Autonomous Mobile Manipulator Robots Market Size, Share & Trends Analysis Report By System Type (Differential, Omni-Directional), By Application (Sorting, Assembly), By Payload, By End-use (FMCG, Logistics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-294-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

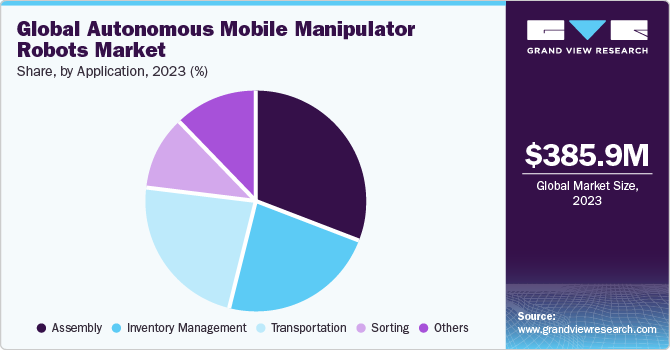

The global autonomous mobile manipulator robots market size was estimated at USD 385.9 million in 2023 and is projected to grow at a CAGR of 23.9% from 2024 to 2030. Technological advancements in Artificial Intelligence (AI), Machine Learning (ML), and sensors fuel the market's growth. Industries are embracing automation to boost efficiency and cut labor costs, with autonomous mobile manipulator robots (AMMRs) offering adaptable solutions across manufacturing, logistics, healthcare, and agriculture. Safety features enable AMMRs to work alongside humans in hazardous environments, improving workplace safety. As production scales up, costs are expected to decrease, making AMMRs more accessible.

AMMRs operate autonomously within manufacturing and distribution facilities using onboard sensors, vision cameras, and facility maps controlled by Warehouse Execution Software (WES). They perform tasks such as picking, transporting, and sorting items, enhancing productivity, reducing labor costs, and preventing product damage. AMMRs empower employees by automating repetitive and high-risk material transportation, fostering highly productive work environments. While currently relying on sensors and algorithms for navigation, the integration of AI makes them even more efficient. With AI capabilities, AMMRs gather data from various sensors, enabling them to make informed decisions, navigate efficiently, and adapt their behavior to dynamic environments, avoiding obstacles and optimizing tasks.

The surge in the adoption of AMMRs within manufacturing and warehouse logistics operations is driving their growth. AMMRs contribute to efficiency and productivity by executing repetitive tasks precisely and consistently, operating continuously to reduce downtime. They address labor shortages and rising costs by automating tasks and offering flexibility across various functions and environments. Equipped with advanced safety features, AMMRs work safely alongside humans, enhancing workplace safety. Scalable and adaptable, they adjust to changing production demands. Continuous technological advancements further improve their capabilities, making them increasingly reliable and versatile in executing a wide range of tasks autonomously.

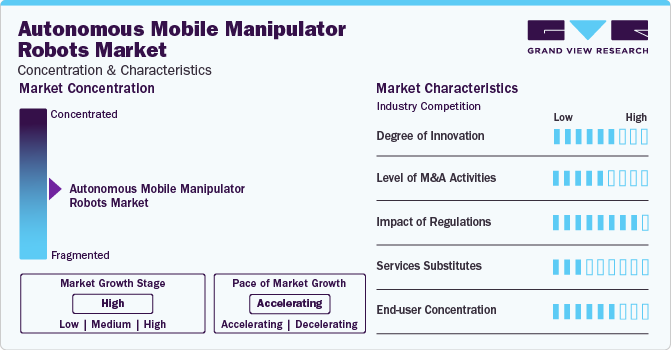

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating, due to technological advancements, increasing demand for automation, intense market competition, and diverse application opportunities across industries. These factors drive innovation, leading to the development of more robots with enhanced capabilities to meet evolving industry needs.

The AMMR market experiences moderate M&A activity due to its emerging nature and technology integration challenges. While there are few acquisitions and partnerships, companies often prioritize organic growth over M&A strategies. Strategic partnerships and collaborations are common, driven by the market's fragmentation and the need for technologies.

