- Home

- »

- Next Generation Technologies

- »

-

Aviation Analytics Market Size, Share & Growth Report, 2030GVR Report cover

![Aviation Analytics Market Size, Share & Trends Report]()

Aviation Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Functions, By Component (Solutions, Services), By Deployment, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-346-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aviation Analytics Market Summary

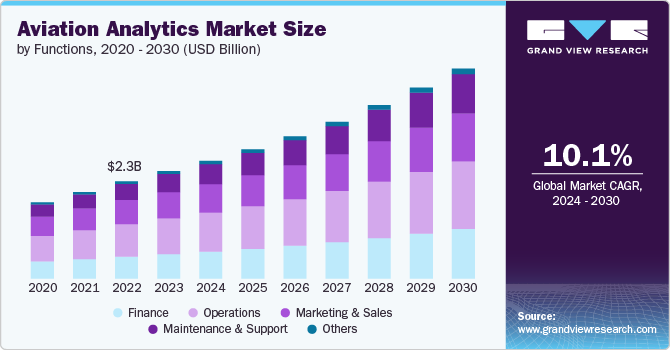

The global aviation analytics market size was estimated at USD 2,601.0 million in 2023 and is projected to reach USD 5.08 billion grow at a CAGR of 10.14% from 2024 to 2030. The increasing adoption of data-driven decision-making processes in the aviation industry, the growing focus on enhancing predictive maintenance capabilities and the shift towards cloud-based solutions are the primary drivers fueling the market expansion.

Key Market Trends & Insights

- The North America dominated the market with the largest revenue share of 33.22% in 2023.

- The U.S. is projected to grow at the fastest CAGR of 9.28% from 2024 to 2030.

- Based on function, the operations segment led the market with the largest revenue shareof 33.23% in 2023.

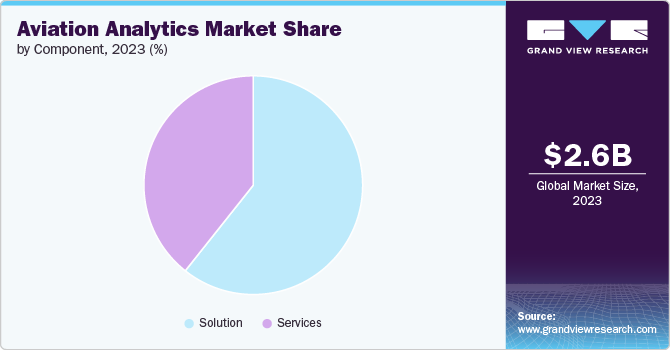

- Based on component, the solutions segment led the market with the largest revenue share of 60.66% in 2023.

- Based on deployment, the cloud segment led the market with the largest revenue share of 50.98% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,601.0 Million

- 2030 Projected Market Size: USD 5.08 Billion

- CAGR (2024-2030): 10.14%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The growing need for sophisticated analytics platforms that can process and analyze the data generated by various systems within the aviation ecosystem in real time is further driving the demand for real-time data analytics solutions.The integration of Big Data and the Internet of Things (IoT) within the aviation industry is revolutionizing data collection and analysis. These technologies enable the collection of vast amounts of data from various sources, such as aircraft sensors, operational logs, and passenger information. Analyzing this data helps in optimizing flight operations, improving fuel efficiency, and enhancing passenger experiences. The increasing reliance on data-driven decision-making processes is propelling the demand for aviation analytics.

Airlines are increasingly focusing on enhancing the passenger experience by utilizing analytics. Personalization of services, real-time feedback, and efficient handling of passenger queries are made possible through advanced analytics tools. By analyzing passenger data, airlines can offer tailored services, improving customer satisfaction and loyalty. This trend is driving airlines to invest heavily in analytics solutions that provide insights into passenger behavior and preferences.

Artificial intelligence (AI) and machine learning (ML) are transforming the aviation analytics landscape by providing sophisticated tools for data analysis and prediction. These technologies enable more accurate demand forecasting, route optimization, and risk management. The ability of AI and ML to process large datasets and identify patterns is enhancing operational efficiency and decision-making processes. This trend towards adopting AI and ML in aviation analytics is expected to fuel the market expansion.

