- Home

- »

- Automotive & Transportation

- »

-

Autonomous Train Market Size, Share & Trends Report, 2030GVR Report cover

![Autonomous Train Market Size, Share & Trends Report]()

Autonomous Train Market Size, Share & Trends Analysis Report By Automation Grade, By Train Type, By Application (Passenger, Freight), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-341-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Autonomous Train Market Size & Trends

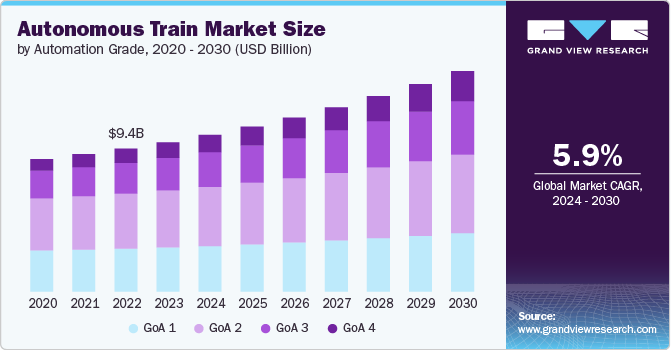

The global autonomous train market size was estimated at USD 9.82 billion in 2023 and is expected to grow at a CAGR of 5.9% from 2024 to 2030. An autonomous train is a train capable of operating without a human driver. This technology has the potential to revolutionize rail travel by offering increased efficiency and safety. The global market is driven by factors such as increased safety focus, growing demand for efficient and sustainable transportation, and government support for autonomous technologies in trains.

Autonomous trains rely on a combination of sensors, cameras, antennas, Light Detection and Ranging (LIDAR), Radio Detection and Ranging (RADAR), and advanced computer systems to perceive their surroundings, control speed and braking, and adhere to schedules. For instance, in August 2023, Aeva Inc., a pioneer in advanced sensing and perception systems, announced that Railergy, a provider of railway automation solutions, has selected Aeva Inc.’s cutting-edge Frequency Modulated Continuous Wave (FMCW) 4D LiDAR technology to power the perception system for its autonomous train operation solution.

Aeva Inc.’s Aeries II sensors offer crucial real-time velocity data and high-resolution sensing capabilities, enabling the detection of obstacles that could potentially impede the safe operation of driverless trains. Thus, growing technological advancements and increased adoption of technologies such as LIDAR and RADAR in autonomous trains are further boosting the growth of the market.

Furthermore, the market is further driven by the rising demand for enhanced mobility amidst the challenges of increasing urbanization. As urban areas become more densely populated, the shift from road-based to rail-based transportation is becoming more evident, presenting a compelling opportunity for the autonomous train market. This transition is driven by the need for efficient and sustainable transportation solutions, aligning with the growing emphasis on environmentally friendly urban mobility. Moreover, the foreseeable shortage of trained drivers in the immediate future highlights the urgency and relevance of autonomous train technology.

In June 2030, Hitachi Rail STS announced the completion and commencement of passenger service for the first phase of Honolulu's new metro system, named 'Skyline'. This marks the debut of the first fully autonomous metro system in the U.S. The fully electrically powered system will transition individuals to sustainable transportation, shifting them away from private cars and toward a cleaner, less congested environment. This shift aims to diminish emissions and alleviate traffic congestion, benefitting both residents and visitors in Honolulu. Such initiatives by several manufacturers are expected to bode well for the growth of the market.

The development, installation, and maintenance of autonomous train systems can be extremely expensive, posing a significant financial barrier for rail operators. Autonomous trains require extensive infrastructure changes that may not be compatible with existing railway networks, making integration and deployment complex. In addition, autonomous systems may struggle to effectively respond to unpredictable events or emergencies, potentially falling short of the adaptability and decision-making capabilities of human drivers. In addition, the risk of hacking and cyberattacks on autonomous train systems is a major concern, as an effective breach could potentially disable or hijack the trains, compromising safety. Thus, factors such as high costs, infrastructure challenges, and cybersecurity risks could hamper the growth of the market.

