Autonomous Navigation Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Platform, By End-use (Commercial, Military & Government), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-365-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Autonomous Navigation Market Trends

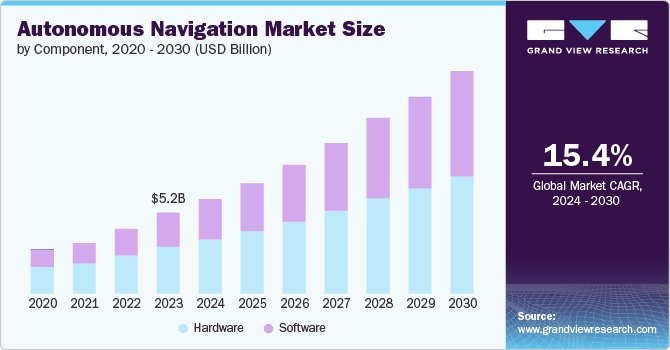

The global autonomous navigation market size was estimated at USD 5.24 billion in 2023 and is expected to grow at a CAGR of 15.4% from 2024 to 2030. The market is experiencing significant growth due to the increasing adoption of autonomous vehicles across various sectors, including automotive, aerospace, and maritime. With major companies such as Tesla and Waymo LLC leading the charge, advancements in self-driving technology are becoming more robust and reliable. These developments are fueled by improvements in AI, machine learning, and sensor technologies, which collectively enhance the safety and efficiency of autonomous navigation systems.

AI and machine learning are pivotal in advancing autonomous navigation systems. These technologies enable vehicles to process vast amounts of data from sensors and make real-time decisions. Companies are heavily investing in AI to improve perception, planning, and control mechanisms in autonomous systems. This integration allows for better object detection, path planning, and adaptation to dynamic environments, which are crucial for the safe operation of autonomous vehicles.

Furthermore, the evolution of sensor technologies, including LiDAR, radar, and cameras, has been a major driver of the market. These sensors provide critical data that help autonomous systems understand their surroundings. The trend towards more affordable and high-resolution sensors is making advanced autonomous navigation more accessible. Additionally, sensor fusion techniques are improving the reliability and accuracy of data, which is essential for precise navigation.

Regulatory frameworks and standards are evolving to keep pace with the advancements in autonomous navigation. Governments and regulatory bodies worldwide are working on policies to ensure the safe deployment of autonomous systems. These regulations address safety, privacy, and cybersecurity concerns, providing a clear pathway for market participants to develop and deploy autonomous technologies. Harmonizing regulations across regions is also a focus to facilitate the global adoption of autonomous navigation systems.

Moreover, autonomous navigation is finding applications beyond traditional vehicles. In aerospace, autonomous drones are being used for delivery, surveillance, and mapping. In maritime, autonomous ships are being developed for cargo transport and environmental monitoring. The agriculture sector is also benefiting from autonomous navigation using autonomous tractors and harvesters. These emerging applications are expanding the scope of the autonomous navigation market, creating new opportunities and driving further innovation.

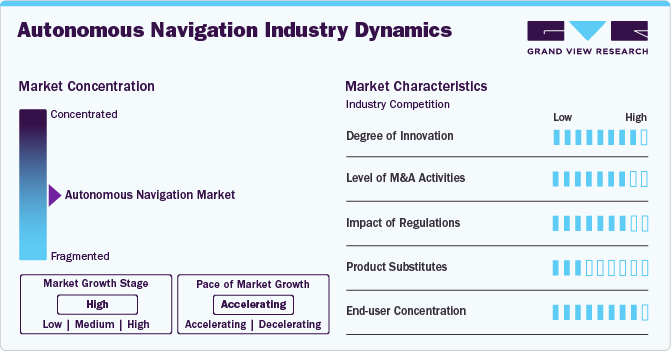

Market Concentration & Characteristics

The market exhibits a high degree of innovation, driven by rapid advancements in artificial intelligence (AI), sensor technologies, and machine learning algorithms. Companies in this market are constantly developing cutting-edge solutions for self-driving cars, unmanned aerial vehicles (UAVs), and autonomous marine vessels. The intense competition among industry leaders, substantial investment in R&D, and the integration of advanced technologies to enhance safety, efficiency, and reliability are key factors contributing to the high level of innovation.

