Autotransfusion Devices Market Size, Share & Trends Analysis Report By Type (Autotransfusion Systems, Consumables& Accessories), By Application, By End Use (Hospitals & Clinics), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-342-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Autotransfusion Devices Market Trends

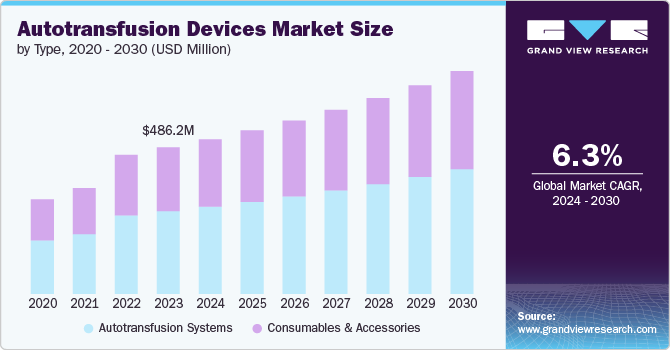

The global autotransfusion devices market size was estimated at USD 486.2 million in 2023 and is anticipated to grow at a CAGR of 6.3% from 2024 to 2030. This growth is majorly driven by the increasing number of surgical procedures attributed to the rising prevalence of lifestyle and chronic disease. According to ISAPS global survey 2023 report published in June 2024, there was a significant increase of 5.5% in surgical procedures compared to 2022. Plastic surgeons performed over 15.8 million surgical procedures globally, indicating a growing demand for aesthetic surgeries.

Furthermore, the scarcity of donated blood or allogeneic blood is also boosting the market's growth owing to the extensive use of autotransfusion systems as they are highly useful in the purification of a patient's blood. For instance , according to the data published by the American Red Cross Society in January 2022, the Red Cross has experienced a 10% decline in the number of people donating blood since the beginning of the pandemic.

The aging population is a significant factor driving the growth of the market. As the global population continues to age, there is a growing demand for healthcare services and orthopedic surgery procedures, including surgeries that require blood transfusions. Chronic diseases such as coagulopathy, anemia, and surgical blood seeking continue to increase along with the increase in the adult population. Currently, there are over 40 million people in the U.S. alone above 65 years and the number is expected to double by 2050. Japan provides potential growth opportunities to this market due to the presence of the highest geriatric population in the country. According to WHO, the percentage of the geriatric population is expected to reach 22.0% by 2050.

Additionally, the growing strategic initiatives such as partnerships, mergers, and product approvals by market players to develop autotransfusion devices and offer safe and effective auto-transfusion solutions are anticipated to boost market growth in the forecast period. For instance, in March 2023, Haemonetics Corporation announced that it had obtained 510(k) clearance from the U.S. FDA for its latest software upgrade designed for the Cell Saver Elite+ autotransfusion system. This new software, named Intelligent Control, has been officially released to the market, offering significant enhancements aimed at simplifying operations and improving user experience.

Furthermore, autotransfusion systems play a crucial role in managing intraoperative blood loss and promoting hemostasis during complex surgical procedures, thereby enhancing surgical outcomes and aiding in patient recovery. This, in turn, contributes to the expansion of the market due to the increasing demand for advanced surgical interventions including organ transplantation, oncology, and cardiovascular surgery. According to the Organ Procurement and Transplantation Network study published in January 2024, there were a total of 46,632 organ transplants performed worldwide. This number includes transplants from both living and deceased donors. The total number of organ transplants in 2023 represents an 8.7 percent increase over the previous year, 2022, and a significant 12.7 percent increase over the year before that, which was 2021. It is worth noting that 2021 was the first year in which the total number of organ transplants exceeded 40,000.

Type Insights

The autotransfusion systems segment accounted for the largest revenue share of 56.4% in 2023. The growth is attributed to the numerous advantages it offers over traditional blood transfusion methods. Autotransfusion reduces the risk of transfusion reactions, infections, and complications associated with allogeneic blood transfusions. By using a patient’s blood, autotransfusion also eliminates concerns related to blood compatibility and immune system responses, making it a safer alternative for many patients.

Moreover, the increasing adoption of autotransfusion systems across a wide range of surgical specialties, including cardiac surgery, orthopedics, trauma surgery, and transplant procedures, has further propelled the growth of this segment. According to a Perfusion article published in August 2023, researchers are studying the effects of using autotransfusion or cardiotomy aspirator during open heart surgery. The goal is to understand how these blood-preserving systems, which separate red blood cells through centrifugation and recirculate the collected blood in the surgical area, impact the patients' hemodynamics, hemostasis, and inflammation levels, to reduce complications.