The market faces increasing regulatory scrutiny, specifically regarding safety, data privacy, ethics, and labor regulations. Regulatory bodies may introduce standards and regulations to address safety concerns, ensure data privacy and security, uphold ethical principles, and mitigate potential impacts on labor practices. Compliance with these regulations is essential for manufacturers and users to ensure the safe and ethical deployment of autonomous mobile manipulator robots.

The AMMR market faces a moderate threat of substitutes, largely mitigated by their unique capabilities compared to traditional labor and other automation solutions. Emerging technology and integration with existing systems further reduce the possibility of direct substitutes. While cost and regulatory factors influence adoption, AMMRs' versatility and safety advantages provide resilience against substitute technologies.

End-user concentration significantly impacts the AMMR market. End-users, such as major manufacturing or e-commerce companies, are driving the market growth. Their scale of deployment affects the market size and revenue potential for AMMR manufacturers. End-user concentration influences supply chain dynamics, with manufacturers prioritizing partnerships catering to these segments.

System Type Insights

The differential segment led the market and accounted for 59.9% of the global revenue share in 2023, driven by the versatility of differential systems across various applications such as manufacturing, logistics, agriculture, and healthcare. Sensors and algorithms facilitate differential robots' robust navigation capabilities, allowing them to maneuver around obstacles efficiently and perform tasks with precision. With significant payload capacities, they handle heavy loads and offer a cost-effective automation solution compared to specialized robots. Their scalability makes them suitable for operations of all sizes, while adaptability to different industries and customization options enhance their utility.

The omni-directional segment is expected to grow significantly over the forecast period. These robots move in any direction without changing orientation, enabling efficient navigation in tight spaces and complex layouts. With the ability to move in multiple directions simultaneously, they offer improved efficiency and throughput in various applications such as material handling and warehouse logistics. Omni-directional robots optimize space utilization and easily navigate through narrow aisles and confined spaces. Highly versatile and adaptable, they switch between tasks and environments seamlessly, supported by advanced navigation technologies such as SLAM and advanced sensor systems, enhancing their overall performance and reliability.

Application Insights

The assembly segment accounted for the largest revenue share in 2023, driven by increasing automation in manufacturing. Autonomous mobile manipulator robots offer adaptable solutions for automating assembly tasks, ensuring precision, accuracy, and efficiency. AMMRs are capable of handling tasks with high precision and are used for essential applications such as electronics and automotive assembly. They enhance productivity by performing tasks quickly, reducing cycle times, and supporting agile manufacturing through flexibility and adaptability. Further, integration with collaborative robotics ensures safe cooperation with human workers, and advanced sensor technologies enable accurate perception and interaction with the environment, enhancing capabilities in complex assembly tasks and adapting to changing conditions.

The sorting segment is poised for significant growth over the forecast period, driven by the expanding e-commerce industry's need for efficient sorting solutions. AMMRs play a vital role in automating sorting tasks in warehouses and distribution centers, ensuring faster order fulfillment and enhancing logistics operations' overall efficiency. With the surge in online shopping and demand for rapid order processing, AMMRs offer flexibility in sorting various items while increasing efficiency and productivity. Integration with existing sorting systems streamlines workflows, while advanced navigation technologies enable autonomous operation in dynamic warehouse environments. Moreover, the long-term benefits of AMMRs, including reduced labor costs and improved accuracy, drive the adoption of AMMRs.

Payload Insights

The 10-20 kg segment accounted for the largest revenue share in 2023, due to the balanced capabilities of autonomous mobile manipulator robots within this payload capacity range. These robots offer versatility across industries, handling tasks such as material handling, assembly, sorting, and inspection efficiently. Additionally, they offer affordable automation solutions, scalable for varying production demands and compatible with standard equipment. With safety features and advancements in robotics technology, including motor efficiency, and sensor capabilities, AMMRs ensure safe collaboration in human-robot workspaces while driving their adoption across industries.

The more than 20 kg segment is poised for significant growth from 2024 to 2030. The segment's growth is driven by the suitability of this payload capacity for heavy-duty applications in industries such as automotive manufacturing, construction, and logistics. These AMMRs handle larger and heavier objects, automating tasks previously reliant on manual labor or specialized equipment. With the rising demand for automation in heavier tasks, these robots enhance efficiency and productivity by reducing downtime and increasing efficiency. Moreover, they streamline operations by autonomously handling bulky objects, integrating seamlessly with heavy-duty equipment such as industrial robots and conveyor systems.