The market experiences a high level of mergers and acquisitions (M&A). This trend is driven by the need for companies to quickly acquire advanced technologies, expand their capabilities, and gain a competitive edge. Established tech giants and automotive manufacturers frequently acquire startups and smaller firms specializing in AI, sensor technology, and autonomous systems to integrate innovative solutions and accelerate their market presence.

The market faces a high impact of regulations due to the critical importance of safety, privacy, and ethical considerations in deploying autonomous systems. Governments and regulatory bodies worldwide impose stringent standards and guidelines to ensure the safe operation of autonomous vehicles, drones, and marine vessels. Compliance with these regulations is essential to prevent accidents, protect data, and address public concerns.

The market has a low level of product substitutes due to the unique capabilities and advantages that autonomous systems offer. Traditional navigation systems, which rely on human input and oversight, cannot match the efficiency, precision, and adaptability of autonomous technologies. The integration of AI, real-time data processing, and advanced sensors allows autonomous navigation systems to operate in complex environments with minimal human intervention.

The market exhibits a high level of end-user concentration, primarily driven by its significant adoption within key sectors such as automotive, aerospace, defense, and maritime industries. These sectors heavily invest in autonomous navigation technologies to enhance operational efficiency, safety, and innovation. The concentration is further intensified by large corporations and government agencies, which dominate the market as major customers due to their substantial resources and specific needs for advanced autonomous solutions. This concentrated demand from a few high-investment sectors underscores the high end-user concentration in the market.

Component Insights

The hardware segment dominated the market with a revenue share of around 58% in 2023. This is due to the increasing demand for advanced sensors, cameras, LiDAR, and radar systems essential for accurate and reliable autonomous navigation. The continuous advancements in these hardware technologies, coupled with their crucial role in enabling real-time data processing and decision-making, pushed significant investments and adoption across various industries. Additionally, the proliferation of autonomous vehicles and drones, which rely heavily on sophisticated hardware components for safe and efficient operation, further propelled the segment’s growth.

The software segment is expected to record a significant CAGR of over 17% from 2024 to 2030, driven by the increasing need for advanced algorithms, AI, and machine learning technologies to enhance the capabilities of autonomous systems. Additionally, the continuous development of high-definition mapping, real-time simulation, and predictive analytics software is crucial for improving the safety, efficiency, and reliability of autonomous navigation. This ongoing innovation and the growing emphasis on software-defined solutions fuel the substantial growth of this segment.

Platform Insights

The land segment held the highest revenue share in 2023, driven by the significant advancements and investments in autonomous vehicles, particularly self-driving cars and trucks. Additionally, regulatory support for autonomous vehicle testing and deployment, along with collaborations between tech companies and traditional automakers, has accelerated the commercialization and integration of these systems on land.

The space segment is estimated to register the highest CAGR from 2024 to 2030. This is likely due to the increasing number of space exploration missions and the growing investment in satellite technology.In addition, the rise of private space companies and international collaborations in space missions is further expected to drive the demand for sophisticated autonomous navigation technologies, contributing to the rapid growth of the space segment.

End-use Insights

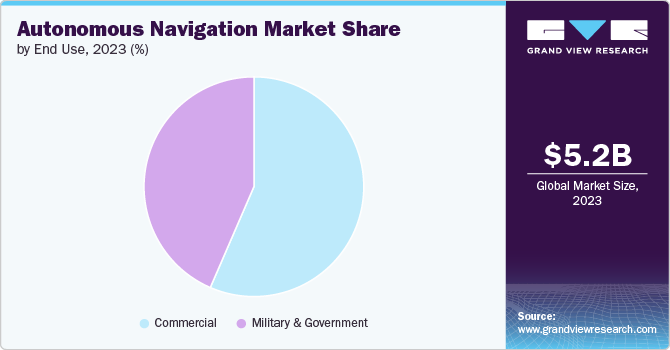

The commercial segment accounted for the highest revenue share in 2023, due to the widespread adoption of autonomous technologies across various industries such as logistics, transportation, and delivery services. Furthermore, technical advancements and favorable regulatory frameworks have encouraged commercial entities to invest heavily in autonomous navigation solutions, driving the significant market share of this segment.