The trend towards implementing robust cybersecurity measures in aviation analytics is driven by the need to safeguard data integrity and maintain customer trust. Ensuring the protection of sensitive data and preventing cyber threats are paramount for airlines. Advanced analytics tools are being used to detect and mitigate cyber threats, enhancing the overall security posture of the aviation industry is expected to further drive the market growth.

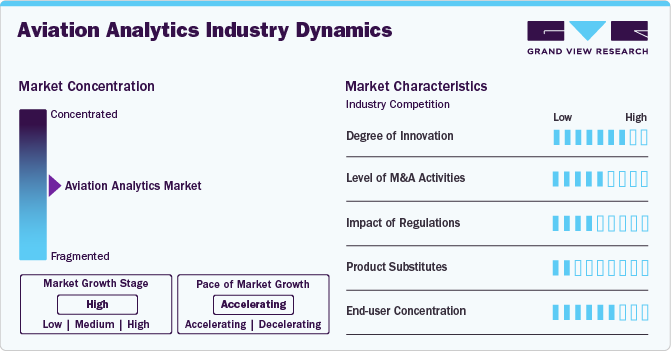

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by the rapid advancements in technologies such as artificial intelligence, machine learning, and big data analytics. Companies are constantly developing new solutions and applications to optimize various aspects of airline and airport operations, such as fuel management, inventory management, revenue management, and customer analytics. These innovations are enabling airlines, airports, and other stakeholders in the aviation industry to optimize operations, enhance safety measures, improve customer experience, and increase profitability.

The level of mergers & acquisition activities in the market is expected to be moderate.Companies in this sector are strategically acquiring or merging with other players to expand their product offerings, enhance their technological capabilities, access new markets, and achieve economies of scale. These mergers and acquisitions are reshaping the competitive landscape of the global market.

The impact of regulations on the market is expected to be moderate. Regulatory bodies impose strict guidelines related to data privacy, security, and compliance in the aviation industry. Companies offering aviation analytics solutions need to ensure that their products comply with these regulations to gain trust from customers and avoid legal issues. Compliance with regulations also influences the development and deployment of innovative solutions in the market.

The product substitute in the market is expected to be low.This is primarily due to the specialized nature of aviation analytics solutions and services. The unique requirements of the aviation industry, such as safety regulations, operational efficiency, demand forecasting, route optimization, and maintenance planning, necessitate tailored analytics solutions that cater specifically to these needs.

The end-user concentration in the market is expected to be moderate. There is a diverse range of end users including airlines, airports, aircraft manufacturers, maintenance providers, and other stakeholders within the aviation ecosystem that contribute to the overall demand for analytics solutions. Airlines are increasingly adopting analytics for various aspects of their operations, including fleet management, fuel management, revenue management, and more. This adoption is driven by the need to optimize business operations, enhance customer experiences, and increase efficiency.

Functions Insights

Based on function, the operations segment led the market with the largest revenue shareof 33.23% in 2023. This growth can be attributed to the critical role it plays in ensuring the efficient and safe functioning of airlines. This segment encompasses various aspects such as flight operations, ground operations, and crew management. By leveraging analytics, airlines can optimize their operations, enhance safety measures, and improve overall performance.

The maintenance and support segment is expected to grow at the fastest CAGR of 11.7% from 2024 to 2030. The increasing adoption of advanced analytics solutions for predictive maintenance and real-time monitoring is driving the growth of this segment. This segment involves predictive maintenance, asset management, and technical support services. Airlines are increasingly focusing on proactive maintenance strategies to minimize downtime, reduce costs, and enhance operational efficiency.

Component Insights

Based on component, the solutions segment led the market with the largest revenue share of 60.66% in 2023. This growth can be attributed to the increasing adoption of analytics software by airlines, airports, and other aviation companies to gain insights from the vast amounts of data generated in the industry. Analytics solutions enable stakeholders to optimize various aspects of operations, including fuel management, route optimization, revenue management, and maintenance, which is further driving the segmental growth.

The services segment is expected to register at the fastest CAGR from 2024 to 2030, owing to the increasing demand for professional services, such as consulting, implementation, and support, to help organizations effectively deploy and utilize analytics solutions. As the adoption of aviation analytics grows, there will be a greater need for skilled professionals to assist in the implementation and optimization of these solutions, which is further driving the segmental growth.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 50.98% in 2023. This can be attributed to the increasing adoption of cloud-based analytics solutions by airlines, airports, and other aviation companies. Cloud deployment offers several advantages, such as scalability, flexibility, and reduced upfront costs, making it an attractive option for organizations looking to implement analytics solutions

The on-premises segment is expected to register at a significant CAGR from 2024 to 2030. On-premises deployment offers enhanced data security, compliance, and customization options, which are crucial for some aviation companies. As organizations increasingly recognize the value of data-driven insights in driving performance improvements and cost efficiencies, the demand for specialized services is expected to grow in the coming years.