Automation Grade Insights

The GoA 2 segment dominated the market in 2023 and accounted for a 38.13% share of the global revenue. GoA 2, or semi-automatic train operation (STO), is a widely adopted level of automation in the rail industry. In this mode, the stopping and starting of the train is automated, but the driver still retains responsibility for operating the doors, controlling the train as needed, and handling emergencies. Thus, rising use of the GoA2 automation level as it offers a balanced approach to automation, providing efficiency and safety benefits while maintaining a level of human oversight can be attributed to the segment’s growth.

The GoA 4 segment is projected to witness significant growth from 2024 to 2030. Grade of Automation Level 4 (GoA 4) is characterized by unattended train operation (UTO), in which the starting and stopping of the train, operation of doors, and management of emergencies are entirely automated without the presence of on-train staff. Driverless train operation at GoA 4 has been implemented on an increasing number of metro lines in cities globally. Increasing adoption of higher levels of automation by regional, mainline, and tram operators to enhance the capacity, flexibility, and energy efficiency of their rail operations can be contributed to the growth of the segment.

Train Type Insights

The metro/monorail segment dominated the market in 2023. The segment's growth can be attributed to the increasing adoption of metro/monorails in urban areas for public transportation. In addition, the integration of autonomous technology into metro and monorails offers various benefits, including reduced operating costs, enhanced safety, and improved passenger experience. Furthermore, as countries and cities worldwide focus on developing smart and sustainable transportation solutions, the demand for autonomous metro and monorail systems is expected to continue growing. This increasing demand is propelling innovations and investments in this segment.

The high-speed rail segment is projected to witness considerable growth from 2024 to 2030. The increasing demand for efficient and sustainable transportation solutions, coupled with the growing emphasis on smart infrastructure and advanced technologies, has propelled the growth of the autonomous high-speed rail segment. Moreover, the potential for autonomous high-speed trains to significantly enhance travel efficiency, reduce travel times, and improve overall passenger experience has garnered considerable interest and investment in this innovative transportation sector.

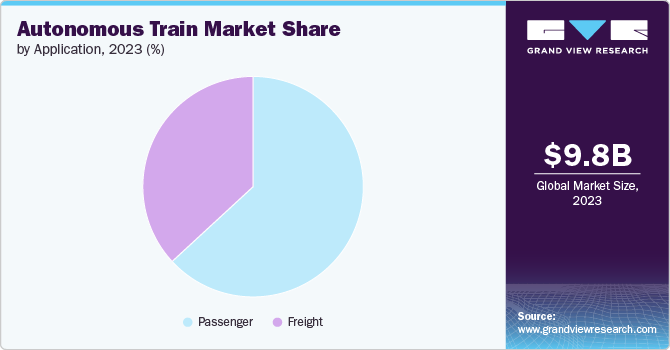

Application Insights

The passenger segment dominated the market in 2023. The integration of automation in passenger trains is playing a pivotal role in driving the autonomous train market. Automation is transforming the passenger experience on trains, making rail travel more appealing and convenient than ever before. Accurate seat availability notifications and platform guidance are some examples of how automation is reshaping the way passengers interact with rail systems.

Moreover, higher capacity and greater reliability are increasingly drawing travelers away from congested roadways to the efficiency and comfort of rail transport, potentially leading to reduced ticket prices and a significant modal shift. Thus, increasing adoption of autonomous technologies in passenger trains owing to the aforementioned benefits is expected to drive the segment’s growth.

The freight segment is projected to witness significant growth from 2024 to 2030. A freight train is used to transport cargo or goods. Autonomous freight trains are an essential part of the logistics chain, transporting a wide variety of goods over long distances. Autonomous train technology provides logistics providers with data to maximize capacity and optimize routes, reducing inefficiencies caused by empty containers and supporting beleaguered supply chains.

In addition, data used from a range of sensors can identify obstacles, calculate their distance from a train, and support machine learning for predictive maintenance and more streamlined operations, thus optimizing supply chain operations. Thus, the rising adoption and development of autonomous freight trains owing to their benefits can be attributed to the segment’s growth.

Regional Insights

The autonomous train market of North America is expected to witness notable growth from 2024 to 2030, driven by several key factors. The region's prioritization of advanced technologies and automation aligns well with the development of autonomous train systems. The increasing demand for efficient and reliable freight transportation is a major driver, as autonomous trains can optimize supply chain logistics and enhance productivity. Sustainability initiatives and the need to reduce carbon emissions are also fueling the adoption of autonomous trains in North America, as they offer more environmentally friendly transportation solutions.