The military & government segment is anticipated to expand at the highest CAGR from 2024 to 2030, due to the increasing need for advanced autonomous systems to enhance national security, surveillance, and defense capabilities. Governments and defense organizations are investing heavily in autonomous drones, unmanned ground vehicles, and maritime systems to improve operational efficiency, reduce human risk, and execute complex missions in challenging environments. The continuous advancements in AI and robotics, coupled with the strategic importance of maintaining technological superiority, drive significant growth in this segment as nations prioritize the integration of cutting-edge autonomous navigation technologies into their defense and security infrastructures.

Regional Insights

The autonomous navigation market in North America accounted for a significant revenue share of over 37% in 2023, driven by substantial investments in research and development, robust technological infrastructure, and a strong ecosystem of tech giants and startups.Government support and private sector funding further bolster growth, making North America a pivotal hub for autonomous navigation advancements.

U.S. Autonomous Navigation Market Trends

The autonomous navigation market in the U.S. is anticipated to grow at a CAGR of over 12% from 2024 to 2030. Initiatives like the U.S. Department of Transportation's AV 4.0 guidance and partnerships with industry leaders ensure continuous advancements in autonomous vehicles and drones, positioning the U.S. at the forefront of the global market.

Asia Pacific Autonomous Navigation Market Trends

The Asia Pacific autonomous navigation market accounted for a significant revenue share of over 26% in 2023. The region is experiencing rapid industrialization and urbanization, driving the adoption of autonomous technologies across transportation and logistics sectors. Countries like China, Japan, and India are investing heavily in AI and robotics, fostering innovation in autonomous navigation systems.

The autonomous navigation market in India is estimated to record the highest growth rate from 2024 to 2030, due to the government's focus on smart city initiatives and advancements in AI and robotics. The push towards electric and autonomous vehicles, supported by initiatives like the National Electric Mobility Mission Plan (NEMMP) and Make in India, drives growth in autonomous navigation technologies.

China autonomous navigation market is projected to grow at a CAGR from 2024 to 2030. The government's strong support for technological innovation, coupled with initiatives like the New Generation Artificial Intelligence Development Plan, accelerates the adoption of autonomous navigation systems across industries in the country.

The autonomous navigation market in Japan is projected to grow at a CAGR from 2024 to 2030. The country's automotive industry, including giants like Toyota and Honda Motor Co., Ltd., drives innovation in autonomous vehicle technologies. With a strong emphasis on safety and reliability, Japan continues to lead in the development and deployment of autonomous systems for automotive, industrial, and consumer applications.

Europe Autonomous Navigation Market Trends

The Europe autonomous navigation market is anticipated to register a CAGR of around 15% from 2024 to 2030. Countries like the UK and Germany lead in autonomous vehicle testing and deployment, supported by favorable government policies and investments in research. The European Union's initiatives on connected and automated mobility further stimulate growth, making Europe a vibrant hub for autonomous navigation innovations.

The autonomous navigation market in the UK is projected to grow at a CAGR from 2024 to 2030. The UK is at the forefront of autonomous vehicle testing and deployment in Europe, supported by progressive regulatory frameworks and government initiatives like the Centre for Connected and Autonomous Vehicles (CCAV). Investments in research and development, along with collaborations between academia, industry, and government, drive innovation in autonomous navigation technologies. The UK's leadership in initiatives like the HumanDrive project underscores its commitment to advancing autonomous mobility solutions.

Germany autonomous navigation market is estimated to record a CAGR from 2024 to 2030. The country's renowned automotive manufacturers and suppliers, including BMW AG, Volkswagen Automobile GmbH, and among others, drive innovation in autonomous navigation systems. Germany's strategic focus on sustainable mobility and digital transformation ensures continued leadership in autonomous technologies across automotive and industrial sectors.

Middle East and Africa Autonomous Navigation Market Trends

The autonomous navigation market in the Middle East and Africa (MEA) region is anticipated to grow at the highest CAGR of around 33% from 2024 to 2030. The region is witnessing growing interest in autonomous navigation technologies, driven by initiatives in smart city development and infrastructure modernization.