Regional Insights

The North America dominated the aviation analytics market with the largest revenue share of 33.22% in 2023. This growth can be attributed to several factors such as technological advancements, increasing air passenger traffic, growing investments in infrastructure and the presence of major aviation companies Furthermore, governments and private companies in North America are investing heavily in airport infrastructure and modernization projects. These investments are driving the demand for analytics solutions to optimize operations and improve efficiency.

U.S. Aviation Analytics Market Trends

The aviation analytics market in U.S. is projected to grow at the fastest CAGR of 9.28% from 2024 to 2030. The market is experiencing significant growth due to the increasing focus on operational efficiency, rising demand for passenger experience enhancement, and the safety and security concerns.

Europe Aviation Analytics Market Trends

The aviation analytics market in Europe is anticipated to grow at a significant CAGR of 9.02% from 2024 to 2030. European aviation companies are increasingly adopting analytics solutions to optimize operations, reduce costs, and enhance customer experience. Airlines are leveraging analytics for fuel management, revenue management, and customer analytics, while airports are using analytics for operational efficiency and passenger experience, which is expected to fuel the market growth in Europe.

The UK aviation analytics market is anticipated to grow at the fastest CAGR from 2024 to 2030. The implementation of 5G technology is enhancing the market growth in UK by enabling faster data transmission and lower latency. This is crucial for real-time analytics, improving the efficiency and effectiveness of data-driven decision-making processes in aviation operations.

The aviation analytics market in Germany is expected to grow at a substantial CAGR from 2024 to 2030. The emphasis on predictive analysis and performance monitoring in Germany contributes to enhancing operational efficiency and cost savings within the aviation sector, which is further fueling the market expansion in Germany.

The France aviation analytics market is projected to grow at a significant CAGR from 2024 to 2030. The French market is witnessing an increased focus on mobility & functionality applications to improve overall operational performance, thereby fueling the market growth in the country.

Asia-Pacific Aviation Analytics Market Trends

The aviation analytics market in the Asia-Pacific region is expected to grow at the fastest CAGR of 11.73% from 2024 to 2030. The Asia-Pacific region is experiencing a significant increase in air passenger traffic, driven by economic growth, rising middle class, and growing tourism. This surge in air travel is fueling the demand for analytics solutions to optimize operations and enhance customer experience.

The China aviation analytics market is projected to grow at a significant CAGR from 2024 to 2030. China's aviation industry is increasingly focusing on sustainability and reducing its carbon footprint. Analytics are being used to optimize flight paths, improve fuel efficiency, and monitor emissions. The push towards sustainable aviation practices is driving airlines and airports to adopt analytics solutions that support environmental goals.

The aviation analytics market in Japan is expected to grow at a substantial CAGR from 2024 to 2030. The focus on maintaining high safety and reliability standards is driving the adoption of predictive maintenance solutions, which is further driving the market growth in Japan.

The India aviation analytics market is expected to grow at the fastest CAGR from 2024 to 2030. India's aviation sector is experiencing rapid growth, with increasing numbers of domestic and international flights. This surge in air traffic is driving the need for advanced aviation analytics to manage operations, optimize resources, and enhance passenger experiences in India.

Middle East and Africa Aviation Analytics Market Trends

The aviation analytics market in Middle East and Africa is expected to grow at the fastest CAGR of 11.29% from 2024 to 2030. Airlines in the region are increasingly adopting analytics solutions to optimize operations, reduce costs, and enhance customer experience. Airlines are leveraging analytics for fuel management, revenue management, and customer analytics, while airports are using analytics for operational efficiency and passenger experience, which is further driving the market growth.

The Saudi Arabia aviation analytics market is anticipated to grow at a significant CAGR from 2024 to 2030.Saudi Arabia is heavily investing in the development of smart airports as part of its Vision 2030 initiative. Smart airports leverage advanced analytics to optimize operations, enhance passenger experiences, and improve security measures.The push towards smart airport infrastructure is driving the adoption of aviation analytics in the country.