End-use Insights

The logistics segment accounted for the largest revenue share in 2023, driven by the increasing integration of robotics and automation in logistics and supply chain operations. AMMRs contribute to enhanced efficiency, accuracy, and speed in warehouse operations by autonomously navigating, picking, packing, and transporting goods, thereby reducing manual labor and streamlining workflows. With the exponential growth of e-commerce, AMMRs play a crucial role in optimizing warehouse operations, managing inventory, and facilitating faster order fulfillment to meet rising demand. Their scalability and flexibility enable adaptation to changing demand patterns, seasonal fluctuations, and dynamic warehouse layouts, providing logistics companies with agility and operational resilience in evolving environments.

The healthcare segment is poised for significant growth over the forecast period, as the industry increasingly adopts automation to enhance operational efficiency and patient care. AMMRs offer solutions for tasks such as material handling, logistics, and intra-hospital transportation, which enables healthcare professionals to focus on essential duties. Additionally, AMMRs contribute to maintaining a clean and safe environment by handling tasks involving exposure to pathogens or hazardous materials. With many healthcare facilities facing workforce shortages, especially in tasks such as material handling and logistics, AMMRs help ease these challenges by automating repetitive tasks. Moreover, AMMRs enhance the patient’s experience by delivering medications, supplies, and meals promptly.

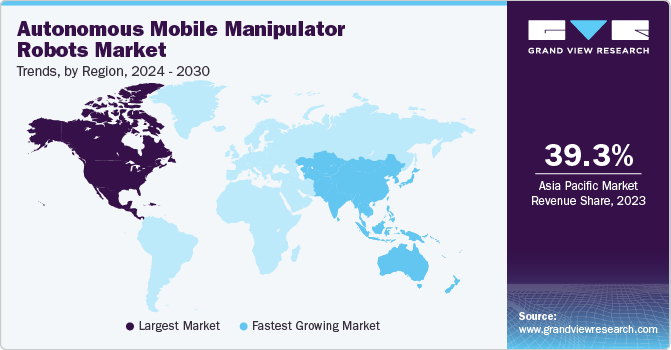

Regional Insights

North America represented a significant market share of 21.2% in 2023. North America, specifically the U.S., boasts an advanced technological ecosystem and a robust infrastructure for research and development, driving innovations in robotics and automation. The region's strong industrial base, encompassing manufacturing, logistics, and healthcare, increasingly adopts autonomous mobile manipulator robots to streamline operations and reduce costs. Significant investments in research and development by companies, academic institutions, and government agencies fuel the development of cutting-edge technologies.

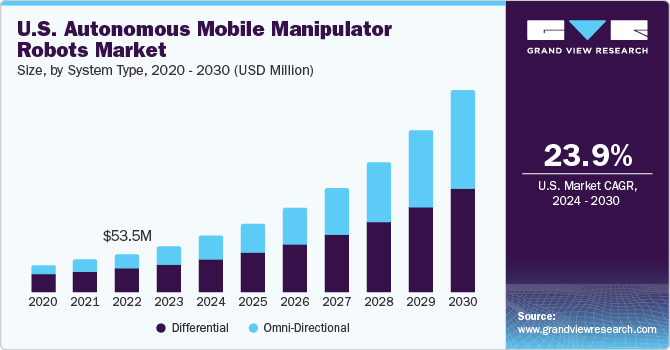

U.S. Autonomous Mobile Manipulator Robots Market Trends

The AMMR market in the U.S. is expected to grow substantially over the forecast period. The U.S. is a major producer of AMMR for warehouse automation, including fulfillment centers. Production of such equipment is experiencing rapid growth, driven by technological advancements and heightened investments in automation. Progress in artificial intelligence, machine learning, sensor technology, mobile networking, and vision systems have improved AMMR's capabilities in mobility, connectivity, and manipulation.