Saudi Arabia autonomous navigation market accounted for a considerable revenue share in 2023, driven by visionary projects like NEOM and the country's Vision 2030 initiative. Investments in smart city developments and infrastructure projects emphasize the integration of autonomous navigation systems for transportation, logistics, and urban planning.

Key Autonomous Navigation Company Insights

Some key players operating in the market are Tesla and Waymo LLC among others.

-

Waymo LCC, a subsidiary of Alphabet Inc., specializes in the autonomous vehicle industry. With its advanced self-driving technology, Waymo has made significant strides in autonomous navigation. The comprehensive system combined LiDAR, radar, and cameras to navigate roads safely and efficiently driving the growth of this company. Waymo has been at the forefront of autonomous vehicle development, conducting extensive real-world testing and deploying autonomous taxis in select markets.

-

Tesla is renowned for its electric vehicles, but it is also a major player in the autonomous navigation market. Tesla's Autopilot and Full Self-Driving (FSD) features leverage advanced AI and sensor technologies to provide a high level of automation. The company continuously updates its software through over-the-air updates, enhancing the capabilities of its autonomous systems. Tesla's extensive data collection from its fleet of vehicles helps improve the performance and safety of its autonomous navigation technologies.

Cruise LLC, and Aurora Innovation Inc. are some emerging market participants in the market.

-

Cruise LLC specializes in developing autonomous vehicle technology. The company focuses on creating self-driving cars for urban environments. Cruise has received significant investment from GM, Honda, and other investors, supporting its mission to deploy a large-scale autonomous ride-hailing service.

-

Aurora Innovation, Inc. specializes in self-driving technology. The company is developing the Aurora Driver, a platform designed to be adaptable to various vehicle types, including passenger cars, trucks, and commercial vehicles.

Key Autonomous Navigation Companies:

The following are the leading companies in the autonomous navigation market. These companies collectively hold the largest market share and dictate industry trends.

- Aurora Innovation, Inc.

- Cruise LLC

- General Dynamics Corporation

- Honeywell International, Inc.

- L3Harris Technologies Inc.

- Nothrop Grumman Corporation

- RTX Corporation

- Safran Group

- Tesla

- Waymo LLC

Recent Developments

-

In June 2024, L3Harris Technologies Inc. partnered with maritime startup SeaSatellites, Inc. to successfully demonstrate the advanced capabilities of an autonomous surface vessel (ASV) in the Pacific Ocean.

-

In June 2024, Tesla launched a software update for its in-car navigation system in China, adding new features like displaying lane markings on its maps that match the actual road lanes.

-

In May 2023, Waymo LLC partnered with Uber Technologies Inc. to Bring Waymo’s Autonomous Driving Technology to the Uber Platform.

Autonomous Navigation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.12 billion |

|

Revenue forecast in 2030 |

USD 14.43 billion |

|

Growth rate |

CAGR of 15.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, platform, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Aurora Innovation, Inc.; Cruise LLC; General Dynamics Corporation; Honeywell International, Inc.; L3Harris Technologies Inc.; Nothrop Grumman Corporation; RTX Corporation; Safran Group; Tesla; Waymo LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Autonomous Navigation Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global autonomous navigation market report based on component, platform, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Airborne

-

Land

-

Marine

-

Space

-

Weapons

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Military & Government

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous navigation market size was estimated at USD 5.24 billion in 2023 and is expected to reach USD 6.12 billion in 2024.

b. The global autonomous navigation market is expected to grow at a compound annual growth rate of 15.4% from 2024 to 2030 to reach USD 14.43 billion by 2030.

b. The autonomous navigation market in North America accounted for a significant revenue share of over 37% in 2023, driven by substantial investments in research and development, robust technological infrastructure, and a strong ecosystem of tech giants and startups.

b. Some key players operating in the autonomous navigation market include Cruise LLC, Aurora Innovation Inc., Tesla, General Dynamics Corporation, Honeywell International, Inc., and Waymo LLC, among others

b. Key factors that are driving autonomous aircraft market growth include increasing adoption of autonomous vehicles across various sectors, including automotive and aerospace, along with advancements in AI, machine learning, and sensor technologies,

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."