Key Aviation Analytics Company Insights

Some of the key players operating in the market include Oracle Corporation, General Electric, SAP, among others

-

Oracle Corporation is a renowned multinational computer Functions company that offers cloud-based analytics solutions tailored for the aviation industry. These solutions are specifically designed to assist airlines, airports, and Maintenance, Repair, and Overhaul (MRO) organizations in optimizing their operations and maintenance processes. Their offerings include Oracle Analytics and Oracle Cloud ERP, which leverage AI to automate analytics processes

-

General Electric is a renowned American multinational conglomerate that offers advanced analytics solutions for aircraft maintenance, fuel efficiency optimization, flight operations, and more.GE also offers advanced analytics solutions for improving overall flight operations. By analyzing vast amounts of data related to flight performance, weather conditions, air traffic patterns, and more, GE helps airlines make informed decisions to enhance operational efficiency and safety

Lufthansa Technik, Collins Aerospace, SAS are some of the emerging market participants in the global market.

-

Lufthansa Technik is a leading provider of maintenance, repair, and overhaul (MRO) services for aircraft. The company offers a wide range of services including component support, engine maintenance, and aircraft modifications. Lufthansa Technik is known for its innovative solutions in aviation Functions and has a global presence with facilities around the world

-

Collins Aerospace, a subsidiary of Raytheon Technologies Corporation, specialize in aerospace systems and solutions. The company offers a diverse portfolio of products and services including avionics, propulsion systems, interiors, and information management solutions

Key Aviation Analytics Companies:

The following are the leading companies in the aviation analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus

- The Boeing Company

- Cirium

- Collins Aerospace

- Honeywell International Inc.

- Lufthansa Technik

- Booz Allen Hamilton

- GE Aerospace

- IBM

- General Oracle

- SAP

- SAS Institute, Inc.

Recent Developments

-

In April 2024, The Boeing Company introduced a new tool called the Parts Planning Hub, which is designed to enhance efficiency in managing spare parts for airlines. The Parts Planning Hub utilizes advanced analytics and machine learning algorithms to optimize inventory levels, reduce costs, and improve operational performance. This tool aims to provide airlines with real-time insights into their spare parts inventory, enabling them to make data-driven decisions that can lead to increased operational efficiency and cost savings

-

In March 2024, Honeywell International Inc. launched the Honeywell Forge Pilot Connect app on the Apple App Store. This app is designed to enhance communication and collaboration between pilots and ground staff, providing real-time data sharing capabilities. The app aims to streamline operations, improve efficiency, and enhance overall safety in aviation

-

In June 2023, Cirium introduced new aviation analytics tools to accelerate digital transformation and sustainability in the aviation industry. These tools aim to provide airlines, airports, and other aviation stakeholders with enhanced insights and capabilities to navigate the challenges posed by the ongoing digital transformation and the increasing focus on sustainability within the industry

Aviation Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,846 million

Revenue forecast in 2030

USD 5.08 billion

Growth rate

CAGR of 10.14% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Functions, component, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE.

Key companies profiled

Airbus; The Boeing Company; Cirium; Collins Aerospace; Lufthansa Technik AG; Booz Allen; General Electric; IBM; General Oracle; SAP; SAS Institute, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aviation Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aviation analytics market report based on functions, component, deployment and region:

-

Functions Outlook (Revenue, USD Million, 2018 - 2030)

-

Finance

-

Operations

-

Marketing and Sales

-

Maintenance and Support

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aviation analytics market size was estimated at USD 2,601.1 million in 2023 and is expected to reach USD 2,846.9 million in 2024.

b. The global aviation analytics market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 5.08 billion by 2030.

b. North America dominated the aviation analytics market with a share of around 33% in 2023. This growth can be attributed to several factors such as technological advancements, increasing air passenger traffic, growing investments in infrastructure and the presence of major aviation companies.

b. Some key players operating in the aviation analytics market include Airbus, The Boeing Company, Cirium, Collins Aerospace, Honeywell International Inc., Lufthansa Technik, Booz Allen Hamilton, GE Aerospace, IBM, General Oracle, SAP, SAS Institute, Inc.

b. Key factors that are driving the aviation analytics market growth include increasing adoption of data-driven decision-making processes, integration of big data and the Internet of Things (IoT), and the adoption AI and ML in aviation analytics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.