Europe Autonomous Mobile Manipulator Robots Market Trends

AMMR is gaining traction in Europe, particularly within the manufacturing industry. The rising demand for efficient and automated manufacturing, warehousing, and logistics processes has fueled the adoption of mobile manipulator robot solutions that optimize operations, boost productivity, and cut costs. Further, sustainability is also driving the adoption of mobile manipulator robots in Europe. By reducing waste, energy consumption, and carbon emissions, automated systems help companies meet their sustainability goals leading to more sustainable and eco-friendly operations.

The autonomous mobile manipulator robots market in the UK is expected to grow significantly over the forecast period. The UK's exit from the European Union (E.U.), commonly known as Brexit, has resulted in changes in trade policies, customs procedures, and supply chain dynamics. To adapt to the post-Brexit landscape, many businesses in the UK invested in mobile manipulator robots to optimize their supply chain operations, improve efficiency, and comply with new regulations.

The France autonomous mobile manipulator robots market is expected to grow substantially over the forecast period. France is a central logistics hub in Europe, with a well-developed transportation and distribution network. Companies in France are increasingly focusing on optimizing their logistics and supply chain operations to enhance efficiency and competitiveness, and mobile manipulator robots play a crucial role in achieving these goals.

The autonomous mobile manipulator robots market in Germany held the largest share of Europe in 2023. Germany's AMMR market is growing due to the increasing demand for automation and optimization of material handling processes in various industries such as automotive, e-commerce, food and beverage, pharmaceuticals, and logistics. Germany represented the highest growth rate in e-commerce turnover in the European region, which is expected to boost the market demand for AMMR over the coming years.

Asia Pacific Autonomous Mobile Manipulator Robots Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 39.3% in 2023. The escalating demand for material handling systems across diverse industries, including e-commerce, automotive, and food & beverage, continues to fuel the expansion of the AMMR sector. This surge in demand is particularly significant in emerging economies such as India, China, and Japan, where rapid industrialization and technological advancements are reshaping the AMMR market.

The China autonomous mobile manipulator robots market is poised for significant growth in the forthcoming years, driven by government support, a robust manufacturing sector, rapid economic expansion, technological advancements, a large domestic market, and strategic investments and partnerships. The Chinese government's initiatives and policies, coupled with subsidies and incentives, fuel investment in robotics, boosting market expansion.

The autonomous mobile manipulator robots market in India is expected to grow substantially over the forecast period. The country's growth is driven by rapid industrialization, government initiatives such as "Make in India" and "Digital India," technological advancements, increasing labor costs, infrastructure development, and rising demand for healthcare. As industries seek efficiency and productivity enhancements, the adoption of AMMR is expected to surge. With a growing ecosystem of technology startups and research institutions, India is witnessing advancements in AI, machine learning, and sensor technology, thus driving the demand for robotic solutions.

The Japan autonomous mobile manipulator robots market is expected to grow significantly over the forecast period. Japan has been one of the prominent adopters of AMMRs for several decades. The country has a highly developed manufacturing industry, and the adoption of mobile manipulator robots has significantly improved the efficiency and productivity of manufacturing operations.

Middle East & Africa (MEA) Autonomous Mobile Manipulator Robots Market Trends

Middle East and Africa is witnessing increasing adoption of AMMRs. With the rise of e-commerce, there's a growing need for automation in warehouse operations and last-mile delivery, where AMMRs excel in streamlining material handling tasks. Additionally, investments in industrial automation and infrastructure projects provide opportunities for AMMR deployment in manufacturing, facility maintenance, and passenger services, contributing to enhanced productivity and efficiency across various sectors in the MEA region.

The Kingdom of Saudi Arabia autonomous mobile manipulator robots market is poised for significant growth, driven by government initiatives and investments, rising labor costs and shortages, and infrastructure development projects. Initiatives such as Saudi Vision 2030 and UAE Vision 2021 prioritize high-tech industries, spurring demand for robotics and automation solutions.

The autonomous mobile manipulator robots market in South Africa is expected to grow significantly over the forecast period. With a diverse industrial base, including mining, manufacturing, and agriculture, there's a growing demand for automation solutions to boost efficiency and safety. These robots offer opportunities in mining for tasks like exploration and maintenance and in agriculture for planting and harvesting. Infrastructure projects also provide opportunities for their deployment, enhancing project efficiency. South Africa's focus on technological advancement drives innovation in tailored solutions, further accelerating market growth.