The consumables & accessories segment is expected to grow at the fastest CAGR of 6.4% during the forecast period. Manufacturers are constantly innovating to develop more efficient and user-friendly products that enhance the autotransfusion process. Improved designs of consumables like filters and reservoirs aim to optimize blood collection and processing, making autotransfusion safer and more effective. These technological advancements attract healthcare facilities looking to upgrade their equipment, thereby fueling market growth. Additionally, increasing number of surgeries, a focus on blood conservation, and technological advancements in product development. As healthcare systems worldwide strive to improve patient outcomes, reduce complications, and streamline surgical processes, the demand for autotransfusion consumables and accessories is expected to rise significantly.

Application Insights

The cardiovascular surgeries segment accounted for the largest market share of 28.0% in 2023. The rising prevalence of cardiovascular diseases globally is a significant factor driving the growth of this segment. As the population ages and lifestyles become more sedentary, the incidence of heart-related conditions such as coronary artery disease, heart failure, and arrhythmias is on the rise. This trend necessitates an increase in cardiovascular surgeries, including bypass surgeries, valve replacements, and heart transplants, which often require autotransfusion to minimize blood loss during procedures.

The obstetrics & gynecological surgeries segment is expected to grow at the fastest CAGR from 2024 to 2030. The growth is owed to the rising number of obstetric and gynecological procedures being performed globally, driven by factors including increasing maternal age, rising prevalence of gynecological disorders, and advancements in surgical techniques. As the demand for these surgeries increases, the need for efficient blood management strategies such as autotransfusion also increases. It allows patients to receive their blood during surgery, reducing the risk of transfusion reactions and complications.

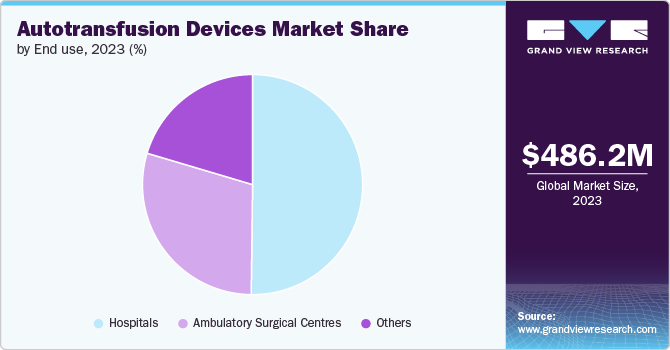

End use Insights

The hospital segment accounted for the largest market share of 50.2% in 2023. The increasing number of surgeries being performed in hospitals globally is driving the segment growth. These systems allow for the collection and reinfusion of a patient’s blood during surgical procedures, reducing the need for allogeneic blood transfusions and associated risks. Additionally, hospitals are increasingly focusing on patient safety and outcomes, and autotransfusion technology aligns with these goals by minimizing the risk of transfusion reactions and infections. Moreover, advancements in autotransfusion technology have led to more efficient and user-friendly systems, making them more appealing to hospitals looking to enhance their surgical capabilities.

The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR of 6.5% during the forecast period. Ambulatory surgical centers have been gaining popularity due to their cost-effectiveness, efficiency, and ability to provide same-day surgical procedures. These centers cater to a wide range of surgical specialties, including orthopedics, ophthalmology, gastroenterology, and more. ASCs are equipped with advanced medical technologies and skilled healthcare professionals, making them a preferred choice for many patients requiring surgical interventions.

Regional Insights

North America autotransfusion devices market dominated the global market with a revenue share of 41.0% in 2023. The growth is driven by a significant patient population with cardiac issues and a strong healthcare infrastructure. The U.S. is experiencing a rise in the prevalence of heart problems, attributed to the fast-paced and stressful lifestyle of its population. As a result, there has been an increase in the number of cardiac surgeries in both the Canada and U.S. leading healthcare facilities to adopt advanced medical equipment for more effective procedures. This trend is fueling the growth of the autotransfusion devices industry in North America.

The U.S. autotransfusion devices market held the largest share in 2023, in the North American region, owing to the aging population of older individuals.According to a Population Reference Bureau article published in January 2024, the projected growth indicates that the number of Americans aged 65 and older is anticipated to rise from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. Simultaneously, the share of the total population represented by the 65-and-older age group is expected to rise from 17% to 23%. Moreover, as per the American Heart Association, about 70% of individuals aged 70 and above are anticipated to experience cardiovascular disease (CVD), which is one of the key factors contributing to cognitive disabilities.

Europe Autotransfusion Devices Market Trends

The autotransfusion devices market in Europe is expected to witness lucrative growth from 2024 to 2030. The growth is driven by the increasing adoption of new and improved technologies in autotransfusion devices. The advancements in washing and filtration technology, as well as the development of more efficient machines, have contributed to enhancing the safety and efficacy of autotransfusion procedures. These technological innovations have led to reduced complications, such as the risk of bloodborne diseases, making autotransfusion a more attractive option for healthcare facilities in Europe.

