth rate from 2024 to 2030. The aviation industry is witnessing a surge in the adoption of private cloud solutions, driven by the need for enhanced data security and compliance. Organizations are increasingly recognizing the benefits of dedicated cloud environments, which offer greater control over sensitive information and ensure compliance with industry regulations. Private cloud platforms enable seamless integration with existing IT infrastructure, facilitating a smooth transition to cloud-based services. As the industry continues to prioritize data protection and regulatory adherence, the demand for private cloud solutions is expected to rise significantly in the coming years.

Service Model Insights

The SaaS segment held the highest revenue share in 2023. SaaS solutions in the aviation industry are increasingly incorporating AI and machine learning to enhance various operational aspects. These technologies enable predictive maintenance, allowing airlines to identify potential issues before they cause disruptions, thus reducing downtime. In addition, AI-driven analytics are helping optimize flight operations, such as route planning and fuel management, leading to cost savings and improved efficiency. The integration of AI in customer service is also gaining traction, providing personalized experiences and improving passenger satisfaction.

The IaaS segment is estimated to register the highest growth rate from 2024 to 2030. The Infrastructure as a Service (IaaS) segment within the aviation cloud market is experiencing robust growth, driven by the increasing need for scalable and cost-effective IT resources. IaaS allows airlines and airports to rent virtualized computing resources over the internet, enabling them to manage fluctuating workloads without the burden of maintaining physical hardware. This flexibility is particularly beneficial in the aviation sector, where demand can vary significantly based on seasonal travel patterns and operational requirements. As the industry continues to embrace digital transformation, the demand for IaaS solutions is expected to rise, facilitating enhanced operational efficiency and improved passenger experiences.

End User Insights

The airlines segment held the highest revenue share in 2023. The demand for personalized and seamless travel experiences is driving airlines to invest in cloud-based customer service solutions. These platforms enable airlines to offer personalized services, such as tailored flight recommendations, seat preferences, and loyalty program management. By integrating cloud-based systems with mobile apps and websites, airlines can provide passengers with real-time updates on flight status, baggage tracking, and other essential information. This enhanced customer experience not only increases passenger satisfaction but also fosters loyalty, driving repeat business.

The airport segment is estimated to have a significant growth rate from 2024 to 2030. The growing emphasis on enhancing passenger experience is another key driver for the adoption of aviation cloud solutions in airports. Cloud technologies enable airports to provide personalized services, such as real-time flight information, mobile check-in, and tailored travel recommendations, significantly improving customer satisfaction. By analyzing passenger data, airports can better understand traveler preferences and behaviors, allowing for more targeted marketing and service offerings. This focus on the passenger experience is essential for airports aiming to remain competitive in a rapidly evolving aviation landscape.

Application Insights

The flight operations segment held the highest revenue share in 2023. Airlines are leveraging cloud technologies to optimize flight schedules and allocate resources more efficiently. Cloud-based systems can analyze vast amounts of data to identify the most efficient flight routes, optimize crew assignments, and manage fleet utilization. This leads to reduced operational costs and better utilization of aircraft and crew, particularly during peak travel periods. The flexibility of cloud platforms also allows airlines to quickly adjust schedules and resources in response to changing conditions, such as unexpected delays or cancellations, driving the demand for these solutions.

The data analytics and business intelligence segment are estimated to register the highest growth rate from 2024 to 2030. Data analytics and business intelligence are transforming the way airlines and airports manage their assets, particularly in maintenance. By analyzing data from aircraft sensors, maintenance logs, and operational records, cloud-based analytics platforms can identify patterns and predict potential issues before they occur. This enables a shift from reactive to proactive maintenance, reducing costs associated with unscheduled downtime and ensuring the optimal performance of aircraft and other critical assets. As the aviation industry continues to prioritize operational efficiency and cost savings, the demand for data analytics solutions in the aviation cloud market is expected to grow significantly.

Regional Insights

The Aviation Cloud market in North America accounted for a revenue share of above 36% in 2023. The stringent regulatory environment in North America drives airlines and airports to invest in cloud technologies that ensure data protection and compliance with safety standards. This focus on regulatory compliance increases the demand for secure cloud-based solutions that safeguard sensitive passenger information while optimizing operations.

U.S. Aviation Cloud Market Trends

The Aviation Cloud market in the U.S. is anticipated to grow at a CAGR of around 11% from 2024 to 2030. There is a strong emphasis on digital transformation within the U.S. aviation sector, with airlines and airports investing in cloud solutions to improve operational efficiency and customer service. Cloud computing facilitates the integration of advanced technologies such as AI and IoT, which are essential for streamlining operations and providing personalized services to passengers.