U.S. Autonomous Train Market Trends

The U.S. autonomous train marketis expected to grow at a significant CAGR from 2024 to 2030. Government initiatives and investments in advanced transportation technologies, including autonomous trains, are propelling market growth. Technological advancements in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities and safety features of autonomous train systems, fostering market growth in the country.

Asia Pacific Autonomous Train Market Trends

The autonomous train market of Asia Pacific regiondominated the market in 2023 and accounted for a 46.26% share of the global revenue. With increasing urbanization, autonomous trains have emerged as a transformative solution for modern rail transportation, positioning the Asia Pacific region as a leader in the autonomous train market. Moreover, the development of rail infrastructure, coupled with significant government spending on the transportation sector and ongoing and upcoming projects in various developing countries within the region, contributes to the market's rapid expansion.

Europe Autonomous Train Market Trends

Europe autonomous train marketis expected to grow at the highest CAGR of 6.9% from 2024 to 2030.The region's emphasis on safety, security, and efficient modes of transport has led to a rising demand for autonomous train technology, propelling market expansion. Additionally, the development of advanced rail infrastructure and significant government spending on transportation projects within Europe are contributing to the market's rapid growth.

Key Autonomous Train Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Autonomous Train Companies:

The following are the leading companies in the autonomous train market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG, Alstom SA

- Thales Group

- Kawasaki Heavy Industries

- Hitachi Rail STS

- Mitsubishi Heavy Industries Ltd.

- Wabtec Corporation

- Ingeteam Corporation SA

- CRRC Corporation Limited

- Green Automated Solutions, Inc.

Recent Developments

-

In July 2024, The Bengaluru Metro Rail Corporation Limited (BMRCL) initiated dynamic signaling tests for the first driverless train on the Namma Metro Yellow Line, which spans a 19-kilometer stretch from Electronics City and R V Road to Bommasandra. This significant development is expected to revolutionize public transportation in the city, with trains running at 20-minute intervals.

-

In November 2022, Alstom SA, in collaboration with Lineas, a Belgian rail freight operator and ProRail, a Dutch infrastructure manager, demonstrated the highest level of automation, known as GoA4, on a shunting locomotive at Netherlands. This level of automation enables fully autonomous starting, driving, stopping, and handling of unexpected obstacles or events during shunting operations, without the direct involvement of any on-board personnel.

Autonomous Train Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.30 billion

Revenue forecast in 2030

USD 14.50 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Automation grade, train type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Siemens AG; Alstom SA; Thales Group; Kawasaki Heavy Industries; Hitachi Rail STS; Mitsubishi Heavy Industries Ltd.; Wabtec Corporation; Ingeteam Corporation SA; Construcciones y Auxiliar de Ferrocarriles; and CRRC Corporation Limited

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Train Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global autonomous train market based on automation grade, train type, application and region.

-

Automation Grade Outlook (Revenue, USD Million, 2018 - 2030)

-

GoA 1

-

GoA 2

-

GoA 3

-

GoA 4

-

-

Train Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Metro/Monorail

-

High-speed Rail

-

Light Rail

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger

-

Freight

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous train market size was estimated at USD 9.82 billion in 2023 and is expected to reach USD 10.3 billion in 2024.

b. The global autonomous train market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030, reaching USD 14.5 billion by 2030.

b. The GoA 2 segment dominated the automation grade segment in 2023. The rising use of the GoA2 automation level, as it offers a balanced approach to automation, providing efficiency and safety benefits while maintaining a level of human error, can be attributed to the segment growth.

b. Some key players operating in the autonomous train market include Siemens AG, Alstom SA, Thales Group, Kawasaki Heavy Industries, Hitachi Rail STS, Mitsubishi Heavy Industries Ltd., Wabtec Corporation, Ingeteam Corporation SA, Construcciones y Auxiliar de Ferrocarriles, and CRRC Corporation Limited.

b. The global autonomous train market is driven by factors such as increased safety focus, growing demand for efficient and sustainable transportation, and government support for autonomous train technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."