Moreover, the increasing number of regulatory approvals, the growing adoption of minimally invasive surgical procedures, agreements, partnerships, & collaborations among market players are further propelling the market growth. In addition, the rising incidence of neurological and orthopedic disorders, and the high prevalence of ENT disorders in the country are likely to boost market stakes. For instance, according to Brain Research UK, around 11 million people live with a neurological condition in the UK. One in six UK individuals has a neurological condition.

Asia Pacific Autotransfusion Devices Market Trends

Asia Pacific autotransfusion devices market is anticipated to grow at the fastest CAGR of 7.1 over the forecast period. The growing cardiovascular problems among the population are driving the market growth. Factors such as dietary habits and the rising adoption of a sedentary lifestyle leading to physical inactivity are contributing to the increased cardiovascular morbidities in the region. According to the Ministry of Health Labor and Welfare, around 170,000 deaths were attributed to cardiovascular diseases each year in Japan. Moreover, several multinational companies are setting up their manufacturing business in the region due to low manufacturing costs and skilled labor. The aforementioned factors are further fueling the demand for mobile cardiac telemetry devices.

Key Autotransfusion Devices Company Insights

The market is a competitive due to the presence of several key players with varying revenue shares. The companies in this market are focusing on research and development, along with strategic partnerships and product launches. The commitment to advancing care through technological innovations has contributed to a substantial revenue share in the market.

Key Autotransfusion Devices Companies:

The following are the leading companies in the autotransfusion devices market. These companies collectively hold the largest market share and dictate industry trends.

- Atrium Orthopedic Surgeries Corporation

- Becton, Dickinson, and Company

- Beijing ZKSK Technology Co. Ltd

- Fresenius SE & Co. KGA

- LivaNova Inc

- Medtronic plc

- Teleflex Incorporated

- Haematonics Corporation

- Braile Biomedica

- Redax

Recent Developments

-

In June 2023, idsMED Indonesia and the LivaNova Principal Team organized the launching of the LivaNova ATS XTRA at the Pullman Hotel Thamrin Jakarta. The theme of the event was named “Autotransfusion Improves Outcomes” emphasizing the benefits of autotransfusion in enhancing patient outcomes. The event aimed to showcase the innovative features of the LivaNova ATS XTRA system and educate healthcare professionals on its potential impact on patient care.

-

In September 2022, i-SEP, a company specializing in medical devices, received a CE-marking for its autotransfusion technology in September 2022. This technology is known as “Same by i-SEP” and is designed to facilitate intraoperative autotransfusion. What sets this device apart is its capability to preserve not only the patient’s red blood cells but also platelets during the transfusion process.

-

In June 2022, Haemonetics, launched its new manufacturing center of excellence in Clinton, Pennsylvania. This custom-built facility is specifically dedicated to the development of auto-transfusion systems, marking a strategic expansion of the company’s product offerings.

Autotransfusion Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 513.2 million |

|

Revenue forecast in 2030 |

USD 739.5 million |

|

Growth rate |

CAGR of 6.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Atrium Orthopedic Surgeries Corporation; Becton, Dickinson, and Company; Beijing ZKSK Technology Co. Ltd; Fresenius SE & Co. KGA; LivaNova Inc; Medtronic plc; Teleflex Incorporated; Haematonics Corporation; Braile Biomedica; Redax |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Autotransfusion Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global autotransfusion devices market report based on type, application, end use and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Autotransfusion Systems

-

Intraoperative Autotransfusion Systems

-

Post-operative Autotransfusion Systems

-

Dual-mode Autotransfusion Systems

-

-

Consumables & Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiaovascular Surgeries

-

Orthopedic Surgeries

-

Neurological Surgeries

-

Obstetrics & Gynecological Surgeries

-

Others

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global autotransfusion devices market size was estimated at USD 486.2 million in 2023 and is expected to reach USD 513.2 million in 2024.

b. The global autotransfusion devices market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 739.5 million by 2030.

b. Autotransfusion systems held the largest market share of 56.4% in 2023 as autotransfusion system reduces the risk of transfusion reactions, infections, and complications associated with allogeneic blood transfusions, promoting market growth.

b. Major market players included in the autotransfusion devices market are Atrium Orthopedic Surgeries Corporation; Becton, Dickinson, and Company; Beijing ZKSK Technology Co. Ltd; Fresenius SE & Co. KGA; LivaNova Inc; Medtronic plc; Teleflex Incorporated; Haematonics Corporation; Braile Biomedica; Redax

b. Key factors that are driving growth are increasing number of surgical procedures attributed to the rising prevalence of lifestyle and chronic disease

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."