Europe Aviation Cloud Market Trends

Aviation Cloud market in Europe accounted for a notable revenue share in 2023. The integration of emerging technologies such as AI, machine learning, and big data analytics with cloud platforms is gaining traction in Europe. These technologies enable predictive maintenance, operational optimization, and enhanced customer service, further driving the demand for cloud solutions in the aviation industry.

Asia Pacific Aviation Cloud Market Trends

The Aviation Cloud market in Asia Pacific is anticipated to grow at the highest CAGR from 2024 to 2030. There is a rising investment in smart airport technologies in APAC, driven by cloud computing advancements. These technologies, supported by cloud infrastructure, include automated check-in systems and biometric security, aiming to modernize and streamline airport operations.

Key Aviation Cloud Company Insights

The Aviation Cloud market is highly competitive, with major players such as Accenture, Adobe, Amazon Web Services, Collins Aerospace, Google, and IBM Corporation dominating the landscape as of 2023. These companies are actively expanding their market share through strategic initiatives, including partnerships, mergers, acquisitions, and the development of innovative products and technologies. For instance, In June 2024, Megaport Limited, a leading Network as a Service (NaaS) provider, announced a strategic partnership with Lufthansa Systems, a prominent aviation IT solutions provider, aimed at accelerating digital transformation in the aviation sector. This collaboration will leverage Megaport's advanced Software Defined Network (SDN) to transition Lufthansa's Global Aviation Cloud from a single to a multi-cloud environment, enhancing connectivity and security for over 350 airlines worldwide. The partnership is expected to deliver significant benefits, including reduced network costs, improved performance, and the ability to provision virtual network services rapidly.

Key Aviation Cloud Companies:

The following are the leading companies in the aviation cloud market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Adobe, Inc.

- Amazon Web Services, Inc.

- Collins Aeropace

- Google LLC

- IBM Corporation

- Luftansa Group

- Microsoft Corporation

- NEC Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SITA

Recent Developments

-

In February 2024, Riyadh Air, Saudi Arabia's new airline, formed a strategic alliance with Adobe to enhance global travel experiences through generative AI. By integrating Adobe Experience Cloud technologies, Riyadh Air aims to streamline trip planning and offer a cohesive experience across various travel and hospitality sectors. This initiative aligns with Saudi Arabia’s National Aviation Strategy, which seeks to attract 330 million visitors annually by 2030.

-

In October 2023, Cathay Pacific partnered with Lufthansa Systems, a Lufthansa Group subsidiary, to transition its operations and critical systems to the Global Aviation Cloud (GAC). The collaboration includes integrating Lufthansa Systems' solutions, such as NetLine Ops++, NetLine/Sched, and NetLine/Plan, to boost operational efficiency. By utilizing the GAC's secure and scalable infrastructure, Cathay Pacific seeks to enhance performance and ensure seamless integration, ultimately improving service delivery for its passengers.

-

In March 2023, Southwest Airlines chose Amazon Web Services (AWS) as its primary cloud provider to further its digital transformation efforts. This decision supports the airline’s goals of improving passenger experiences, optimizing operations, and advancing IT infrastructure, with AWS's scalable and secure cloud solutions intended to drive innovation and service enhancements.

Aviation Cloud Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.74 billion

Revenue forecast in 2030

USD 13.64 billion

Growth rate

CAGR of 12.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, service model, end user, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Accenture; Adobe; Amazon Web Services; Collins Aerospace; Google; IBM Corporation; Lufthansa Group; Microsoft; NEC Corporation; Oracle Corporation; Salesforce; SAP SE; SITA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aviation Cloud Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global Aviation Cloud market report into deployment, service model, end user, application, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Service Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infrastructure as a Service (IaaS)

-

Platform as a Service (PaaS)

-

Software as a Service (SaaS)

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Airports

-

Airlines

-

OEMs

-

MROS

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Flight Operations

-

Passenger Service

-

Maintenance & Management Systems

-

Supply Chain Management

-

Data Analytics And Business Intelligence

-

Cargo Management & Baggage Handling

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aviation cloud market size was estimated at USD 6.19 billion in 2023 and is expected to reach USD 6.74 billion in 2024.

b. The global aviation cloud market is expected to grow at a compound annual growth rate of 12.5% from 2024 to 2030, reaching USD 13.64 billion by 2030.

b. North America dominated the aviation cloud market with a share of 36.2% in 2023. North America's robust regulatory framework supports the adoption of cloud solutions that comply with safety and data protection standards. This compliance is essential for fostering trust and encouraging further investment in cloud technologies by aviation stakeholders.

b. Some key players operating in the aviation cloud market include Accenture, Adobe, Amazon Web Services, Collins Aerospace, Google, IBM Corporation, Lufthansa Group, Microsoft, NEC Corporation, Oracle Corporation, Salesforce, SAP SE, and SITA.

b. Key factors driving market growth include increasing demand for operational efficiency, enhanced passenger experience, and advancements in cloud technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.