Key Autonomous Mobile Manipulator Robot Company Insights

Key players have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in January 2024, Robotnik, an international mobile robotics company, launched RB-ROBOUT+, an autonomous mobile manipulator with a 20 kg arm load capacity. It's designed for automating handling tasks and tool operations in large industrial spaces, offering precision and efficiency. With its UR20 arm, it can handle loads up to 20 kg with a reach of 1,750 mm, making it one of the highest load capacity options available.

Key Autonomous Mobile Manipulator Robots Companies:

The following are the leading companies in the autonomous mobile manipulator robots market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Boston Dynamics.

- FANUC CORPORATION

- KUKA AG

- OMRON Corporation

- Onward Robotics

- PBA Group

- Robotnik

- Stäubli International AG

- YASKAWA Electric Corporation

Recent Developments

-

In April 2024, Cobot, an automation machinery manufacturing company, secured USD 100M in Series B Funding for its autonomous mobile manipulator. The company specializes in developing robots that seamlessly integrate into various environments, such as manufacturing, supply chain, and healthcare. In contrast to humanoid robots, the Cobot machine showcases a distinctive base enabling omnidirectional movement and seamless interaction with existing infrastructure within facilities. This functionality enhances efficiency and workflow within the operational environment.

-

In February 2024, Hello Robot, a provider of mobile manipulators, launched the Stretch 3, an open-source mobile manipulator that enhances manufacturability and usability. Stretch 3 includes features such as a rotating 3D camera at the mast for perception and environmental observation. Additionally, the key feature of the Stretch 3 is the DexWrist 3 gripper, which is robust and includes a built-in 3D camera for vision serving the gripper fingers.

-

In May 2021, Desarrollo de Máquinas y Soluciones Automáticas S.L. introduced a new mobile manipulator called a "mobile collaborative robot" (MCR). This design allows the entire platform to move, facilitating the placement of a collaborative robot (cobot) arm anywhere within a facility where automated pick-and-place operations are needed.

Autonomous Mobile Manipulator Robots Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 469.5 million |

|

Revenue forecast in 2030 |

USD 1,699.5 million |

|

Growth rate |

CAGR of 23.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

System type, application, payload, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; Brazil; Mexico; UAE; KSA; South Africa |

|

Key companies profiled |

ABB; Boston Dynamics.; FANUC CORPORATION; KUKA AG; OMRON Corporation; Onward Robotics; PBA Group; Robotnik; Stäubli International AG; YASKAWA Electric Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Autonomous Mobile Manipulator Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global autonomous mobile manipulator robots market report based on system type, application, payload, end-use, and region:

-

System Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Differential

-

Omni-Directional

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Sorting

-

Transportation

-

Assembly

-

Inventory Management

-

Others

-

-

Payload Outlook (Revenue, USD Million, 2017 - 2030)

-

3-5 Kg

-

5-10 Kg

-

10-20 Kg

-

More than 20 Kg

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Electronics

-

Logistics

-

FMCG

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous mobile manipulator robots market size was estimated at USD 385.9 million in 2023 and is expected to reach USD 469.5 million in 2024

b. The global autonomous mobile manipulator robot market is expected to grow at a compound annual growth rate of 23.9% from 2024 to 2030 to reach USD 1,699.5 million by 2030.

b. The differential segment led the autonomous mobile manipulator robots market in 2023, accounting for over 59.9% of the global revenue share. The segment's growth is driven by its versatility across various applications such as manufacturing, logistics, agriculture, and healthcare.

b. Some key players operating in the autonomous mobile manipulator robot market include ABB, Boston Dynamics, FANUC CORPORATION, KUKA AG, OMRON Corporation, Onward Robotics, PBA Group, Robotnik, Stäubli International AG, YASKAWA Electric Corporation.;

b. Key factors driving the autonomous mobile manipulator robot market growth include rapid automation in logistics and supply chains and expanding integration with mobile technologies and smart devices

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."